Cryptocurrency Weekly Summary

- Cryptocurrency weekly highlights bullish sentiment as U.S. data bolsters hopes for consecutive Fed rate cuts.

- Bitcoin and Ripple’s XRP extended their previous weekly gains, while Ethereum snapped a two-week downtrend with a stellar rise.

- Altcoins outshine BTC gains, crypto market cap jumps past $5.0 trillion, but trading volume eased.

- Buzz around Solana, Dogecion and pro-industry news also favored crypto bulls despite mixed on-chain details.

- Gold, U.S. equities hit record highs as expectations of lower interest rates lift investor confidence.

- Multiple central bank events, top-tier data to offer a busy week ahead, risk news eyed too.

Cryptocurrency Weekly Snapshot

Cryptocurrency markets faced a wave of optimism, amid modest volatility, during the last week as U.S. statistics favored the Federal Reserve’s (Fed) consecutive rate cuts. Also entertaining the momentum traders were grim geopolitical and trade news, contrary to the industry-positive headlines and speculation surrounding the exchange-traded funds (ETFs).

With this, Bitcoin (BTC) and Ripple (XRP), both extended their previous weekly gains, with more than 4.0% and 8.0% respective rise on the week. Meanwhile, Ethereum (ETH) gained major attention with the first weekly gain in three and the biggest jump since early August.

Bitcoin Rise Cautiously: Bitcoin (BTC) posted its consecutive second weekly gains, up more than 4.0% on a week to $115,800, despite falling for three days in the last week. The crypto major’s gains were smaller compared to the altcoins, gold and equities, boosting the altseason talks. Notably, BTC’s losses in August were the first in five, but the following rise reversed losses.

Ethereum Steals The Spotlight: Ethereum (ETH) gained more attention as it reported the first weekly gain in three, resuming its run-up towards the all-time high (ATH) after facing a correction in late August and early September. That said, the ETH rose more than 8.0% over a week to around $4,650 at the latest.

Ripple Stays Firmer: Ripple (XRP) traces Ethereum while posting around 8.00% weekly gains, despite falling for two days in the last week, close to $3.08 at the latest. In doing so, the XRP not only traces the top-tier coins but also benefits from slightly upbeat on-chain metrics while rising for the second consecutive week.

The Weekly Moves

Key Macro Catalysts

Global financial markets faced an upbeat week as the U.S. statistics bolstered the odds of witnessing consecutive Federal Reserve (Fed) interest rate cuts. The improved outlook lifted market sentiment, along with positive news and strong earnings from Wall Street, paying little heed to escalated geopolitical and trade tensions.

Despite hot U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) data, a record downward revision in Nonfarm Payrolls (NFP), and a sharp rise in the Jobless Claims boosted dovish expectations for the September 17 Federal Open Market Committee (FOMC) meeting. Meanwhile, the University of Michigan’s (UoM) Consumer Sentiment Index (CSI) eased, but the U.S NFIB Small Business Index jumped to a multi-month high.

Elsewhere, trade tensions intensified as the U.S. allegedly pushes the Group of Seven (G7) and Europe to impose high tariffs on China and India over Russian oil imports.

Further, Russia attacked Poland and challenged the North Atlantic Treaty Organization (NATO), indirectly, while Israel attacked a senior Hamas official in Doha via multiple blasts, but failed and received strong international criticism.

On a legal front, a federal judge blocked Trump from firing Federal Reserve Board Governor Lisa Cook, meaning she will vote at the September Federal Open Market Committee (FOMC) meeting. Alternatively, the U.S. Supreme Court agreed to fast-track its review of Trump’s tariffs, with arguments scheduled for November, making these tariffs valid until then.

On a different page, the European Central Bank (ECB) matched market forecasts and kept the current monetary policy unchanged, allowing the Euro (EUR) to better cheer the USD weakness.

For more macro updates like this, please check our news section here!

Crypto Market News

In the crypto universe, Bitcoin (BTC), Ripple (XRP) and Ethereum (ETH) all cheered the dovish Fed bets to post weekly gains. The major attention was given to Ethereum’s first weekly gains in three, and the biggest in a month, while coins like Solana (SOL) and Dogecoin (DOGE) cheered ETF speculations.

With this, the total cryptocurrency market capitalization (market cap) hit another record top above the $5.00 trillion mark, though the weekly trading volume declined by over 8.0%, according to Santiment, raising concerns about the authenticity of the latest gains.

That said, some of the top crypto news are as follows, while more updates like this could be traced to our Coin Bytes.

Japan’s largest corporate Bitcoin holder, Metaplanet, doubled its Bitcoin reserves since June to 20,136 BTC. Still, the firm’s shares dropped amid fears emanating from dilution.

Also Read: Metaplanet’s Bitcoin Stash Tops 20,000 BTC as Shares Dip on Dilution Concerns

Elsewhere, the world’s biggest corporate holder of Bitcoin, Strategy (previously MicroStrategy), fights back against its exclusion from the S&P 500 index. The BTC major was excluded from the benchmark U.S. equity index in the latest quarterly rebalance, flagging market fears over its heavy exposure to Bitcoin, which makes the stock more volatile than traditional constituents.

Read More: Strategy fights back against S&P exclusion with 1,955 Bitcoin purchase

Sky, formerly MakerDAO, joined the league of Agora, Paxos, and Frax Finance while submitting a proposal to become the first official issuer of Hyperliquid’s new USDH stablecoin. The proposal includes a 4.85% yield for holders and a $25 million fund to bolster Hyperliquid’s decentralized finance (DeFi). A validator vote on September 14 will decide who will own the new USDH stablecoin.

Read More: Hyperliquid’s USDH Stablecoin Issuance: DeFi Giant Sky Proposes 4.85% Yield

Meanwhile, crypto thefts continue to spread, making traders cautious and in need of strong security measures. Hackers injected sophisticated malware into 18 popular Node Package Manager (NPM) packages, namely ‘chalk’ and ‘debug’, to steal crypto from wallets. The NPM packages hack impacted tools that had over two billion downloads a week combined.

Check Details: Crypto-Stealing Malware Found in 18 Popular NPM Packages

The U.S. Securities and Exchange Commission (SEC) poured cold water on the face of Exchange-Traded Fund (ETF) optimism by delaying approval of the Ethereum staking bids from major financial firms, like Franklin Templeton, Fidelity, and BlackRock.

Meanwhile, a Central Asian Country, Kyrgyzstan, passed a law to establish a national cryptocurrency reserve and introduce state-managed crypto mining. The law allows issuance of fully asset-backed stablecoins and real-world asset tokens, including in foreign currencies.

More Details: Another Central Asian Country Joins the Race With a Crypto Reserve; What’s Inside the Law

On a grim note, a U.S. Bitcoin supporter and a conservative activist, Charlie Kirk, was killed with a gunshot to the neck during a speech at Utah Valley University. Tragically, the death of Turning Point USA’s founder allowed memecoin developers to introduce the CHARLIE token, which shot a market cap of $74.9 million on the first day.

Also read: ‘Justice Movement’: IRYNA and CHARLIE Token Spark Outrage After Tragic Deaths

Belarus continues its shift toward digital assets amid sanctions linked to the Russia-Ukraine war, with President Alexander Lukashenko calling crypto “strategic”. The Belarusian leader ordered banks to expand crypto participation and tokenization to bypass sanctions and stabilize the economy.

Read: Lukashenko Orders Belarusian Banks to Expand Crypto and Tokenization Amid Sanctions

Elsewhere, an Ethereum-based memecoin Little Pepe ($LILPEPE) gained the market’s attention as it crossed $25.0 million mark in presale. The token stood out with its Ethereum Layer 2 (L2) ties and the 15 ETH community giveaway.

For More Details: Little Pepe Memecoin Soars Past $25M Presale, Launches 15 ETH Giveaway

On a different note, Bloomberg’s crypto analyst Eric Balchunas raised expectations of witnessing the first U.S. memecoin Exchange-Traded Fund (ETF), $DOJE ETF, boosting market optimism amid anxiety before the Fed’s interest rate decision.

Also Read: What is Fueling Dogecoin (DOGE) Price Upside This Week? Read Here!

Bitcoin, Equities, and Gold Rally Together

Bitcoin (BTC) notched its second weekly gain in four, up slightly over 4.0% week-over-week (WoW), amid dovish Fed bets. Elsewhere, the spot Gold (XAU) rose for the fourth consecutive week and refreshed a record high before ending the week with around 1.6% weekly gains to near $3,645. On the same line, S&P 500 (SPX) refreshed record high and ended the week on a positive note, with 1.6% weekly upside. With the BTC back in sync with the other risk assets, the hopes of its fresh ATH, like XAU and SPX, also gain momentum.

To clearly visualize links among these key risk assets, let’s see the correlation chart from TradingView.

BTC, S&P 500 and Gold

With the clearly linear relations between Bitcoin, Gold, the U.S. equities, the BTC traders should stay optimistic as the latest data and news answer many questions and have already flashed record tops in XAU and SPX. Still, uncertainties around the Fed interest rate decisions after September, concerns over the Fed’s independence, the ongoing Ukraine-Russia war, coupled with the impact of President Donald Trump’s tariffs could cloud the market outlook.

ETF Signals, On-Chain Clues Pique BTC Trader Interest

Starting with the latest U.S. spot Exchange Traded Fund (ETF) data from the SoSoValue, the Bitcoin (BTC) spot ETFs reported a two-day outflow pattern, with a daily outflow of $160.18 million on Friday.

Still, the weekly ETF performance marked a consecutive third inflow, and the highest in two months, worth $2.34 billion for the last week.

It’s worth observing that August reported the first monthly outflow in five months, the biggest since March, but September’s inflows have been stellar, with the latest figures of $2.59 billion.

With this magnitude of surprise from the ETF flows on a monthly basis, the BTC bulls seem to be keeping the reins for a while.

Bitcoin Whales and Network Details Eyed

Apart from the U.S. spot BTC ETF data, the performance of the key wallets also shows promising signs for the Bitcoin buyers. However, a pullback in the transaction volume, active addresses, and network growth challenges the bullish bias surrounding the crypto major, requiring traders to remain cautious.

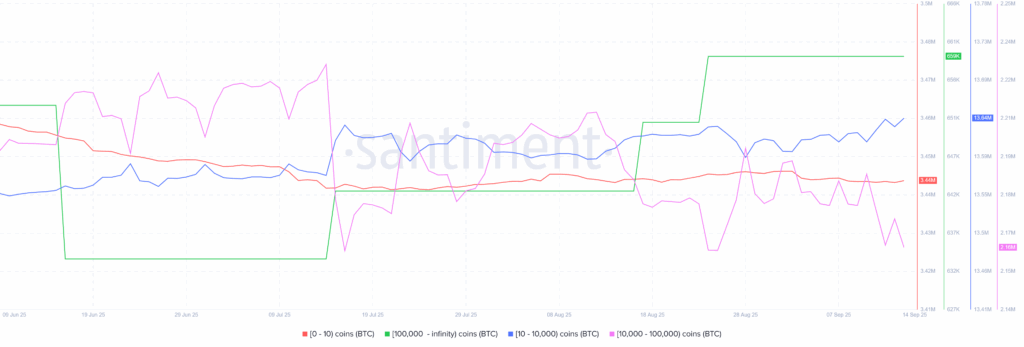

Bitcoin Supply Distribution for September 08-14

As per the Santiment data for the September 08-14 period, the wallets (addresses) holding 10–10,000 BTC, known as sharks, increased their holdings by 18,347 BTC, marking a 0.13% addition.

On the other hand, the retail wallets (holding 0–10 BTC) added a meagre 95.00 BTC while the whales (wallets with 10,000–100,000 BTC) reduced their holdings by 15,982 BTC, or 0.73%, during the said period.

Meanwhile, the wallets with over 100,000 BTC holdings (mega-wallets) reported no change in their holdings during the stated period, currently around 659K BTC.

This suggests active participation in Bitcoin, even with large wallet holders (whales) cutting their positions while sharks increasing their exposure and retail traders are also optimistic. Such accumulation often signals a potential price recovery, hinting at a possible BTC upside ahead.

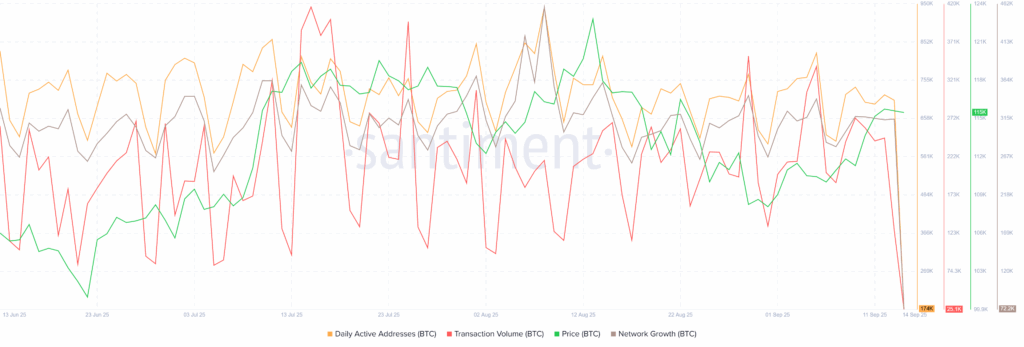

Bitcoin Transaction Volume, Active Addresses, and Network Growth

While the Bitcoin wallet details are mostly upbeat, the utility metrics flash mixed signals to tame the optimism, requiring traders to remain cautious.

That said, the Daily Active Addresses on the Bitcoin network marked a 2.0% fall, while the Transaction Volume marked a whopping 47% slump during the September 08-13 period. Meanwhile, the Network Growth, the number of new addresses created on the network each day, marked an increase of 5.37% during the said period.

Technical Analysis Lures BTC Bulls

As per Bitcoin’s daily chart, BTC’s early-week bullish breakout, sustained trading beyond the key Exponential Moving Averages (EMAs), and upbeat momentum indicators like the Moving Average Convergence and Divergence (MACD) and the Directional Movement Index (DMI) keep buyers hopeful.

Bitcoin Price: Daily Chart Points To Multiple Upside Hurdles

Bitcoin’s steady trading beyond the resistance-turned-support line from late May and the 50-day EMA, combined with bullish signals from MACD and DMI, bolsters the crypto major’s upside outlook.

That said, MACD histograms (green) are the most bullish in over two months, portraying BTC’s upward momentum.

Similarly, the DMI’s Upmove line (Blue) holds the top spot on the daily chart, staying near the 25.0 neutral level to indicate buying strength. However, the Average Directional Index (ADX in red) and the Downmove (D- in Orange) hover around 15.00, reflecting the need for a strong bullish catalyst to fuel the prices beyond the immediate resistance.

This highlights the 23.6% Fibonacci Extension (FE) of Bitcoin’s April-September moves, close to $119K, a break of which could propel prices toward a two-month-old horizontal resistance near $123,300.

Beyond that, the all-time high around $124,500 holds the key to BTC’s potential rally toward the 38.2% and 50% FE hurdles, respectively near $126,300 and $132,300, with the $130K threshold likely acting as an intermediate halt.

Alternatively, the 50-day EMA and the previous resistance line limit short-term BTC pullbacks around $113,300 and $112,200 in that order.

Below that, an ascending support line from late April, close to $109,300, appears to be an important level to watch, before the monthly low of $107,270.

Above all, the 200-day EMA near $105,190 becomes the final defense of the Bitcoin buyers, after which June’s low of $98,250 should grab the bear’s attention.

Ethereum Finally Rises!

Ethereum finally gained upside momentum, snapping a two-week downtrend and bouncing off a month’s low, amid broad market optimism and upbeat institutional participation. The second-largest cryptocurrency also grabbed attention as it rallied more than 8.0% during the week, posting the biggest jump in over a month.

ETH ETFs Report Fresh Inflows

As per the latest SoSoValue data, the U.S. Ethereum (ETH) spot ETFs reversed the previous weekly outflow with a heavy daily and weekly inflow. That said, ETH ETF inflows were present for the fourth consecutive day on Friday, reversing the previous weekly outflow and justifying ETH’s latest strength in prices.

On September 12, the U.S. Spot ETH ETFs reported its fourth daily inflow, and the largest one since August 26, with a strong $405.55 million figure.

This also resulted in the weekly ETH ETF inflows, with a total of $637.69 million for the week, following the surprising outflow in the previous week.

Meanwhile, the monthly ETH ETF scenario is downbeat as it snaps the five-month inflow pattern, even with a meagre $150.05 million monthly outflow.

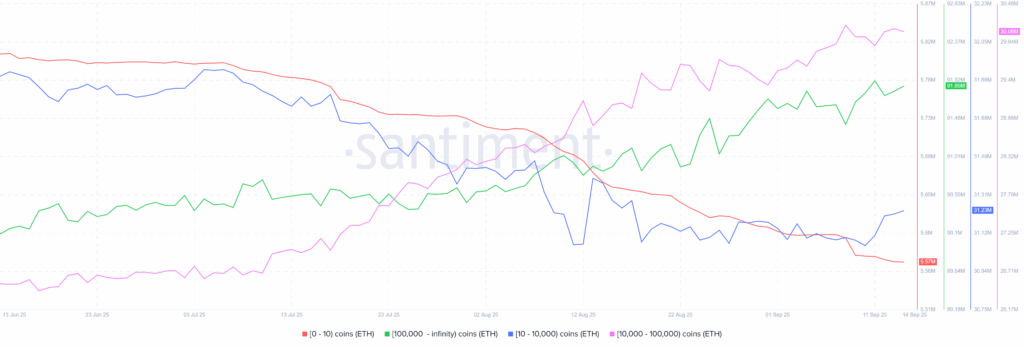

Ethereum Supply Distribution Pokes Buyers

Even if the ETF inflows justify Ethereum’s latest jump, mixed signals from the on-chain metrics conveying the ETH supply distribution keep the buyers vulnerable. That said, the supply distribution metric signals accumulation/reduction in the ETH positions by the important wallets.

Ethereum Supply Distribution for September 08-14

As per the Santiment data for September 08-14, the wallets (addresses) holding 10–10,000 ETH, known as sharks, increased their holdings by 131K ETH, marking almost a 0.42% addition.

Alternatively, the retail wallets (holding 0–10 ETH) cut their holdings by 28,211 ETH (or -0.50%), while the whales (wallets with 10,000–100,000 ETH) also reduced their holdings by 93,167 ETH, or -0.31%.

Meanwhile, the mega-wallets, wallets with over 100,000 ETH holdings, reported a notable increase in their holdings, by 457.44K or 0.50% during the stated period, currently around 91.85 million ETH.

Hence, mega wallets and sharks have increased their ETH holdings, while the retail traders and whales have cut their exposure, suggesting doubts in the latest run-up of the second-largest crypto.

Ethereum Technical Analysis Signals Consolidation

Ethereum’s technical analysis portrays its struggle with the upper Bollinger Band (BB) amid bullish signals from MACD and DMI momentum indicators. Still, the quote’s sustained trading beyond the key EMAs keeps the long-term buyers hopeful.

Ethereum Price: Daily Chart Points To Pullback

Ethereum failed to refresh its two-week high and witnessed a pullback during the weekend, mainly because of its inability to cross the upper BB. Still, the bullish MACD signals (green histograms) join upbeat DMI indicators to term the latest weakness in the ETH price as a healthy consolidation.

That said, the DMI shows that the D+ (Upmove, blue) remains well beyond the 25.00 neutral level, signaling bullish momentum, while the ADX (Average Directional Index, red) and the D- (Downmove, orange) line stay beneath 20.00, marking weak selling pressure.

With this, the ETH is likely to witness a pullback toward the middle BB support of $4,425, but its further downside could be capped by the monthly low of $4,215, followed by a convergence of the 50-day EMA and the lower BB, close to $4,175.

Even if the quote defies the Bollinger Band and drops beneath $4,175 key support, the 100-day and 200-day EMAs, respectively near $3,725 and $3,278, and an ascending trend line from early April, close to $3,148, will be tough nuts to crack for the bears.

Alternatively, a month-old horizontal resistance area surrounding $4,765-$4,830 will be decisive for the Ethereum buyers to watch during the quote’s fresh rise, along with the record high of $4,954. Should the quote manage to remain firmer past $4,954, it’s quick rally to the $5,000 threshold can’t be ruled out.

Ripple Stays Firmer

Ripple (XRP) posted its second weekly gain, rising around 8.0% over a week to $3.08 by the press time.

The coin’s latest rally could be linked to speculations about BlackRock’s imminent play for the spot XRP ETF. The rumours swirled after the global asset manager BlackRock’s Director of Digital Assets, Maxwell Stein, and Nasdaq’s Chief Executive Officer, Adena Friedman, were shown as the headline speakers at Ripple’s flagship conference, Ripple Swell.

Meanwhile, an increase in the number of XRP mega wallets, holding over 1.0 million coin, and the broad crypto optimism, also underpinned the quote’s rise even as the total balance held by these mega wallets dropped.

XRP 1M+ Coin Balance By Number & Total Balance Held

Wallets holding 1 million or more XRP, known as whales or mega wallets, hit a record high of 2,749 earlier in July, before falling to 2,657 in August and rising to 2,684 by the end of August 14. That said, these wallets collectively hold roughly $47.67 billion in XRP, down a bit from $47.69 billion marked on September 08.

With this, Ripple buyers show slightly upbeat confidence, maybe because of the resolution of its multi-year battle with the U.S. Securities and Exchange Commission (SEC) and the recent ETF talks.

Ripple Technical Analysis Suggests Short-Term Consolidation

Ripple’s XRP keeps a bullish breakout of an eight-week descending resistance line, now support, even if the upper Bollinger Band triggers the quote’s latest pullback. Adding strength to the upside bias are the bullish MACD signals and the DMI indicators.

Ripple Price: Daily Chart Signals Short-term Pullback

With the quote’s latest retreat from the upper BB joining the potential market consolidation ahead of Wednesday’s FOMC, the XRP is likely to witness a short-term decline toward the previous resistance line from late July, currently around $2.96.

However, strongly bullish MACD signals and the DMI’s upbeat D+ (Upmove, blue) line, well beyond the 25.00 neutral level, as well as downbeat ADX (Average Directional Index, red) and the D- (Downmove, orange) line, suggest strong support for the bullish momentum.

Even if the quote drops beneath the resistance-turned-support line, the 100-day EMA and the lower BB, close to $2.81 and $2.69 in that order, will challenge the bears.

Below that, the six-month-old previous resistance line, now acting as support near $2.65, and the 200-day EMA support near $2.56, will act as the final defense of the XRP bulls.

On the flip side, the XRP’s run-up beyond the upper BB of $3.15 could enable buyers to aim for a seven-month horizontal zone between $3.33 and $3.40.

That said, a break of $3.40 will potentially open the door to challenge the record high near $3.67 and target the psychological $4.00 level.

Conclusion

Looking forward, the U.S. Federal Reserve’s (Fed) monetary policy meeting announcements, scheduled for Wednesday, will be decisive for the markets. Apart from the FOMC, monetary policy meetings of the Bank of Japan (BoJ), Bank of Canada (BoC) and Bank of England (BoE) will join the U.S. Retail Sales and the UK CPI to offer a busy week. Also important to watch will the developments about the U.S. tariffs and geopolitical tensions surrounding Russia, Israel and U.S. President Donald Trump.

As the Fed’s September meeting approaches, the money markets almost fully price a 25 basis points (bps) cut and two more in 2025, with the “dot-plot” likely showing increased easing in 2026, which in turn can allow the crypto optimists to keep the reins.

Even if the Fed’s 0.25% rate reduction and dovish signals appear to be given, stubborn inflation and soft jobs data may allow Fed Chair Jerome Powell to emphasize data-dependence, limiting the rate cut’s impact. Meanwhile, the political uncertainty over Fed governor changes and a few dissenters to the rate cuts, like Chicago Fed President Austan Goolsbee and Kansas Fed President Jeffrey Schmid, could also surprise the markets and are worth observing.

If the Fed delivers a softer rate cut, or signals fewer reductions for the future, or altogether holds the rates steady, the U.S. Dollar could rally, which in turn can pressure stocks and cryptocurrencies, especially Bitcoin, due to the mixed on-chain signals.

Alternatively, a smooth 25bps cut aligned with expectations may boost risk assets, while gold stays supported amid global tensions. Notably, a 0.50% rate cut surprise could drown the U.S. Dollar, allowing major cryptocurrencies and equities to cross the latest peaks with a stellar rally.

That said, the September FOMC meeting is decisive and could swing markets sharply, requiring traders to stay alert!