Cryptocurrency Weekly Snapshot

Cryptocurrency weekly outlook turned out to be a grim one as major coins hit a fortnight low before refreshing the weekly highs, just to end the trading week with mixed signals.

That said, the market’s confidence in the U.S. Federal Reserve’s (Fed) December rate cut joined optimism surrounding the Ukraine-Russia peace deal to underpin the mildly positive bias about the major cryptocurrencies.

However, fears surrounding U.S. President Donald Trump’s selection of the Fed Chair’s position, mixed U.S. data, and unclear geopolitical news fueled the global bond yields, led by Japan, and challenged the optimists of late.

Above all, the market’s preparations for the December Federal Open Market Committee (FOMC) monetary policy meeting seemed to have restricted this week’s crypto performance.

Against this backdrop, Bitcoin (BTC) and Ripple (XRP) failed to defend the previous week’s recovery, while Ethereum (ETH) rose for the second consecutive week, despite lacking upside momentum. Meanwhile, the spot Gold (XAU) price posted a weekly loss, the U.S. equities are modestly positive, and the U.S. Dollar Index (DXY) dropped for the second consecutive week.

Bitcoin Drops Back: Bitcoin (BTC) fades recovery from a two-week low, as well as reversing the previous weekly gains, despite whale buying and softer U.S. Dollar. That said, the crypto major is down nearly 1.0% on a week to $89,600 by the press time.

Ethereum Edges Higher: Ethereum (ETH) parted ways with its long-term partner Bitcoin while posting a 1.0% weekly jump to $3,025 at the latest, up for the second consecutive week.

Ripple Falls Heavily: Ripple (XRP) declined the most among top five cryptocurrencies with over 5.0% weekly fall to $2.03 as we write. With this, the altcoin not only reversed the previous weekly gains but also registered extra fall.

The Weekly Moves

Key Macro Catalysts

Looking at the major catalysts, a mixed play of the mostly confirmed December FOMC rate cut jostled with an uncertainty about the Fed’s politicizing and unimpressive data could be witnessed. Notably, the strong Treasury bond yields challenged risk assets, but equities managed to post mild gains, while Gold failed to defend the previous week’s stellar gains. The following are some of last week’s key data/news:

Starting with the data, the U.S. Core Personal Consumption Expenditures (PCE) Price Index for September, also known as the Federal Reserve’s (Fed) favorite inflation, matched the market’s expectations of reprinting 0.2% Month-over-Month (MoM) figures, but the Year-over-Year (YoY) numbers eased to 2.8% versus 2.9% market forecasts and prior readings.

Further, the preliminary readings of the University of Michigan (UoM) Consumer Sentiment Index for December rose to 53.3 from 51.0 prior, versus the analyst estimations of 52.0. Also, the UoM Consumer Inflation Expectations eased on both fronts, namely the one-year and five-year, to 4.1% and 3.2% from 4.5% and 3.4% in that order.

November Challenger Job Cuts eased to 71.32K from 153.07K prior, while the weekly Initial Jobless Claims also softened to 191K versus 220K market estimate. Further, Chicago Fed’s Unemployment tracker for November eased to 4.44% compared to 4.46% in October, whereas Revelio Labs’ monthly employment survey showed a consecutive second monthly job loss, with November’s figures be -9.0K.

The monthly U.S. ADP Employment Change for November was-32K versus an estimated +5K, while Industrial Production for September came in 0.1% Month-over-Month (MoM), versus 0.0% expected and -0.3% prior.

Further, the final readings of the S&P Global Manufacturing PMI for November rose to 52.2, versus 51.9 expected and prior, whereas S&P Global Services PMI for November came in 54.1 compared to 55.00 initial estimations.

More importantly, the U.S. ISM Services PMI for November jumped to the highest level since April, to 52.6 from 52.4, versus 52.0 expected, while the ISM Manufacturing PMI for the same hit a 12-month low of 48.2 compared to the market expectations of 48.6 and 48.7 prior.

That said, global Treasury bond yields edge higher, with the ultra-long-term (30-year) bond coupons rising in Japan, the U.S., the U.K., and Germany, challenging the market’s risk-on sentiment, even as the short-term yields face a pullback by the week’s end.

However, the Chicago Mercantile Exchange’s (CME) FedWatch Tool portrays an 87% chance of the rate cut in December, versus an 11.0% chance of no rate cut, and favors modest optimism among traders. Notably, the December Fed rate cut bets were nearly 40% during mid-November and raised risk aversion before restoring the dovish Fed bias and favoring the sentiment.

On trade, U.S. Trade Representative Greer stated that Washington seeks a stable but recalibrated relationship with China, emphasizing more balanced and potentially smaller bilateral trade flows.

It’s worth mentioning that the U.S. Supreme Court is hearing the legality of the majority of President Trump’s tariffs and hence policymakers from the Trump administration are mostly trying to justify the action, which if accepted and ruled in favor, could allow Trump to go for higher tariffs and raise a new wave of the trade war, keeping traders on the edge of late.

Furthermore, developments surrounding the Ukraine-Russia peace deal have been mixed of late as statements from Russian President Vladimir Putin criticized Europe and reiterated territory demand. That said, the U.S. diplomats will meet with Ukrainian officials in Florida, after recently visiting Kremlin leaders, to tighten the loose ends of the peace deal framework.

On a different page, talks also made rounds that the Trump administration is considering whether to allow Nvidia to sell its H200 chips to China, which are one generation behind its current flagship chips, per Reuters. There is no clear news on this one yet, but the traders are anxious, especially the technology share watchers.

President Trump signaled proximity to his choice for the next Fed Chair, with National Economic Advisor Kevin Hassett seen as a strong candidate. That said, Trump cancelled Wednesday’s interviews with other candidates, signaling a decision may have already been made, even as the White House rejects confirmation. Market chatter is growing that Hassett’s selection could exert additional downside pressure on the U.S. Dollar and politicize the Fed.

Meanwhile, China faced downbeat activity numbers for November and renewed global economic woes, exerting additional downside pressure on the risk. That said, the U.S. data have been mixed and failed to derail expectations of a 0.25% Fed rate cut in December, which previously favored the risk assets.

Crypto Market News

In the crypto universe, Bitcoin (BTC) and Ripple (XRP) reversed their previous weekly gains, but Ethereum (ETH) remained firmer for the second consecutive week, maybe because of Ethereum’s Fusaka upgrade.

That said, MYX Finance (MYX) rallied over 20% to gain the bull’s attention, while Canton (CC), Zcash (ZEC), and Starknet (STRK) are down almost 20% during the last week.

Meanwhile, the crypto market capitalization (market cap) dropped almost 2% to $3.04 trillion, whereas the Bitcoin Dominance improved to 58.7% from 58.6% during the last week.

That said, some of the top crypto news are as follows, while more updates like this could be traced to our News section.

Ethereum’s highly talked about Fusaka upgrade went live on December 3, at block slot 13,164,544. Fusaka improves Ethereum’s speed and scalability by introducing PeerDAS, allowing the network to verify rollup data without every node downloading it. It also increases block data capacity and stabilizes blob fees, ensuring future scaling doesn’t need a full hard fork.

The European Commission (EC) has proposed a wide-ranging reform package aimed at joining the European Union’s (EU) fragmented financial markets. The proposal signals that the ESMA could move into a more prominent supervisory role, overseeing selected trading venues, clearing houses, and securities depositories itself. The plan also brings all crypto-asset service providers under ESMA’s supervision and strengthens the agency’s role in coordinating rules for asset managers.

A European nation , Georgia, signed a Memorandum of Understanding (MOU) with Hedera to explore moving its land registry on-chain and tokenizing real estate. Previously, Dubai and New Jersey have launched similar blockchain initiatives, expanding global experiments with digital deeds and tokenised assets.

Binance introduced “Binance Junior,” a parent-supervised crypto savings app for users aged 6 to 17. The service blocks trading and withdrawals while allowing earnings through Simple Earn.

The UK’s Property (Digital Assets, etc.) Act 2025 received Royal Assent, creating a distinct legal category for digital assets, considering them as the “Third kind of property”, while providing crucial clarity on ownership, inheritance, and asset recovery.

Russian central bank weighs the possibility of taking a more flexible stance toward domestic cryptocurrency activity as Western sanctions continue to complicate international payments for Russian businesses and citizens, per a report by local news outlet Kommersant. The news quotes First Deputy Governor Vladimir Chistyukhin saying that the Bank of Russia is now reconsidering its earlier plan that would have limited crypto trading to a small group of highly experienced investors, and officials are reviewing whether the “super-qualified” category should remain central to the draft framework.

On the same line, Nikkei Asia reported that Japan is preparing its most sweeping revision of cryptocurrency taxation in years, backing a plan to replace its steep progressive rates with a 20% tax on crypto trading profits, bringing digital assets under the same framework that currently applies to equities and investment trusts.

OpenPayd and Altify collaborate to facilitate Altify’s more than 80K users to exchange their Euros (EUR), British pounds (GBP), and U.S. dollars (USD) into digital assets through OpenPayd’s on/off ramp, which is integrated with Single Euro Payments Area (SEPA) and Society for Worldwide Interbank Financial Telecommunication (SWIFT).

A consortium of ten major EU banks, including BNP Paribas and ING, has formed an entity, Qivalis, to issue a regulated, Euro-pegged stablecoin under Markets in Crypto-Assets (MiCA) rules by 2026.

Chief Executive Officer (CEO) of Telegram, Pavel Durov announced on X, that Cocoon, a confidential AI compute platform developed by Telegram on The Open Network blockchain, is now fully operational and processing its first user tasks. The system allows GPU owners to contribute computing power for AI inference and earn TON tokens, cutting out traditional intermediaries such as Amazon and Microsoft.

The U.S. banking regulator, Federal Deposit Insurance Corporation (FDIC), is finalizing its first set of rules to implement the new Genius Act, the U.S. stablecoin law, which was signed in July. Initial proposals will focus on application frameworks and prudential standards like capital and liquidity.

Vanguard Group, the world’s second-largest asset manager, will permit trading of select Vanguard crypto ETFs and mutual funds on its brokerage platform. The move grants over 50 million clients, with $11 trillion in assets, access to regulated crypto exposure.

Among the top-tier news, the People’s Bank of China’s (PBoC) reiteration of crypto ban and warnings of heavy crackdowns on stablecoins gained major attention. “China’s central bank reaffirmed its tough stance on virtual currencies on Saturday, warning of a resurgence in speculation and vowing to crack down on illegal activities involving stablecoins,” per Reuters.

Meanwhile, Europe’s largest asset manager, Amundi, shared the news of tokenizing a part of its AMUNDI FUNDS CASH EUR money market fund. The fund manager collaborated with CACEIS as it aims to bring blockchain-based processes into the heart of its distribution model.

Hong Kong’s leading crypto exchange, HashKey, filed for an Initial Public Offering (IPO) of $500 million to test investor appetite for regulated crypto equities.

Position Liquidations

Crypto market position liquidation justifies the latest weakness in major coins, ex-ETH, with more long liquidations. That said, position liquidation is the forced closing of a trader’s positions by a broker due to insufficient margin. This data reveals whether long (buy) or short (sell) positions were closed, helping explain recent price movements. Typically, heavy long liquidations happen during a downtrend and suggest short-term bearish sentiment, and vice versa.

During the November 30 to December 06 period, a total of $2.634 billion of positions were liquidated, per the CoinGlass data. Out of which, “Long Positions” contributed $1.651 billion, whereas “Short Positions” accounted for $982.76 million, suggesting a bigger flow of long liquidations.

Bitcoin and Gold Drop, but Equities Hold Gains

Bitcoin (BTC) faded the previous weekly rebound from a seven-month low, posting the fifth weekly loss in the last six, despite posting mild intraday gains early Saturday.

That said, Bitcoin is down nearly 1.0% on a week to $89,600 by the press time, while the spot Gold (XAU) price posted modest weekly loss of around 0.50%. That said, major U.S. equity indices were mildly bid.

Dow Jones Industrial Average (DJI) gained 0.50% on the week, while the S&P 500 (SPX) rose 0.19% weekly. That said, Nasdaq Composite (NQ100) led the gainers with nearly 0.91% weekly rise.

This raises doubts about Bitcoin’s historical linear relationship with equities and Gold, favoring concerns of a probable recovery in the BTC price once the U.S. equities and Gold extend their broad bullish trend.

To clearly visualize links among these key risk assets, let’s see the correlation chart from TradingView.

BTC, S&P 500, and Gold

With the clear linear relations between Bitcoin, Gold, and the U.S. equities, despite the latest jitters, the BTC traders shouldn’t be too pessimistic while facing the recent inaction after a bullish week.

BTC ETF, On-Chain, and Options Market Flash Mixed Signals

Bitcoin’s (BTC) latest weakness faces mixed signals amid the weekly ETF outflows, upbeat whale buying, addresses holding between 10 and 10,000 BTC, and strong options market participation. However, chatter surrounding Michael Saylor’s Strategy (previously MicroStrategy) and mixed sentiment in the crypto currency market might have tamed the BTC bulls.

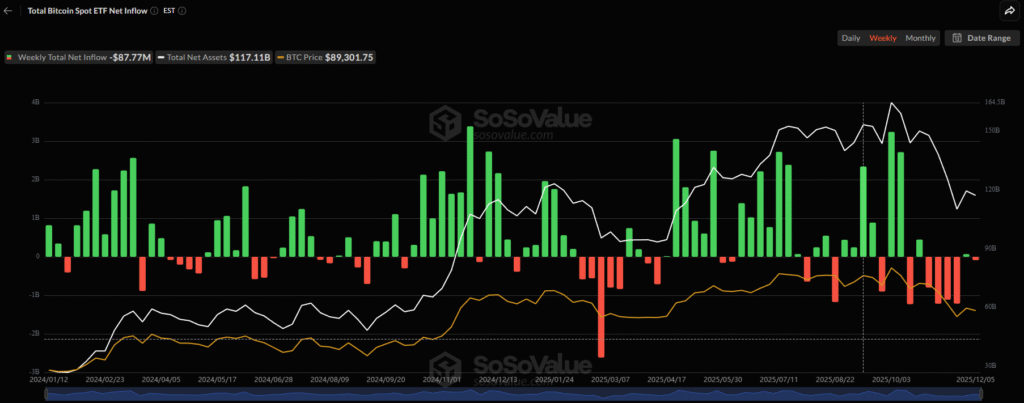

Starting with the latest U.S. spot Exchange Traded Fund (ETF) data from the SoSoValue, the Bitcoin (BTC) spot ETFs reported a three-day inflow pattern, but faced a weekly outflow. That said, Friday’s softer daily inflows of $54.79 million couldn’t portray a rosy picture about the institutional interest.

Still, the spot BTC ETFs marked the weekly outflow, after stalling a four-week drain pattern, worth $87.77 million by the end of Friday.

It’s worth observing that August reported the first monthly outflow in five months, the biggest since March, but there were inflows in September and October, whereas the November Outflows have been $3.48 billion by press time, the biggest since February. Meanwhile, December faces a modest outflow of $54.79 million.

With a small magnitude of the ETF outflow on the week, versus the previous heavy monthly outflows, the BTC optimists should remain cautious going forward.

Meanwhile, Santiment cites an accumulation pattern from the Bitcoin whales and sharks, wallets holding 10 to 10K BTC, following weeks of selling by major players. “Bitcoin’s whales and sharks have accumulated a net total of 47,584 $BTC thus far in December. This follows a long period of dumping from October 12th to November 30th, where their bags decreased by -113,070 $BTC,” said the crypto data-provider.

Furthermore, an X post from Laevitas cites significant institutional participation in the options market. The analytical details said, “On Deribit, BTC options recorded their highest monthly volume in October 2025 at 1.49 million contracts, followed by November at 1.33 million.” Further, the Year-to-Date (YTD) BTC options volume was 10.27 million contracts (even as December is still incomplete), representing a 36% increase from 7.56 million contracts faced in 2024.

On the contrary, a shift in the corporate global Bitcoin giant Strategy’s BTC accumulation pattern test the bulls, especially amid the mixed market sentiment. Latest data from CryptoQuant states that the world’s largest Bitcoin Treasury firm Strategy’s BTC buying slumped in 2025. The report stated on Thursday, “The monthly purchases fell from 134,000 BTC at the 2024 peak to just 9,100 BTC in November 2025, only 135 BTC so far this month (December).”

Technical Analysis Tease Bitcoin Sellers

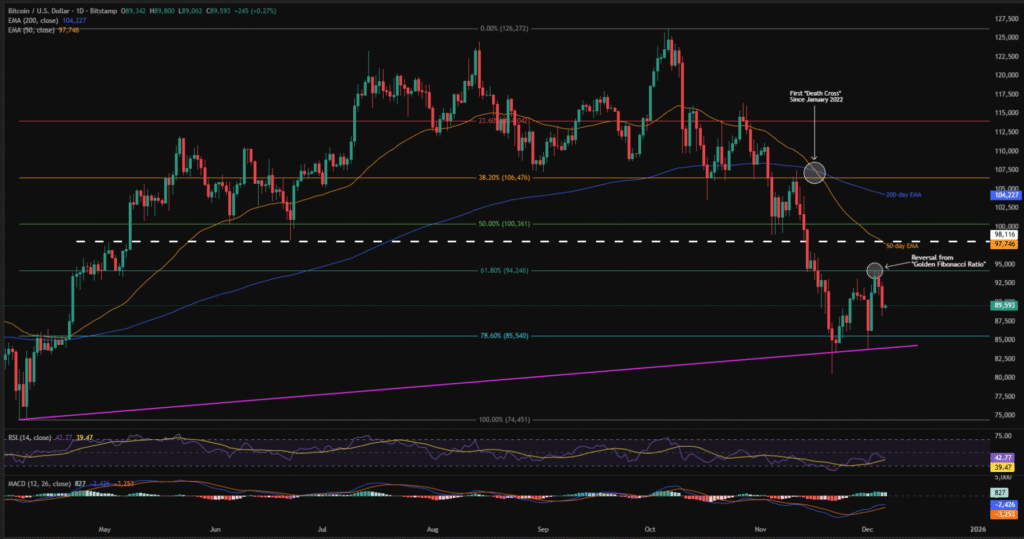

On a technical side, Bitcoin’s U-turn from the 61.8% Fibonacci retracement level of its April-October rise, also known as the “Golden Fibonacci Ratio”, contradicts with upbeat signals from the 14-day Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) momentum indicators. This suggests increasing odds of the quote’s short-term pullback to a multi-month support line, but no further weakness.

Bitcoin Price: Daily Chart Highlights Seller’s Dilemma

Bitcoin’s reversal from the 61.8% Fibonacci retracement level, also known as the “Golden Fibonacci Ratio”, close to $94,250, lures short-term BTC sellers. However, the RSI’s upbeat conditions, recovering from the 30.00 oversold limit, and bullish signals from the MACD (green histograms), challenge the bears.

Meanwhile, the BTC’s first “Death Cross” since January 2022, a bearish moving average crossover wherein the 50-day Exponential Moving Average (EMA) crosses the 200-day EMA from above, also add strength to the downside bias.

This highlights the 78.6% Fibonacci retracement level of BTC’s rise from April to October 2025, close to $85,500, and an ascending support line from April, near $84,000, as immediate support for the sellers to watch.

Below that, November’s low of $80,537 will be a decisive level to follow as a downside break of the same could direct prices to April’s yearly low of $74,434.

Alternatively, Bitcoin price recovery may initially aim for the 61.8% Fibonacci retracement level near $94,250.

Meanwhile, the 50-day EMA of $97,750 and a seven-month-old previous support line, now resistance near the $98,000, could test the BTC rebound before directing buyers to the $100K.

Beyond that, the 200-day EMA of $104,230 could test the BTC bulls before giving them control.

Fusaka Upgrade Saved Ethereum Despite Mixed Signals

Ethereum (ETH) outplayed Bitcoin and Ripple’s XRP, not to mention Binance Coin (BNB) and Solana (SOL) as it posted a 1.0% weekly jump to $3,025 at the latest while others are facing a downbeat week.

If we look at the major catalysts, the U.S. spot ETH ETFs faced the outflows, similar to the BTC, but a shift in the futures trading volume pattern was in favor of Ethereum. Above all, the ETH’s Fusaka upgrade allowed the second-largest cryptocurrency to remain firmer.

ETH ETFs Report a Return of Outflows

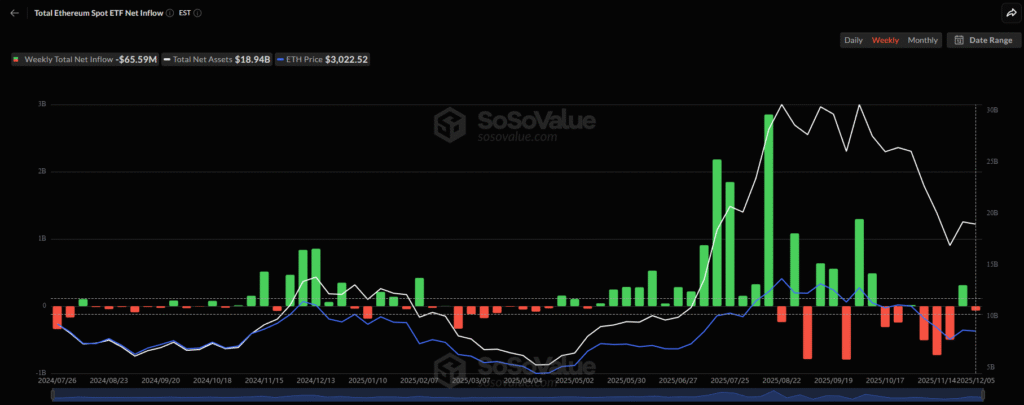

As per the latest SoSoValue data, the U.S. Ethereum (ETH) spot ETFs reported the fifth weekly outflow pattern in the last six, barring the previous weekly inflow, suggesting a steady deterioration in institutional demand.

On December 05, the U.S. Spot ETH ETFs reported its fourth daily outflow of the week, worth $75.21 million.

With this, the second-largest coin defied the previous weekly ETH ETF inflow pattern, with last week’s total outflow of $65.59 million.

Notably, the monthly figures were red, as November posted the first monthly outflow since March, as well as the biggest monthly outflow on record, with the $1.42 billion outflows. Meanwhile, December’s outflows have been $65.59 million so far.

A Bullish Shift in the ETH’s Futures Trading Volume

Markets.com cited the higher trading volume of the ETH on the Chicago Mercantile Exchange (CME) than the Bitcoin (BTC) as a clear vote of confidence from institutional investors. As per the latest readings from the CME, Bitcoin Futures Volume was 13,300 for December, while that of Ethereum was 21,786.

Fusaka Upgrade

The widely hyped Fusaka upgrade went live on December 3, at block slot 13,164,544. The upgrade improves the network speed and scalability by introducing PeerDAS, allowing the network to verify rollup data without every node downloading it, suggesting an 85% reduction in the data load. It also increases block data capacity and stabilizes blob fees, ensuring future scaling doesn’t need a full hard fork.

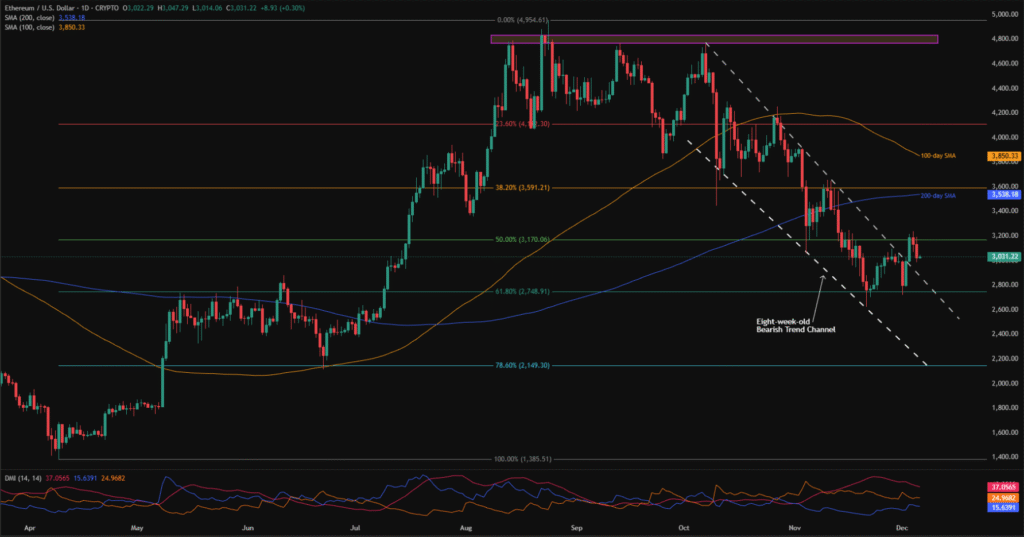

Technical Analysis Teases Buyers

Ethereum’s technical analysis raises doubts on the bearish bias as it defends the key Fibonacci support and prior breakout of a multi-week bearish trend channel. However, bearish signals from the Directional Movement Index (DMI) momentum indicator and sustained trading below the key Simple Moving Averages (SMAs) test the bulls.

Ethereum Price: Daily Chart Attracts Buyers

ETH’s clear breakout of an eight-week-old bearish chart formation lacks support from the DMI as the Average Directional Index (ADX, red) line tops the Downmove (D-, Orange) and the Upmove (D+, Blue) lines, in that order, and stays well past the 25.00 neutral level, to portray a presence of strong bearish momentum.

Hence, Ethereum buyers will need validation from the 50% Fibonacci Retracement of its April-August upside, near $3,170.

Even so, the 200-day and 100-day Simple Moving Averages (SMAs), respectively near $3,540 and $3,850, as well as the $3,900 threshold, could challenge the ETH’s further upside before restoring the broad bullish outlook.

On the contrary, a downside break of $2,880 will defy the bullish breakout of a multi-week descending trend channel.

Still, the 61.8% Fibonacci ratio of $2,748, also known as the “Golden Fibonacci Ratio”, could challenge the sellers.

After that, the stated bearish channel’s bottom of $2,200, the 78.6% Fibonacci retracement level of $2,150, the $2,000 threshold, and April’s bottom of $1,385 will be in the spotlight.

Ripple Ignores ETF Optimism

Ripple (XRP) dropped the most among the major cryptocurrencies, down over 5.0% weekly fall to $2.03 as we write, while gaining the bear’s eye. In doing so, the altcoin ignores a sustained institutional interest in the XRP.

Strong inflows into the U.S. Ripple (XRP) spot ETFs failed to favor the XRP buyers. As per the latest SoSoValue data, the U.S. Ripple (XRP) spot ETFs reported a consecutive 15 days of inflow, with the latest daily figures be $10.23 million. Notably, the XRP’s weekly inflows were $230.74 million during a four-week inflow pattern.

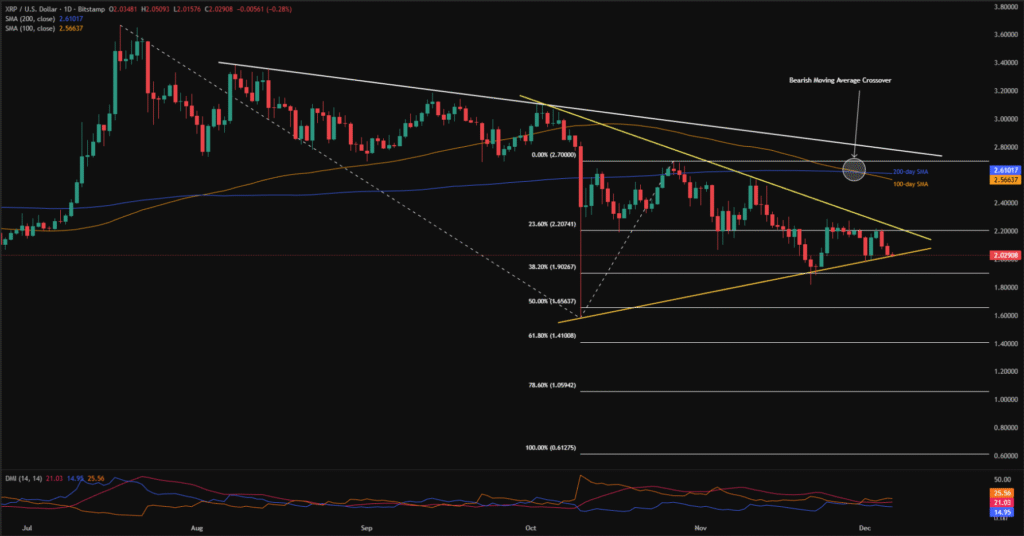

Technical Analysis Teases XRP Sellers

On the technical side, downbeat signals from the Directional Movement Index (DMI) momentum indicator and bearish moving average crossover suggest a short-term weakness in the Ripple price. However, a multi-week symmetrical triangle may restrict the altcoin’s downside.

Ripple Price: Daily Chart Suggests Bearish Consolidation

Ripple price reverses from the 23.6% Fibonacci Extension (FE) of its July-October moves while poking the bottom line of a two-month symmetrical triangle.

Adding strength to the bearish bias are the downbeat signals from the DMI and bearish moving average crossover.

That said, the DMI’s Downmove (D-, Orange) tops the Average Directional Index (ADX, red) line and the Upmove (D+, Blue) lines, with the D- being close to the 25.00 neutral limit and hence portraying a slightly bearish directional momentum.

Meanwhile, the 100-day Simple Moving Average (SMA) crossed the 200-day SMA from above during late November and portrayed the bearish moving average crossover.

Still, the XRP sellers need a daily closing beneath the aforementioned triangle’s bottom line, close to the $2.00 threshold by press time, to convince sellers.

Following that, the quote’s south-run towards October’s low of $1.58 can’t be ruled out, with the 38.2% and 50% FE level of $1.90 and $1.66 likely offering intermediate halts.

In a case where the Ripple price remains weak past $1.58, the 61.8% and 78.6% FE levels, close to $1.41 and $1.06, as well as the $1.00 psychological magnet, could attract the sellers.

Alternatively, an upside clearance of the 23.6% FE hurdle of $2.21 can help the XRP bulls attack the stated triangle’s top, close to $2.24 by press time.

Should the XRP manage to offer a daily closing beyond $2.24, the 100-day and 200-day SMA levels, close to $2.57 and $2.61 in that order, could flash on the buyer’s radar ahead of the late October swing high of $2.69.

Above all, the XRP remains on the bear’s list as long as the price stays below a downward-sloping resistance line from early August, near $2.80 as we write.