Cryptocurrency Weekly Summary

- Cryptocurrency weekly outlook highlights cautious optimism among traders on the restoration of dovish Fed bias and mixed geopolitical news.

- Bitcoin, Ethereum, and Ripple posted the first weekly gain in five, despite lacking momentum around the end.

- U.S. statistics, Fed clues bolster odds of facing a December FOMC rate cut and fuel the sentiment.

- U.S. peace plan to end the Ukraine-Russia war gains widespread acceptance.

- Geopolitical woes surrounding China escalate, but fail to receive attention.

- Wall Street flashed mixed results during a holiday-shortened week.

- A return of ETF inflows, whale performance, and market dynamics also added to the cryptocurrency weekly optimism.

- Skepticism about BTC recovery needs validation from U.S. data as Fed officials face blackout ahead of December FOMC.

Cryptocurrency Weekly Snapshot

Cryptocurrency weekly outlook turned positive after a four-week pessimism as increasing odds of the U.S. Federal Reserve’s (Fed) December rate cut joined optimism surrounding the Ukraine-Russia peace. Adding to the market’s corrective bounce could be a consolidation in the institutional demand and a month-end position.

However, crypto traders remain skeptical, as the rebound of major coins faded before they could cross the key resistances. Also contributing to the buyers’ dilemma is the line of upcoming U.S. statistics and the absence of Fed speakers during the blackout period before the December Federal Open Market Committee (FOMC) meeting.

Against this backdrop, Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) all posted their first weekly gain in five, Wall Street benchmarks ended the week on a modestly positive note, and the spot Gold (XAU) price marked the biggest weekly jump in six.

Bitcoin Recovers: Bitcoin (BTC) keeps recovering from a seven-month low, after falling for four consecutive weeks, up nearly 4.5% on a weekly basis to $90,600 by press time. Notably, Bitcoin cracked the $93K threshold, but retreated during the late week, spreading fears among buyers amid mixed on-chain signals. Meanwhile, Bitcoin marked a second straight monthly loss and posted the biggest downside since February, despite the latest weekly rebound.

Ethereum Springs Back: Ethereum (ETH) supersedes BTC while posting close to 7.5% weekly gain, to $3,000 at the latest. The ETH latest snapped its previous four-week downtrend, raising optimism about the sustainability of the altseason talks. On a monthly basis, Ethereum posted a three-month losing streak while facing the biggest fall since February, down over 20% in November.

Ripple Renews Bullish Talks: Ripple (XRP) traces other major cryptos, stalling a four-week losing streak by rising around 6.4% to $2.18 by press time. A sustained institutional interest in the XRP and positive ecosystem news helped revive talks about the much-awaited rally in Ripple’s XRP. That said, XRP is still down for the second straight month in November, down 13% at the latest.

The Weekly Moves

Key Macro Catalysts

Among the key catalysts, a jump in the market’s expectations of December Fed rate cuts, unclear U.S. data, and increasing hopes of the Russia-Ukraine peace gained major attention.

Notably, the risk-on mood favored the digital assets, the technology stocks, and Gold in posting the weekly gains.

Starting with the U.S. data, a slump in the U.S. Durable Goods Orders for September, to 0.5% from 3.0% (revised), versus 0.3% expected, gained attention. Also, important was a reduction in the Weekly Initial Jobless Claims to 216K, compared to the market’s forecast of 225K and 222K prior (revised).

Further, ADP Employment Change 4-week Average ending November 08 dropped to -13.5K, versus -2.5K prior, while Retail Sales growth for September eased to 0.2% Month-over-Month (MoM), versus 0.4% expected and 0.6% prior. Further, the Producer Price Index (PPI) for September matched 0.3% MoM expectations, compared to -0.1% prior, whereas the yearly figures remained unchanged at 2.7%.

In case of the Fed signals, officials, including Mary Daly and Christopher Waller, voiced support for a potential rate cut in December.

Meanwhile, doubts about the U.S. Federal Reserve’s independence, especially with the White House Economic Adviser Kevin Hassett’s potential nomination for Fed chair, dampened the mood.

Against this backdrop, the Chicago Mercantile Exchange (CME) FedWatch Tool portrays an 86% chance of the rate cut in December, and a 14.0% chance of no rate cut, versus almost 40% odds favoring the December rate reductions portrayed on November 20.

On the Ukraine-Russia peace deal, major interested parties conveyed their optimism about the ‘framework’.

Russian President Vladimir Putin said that the U.S. is taking into account their (Russian) position while adding, “We agree that Trump’s Ukraine plan can be used as a basis for future agreements.”

However, Belgium warned that the European Union’s (EU) plan to use frozen Russian assets could threaten the peace efforts.

Alternatively, China’s real-estate giant Vanke sought a delay in the payment for domestic bonds and renewed property sector woes in Beijing. This pushed the global rating giant to cut Vanke’s credit rating and raised fears among Chinese investors.

Elsewhere, the China-Japan tensions continue, and Beijing also showed its dislike for the trade deal between the U.S. and Malaysia, mainly due to the concerns surrounding the rare earth compound.

That said, U.S. President Donald Trump took a hard stand against migrants while saying, “Will pause migration from third-world countries,” after a fatal shooting on the National Guard the previous day. The U.S. leader also pledged a crackdown in many forms. Earlier in the week, Trump also lauded the future economic benefits of his tariffs, claiming that the U.S. will soon experience unprecedented wealth from them.

Crypto Market News

In the crypto universe, Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) all stopped their previous weekly losses while posting the first weekly gain in five.

Still, popular on-chain analysts from Santiment cited social media buzz to highlight the market’s indecision as the “buy the dip” trend is fading, while concerns over companies like MicroStrategy and potential liquidations gain momentum.

Meanwhile, the crypto market capitalization (market cap) rose almost 7% to $3.09 trillion, whereas the Bitcoin Dominance improved to 58.6% from 58.4% during the last week.

That said, some of the top crypto news are as follows, while more updates like this could be traced to our News section.

Kyrgyzstan eyes to secure a leading position in the crypto race while issuing 50 million gold-backed and dollar-pegged tokens on the Tron network. The nation is pilot testing a second token tied to the som, KGSToken.

Also Read: Kyrgyzstan Launches Gold-Backed USDKG as XAU₮ Surpasses $2Bln; What’s Driving the Gold Rush?

JP Morgan’s research note suffered widespread criticism from the crypto community, as well as a boycott campaign against the banking giant, over its harsh decision. Morgan Stanley Capital International (MSCI) planned to remove any firms that have more than 50% of their balance sheets in crypto from its indexes, beginning in 2026.

Read More: MSCI Decision Sparks Bitcoin Backlash and JP Morgan Boycott

Global crypto exchange Binance faces a lawsuit filed by over 300 victims of the October 7 attacks in Israel. The lawsuit alleges Founder and CEO, Changpeng “CZ” Zhao, and Senior Executive, Guangying Chen, knowingly enabled terrorist organizations, including Hamas and Hezbollah, to receive substantial amounts of money from Binance’s platform.

Read Details: New Binance Lawsuit Alleges Platform Funneled Billions to Terror Groups

On a severe note, an armed thief, posing as a courier, tied up a San Francisco homeowner and stole $11 million worth of crypto by taking the laptop and phone containing the digital asset. The robbery took place on November 22 and is a part of the rising wave of targeted, violent attacks against crypto hodlers.

For More: Fake Delivery Stole Crypto in Brazen $11 Million Home Invasion

A study from the European Central Bank (ECB) said the stablecoins’ rapid rise and reliance on traditional assets like US Treasury bills could expose global markets to stress, even though real-economy adoption remains low. The report also warned that uneven global rules and high market concentration could amplify stress in a crisis, though current risks to the euro area remain limited.

More Details: ECB Warns Stablecoin Surge Risks Global Market Turbulence; How Soon Could It Hit?

One of the world’s largest digital banks and payments firms, Klarna, launched KlarnaUSD, a dollar-backed token, marking the company’s first step into digital assets. The company expects KlarnaUSD to launch on the main network in 2026, and said the token is already being tested through Bridge’s Open Issuance platform.

Read Details: Klarna Bank Picks Stripe-backed Tempo for Its First Stablecoin as It Expands Into Digital Assets

The global exchange body representing over 250 market infrastructures, the World Federation of Exchanges (WFE), urges global regulators to clamp down on tokenized equities. The WFE stated in a letter to the Securities and Exchange Commission (SEC) and other global regulatory bodies that granting special exemptions to crypto firms would create an opportunity for regulatory arbitrage.

Read Details: World Federation of Exchanges Demands Crackdown on Crypto “Mimic” Stocks

The Bolivian government took a bold move to combat 22% inflation and dollar shortages, allowing banks to custody cryptocurrencies and stablecoins as part of a broader $9 billion recovery plan. Economy Minister Jose Gabriel Espinoza stated that banks can now hold cryptocurrencies, allowing individuals to store their crypto in savings accounts, use crypto for credit products, and receive loans based on crypto collateral.

For More: Bolivia Crypto Integration Policy to Stabilize Ailing Economy

The UK’s Financial Conduct Authority (FCA) has admitted RegTech firm Eunice into its Regulatory Sandbox to test new disclosure tools aimed at improving transparency in the UK’s crypto market.

Also Read: UK’s FCA Turns To Market Players For Crypto Clarity, With Eunice First Into The Sandbox

Abu Dhabi’s Financial Services Regulatory Authority (FSRA) recognized Ripple USD as an Accepted Fiat-Referenced Token, clearing it for use within the Abu Dhabi Global Market (ADGM). The recognition strengthens Ripple’s growing footprint in the Middle East as the firm expands partnerships in Bahrain, the UAE, and Africa.

For More: Ripple USD Gains FSRA Approval for Use Within Abu Dhabi Global Market

In addition to the aforementioned news, BitMine’s $44 million worth of ETH buy and Bitwise’s updated filing for the Avalanche (AVAX) Exchange-Traded Fund (ETF) gained major attention.

Elsewhere, global payment giant Visa collaborated with Aquanow to expand settlement across Europe, the Middle East, and Africa.

Further, Upbit was also hacked for $37 million worth of Solana coins, before halting withdrawals, moving funds to cold storage, and pledging full customer compensation.

Position Liquidations

Crypto market position liquidation flashed recovery signals, with short liquidations justifying the latest rebound in the major coins’ price. That said, position liquidation is the forced closing of a trader’s positions by a broker due to insufficient margin. This data reveals whether long (buy) or short (sell) positions were closed, helping explain recent price movements. Typically, heavy long liquidations happen during a downtrend and suggest short-term bearish sentiment, and vice versa.

During the November 23 to 29 period, a total of $1.647 billion of positions were liquidated, per the CoinGlass data. Out of which, “Long Positions” contributed $681.38 million, whereas “Short Positions” accounted for $965.83 million, suggesting a bigger flow of short liquidations.

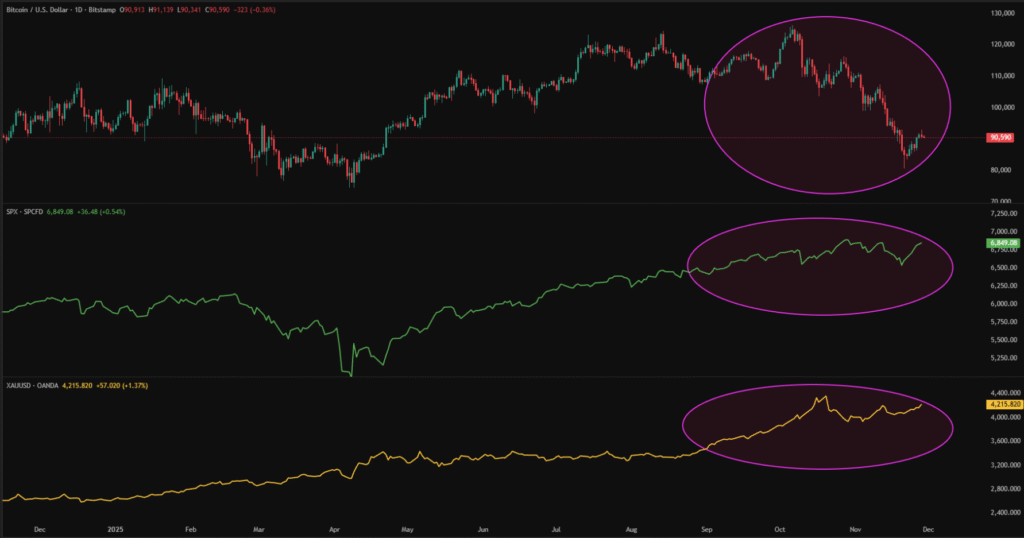

Bitcoin, Equities, and Gold Recover in Harmony

Bitcoin’s (BTC) latest rebound from a seven-month low, posting the first weekly gain in five, lacked momentum near the week’s end, which in turn raised doubts about the crypto major’s further advances ahead of the key FOMC. Still, the BTC rose 4.5% on a weekly basis to $90,600 by press time, as well as marked the biggest monthly loss since February, down for the second straight month in November.

The market’s cautious optimism also favored equities, as the Dow Jones Industrial Average (DJI)and the S&P 500 (SPX) both gained over 3.0% on the week, but the tech-heavy Nasdaq Composite (NQ100) snapped a three-week downtrend with over 4.0% weekly rise. That said, the U.S. market’s risk barometer SPX rose 3.73% over a week to 6,849 by the end of Friday.

Meanwhile, the spot Gold (XAU) also rose 3.70% on a weekly basis to $4,215, posting the biggest weekly jump since early October.

This restores Bitcoin’s historical linear relationship with equities and Gold, favoring concerns of a probable recovery in the BTC price once the U.S. equities and Gold extend their broad bullish trend.

To clearly visualize links among these key risk assets, let’s see the correlation chart from TradingView.

BTC, S&P 500, and Gold

With the clear linear relations between Bitcoin, Gold, and the U.S. equities, the BTC traders shouldn’t be too pessimistic while facing the recent inaction after a bullish week.

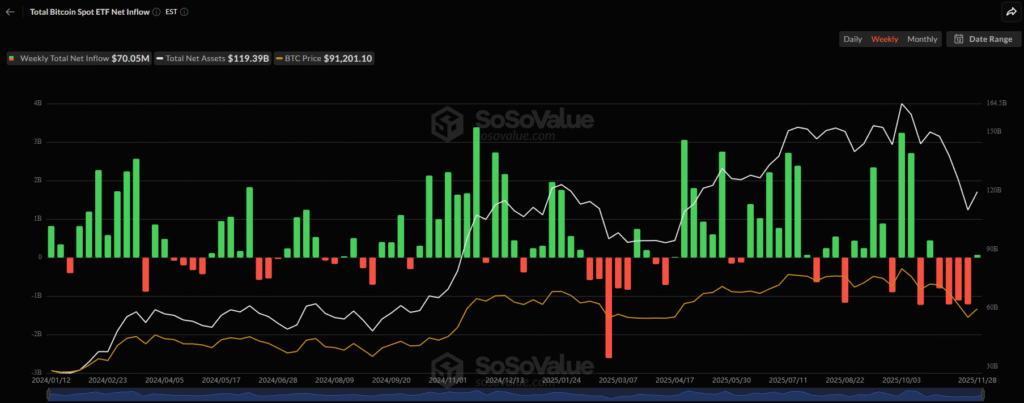

BTC ETF, On-Chain, and Options Market Flash Mixed Signals

Bitcoin’s (BTC) latest recovery faces mixed signals amid the ETF inflows and consolidation from whale wallets, addresses holding between 10 and 10,000 BTC, apart from the broadly upbeat sentiment. However, a few on-chain catalysts and the options market data backed the latest rebound in the BTC prices.

Starting with the latest U.S. spot Exchange Traded Fund (ETF) data from the SoSoValue, the Bitcoin (BTC) spot ETFs reported a three-day inflow pattern, following a downbeat start, during the Thanksgiving holiday-shortened week. However, the Black Friday’s short trading session and CME woes ended the week with softer daily inflows of $71.37 million.

Still, the spot BTC ETFs marked the first weekly inflow after a four-week outflow, worth $70.05 million by the end of Friday.

It’s worth observing that August reported the first monthly outflow in five months, the biggest since March, but there were inflows in September and October, whereas the November Outflows have been $3.48 billion by press time, the biggest since February.

With a small magnitude of the ETF inflow on the week, versus the heavy monthly outflow, the BTC optimists should remain cautious going forward.

Meanwhile, CoinDesk cites Glassnode’s Accumulation Trend Score, an on-chain metric measuring the relative size of entities actively accumulating cryptocurrencies, to suggest a return of the heavy buyers. Glassnode’s definition also states that a score close to 1.0 indicates strong aggregate accumulation, while a score close to 0.0 suggests distribution. The report said that the Accumulation Trend Score is 0.8 for entities holding 10,000 BTC or more, and the first positive print for the 1,000 to 10,000 BTC holders since September. That said, the 100 to 1,000 BTC wallets were cited in aggressive accumulation since October, while the Retail holders with less than 1 BTC showed their strongest accumulation since July.

On the flip side, a $13.68 billion options expiry favoured the Bitcoin buyers amid the cautiously positive sentiment. Notably, the maximum pain price, the strike price at which option holders (buyers) lose the most money and options writers (sellers) profit the most, was at $101,000, up from Friday’s high of $93K. Meanwhile, Call options (the right to buy) accounted for 63% of the total market share and demonstrated strong market confidence in potential upward moves. This could be considered a positive sign for BTC.

Also read: Crypto Options: Bitcoin Tests $91,000 ahead of $13.68 Billion Monthly Expiry

Elsewhere, buzz around a halt in the BTC buying from Strategy (MSTR), the world’s largest publicly traded corporate holder of Bitcoin, having 640,250 BTC per the official reports, gained attention and challenged the crypto optimists.

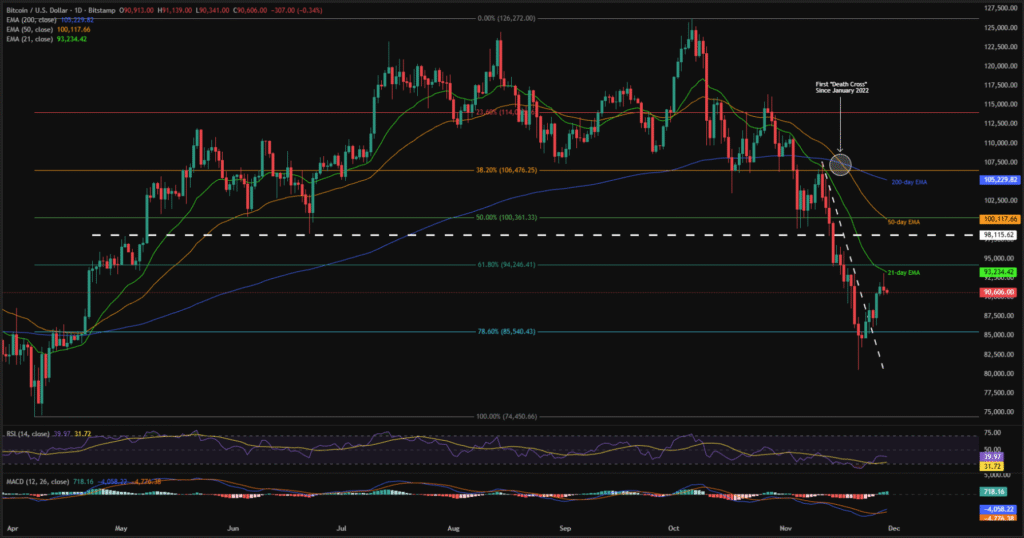

Technical Analysis Tease Bitcoin Sellers

On a technical side, Bitcoin’s upside break of a two-week resistance line, now support, joined upbeat conditions of the 14-day Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) momentum indicator to lure the buyers.

However, its failure to cross the 21-day key Exponential Moving Averages (EMAs) keeps the BTC sellers hopeful.

Bitcoin Price: Daily Chart Highlights Seller’s Dilemma

Bitcoin’s U-turn from the 21-day EMA joins a sustained trading below the horizontal support from May, now resistance, to lure the sellers. However, the RSI’s upbeat conditions, recovering from the 30.00 oversold limit, and bullish signals from the MACD (green histograms), join the upside break of a short-term resistance line to test the downside bias.

Adding strength to the downside bias is the first “Death Cross” since January 2022, a bearish moving average crossover wherein the 50-day Exponential Moving Average (EMA) crosses the 200-day EMA from above.

This highlights the 78.6% Fibonacci retracement level of BTC’s rise from April to October 2025, close to $85,500 as we write, as an immediate support for the sellers to watch.

Below that, the previous resistance line from November 11, now support around $80,600, will be a decisive level to follow as a downside break of the same could direct prices to the monthly bottom of $80,537 and then to April’s yearly low of $74,434.

Alternatively, Bitcoin price recovery may initially aim for the 21-day EMA hurdle of $93,240, but the upside remains elusive below the $98,000 hurdle, comprising a multi-month previous horizontal support. That said, the 61.8% Fibonacci retracement level near $94,250, also known as the “Golden Fibonacci Ratio”, can guard the BTC’s immediate upside.

Meanwhile, the $100K, the 50-day EMA of $100,200, and the 200-day EMA around $105,230 could test the BTC bulls before giving them control.

Ethereum Recovery Becomes Interesting

Ethereum (ETH) superseded BTC while posting close to 7.5% weekly gain, to $3,000 at the latest. With this, the altcoin posted its first weekly gain in five, but faced over 20% monthly loss for November, after turning down the ‘Uptober’ hopes.

Notably, the ETH’s latest rise justifies the strong weekly inflow of the U.S. spot ETH ETFs and the cautious optimism.

ETH ETFs Report a Return of Inflows

As per the latest SoSoValue data, the U.S. Ethereum (ETH) spot ETFs reported the first weekly inflow pattern in four, suggesting a steady accumulation in institutional demand.

On November 28, the U.S. Spot ETH ETFs reported its fifth daily inflow since November 20, worth $76.55 million.

With this, the second-largest coin defied the previous three-week ETH ETF outflow pattern, with last week’s total inflow of $312.62 million.

Despite the latest weekly ETH ETF inflows, the monthly figures are still red, posting the first monthly outflow since March, as well as the biggest monthly outflow on record, with the latest figures for November being $1.42 billion.

ETH Whales Show Positive Signs

Earlier in the week, crypto data miner CryptoQuant came out with interesting statistics about addresses (wallets) holding between 10,000 and 100,000 ETH, as well as the larger 100,000+ ETH wallets. As reported, the total balance of wallets holding between 10K and 100K ETHs jumped to a record high while crossing the 21.00 million threshold. More importantly, the 100K+ ETH holders marked a total balance of 4.30 million.

Meanwhile, CryptoQuant also mentioned that data from Binance shows a steady decline in the Ethereum exchange reserves since September, to nearly 3.764 million ETH by November.

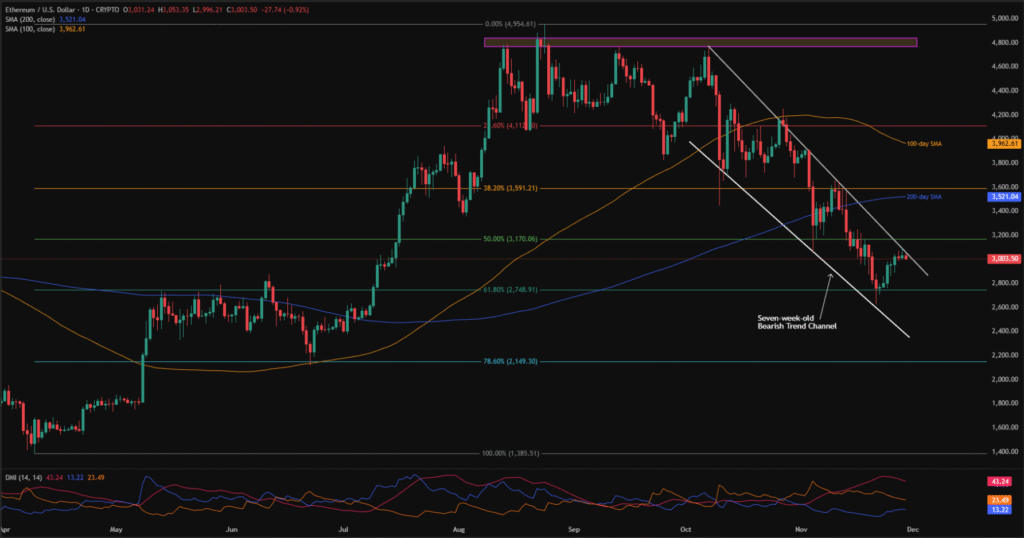

Ethereum Technical Analysis

Ethereum’s technical analysis portrays the quote’s latest recovery as it defends the key Fibonacci support despite bearish signals from the Directional Movement Index (DMI) momentum indicator. However, the quote still has an important resistance to break before restoring the bullish outlook.

Ethereum Price: Daily Chart Tests Buyers

On the daily chart, Ethereum retreats from a seven-week descending trendline resistance surrounding $3,060, forming part of the multi-week bearish trend channel, even as it extends recovery from the 61.8% Fibonacci ratio of $2,748, also known as the “Golden Fibonacci Ratio”.

Notably, the DMI’s Average Directional Index (ADX, red) line tops the Downmove (D-, Orange) and the Upmove (D+, Blue) lines in that order and stays well past the 25.00 neutral level to portray a presence of strong bearish momentum.

With this, Ethereum upside hinges on a clear breakout of the $3,060 hurdle, which in turn will defy the bearish chart pattern and propel the ETH price towards the 200-day Simple Moving Average (EMA) hurdle of $3,521.

That said, the 50% Fibonacci Retracement and 100-day SMA, respectively near $3,170 and $3,965, act as additional upside filters to watch for the ETH bulls.

Alternatively, the ETH pullback may initially aim for the 61.8% Fibonacci ratio of $2,750 before the stated bearish channel’s bottom surrounding $2,370.

Below that, the 78.6% Fibonacci retracement level of $2,150, the $2,000 threshold, and April’s bottom of $1,385 will be in the spotlight.

Ripple Justifies ETF Optimism, Positive On-Chain Clues

Ripple (XRP) also stalled its four-week losing streak by posting the first weekly gain of 6.4%, to $2.18 by press time. However, XRP is still down for the second straight month in November, down 13% at the latest.

A sustained institutional interest in the XRP and positive ecosystem news helped revive talks about the much-awaited rally in Ripple’s XRP.

That said, the International Monetary Fund’s (IMF) promotion of the XRP Ledger, as one of three major solutions capable of transforming international payments, also underpinned the Ripple prices.

Meanwhile, Ripple’s RLUSD stablecoin gained institutional rollout approval from the Abu Dhabi Global Market (ADGM), after being formally recognized as an Accepted Fiat-Referenced Token.

On the same line, strong inflows into the U.S. Ripple (XRP) spot ETFs also favoured the XRP buyers to defy the four-week downtrend. As per the latest SoSoValue data, the U.S. Ripple (XRP) spot ETFs reported a consecutive 10 days of inflow, with the latest one being $22.68 million.

Elsewhere, a slump in XRP’s Exchange Reserves on Binance to the record low of 2.7 billion grabbed the market’s attention.

Furthermore, CryptoQuant also cited a notable slump in the circulating supply of XRP on Binance to bolster bullish bias about XRP.

Additionally, the options market also suggests an optimistic outlook surrounding the XRP, as details of the monthly options expiry suggest fewer bearish calls and an upbeat maximum pain price. That said, XRP options worth $15 million are set to expire during this monthly expiry, namely on Friday. Further, the put-call ratio is 0.41, meaning that there are 0.41 put (sell) bets for each 1.0 call (bullish) bet. Further, the maximum pain price, the strike price at which option holders (buyers) lose the most money and options writers (sellers) profit the most, was at $2.30, higher than the current price.

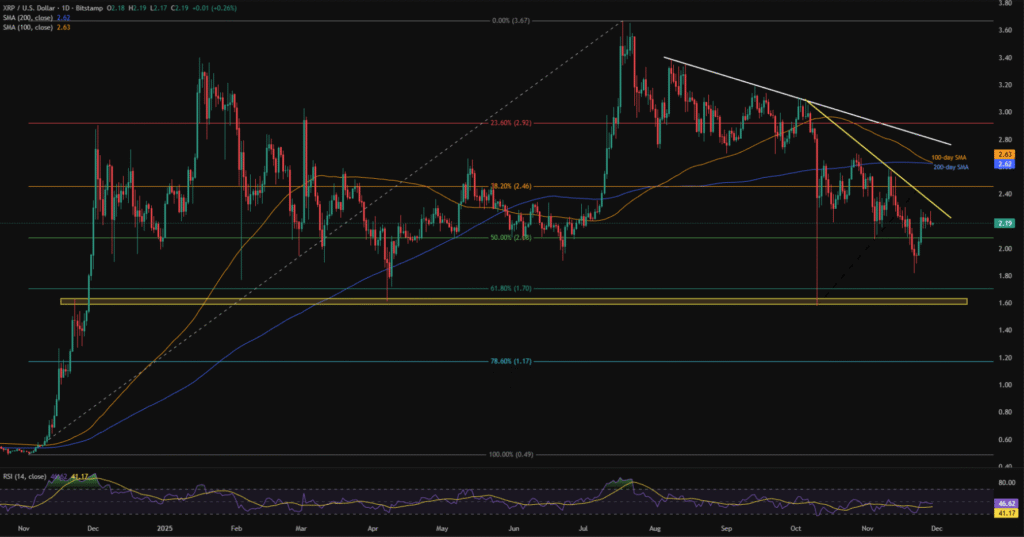

Technical Analysis Troubles XRP Traders

On the technical side, Ripple’s latest consolidation between the 50% and 38.2% Fibonacci retracement of its run-up from November 2024 to July 2025, close to $2.08 and $2.48 in that order, joins upbeat conditions of the 14-day Relative Strength Index (RSI) to suggest a continuation of the price recovery. However, a seven-week resistance near $2.35 guards the quote’s immediate upside.

Ripple Price: Daily Chart Suggests Consolidation

Given the quote’s sustained trading beyond the 50% Fibonacci ratio and upbeat RSI, the XRP is likely to overcome the immediate $2.35 upside hurdle, but a daily closing beyond that becomes necessary to convince the bulls.

That said, Ripple’s daily closing beyond the $2.35 hurdle will highlight the 38.2% Fibonacci retracement level of $2.46 before shifting the market’s attention to a convergence of the 100-day and 200-day Simple Moving Averages (EMAs), close to $2.62-$2.63, as a tough nut to crack for the bulls.

Beyond that, a resistance line from August near $2.80 is the level to knock for the bulls before retaking control.

Alternatively, the 50% Fibonacci retracement level of $2.08 can challenge short-term XRP bears before the 61.8% Fibonacci retracement level of $1.70, also known as the “Golden Fibonacci Ratio”.

Above all, a horizontal area including multiple levels marked since November 2024, near $1.63-$1.58, looks like a tough nut to crack for the Ripple bears, a break of which could make the altcoin vulnerable to refresh its yearly low by targeting the 78.6% Fibonacci ratio of $1.17 and the $1.00 threshold.

Conclusion

Cryptocurrency weekly performance was convincingly positive amid a jump in the odds of December Fed rate cuts and a return of the ETF inflows.

However, mixed on-chain data and a pullback in the BTC ETF inflows, as well as in the price from the short-term resistance, suggest the need for a strong bullish catalyst to defend the latest recovery in prices.

This could be tricky as the Fed officials are on the pre-FOMC blackout period, meaning they’re not supposed to speak about anything on monetary policy in their public appearances before December 10.

As a result, the scheduled ISM Purchasing Managers Index (PMI) data and the clues surrounding the employment, as well as inflation, will be in the spotlight for clear directions. It’s worth noting that Fed Chairman Jerome Powell is up for a speech on December 02, but is restricted by the law to speak lightly on monetary policy and hence may not help determine the market’s next moves.

Should the incoming data highlight inflation and employment problems, the latest buzz around the Fed’s rate cut during the December monetary policy meeting may hit a wall. The same can allow the U.S. Dollar to rebound, and can trigger a pullback in the cryptocurrency prices.

Also Read: Top 5 Fastest Growing Blockchains in 2025