- Dogecoin pares the biggest monthly gain of 2025 amid mixed on-chain signals, cautious markets.

- Total amount of DOGE holders, whales buying hit record high but long liquidations, daily active addresses test buyers.

- Technical analysis validate DOGE/USD pullback tracing major cryptocurrencies amid market consolidation.

- Recovery hopes hold above $0.2000 but reversal of yearly loss hinges on $0.2900 breakout.

Dogecoin price (DOGE/USD) is down 4.45% intraday to $0.2375 during Monday’s U.S. trading session, pulling back from a five-day high as it tracks broader retreat across major cryptocurrencies.

The memecoin’s latest pullback could be linked to the cautious sentiment among crypto traders ahead of this week’s closely watched Crypto Report and key U.S. macroeconomic events.

The DOGE bulls struggle to justify the record high total number of holders and buying from big wallets, known as whales, amid long liquidations and a sluggish performance of daily active addresses.

Record holders, whales fail to keep DOGE bulls happy

According to the latest data from Santiment, the number of distinct addresses holding Dogecoin — referred to as the Total Amount of Holders — has climbed to a record high. Additionally, wallet balances holding over 10 million DOGE, often classified as whales, have also reached historic levels. These strong on-chain signals likely supported DOGE/USD in extending its rally, helping it post the largest monthly gain of 2025, up over 40% at the time of writing.

However, the inconsistent performance of daily active addresses and the number of users actively interacting with the protocol raise concerns about network activity. At the same time, a rise in long liquidations — the forced closure of leveraged buy positions due to insufficient margin — suggests increasing selling pressure. The DOGE/USD pair’s struggle to defend the early-July breakout of the key resistance, now support, also lures sellers as they keep the reins after 25% year-to-date loss.

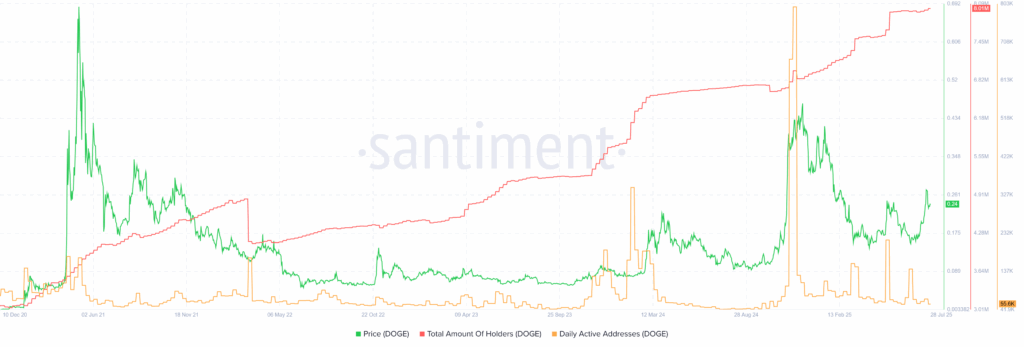

Dogecoin Price, Total Amount of Holders and Daily Active Addresses

As shown in the Santiment chart, the Total Number of Holders surged to a record high of 8.01 million at the time of writing, reflecting a strong accumulation trend and growing interest among crypto traders. However, the Daily Active Addresses metric remains subdued, with just 55.6K active users recorded, highlighting weak network activity despite the rise in holders.

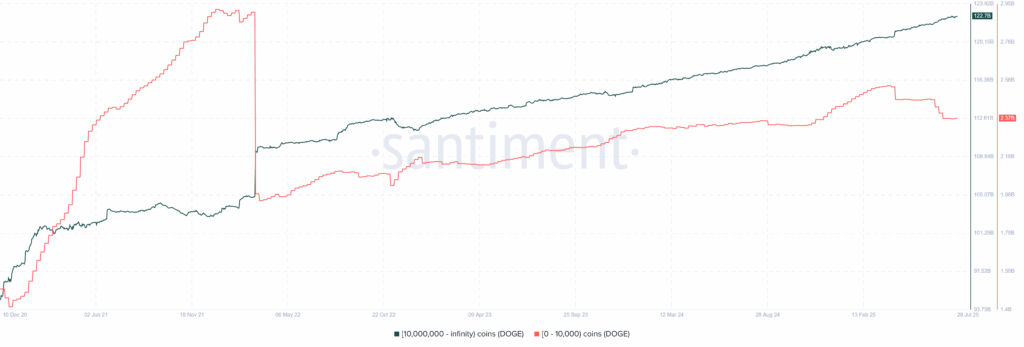

Dogecoin: Whale versus Retail Buying

Santiment’s supply distribution statistics per balance of address suggest an all-time high in the balance of wallets holding more than 10.0 million DOGE, known as whales, to 122.7 billion tokens. On the other hand, wallets holding less than 10K Dogecoin kept their holdings steady at 2.37 billion. This suggests DOGE’s growing preference among the major players and upside potential.

Elsewhere, Coinglass data suggests heavy forced closure of long positions due to margin requirements, suggesting an increase in selling pressure and challenges for the DOGE buyers. That said, out of total $1.73 million liquidations for the last 24 hours, the long liquidations marked a lion’s share of $1.71 million, per the Coinglass heatmap.

Technical Analysis

Apart from the daily active addresses and long liquidations, the technical analysis also suggests a short-term pullback in DOGE/USD prices, especially after its pullback from the 50-bar Simple Moving Average (SMA).

Dogecoin: Four-Hour Chart Teases Sellers

The four-hour chart of Dogecoin shows the buyers’ inability to defend the mid-July breakout of a descending resistance line from early May, now supported near $0.2180.

That said, the U-turn from the 50-bar SMA hurdle of $0.2485 currently pokes the 100-bar SMA support of $0.2310, a break of which could direct sellers toward the $0.2180 resistance-turned-support line.

However, a convergence of the 200-bar SMA and a five-week-old ascending trend line, close to the $0.2000 psychological magnet, appears to be a tough nut to crack for the DOGE/USD bears to retake control.

Alternatively, an upside break of the 50-bar SMA hurdle of $0.2485 could trigger a DOGE run-up targeting the monthly high surrounding $0.2875. Even so, tops marked in February and July around $0.2900 will be a crucial test for the buyers targeting the reversal of the yearly loss. If they succeed, the $0.3000 and $0.3100 thresholds might test the run-up.

It’s worth noting that the 14-bar Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicator suggest continuation of the latest pullback in Dogecoin prices.

Conclusion

Even if mixed on-chain signals and technical analysis support the latest pullback in Dogecoin prices, the memecoin still shows upside potential as major investors show consistent interest.

In addition, the feud between Elon Musk and U.S. President Donald Trump also appears to have weighed on the DOGE/USD pair, challenging market optimism previously fueled by their close friendship.