- Ethereum price holds ground, paring weekly losses despite Middle East risks.

- Positive ETF and derivative activity, along with technical factors, support ETH/USD buyers.

- ETH’s next move toward $2,850 depends on the 200-day SMA.

Ethereum (ETH/USD) rose 1.50% intraday to around $2,560 during Friday’s European session, holding firm above the $2,470 support despite a cautious crypto market driven by rising Middle East tensions. The pair stays strong above $2,500, supported by institutional buying and a bullish technical setup, hinting at a possible new recovery wave for buyers.

Spot ETH ETFs print five-week inflows

Ethereum (ETH/USD) remains defensive on the weekly basis, but institutional support continues for the fourth straight day and fifth consecutive week.

According to SoSoValue, Ethereum spot Exchange-Traded Funds (ETFs) saw a net inflow of $19.10 million on June 18, marking four days of gains following a small outflow of $2.18 million on June 13.

Source: Sosovalue.com

It’s worth noting that the ETFs have recorded five consecutive weeks of net inflows, with the latest weekly total reaching $51.58 million, according to SoSoValue.

Source: Sosovalue.com

That said, June’s net inflow into the U.S. Ethereum spot ETFs hit a yearly high of $860 million, marking the third straight monthly increase—a strong sign that institutional buying may soon drive ETH/USD prices higher.

Source: Sosovalue.com

ETH Derivatives are mostly bullish too

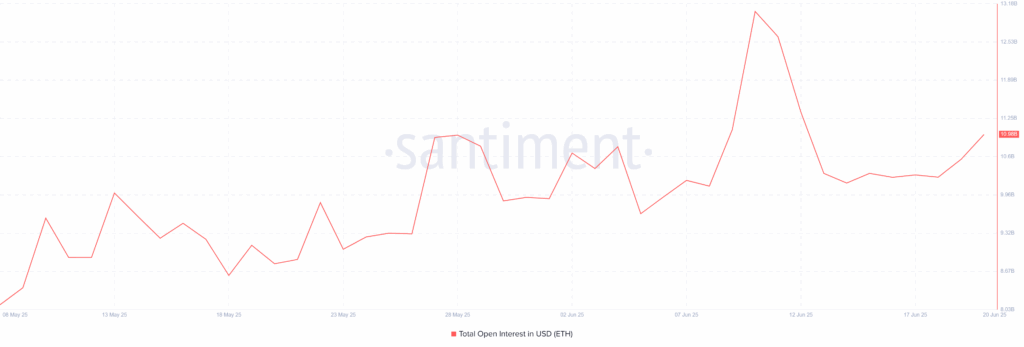

Alongside positive institutional inflows, derivatives data also reflect growing trader optimism for Ethereum (ETH). According to Santiment, open interest in the Ethereum derivatives market rose 3.97% in a day, reaching $10.98 billion on June 20. This increase suggests a fresh wave of bullish trader accumulation, likely triggering new capital inflows into Ethereum derivatives.

Source: Santiment

On a different note, CoinGlass data shows that $3.53 million in long positions were liquidated over 24 hours, compared to $13.17 million in short liquidations. This results in a long-to-short ratio of 0.27, indicating a higher number of active long positions in the market.

Source: CoinGlass.com

Technical Analysis

On the daily chart, Ethereum (ETH/USD) has been trending lower since last week but still holds above a month-old support line, while testing the early-June pullback zone near a key resistance. At the time of writing, the pair is trading above a key support area formed by the 50-day Simple Moving Average (SMA) and a month-long ascending trend line, both near $2,470.

ETH/USD: Daily Chart Signals Gradual Recovery

Source: Tradingview

Although ETH remains above the key $2,470 support confluence, it continues to trade below the 200-day Simple Moving Average (SMA), near $2,610 at the time of writing. This, along with weak momentum indicators, continues to challenge buyer confidence.

The declining Moving Average Convergence Divergence (MACD) and signal lines are nearing the zero line, indicating rising selling pressure. Meanwhile, the 14-day Relative Strength Index (RSI) stays flat at the midpoint, showing that Ethereum (ETH/USD) remains in a defensive stance.

For bulls to gain confidence, ETH needs to break above the 200-day SMA near $2,610. This would help challenge the key resistance around $2,850, which includes an upward trend line from late February and a five-month horizontal resistance.

On the downside, a drop below $2,470 could push ETH toward the late May low near $2,328, with the monthly bottom around $2,387 likely providing some support.

Traders should also watch the crucial support zone between $2,100 and $2,150, marked by levels from early February and the 100-day SMA.

Conclusion

Ethereum remains a key focus for institutional buyers despite a cautious crypto market amid the Iran-Israel tensions. Strong inflows into U.S. Ethereum spot ETFs, hitting a yearly high of $860 million in June, and rising open interest in derivatives signal growing optimism. Technically, ETH/USD is holding important support near $2,470 and facing resistance around the 200-day SMA near $2,610. While a clear break above this level could spark further gains, traders should stay cautious as key support levels remain critical. Overall, the combination of solid institutional demand and positive market activity points to potential further advances for Ethereum.