- Ethereum hits monthly top after the biggest daily jump in four weeks.

- Upbeat on-chain signals, technical details boost ETH buyers’ hopes of breaking key resistance for $3,000.

- ETH/USD is seeing bullish momentum from ETF inflows and favorable funding rates, even with erratic whale movements.

- Bulls must secure a clear breach of $2,800 to set sights on $3,000 for Ethereum.

Ethereum (ETH/USD) hit its highest price in June during Tuesday’s European session, nearing $2,770 after its biggest daily jump in a month.

This move is backed by largely positive on-chain signals and favorable technical analysis, as bulls now target the $3,000 psychological level. Ethereum buyers are also getting a boost from increasing market confidence in ETH over Bitcoin, alongside general optimism from the ongoing US-China trade talks in London.

ETF Inflows

While spot Bitcoin ETFs saw outflows for two straight weeks, spot Ethereum ETFs grew for three consecutive weeks, now marking their fourth with a $42.71 million net inflow. According to recent SoSoValue data, total ETH spot ETF net inflows reached $281.07 million last week.

Source: SoSoValue.com

On-Chain Metrics

Even if positive sentiment and ETF inflows are supporting ETH buyers, several on-chain metrics show mixed signals but ultimately favor Ethereum’s price. Key factors drawing traders’ attention include a declining exchange supply, mixed whale participation, an upbeat OI Weighted Funding Rate, and notable wallet activity.

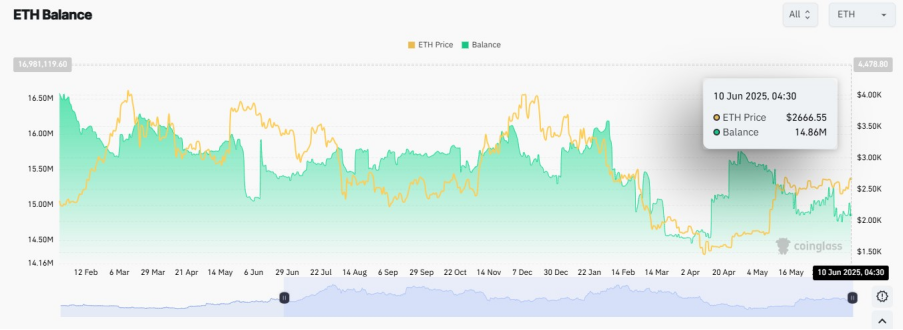

Ethereum Balance on Exchanges

A CoinGlass chart reveals Ethereum’s exchange balance, currently at 14.86 million coins, remains under pressure despite last Friday’s bounce from a seven-week low. This indicates reduced supply and strong investor holding, signaling a bullish outlook for ETH/USD.

Source: CoinGlass.com

ETH Wallet Inflow/Outflow

Despite positive ETF inflows and favorable exchange supply for Ethereum bulls, recent Coinglass data on ETH inflow/outflow patterns shows increased outflows from wallets. This suggests traders are booking profits and indicates a potential lack of confidence.

Source: CoinGlass.com

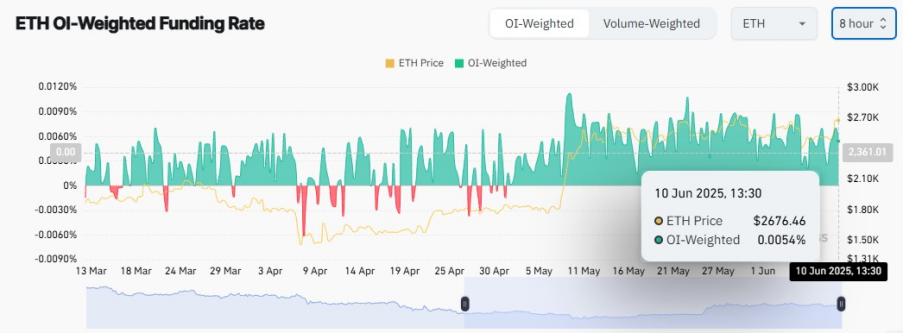

Open Interest (OI) weighted funding rate

The Open Interest (OI) weighted funding rate’s increase, currently at 0.0054% per CoinGlass, indicates traders are paying more to hold long positions. This rate has been positive since early May, reinforcing a bullish outlook for ETH/USD.

Source: CoinGlass.com

Whale Activity

Recent whale transactions show mixed signals for ETH buyers, necessitating caution for long positions.

Specifically, Whale Alert on X reported one transfer of 23,075 ETH ($57.57 million) from an unidentified wallet to Binance. Another notable transaction involved 22,500 ETH ($56.07 million) moving from CeFFu, a platform for large financial institutions’ digital custodial and security services, to an unknown wallet.

Separately, BeinCrypto noted weekend sell-offs by an “OG” ICO-era address, which sold 991.67 ETH ($2.51 million) over the weekend, bringing its total ETH sales since May 26 to 9,845.96 ETH ($25.23 million). Additionally, a whale dormant for four years unexpectedly transferred 4,949.63 ETH to a centralized exchange (CEX), and another whale withdrew 10,708 ETH from Lido before immediately sending it to OKX.

Technical Analysis

Ethereum (ETH/USD) is holding onto yesterday’s significant gains, supported by a recent short-term trend line breakout, despite being unable to overcome a month-old horizontal resistance. Bullish momentum is evident from the Moving Average Convergence and Divergence (MACD) indicator.

However, the 14-day Relative Strength Index (RSI), currently near 71.00, signals overbought conditions, challenging ETH bulls. Even so, sustained trading above the 200-bar Exponential Moving Average (EMA) keeps buyers optimistic about clearing the immediate resistance and targeting key Fibonacci Extension (FE) levels from the May-June price moves.

ETH/USD: Four-hour chart favors bulls

Source: Tradingview

ETH/USD buyers remain hopeful due to a successful rebound from the 200-bar EMA, bullish MACD signals, and a break above a late-May downward trend line, now acting as immediate support around $2,565.

However, a month-old horizontal resistance area ($2,740-$2,765) and overbought RSI (14) suggest consolidation before a further price increase.

A validated break above $2,765, confirmed by the $2,800 psychological level, is needed for ETH buyers to target the 50% Fibonacci Extension at $3,036, with $3,000 as an intermediate stop.

Immediate support for ETH/USD is the former resistance line at $2,565.

Below this, the convergence of the 200-bar EMA and a month-old rising trend line near $2,450 presents strong support against sellers.

Finally, an early April upward-sloping support line near $2,355 serves as the last defense for ETH/USD buyers before sellers gain control.