- Ethereum jumps to 5.5-month high as technical breakout meets smart money and Crypto Week hype.

- SharpLink’s ETH buying spree, strong ETF inflows, and rising staking demand boost bullish sentiment.

- Hopes for progress on three key U.S. crypto bills fuel ETH/USD optimism ahead of House review.

- Technical breakout above key resistance and strong on-chain signals suggest further upside despite overbought RSI & Stochastic.

Ethereum price (ETH/USD) surged to a 5.5-month high near $3,165 early Wednesday, after defying Bitcoin’s (BTC/USD) pullback from record top the previous day. That said, the ETH’s latest rally is fueled by strong institutional buying, bullish sentiment on U.S. crypto bills in the House, solid on-chain data, and increasing staking demand. Let’s dig deeper into these catalysts.

Institutional Buying Steals the Spotlight

SharpLink Gaming (SBET on Nasdaq), a U.S.-based online performance marketing company, surpassed the Ethereum Foundation to become the largest corporate holder of Ethereum after buying 74,656 ETH for $213 million last week, according to SharpLink’s official release. Along with staking earnings of 94 ETH during this period, SharpLink’s total holdings have risen to 280,706 ETH. That said, the press release also signalled that SharpLink still holds $257 million from the proceeds, with plans for more ETH acquisitions.

Elsewhere, several low-cap publicly traded firms, including former Bitcoin miners Bit Digital (BTBT) and BitMine (BMNR), have shifted focus to building Ethereum treasuries.

Meanwhile, U.S. spot Ethereum exchange-traded funds (ETFs) are seeing strong inflows. SoSoValue reports that total spot ETH ETF inflows for July hit $1.55 billion — the highest since December 2024 and marking a fourth consecutive month of growth.

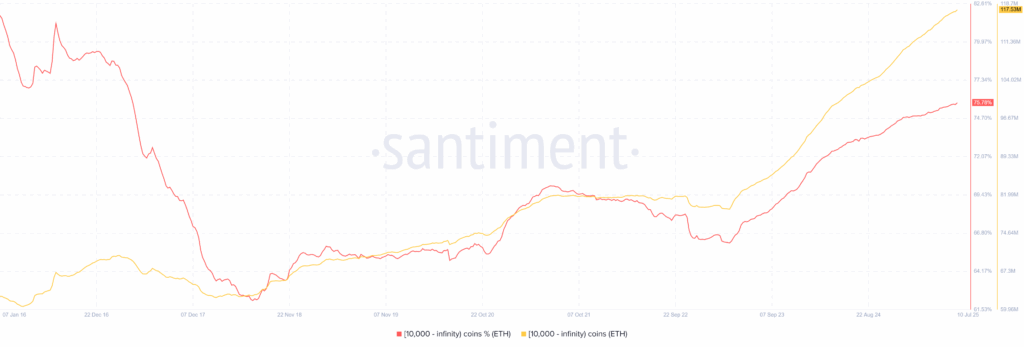

Santiment confirms that the largest Ethereum wallets—those holding 10,000 or more ETH, known as whales—have increased their holdings to a staggering 75.78% of the total supply, marking the highest level since April 2017. This accumulation also hit a record high in value terms, drawing major attention and strongly favoring ETH/USD bulls.

Other on-chain positives

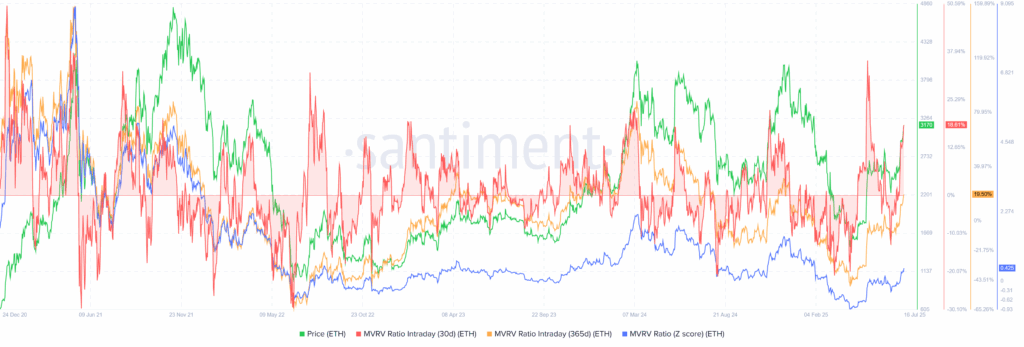

Beyond institutional buying, or “Smart Money,” on-chain data also backs Ethereum (ETH/USD) bulls. The Market Value to Realised Value (MVRV) metric stands out: short-term ETH traders are seeing 18.60% gains, while long-term holders remain underwater despite a 19.50% rise. This points to more upside potential before Ethereum becomes overvalued. Supporting this, the MVRV Z-Score sits near 0.425 — reflecting strong valuation momentum and rising market optimism.

According to the latest Q2 report from DeFi, Ethereum’s Total Value Locked (TVL) surged 33% from the previous quarter, reaching $63.4 billion.

ETH staking demand also hit a new record, with 35.6 million ETH staked in Q2—up 4% quarter-over-quarter—while the staked ETH-to-circulating supply ratio climbed to an all-time high of 29.5%. The report further highlights massive institutional accumulation, with ETH held in public treasuries jumping by 5,829% during Q2.

Ethereum Ecosystem Buzz, Crypto Week Optimism Also Favor Bulls

Growing optimism within the Ethereum developer community is adding momentum to ETH/USD prices. That said, Robinhood recently announced it is building its own Layer-2 (L2) scaling solution on Ethereum network whereas Ethereum Community Conference (EthCC) in France gained major accolades with the Ethereum co-founder Vitalik Buterin introducing a new digital identity system based on zero-knowledge proofs.

Elsewhere, U.S. President Donald Trump stepped in to revive momentum for stalled crypto legislation after resistance in the House threatened “Crypto Week” progress. On Wednesday, Trump announced that 11 of 12 House representatives now back the GENIUS Act—a bill to establish a stablecoin regulatory framework—after it was rejected 196–222 in a prior vote. A full vote could take place as early as today.

Markets are also watching for expected House votes on two other major bills: the CLARITY Act and the Anti-CBDC Act. Together, these aim to loosen the U.S. SEC’s control over the crypto sector and enable broader structural reforms to support market participants.

Technical Analysis

Backed by strong fundamentals, technicals also support Ethereum (ETH/USD) bulls. Price broke above key resistance lines from February and May, with bullish confirmation from the Moving Average Convergence Divergence (MACD) indicator. However, the 14-day Relative Strength Index (RSI) and Stochastic are in overbought territory, signaling a steady climb rather than a sharp rally.

ETH/USD: Daily chart lures bulls

Ethereum (ETH/USD) broke above a key May trendline and hit a five-month high, clearing resistance near $3,070. This level, now strong support, aligns with the overbought Relative Strength Index (RSI) and the 61.8% Fibonacci Retracement of the December 2024–April 2025 drop—the “Golden Fibonacci Ratio.”

Last week’s breakout above the February trendline resistance (now support near $2,915) and continued strength above the 200-day Simple Moving Average (SMA) at $2,472 further reinforce the bullish outlook.

With this, ETH/USD now looks poised to test the eight-month horizontal resistance zone at $3,450–$3,520. If bulls overcome the overbought RSI and Stochastic pressures, the next upside targets lie at the 2025 high of $3,742 and the late 2024 peak near $4,105, with $4,000 acting as a likely interim barrier.

Conclusion

Ethereum (ETH/USD) continues to gain bullish traction, powered by institutional accumulation, record ETF inflows, strong on-chain metrics, and favorable developments from Crypto Week and U.S. legislation.

Technicals also support the rally, with key breakouts and momentum indicators pointing to sustained strength despite overbought signals. As long as ETH holds above key supports like $3,070 and $2,915, bulls may target the $3,450–$3,520 resistance zone, with further upside toward $3,742 and $4,105 if momentum holds. Traders should watch for consolidation and political headlines, which could drive the next big move.