- Ethereum (ETH) price extends week-start pullback from yearly top, testing previous four-week uptrend.

- Crypto market consolidation, ETH validator queue data and technical analysis give bulls room to breathe.

- Bulls cheer strong ETH ETF inflows, institutional actions and whale-driven buying momentum.

Ethereum price (ETH/USD) slips over 2% intraday to $3,662 during Wednesday’s session, entering price discovery after hitting yearly high. This pullback extends Monday’s retreat from 2025’s highest level, reflecting month-end market consolidation and validator queue data pointing to short-term cooling.

Despite this, strong institutional demand fuels bullish hopes, keeping ETH/USD buyers confident for what’s next. Let’s discuss the key catalysts.

Institutional Actions Driving Ethereum Price

Earlier in the week, ARK Invest’s CEO Cathie Wood leads a major portfolio shift, selling about 219,000 Coinbase (COIN) shares worth $90.5 million across three ETFs to invest in Ethereum treasury company Bitmine Immersion Technologies (BMNR), managed by Fundstrat’s Tom Lee—marking ARK’s move from Bitcoin to Ethereum treasuries.

Similarly, Bit Digital Inc. (BTBT) transitioned from Bitcoin mining to an Ethereum treasury after raising $172 million and selling 280 BTC, now holding over 100,600 ETH. Further, SharpLink Gaming (SBET) raised $425 million via private placement and $79 million in ATM equity to build its ETH reserve.

Meanwhile, global players like JP Morgan and Robinhood are leveraging Ethereum’s layer-1 blockchain for stablecoins, tokenization, and may enable crypto-backed loans by 2026, according to Financial Times sources.

U.S. ETH Spot ETF Optimism Remain Intact

Strong inflows into U.S. spot Ethereum ETFs signal heavy buying and support ETH/USD bulls despite recent price dips, marking a near 11-week streak of gains. Weekly ETF inflows hit a record $2.18 billion last week before easing to $830 million, per the Sosonalue data.

Meanwhile, daily inflows continue for 13 straight days, with $533.87 million added as of July 23—showing growing institutional appetite even as Bitcoin inflows pull back.

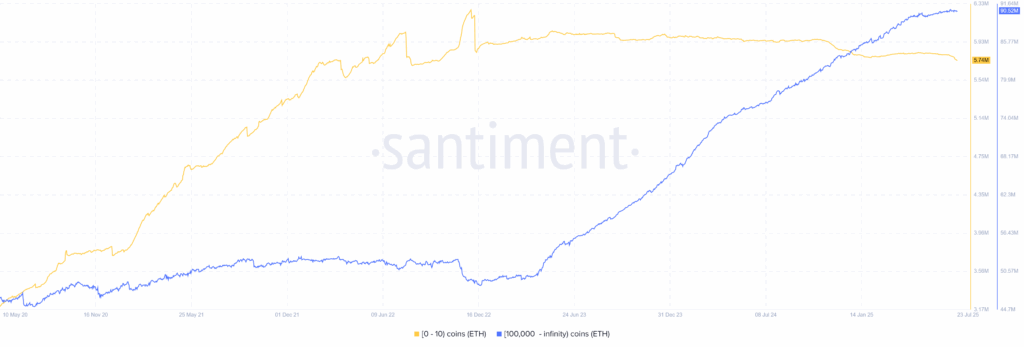

ETH Retail vs. Whale

Santiment data shows retail Ethereum holders (under 10 ETH) dropped to their lowest since Sept 2022, down 59,934 ETH (1.03%) in July to 5.74 million ETH, signaling waning retail interest. Meanwhile, whales (wallets over 100,000 ETH) hit a record 90.73 million ETH on July 10 and, despite some consolidation, added 97,249 ETH (0.11%) in July, holding steady around 90.52 million ETH.

Additional Positive Catalysts

Apart from the aforementioned catalysts, there are a slew of upbeat catalysts that favor the ETH/USD bulls. Some of them are discussed as follows:

Bitwise CIO Matt Hougan predicts $20 billion (5.33M ETH) could flow into ETH via ETPs and treasuries next year—over seven times the network’s 800,000 ETH supply—highlighting Ethereum’s underweight status versus Bitcoin.

On-chain data and price prediction firm CoinCodex forecasts project ETH soaring to $7,400–$8,000 by end-2026.

TradingView data shows ETH gaining market share as Bitcoin dominance dips from 66% to 60.9%, while ETH’s dominance climbs to 11.52%.

Factors Suggesting Profit-Booking

While earlier catalysts keep ETH/USD bulls hopeful, several factors may have triggered the latest pullback in the second-largest cryptocurrency.

A key reason is month-end consolidation after a strong 46% surge in ETH/USD during July. The shift in sentiment also reflects broader market concerns, including U.S. President Donald Trump’s recent trade and geopolitical threats, his push for Federal Reserve rate cuts, and even his stated willingness to fire Fed Chairman Jerome Powell.

Additionally, Ethereum’s Validator Queue data shows a sudden shift in validator sentiment: the queue to exit the network has surged from 1,920 ETH last week to 521,252 ETH (worth $1.95 billion) as of Wednesday, raising the wait time from just 0.03 days to over 9 days. Such spikes typically signal declining validator confidence after major price rallies. However, it’s worth noting that validator entry demand is also rising—entry wait times have climbed to 6 days from a monthly low of 2.54 days on July 7, with 359,557 ETH ($1.33 billion) waiting to join the network—hinting at ongoing long-term interest in Ethereum despite the short-term correction.

Technical Analysis

The Ethereum’s technical price analysis also favors short-term pullback in prices while portraying the overbought conditions of the 14-day Relative Strength Index (RSI) and the Doji candlestick on the daily chart.

ETH/USD: Daily Chart Signals Short-term Pullback

Monday’s Doji candlestick at the yearly high, combined with overbought conditions in the RSI, suggests a potential ETH/USD pullback toward a key two-week-old support near $3,450. If this level fails to hold, the pair could be exposed to a deeper decline toward the psychological $3,000 mark.

Below that, a confluence of technical supports—namely the 50-day Exponential Moving Average (EMA) and a previous resistance line from early February near $2,870—may come into play, followed by an ascending trendline from early April around $2,555, which could provide a strong floor for prices.

On the upside, immediate resistance lies at the recent peak of around $3,860, ahead of a descending trendline from November 2021, now positioned near $3,960.

A decisive breakout above this trendline would pave the way for a run toward the key $4,000 psychological level, with further bullish potential extending to a horizontal resistance zone around $4,100, marked by multiple tops since March 2024.

Conclusion

Ethereum’s latest dip comes amid a mix of month-end profit-taking, shifting validator sentiment, and broader macro uncertainty. Still, the bullish narrative remains intact, supported by robust institutional flows, growing spot ETH ETF inflows, whale accumulation, and increasing real-world adoption by giants like JP Morgan and Robinhood. With Ethereum gaining market share and long-term forecasts turning increasingly optimistic, any short-term pullback may offer a fresh opportunity for accumulation. As institutional interest deepens and supply remains constrained, ETH/USD bulls are likely to stay in control over the medium to long term.