- Ethereum hits 6-month high with 43% monthly jump, Ripple spikes to a fresh all-time high before easing—still up 53% in July.

- U.S. House passes GENIUS Bill; Trump backs crypto for $9.0 trillion retirement market—ETH, XRP respond with gains.

- XRP bulls face resistance as U.S. SEC delays appeal dismissal even after Ripple confirms penalty payment.

- Pullback emerges as key technical levels test ETH and XRP buyers, though broader uptrend remains intact.

Ethereum (ETH/USD) and Ripple (XRP/USD) showcase strong market optimism on Friday, driving July gains close to 50% each despite recent pullbacks. This rally was supported by positive news from the U.S. House of Representatives and President Donald Trump.

Ethereum reached its highest level since early January, retreating slightly to $3,613, up 3.83% intraday and 45% for July during Friday’s European session.

Ripple hit a record high of $3.48 but then declined 1.00% to around $3.45, while still marking over 53% gains for the month. That said, XRP bulls face challenges as the delayed dismissal of the U.S. Securities and Exchange Commission’s (SEC) appeal in the Ripple case tests resistance near the all-time high.

GENIUS Act Passage & Trump’s Push

The GENIUS Act, which sets regulations for stablecoins, passed the U.S. House of Representatives with a 308-122 vote and is now headed to President Trump for signing into law. This marks a major step forward for the digital asset sector and boosts crypto bulls during the much-anticipated “crypto week,” when Capitol Hill was expected to vote on three key bills: the GENIUS Act, the CLARITY Act, and the Anti-CBDC Act.

While the GENIUS Act is close to becoming law, the CLARITY Act—which aims to define the broader structure of crypto markets—passed the House 294-134 with strong bipartisan support and will move to the Senate next. The Anti-CBDC Act, which proposes banning central bank digital currencies, faces more political division. It is tied to the critical National Defense Authorization Act as a Republican compromise, meaning it may take longer before it becomes law.

In addition to the GENIUS Act progress, a report from the Financial Times (FT) boosted crypto optimism by revealing that U.S. President Donald Trump plans to open the $9.0 trillion retirement market to crypto investments. According to sources briefed on the plan, per the FT, the President is expected to sign an executive order allowing 401(k) retirement plans to include alternative investments beyond traditional stocks and bonds.

U.S. SEC vs. Ripple

Ripple’s long-running legal battle with the U.S. SEC hit a key milestone with a $125 million fine agreement. Rumors that Ripple paid the fine in XRP tokens were dispelled by former SEC regional director Marc Fagel, who confirmed in his tweet that they already paid in cash.

Concerns about delays in the SEC’s dismissal of its appeal in the Ripple case have also increased. However, Fagel clarified that the SEC’s appeal dismissal process typically takes one to two months after a formal vote, and the current timeline is consistent with normal legal procedures. This suggests some more grinding for the XRP/USD before they witness the final settlement in the U.S. SEC versus Ripple case, as well as brace for heavy ETF approvals.

Statistics Favoring ETH, XRP Bulls

Apart from the news, a slew of on-chain and ETF details also unpin bullish bias surrounding the Ethererum and Ripple prices. Among them, performance of XRP whales and the U.S. spot ETH ETF inflows gain major attention.

Starting with the inflows to the U.S. Spot ETH ETFs revealing growing excitement for top cryptocurrencies, with the latest monthly figures hitting a record $2.88 billion in July—marking a fourth straight month of gains, according to sosovalue data.

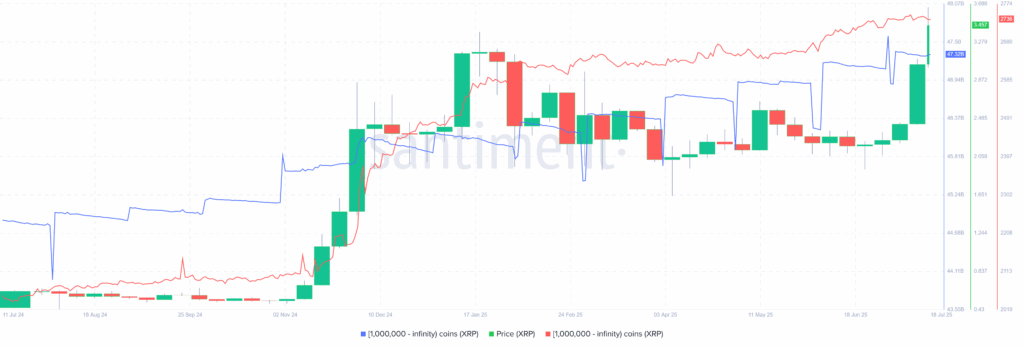

Elsewhere, on-chain data from Santiment shows bullish signs for Ripple (XRP/USD), with XRP whale activity rising. The number of wallets holding at least one million XRP hit a record 2,747, now at 2,736, controlling $47.32 billion in XRP. This reflects strong confidence from large investors.

Additionally, Santiment data shows XRP’s Exchange Flow Balance turned negative at -1.53 million on July 18, indicating more XRP was withdrawn than deposited. This suggests growing investor confidence, as tokens are likely being moved to cold storage—reducing selling pressure and supporting potential price growth.

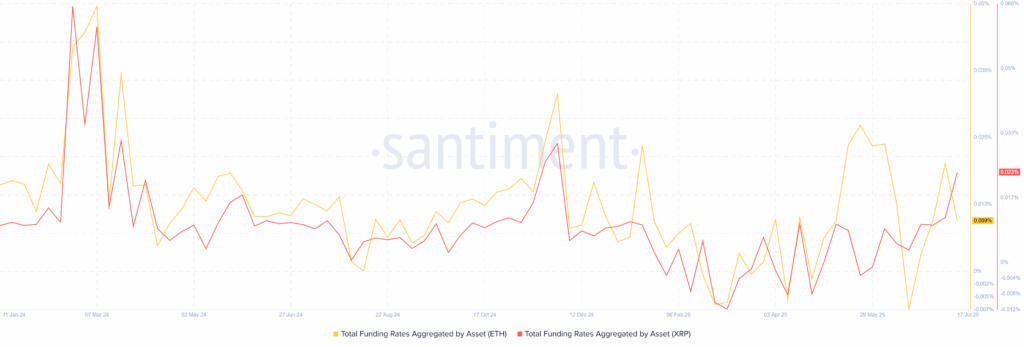

If we take a look at the Total Funding Rates, Ripple (XRP) has advantage over the Ethereum (ETH). According to Santiment data, ETH’s funding rate stands at 0.009% while that of XRP’s stay near 0.023%, almost three times, indicating higher profitability for XRP/USD traders.

Technical Analysis

While fundamentals, on-chain metrics, and ETF-related signals remain mostly positive for both Ethereum (ETH) and Ripple (XRP), XRP holds a slight advantage over ETH in terms of funding rates. However, that edge may soon be tested technically, as XRP/USD retreats after hitting an all-time high and facing rejection from a long-term ascending resistance line dating back to 2021.

ETH/USD: Monthly Chart Signals Further Upside

Even though a downward-sloping resistance line from November 2021 challenges Ethereum (ETH/USD) near $3,680, a decisive break above the 24-month Simple Moving Average (SMA), combined with a 14-day Relative Strength Index (RSI) holding above 50.00 without being overbought, keeps bulls optimistic. A potential bullish crossover on the Moving Average Convergence Divergence (MACD) indicator further supports the upside momentum.

If ETH/USD breaks above $3,680, the next targets include the 2024 high near $4,105, followed by key resistance levels from May and November 2021 at $4,381 and $4,868.

On the downside, a meaningful pullback appears unlikely as long as ETH holds above the 24-month SMA at $2,693, with $3,000 providing immediate support. Further below, an ascending trendline from June 22, around $1,415, serves as the final defense for the bulls.

XRP/USD: Monthly Chart Signals Pullback

Ripple’s (XRP/USD) monthly chart suggests bulls may need to wait, as the price fails to hold above the ascending resistance line from April 2021 near $3.60. The current pullback toward the February 2018 resistance line around $3.40, combined with overbought RSI conditions, points to potential further downside.

Still, XRP/USD remains bullish above the April 2021 peak of $1.97 and the 24-month SMA $1.23. Key supports lie at $3.00 and $2.00, while a clear break above $3.60 could open the door to test the psychological levels of $4.00 and $5.00.

Conclusion

Despite brief pullbacks, Ethereum and Ripple remain firmly in bullish territory, backed by strong July gains, favorable U.S. legislation, rising institutional interest, and solid on-chain metrics. ETH looks set to test $3,680 and possibly $4,105, while XRP eyes a breakout above $3.60 toward $4.00 and beyond. With Trump’s crypto-friendly push and pending ETF and regulatory milestones ahead, both assets are well-positioned for further upside in the coming weeks.