- Ripple trades lower following a four-day winning streak, but holds close to last week’s all-time high.

- XRP bulls face heat from a multi-year resistance as broader market consolidation tests momentum.

- Upbeat whale demand, MVRV ‘Golden Cross’ boost confidence of XRP/USD investors amid strong fundamentals.

Ripple price (XRP/USD) prints its first daily loss in five sessions, printing an intraday low to $3.47 during Wednesday’s European trading session. Even so, bulls maintain control near last week’s all-time high (ATH). That said, the XRP/USD pair has gained an impressive 55% so far in July.

Despite facing a multi-year resistance line amid market consolidation following a strong rally, powerful on-chain indicators and positive fundamental catalysts keep the bullish outlook intact in the short to medium term.

Let’s dive deeper into what’s fueling XRP’s upside momentum!

What’s Fundamentals Are Saying!

XRP’s latest rally draws strength from the growing optimism over U.S. crypto regulations, Ripple’s expanding role in tokenized assets and stablecoins, and speculation around a potential XRP Exchange-Traded Fund (ETF).

The recent signing of the GENIUS Act and the Senate’s passage of the CLARITY Act have paved the way for clearer regulatory frameworks, boosting sentiment across Ripple, XRP, and RLUSD.

That said, Ripple’s long-standing legal battle with the U.S. Securities and Exchange Commission (SEC) reached a turning point earlier in 2025 with a $125 million settlement and withdrawal of its cross appeal. However, the U.S. SEC has yet to confirm whether it will drop its own appeal—despite holding closed-door meetings on July 10 and 17—stalling BlackRock’s XRP Trust filing and dampening momentum near key technical resistance after a sharp rally.

Meanwhile, Ripple’s application for a banking license and its potential benefit from the Fedwire ISO 20022 upgrade, supported by prior involvement, continue to fuel bullish sentiment for XRP/USD.

On-Chain Signals

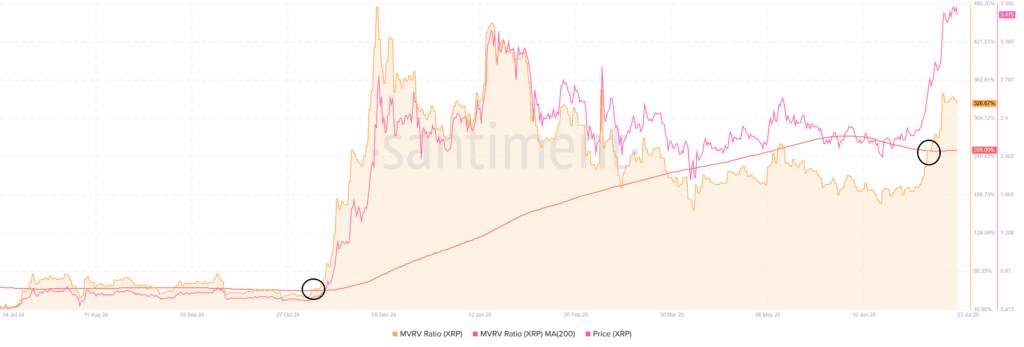

Alongside strong fundamentals, Ripple (XRP) enjoys bullish on-chain support, highlighted by a “Golden Cross” on its Market Value to Realized Value (MVRV) ratio — a signal flagged by noted crypto analyst Ali Martinez.

Adding to the upside bias are record-high XRP whale wallets and consistently positive funding rates, all pointing to sustained bullish momentum.

Ripple’s Market Value to Realized Value (MVRV) ratio has crossed above its 200-day Moving Average, flashing a “Golden Cross” — a historically bullish signal. Notably, the last time this pattern appeared in November 2024, XRP/USD surged by 630%, raising hopes for a similar breakout this time around.

XRP’s MVRV “Golden Cross”

Currently, the MVRV ratio is 326.67% and the 200-day moving average is around 255%, per the Santiment data.

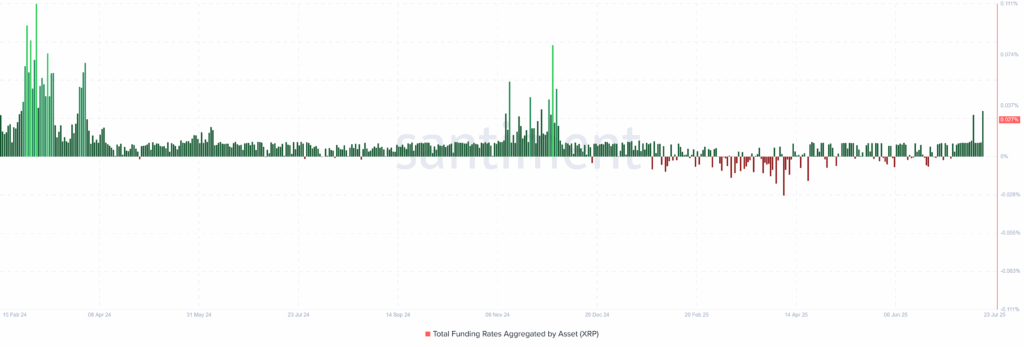

XRP’s total aggregated funding rates surged to an eight-month high of 0.027% by the press time of early Wednesday, indicating a rise in long-position demand and growing investor interest.

This suggests that newcomers entering the market must now pay higher fees to hold bullish positions. However, while such elevated funding rates often align with increased optimism, they don’t guarantee sustained upside—as historically, extreme readings have sometimes preceded local tops or price reversals in XRP/USD. Investors are advised to wait for the confirmation before placing any bet.

XRP Total Funding Rates Aggregated

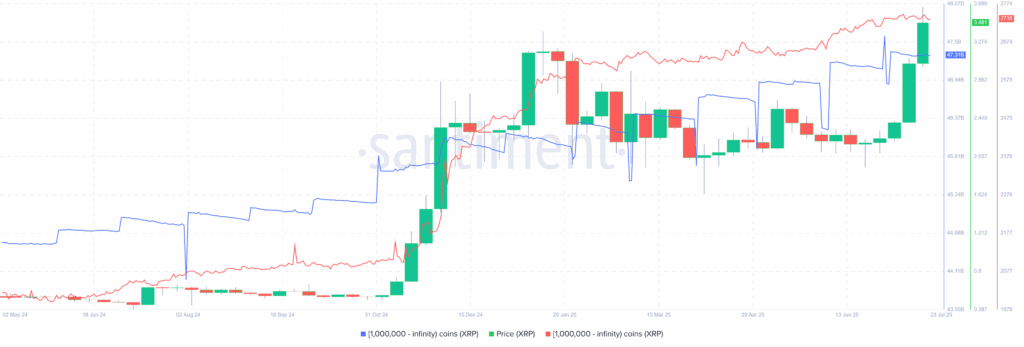

Whale activity in Ripple’s XRP has surged. Earlier in July, the number of wallets holding 1 million or more XRP hit a record 2,747, before slightly dipping to 2,735.

These large wallets now hold a total of around $47.31 billion worth of XRP, just below the early-month peak of $47.39 billion. This rise in accumulation by high-value investors (“smart money”) signals growing confidence in XRP and adds strong momentum to the bullish sentiment surrounding Ripple’s outlook.

XRP 1M+ Coin Balance By Number & Total Balance Held

Technical Analysis

Despite the recent pullback, Ripple (XRP/USD) keeps the previous week’s decisive breakout of the key horizontal resistance levels from January 2018 and 2025, boosted by a bullish Moving Average Convergence Divergence (MACD) crossover. This keeps buyers optimistic, although overbought signals in the 14-day Relative Strength Index (RSI) and an ascending resistance line from April 2021 could slow near-term gains for XRP/USD bulls.

XRP/USD: Weekly Chart Signals Price Discovery

XRP/USD has made a key technical breakout, clearing the multi-month resistance zone around $3.32-$3.40, supported by a bullish MACD crossover.

However, an overbought RSI and an ascending resistance line from April 2021 near $3.60 may limit immediate gains.

A short-term pullback to the $3.30-$3.00 zone remains possible unless XRP clears the $3.60 hurdle and holds above the recent ATH of $3.66—potentially pushing toward a new target near the $5.00 psychological level.

On the downside, a break below $3.00 could shift the bullish sentiments. In that case, the XRP price could test the low of the April 2025 at $1.61.

Conclusion

Ripple (XRP/USD) is poised for exciting moves ahead, buoyed by strong fundamentals, bullish on-chain signals, and a key technical breakout above multi-year resistance. With growing regulatory clarity, institutional interest, and “smart money” accumulation, the bulls remain firmly in control—but near-term pullbacks could test support around $3.30-$3.40 before potentially targeting new highs near $4.00. Traders should watch closely as XRP navigates these critical levels amid a backdrop of optimism and cautious consolidation.