- Ripple price slide 6.0% to hit a 10-week low, posting the biggest fall in a month.

- Broad crypto sell-off, XRP’s 21-day SMA breakdown, and heavy long liquidations lure bears.

- XRP ecosystem growth, official end of the Ripple vs. U.S. SEC lawsuit, after a fine payment, keeps buyers optimistic.

- Key technical, fundamental catalysts eyed amid month-end positioning.

Ripple (XRP) price dropped over 6.0% intraday to $2.69, before bouncing off a 10-week low to $2.82, as Monday’s U.S. trading session approaches. The XRP’s latest fall traces the broad crypto market rout, along with position liquidations and a technical breakdown. The altcoin’s fall also bolsters the trading volume and weighs on the market capitalization, further luring sellers. Still, several positive fundamental catalysts keep the buyers optimistic.

Ripple Price Slips 4% amid Broader Bearish Sentiment

Cryptocurrency markets witnessed a grim Monday as top coins posted losses ranging from 2.0% to 20% due to wide-ranging catalysts from risk-aversion to long liquidations and technical breakdown, not to forget a record high in Gold, grabbing funds from elsewhere.

Among the major losers, Ethena (ENA) gained attention with its 20% slump, while Bitcoin (BTC) dropped nearly 3.0% and Ethereum (ETH) marked a 7.0% fall.

Also read: Why is Crypto Falling Today? BTC falls 3%, ETH slips 7%, XRP down 6%

The total crypto market capitalization (market cap) dropped 3.80% to $3.88 trillion, per CoinMarketCap.

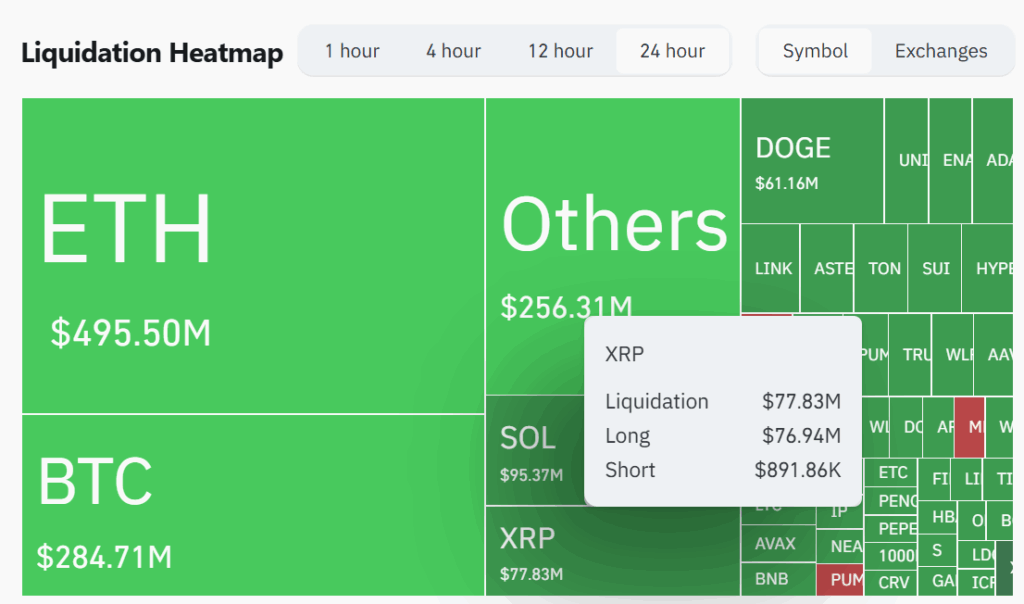

Heavy long position liquidations have grabbed media attention, contributing to the recent market downturn. Long liquidations, forced by brokers due to insufficient margin, are common during downtrends and point to short-term bearish sentiment. In the past 24 hours, $1.67 billion worth of liquidations occurred, with $1.59 billion coming from long positions.

For XRP, $77.83 million in liquidations were recorded, with $76.94 million in long positions, explaining its recent slump.

Liquidations HeatMap

Source: CoinGlass.com

XRP Positives to Look Out

While the aforementioned catalysts justify Ripple’s latest fall, several positive fundamental catalysts stand tall to defend buyers.

Among them, an official end to the Ripple vs. U.S. Securities and Exchange Commission (SEC) lawsuit gained major attention after the XRP’s parent paid $125 million penalty to the U.S. Treasury last month. This allowed prominent lawyer Bill Morgan and crypto commentator Jake Claver to stay hopeful about more XRP price action, especially backed by the latest ecosystem growth.

Elsewhere, Ripple chief technology officer, David Schwartz, said, “XRP is at the core of trillions in banking future,” per NewsBTC. The statements gained credence from Ripple’s efforts to take a New York banking charter, a Federal Reserve master account, confirming with ISO 20022 messaging standards used by major banks.

Ripple’s launch of RLUSD stablecoin and its acceptance by major banks, such as DBS and Franklin Templeton, also play a crucial role in signifying the future potential of XRP.

Meanwhile, the launch of the first XRP ETF, by Rex-Osprey, joins the U.S. SEC’s easing of rules for filling the cryptocurrency spot ETFs, which also adds to the optimism surrounding the altcoin.

Furthermore, Flare Network announced a stablecoin backed by XRP while Japan’s gaming and blockchain firm Gumi established an XRP treasury worth $17 million.

Additionally, PayPal and MasterCard have also recently taken measures to boost XRP usage in day-to-day payments, whereas Ripple’s plans to launch RLUSD in Africa also signify XRP’s future potential.

Technical Analysis

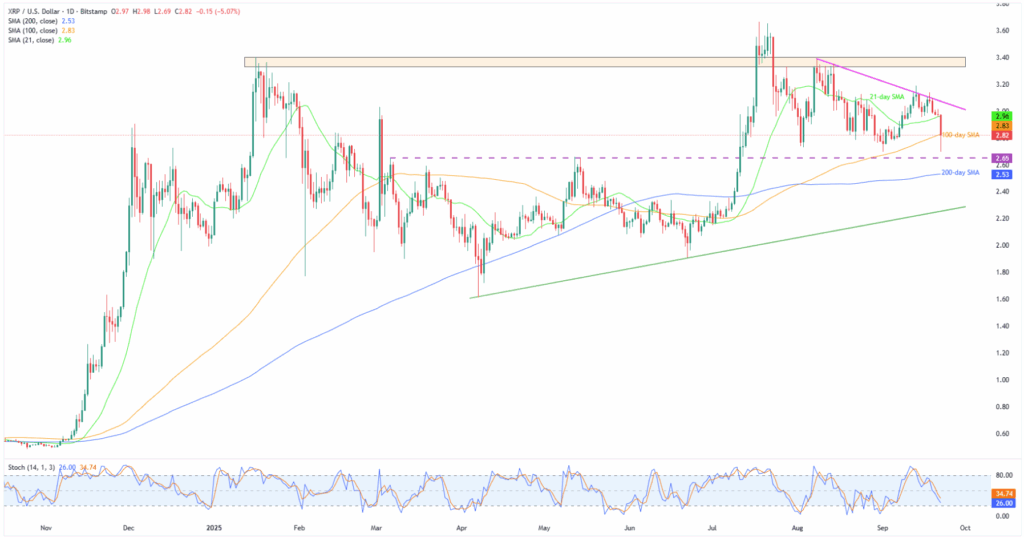

Ripple’s downside break of the 21-day Simple Moving Average (SMA) recently lured the bears, even as the oversold Stochastic momentum indicator and the 100-day SMA challenge the south-run.

Ripple Price: Daily Chart Points To Pullback

Even after breaking the 21-day SMA support of $2.96, now resistance, the XRP bears need a daily closing beneath the 100-day SMA of $2.80 to approach a resistance-turned-support line from March, surrounding $2.65.

Notably, the overheated stochastic hints at a corrective bounce, highlighting the immediate support levels.

If the XRP drops beneath the $2.65 support, bears will keep eyes on the 200-day SMA support of $2.52 and an ascending trendline support from early April, close to $2.25.

Meanwhile, Ripple’s recovery remains elusive beneath the 21-day SMA support of $2.96.

Also acting as a short-term key resistance is a descending resistance line from early August, close to $3.08.

Beyond that, a broad resistance area comprising levels marked since January, surrounding $3.33-$3.40, and the XRP’s ATH of $3.67 might stop the bulls before directing them toward the $4.00 threshold.

Conclusion

Ripple traces the broader crypto market sell-off, as well as position liquidations and a technical breakdown, to post stellar losses on Monday.

However, official resolution of the Ripple vs. SEC lawsuit, XRP’s ecosystem growth, and recent institutional interest in the altcoin defend the long-term bullish sentiment.

That said, traders should keep a close eye on key technical levels, particularly the 100-day SMA of $2.80 and $2.65 support, for potential rebound.

On a broader front, the XRP looks poised to refresh its ATH and can well reach the market’s widely anticipated $5.0 target in 2025.

Also read: Cryptocurrency Weekly Price Prediction: BTC Holds, But ETH & XRP Dip as Dollar Edges Up