- Ripple price tests six-week-old bullish channel, 200-bar SMA support with eyes on first daily/weekly loss.

- RSI, MACD signals further consolidation of XRP’s monthly gains.

- Depleting supplies, higher exchange reserves and upbeat OI-weighed funding rates keep XRP/USD bulls hopeful.

Ripple (XRP/USD) faces its first daily and weekly loss, dropping to $2.29 on Friday. This move tests a six-week-old bullish trend channel and the 200-bar Simple Moving Average (SMA) support on the 4-hour chart. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest the pullback may continue. However, on-chain data shows strong buyer accumulation, limited supply, and positive sentiment, which could limit the downside for XRP, leaving sellers with limited opportunities

On-chain analysis

Although Ripple’s price momentum surprises traders on Friday, the on-chain signals are mostly optimistic, apart from the exchange reserves, and requests bulls to remain hopeful despite the latest pullback.

Whale Activity: As per the latest Supply Distribution metric from Santiment, there prevails a steady, though small, increment in XRP holdings of investors with between 10 million and 100 million coins, known as ‘whales’, suggesting bullish sentiment among investors. That said, such whales held 12.1% positions during this week compared to 11.8% marked on May 12 and 11.58% for April 12.

XRP Supply Distribution metric

Source: Santiment

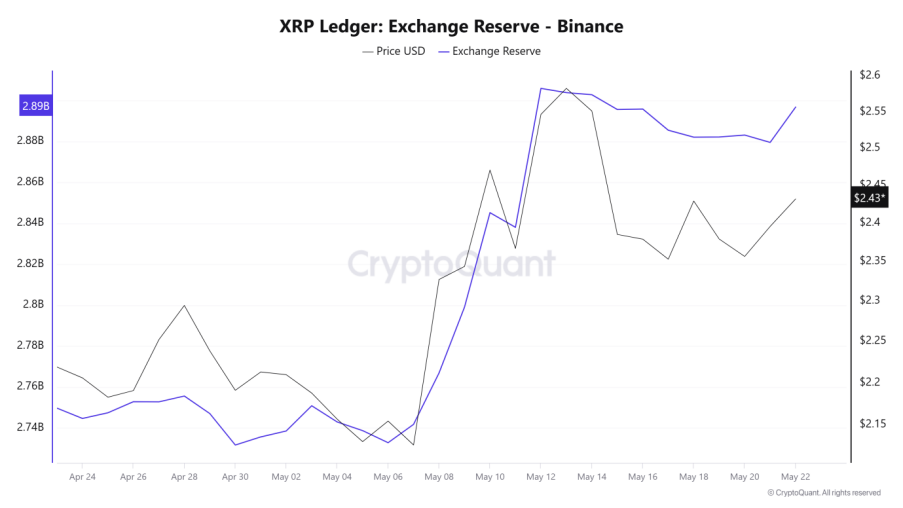

Exchange Reserves: While the supply distribution metric shows more whale activity, CryptoQuant’s XRP Ledger Exchange Reserve data for Binance indicates a steady rise from $2.7 billion on May 7 to $2.9 billion on May 22. This suggests potential selling pressure or increased volatility. However, the latest 24-hour trend (though not charted yet) shows a 0.4% decline in exchange reserves, hinting at ongoing accumulation. If this trend continues, it could support Ripple buyers and limit downside risks.

Source: CryptoQuant

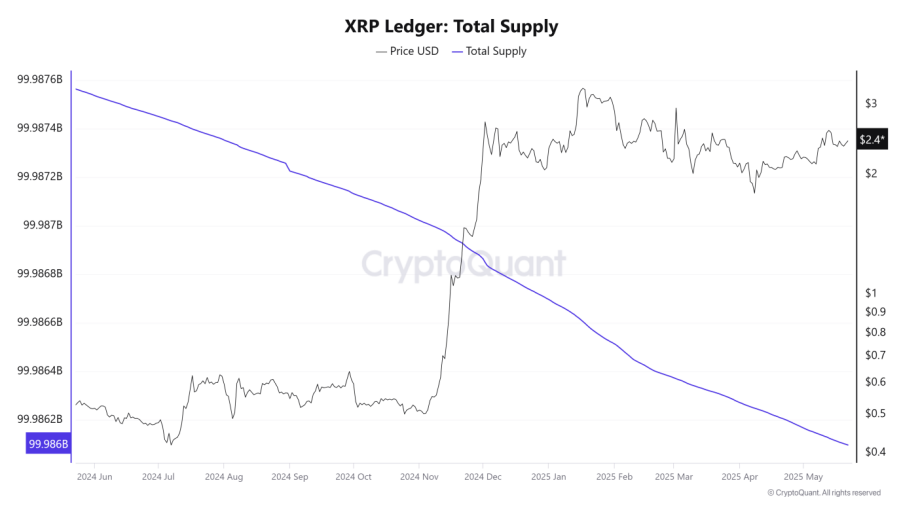

Total Supply: A steady decline in the XRP supplies, per the XRP Ledger’s Total Supply graph of CryptoQuant, from 99.987 billion in early January to 99.986 billion on May 22, suggests further recovery in prices.

Source: CryptoQuant

Active Addresses: A rise in the total number of unique active addresses, including both senders and receivers, from close to 22K to 25K in a week, signals increased trading activity in XRP/USD. This uptick suggests positive sentiment, similar to the one that fueled the previous price rally, potentially challenging the recent pullback in prices.

Source: CryptoQuant

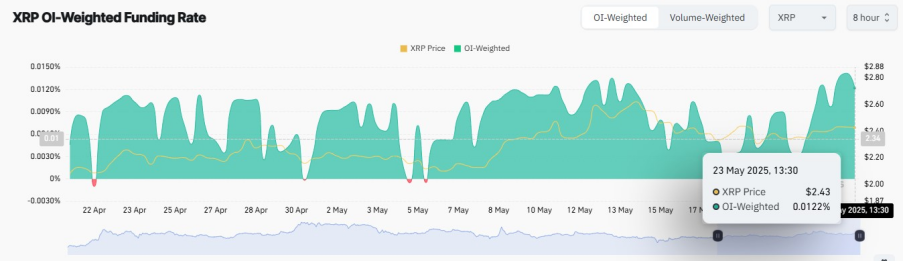

Open Interest (OI)-Weighted Funding Rate: An uptick in Open Interest (OI) weighted funding rate hints at trader’s readiness to pay more to uphold long positions. This can be viewed in the latest data from CoinGlass citing increase in Oi-Weighted Funding Rate from 0.0017% on May 18 to 0.0122% at the latest.

Source: CoinGlass

Technical analysis

With mostly bullish on-chain signals, it’s time to turn to technical analysis, which raises concerns for XRP/USD buyers. A dip in the RSI and a potential bearish crossover on the MACD challenge the six-week-old bullish trend, putting buyers’ optimism to the test.

XRP/USD: Four-hour chart challenges bullish bias

Source: TradingView

Ripple (XRP/USD) sellers are testing the lower boundary of a six-week-old bullish trend channel around $2.36, as well as the 200-bar SMA support at $2.29. The RSI below 50.00 indicates weak momentum for any bullish moves, while the MACD histogram has flashed a bearish signal, attracting sellers.

For sellers to regain control, a clear break below $2.29 is crucial. If this happens, a swift drop towards the monthly low of $2.07 and potentially down to $2.00 is possible.

On the flip side, if XRP/USD recovers, the first target would be the recent peak near $2.48, followed by the monthly high around $2.65. If buyers manage to push past $2.65, attention will shift to the upper channel boundary near $2.82, and then the $3.00 mark.