Key Takeaways

- Tokyo-listed Quantum Solutions becomes the largest public Ethereum treasury, holding 3,866 ETH.

- CEO Francis Zhou shared plans to build a 100,000-ETH treasury with support from ARK Invest and Susquehanna International Group.

- ETH’s bullish thesis relies on holding above the $3,800 support level.

Ethereum (ETH) appears to be gearing up for a bull run after Japan-based Quantum Solution became the largest ETH treasury outside the United States. The Tokyo-listed firm purchased 2,365 ETH worth $9 million, increasing its total ETH holdings to 3,866 ETH, valued at $14.8 million.

Quantum Solutions ETH Holdings

With the recent acquisition, Quantum Solution has become Japan’s largest public Ethereum treasury and the 11th largest in the world, following BitMine, Sharplink Gaming, Bit Digital, Coinbase Global, and ETHZilla.

In a report, the company’s CEO, Francis Zhou, noted that the firm will continue buying more ETH until it builds a 100,000-ETH treasury. For this acquisition, ARK Invest and Susquehanna International Group are providing assistance.

While supporting Quantum Solution, ARK Invest CEO Cathie Wood said that her company is more than happy to help build the firm’s ETH treasury.

This update comes during a period when the overall cryptocurrency market is experiencing a price reversal, but it has strengthened Ethereum’s (ETH) bullish outlook.

Besides Quantum Solution, BitMine also appears to be continuing its ETH accumulation. According to recent data, the firm acquired 203,826 ETH last week, bringing its total holdings to 3.2 million ETH.

ETH Current Price Momentum

Besides these acquisitions, ETH’s price remains stable but has now begun climbing. As of press time, ETH is trading near $3,860, posting a decent price increase of 1.45% today, according to TradingView data. However, market participants have shown less interest compared to the previous day, as evidenced by trading volume, which dropped 15% to $39.45 billion.

Looking at the institutions’ massive accumulation, this could be an ideal buying opportunity. Let’s examine the key levels and upcoming ETH price points that are likely to play an important role.

Ethereum (ETH) Price Action and Upcoming Levels

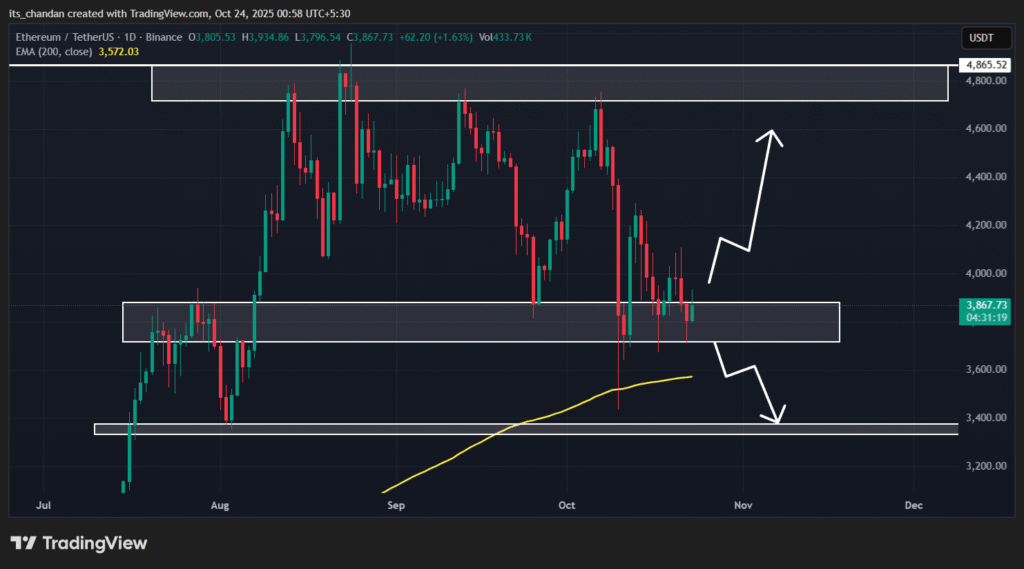

According to TimesCrypto technical analysis, Ethereum is at a make-or-break level of $3,800, and institutional interest and confidence hint at ETH’s long-term potential. On the daily chart, it is evident that historically, whenever ETH’s price reaches this key support level, it has witnessed impressive reversals.

Based on the current price action, if ETH holds the $3,800 support, it could see a price reversal. However, if momentum fails and the price falls below this key support, a sharp decline is possible, with ETH potentially dropping to the next support near the $3,400 level.