Key Takeaways:

- Hyperliquid is a decentralized exchange (DEX) founded by Jeff Yan and Iliensinc in 2020, presently controls 74.3% of market share in the DEX perpetual space.

- Launched its native token HYPE via an airdrop worth $1.2 billion without any backing from a venture capitalist or an initial coin offering (ICO).

- Centralization has been criticized, including closed-source code, validator concentration (81% with foundation nodes), and situations such as the JELLY delisting, in which positions were forced to be closed.

Hyperliquid is a decentralized exchange platform (DEX) founded by Jeff Yan and Iliensinc, two Harvard classmates without any funding or backing from a venture capitalist (VC). Jeff Yan previously worked at Hudson River Trading, where he worked on high-frequency trading systems before launching Chameleon Labs, a crypto market-making startup, in 2018.

The DEX also has its own layer-1 called HyperEVM to provide ultra-fast, gas-free trading with a fully on-chain order book. The idea is to create the feeling of a centralized exchange (CEX) while maintaining the self-custody and transparency of a DEX. Every order, exchange, and cancellation is recorded on-chain, so you maintain control over your funds.

Trading on Hyperliquid

Futures (Perpetual Contracts)

Hyperliquid is mainly built for derivatives trading, letting users bet on the price of Bitcoin (BTC), Ethereum (ETH), and 100+ other assets without owning them directly.

The DEX allows users to trade perpetuals, which are futures contracts with no expiry date, letting traders long or short crypto prices indefinitely as long as they maintain margin. According to Dune Analytics, Hyperliquid controls 74.3% of market share in the DEX perpetual market.

Traders can use leverage of up to 40–50x, place advanced order types like market, limit, stop, TWAP (orders spread out over time) and scale. Perpetual futures fees on Hyperliquid get cheaper the more you trade, with tiered discounts ranging from Diamond, Platinum, Gold, Silver, Bronze, and Wood based on your 14-day trading volume.

Spot Trading

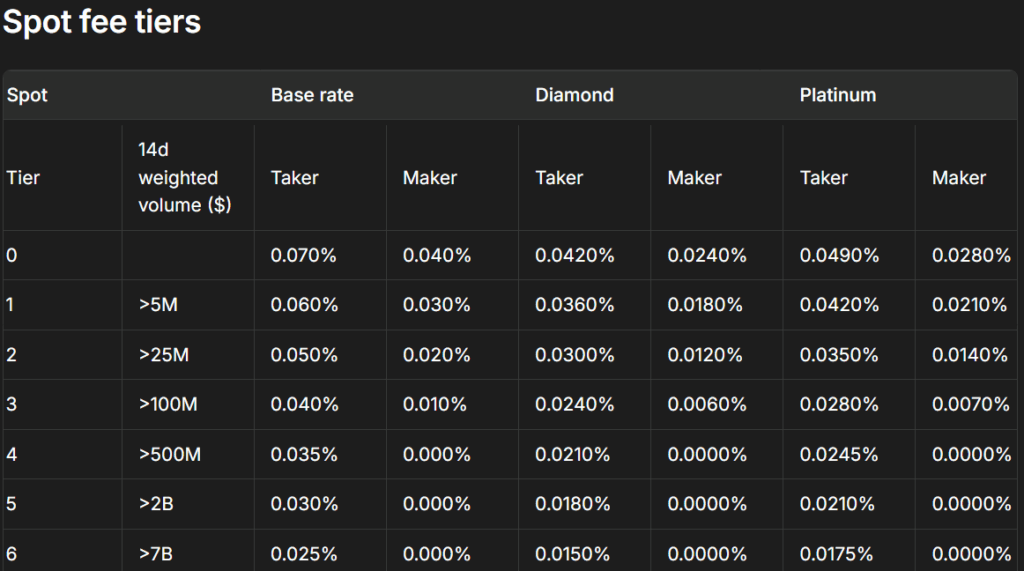

Spot trading fees on Hyperliquid also use a tiered system, where the more you trade over a set period, the lower your fees become. Traders are grouped into similar categories ranging from Base to Wood, with each tier offering different fee rates.

Vaults

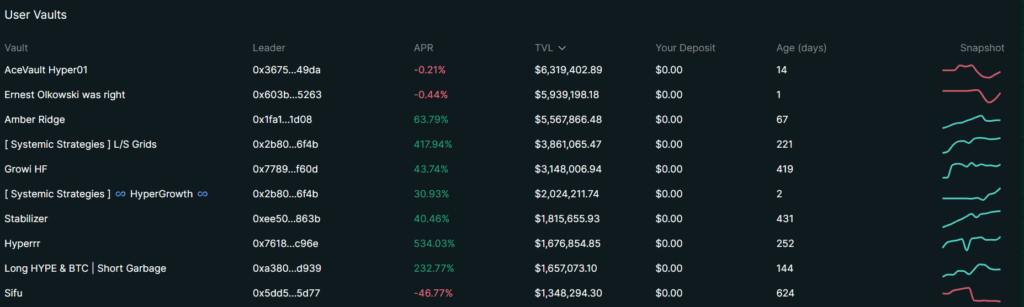

The Vaults on Hyperliquid show trades made by different traders essentially copy-trading systems. Users can deposit funds into the top-performing traders’ vaults and earn from them. However, in the case of a loss that is divided proportionally across participants.

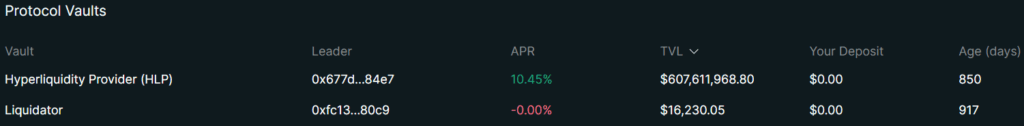

In addition, the Hyperliquid Protocol Liquidity (HLP) vault serves as a community-owned liquidity pool. It participates in market creation and liquidations while also returning a portion of the platform’s trading costs to donors.

Official Token of Hyperliquid: $HYPE

The native token of Hyperliquid is called HYPE, which was launched via Genesis Airdrop in November 2024, releasing over 310 million tokens worth approximately $1.2 billion to over 90,000 individuals, rather than an Initial Coin Offering (ICO) or private sale. Currently, the market cap of HYPE stands at $14.89 billion at the time of reporting.

The total supply is limited to 1 billion, with around 38% saved for community incentives and future emissions. Within the ecosystem, HYPE is utilized for staking (securing the network and earning rewards), governance (providing holders a say in future decisions), and as a gas token for HyperEVM transactions.

What are the Risks

In January 2025, KamBenbrik, the head of research at ChorusOne wrote a letter on X criticizing Hyperliquid for being centralized despite branding itself as a DEX and the post received over 879K impressions.

Validators face challenges such as closed-source code, a lack of documentation, and reliance on a single centralized API, which leads to frequent difficulties.

On mainnet, foundation nodes control 81% of staked HYPE, resulting in minimal actual decentralization. The letter asks Hyperliquid to open-source its code, enhance validator selection, and more evenly distribute staking in order to compete with leading Layer-1 blockchains.

Hyperliquid again came under controversy in March 2025 for centralization risks after it delisted the JELLY token and forcibly closed a trader’s position after incurring heavy losses to its liquidity vault. The trader had financially engineered an attack against Hyperliquid’s decentralized vaults. This incident raised questions about whether Hyperliquid operates like a CEX or a DEX.

Who Should Use Hyperliquid?

Hyperliquid is best for traders who want:

- Fast perpetual trading with high leverage

- On-chain transparency

- No KYC restrictions

However, it’s not ideal for complete beginners who want to swap tokens quickly or for those depositing fiat directly. On the other hand, If someone is comfortable using USD Coin (USDC) and wallets, and wants to try DEX trading with Centralized Exchange (CEX) speed, Hyperliquid is worth exploring in 2025.

What is a DEX

DEX is a short abbreviation for Decentralized Exchanges. These exchanges are different from Centralized Exchanges. There is no requirement for Know Your Client (KYC), and investors’ funds are under their own custody.

What are perpetual contracts?

Perpetual contracts are futures contracts with no expiry dates, allowing traders to undertake a short or long position for an indefinite amount of time.