Uniswap is one of the leading decentralized exchanges (DEX) in the DeFi ecosystem. The exchange is widely recognized for its liquidity, trading volume, and market presence and has a native token termed “UNI.”

What is a Decentralized Exchange (DEX)?

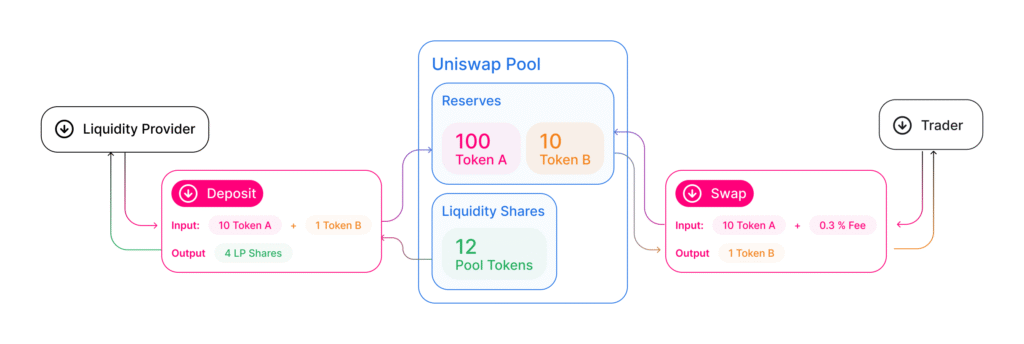

A DEX is a blockchain-based system that allows the individuals to trade or swap cryptocurrencies straight from their Web3 wallets without the involvement of centralized intermediaries. Uniswap utilizes smart contracts and automated market makers (AMMs) to automate people’s trades, making sure that the operation is clear and open to everyone.

Protocol fundamentals

Uniswap remains the top AMM (Automated Market Makers) DEX, operating on multiple blockchains, including the Ethereum mainnet and major Layer 2s like Arbitrum, Optimism, Base, and Polygon, mainly focusing on Ethereum but also seeing increased activity on Layer 2s. Sector overviews place Uniswap’s TVL in the multi‑billion‑dollar range, ahead of competitors like PancakeSwap and Curve, and note that a majority of Uniswap’s trading activity has shifted to cheaper L2s, improving capital efficiency for active users.

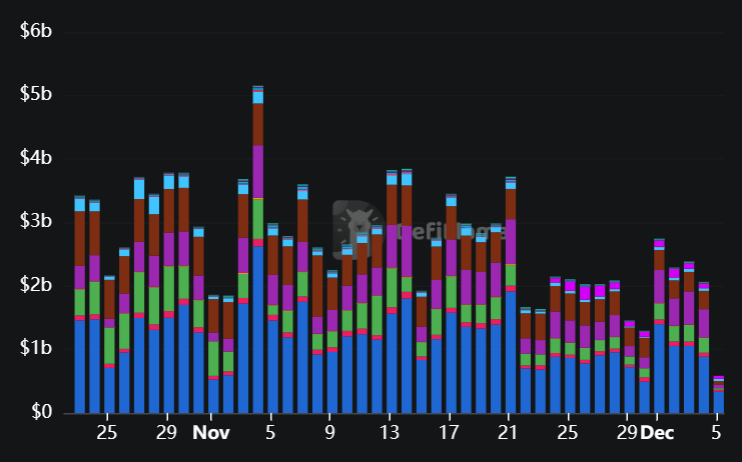

Daily trading volume on Uniswap regularly exceeds $2 billion, reflecting its role as primary price discovery for long‑tail assets and majors alike. This flow sustains meaningful fee generation at the protocol level even before turning on the full protocol‑fee switch, which is central to the upcoming UNIfication design.

UNI token economics

UNI has a circulating supply of roughly 630.33 million tokens with a current market capitalization near $3.64 billion and a fully diluted valuation of $5.78B. Several analyses also highlight a 2% annual inflation schedule from 2024 onward, used to incentivize participation and ecosystem development, making future burn and buyback mechanics critical to offset dilution.

The UNIfication design introduces a structural burn of UNI funded by protocol fees (including Unichain sequencer fees), alongside a one‑time 100 million UNI burn from the treasury meant to mirror what would have been burned if fees had been active since launch. This shifts UNI from a purely governance token to one with a direct claim on protocol cash flows through a buy‑and‑burn model, tightening effective supply over time if volumes and fees remain robust.

UNIfication catalyst

The UNIfication proposal has four main parts: starting protocol fees, using those fees to burn UNI tokens, sending revenue from the Unichain sequencer to the same burn system, and using Protocol Fee Discount Auctions (PFDA) to manage MEV and improve returns for liquidity providers. PFDA auctions off the right for an address to trade without paying the protocol fee for a brief period, with bids paid in value that goes to the burn mechanism, turning otherwise external MEV into value captured by UNI holders.

Governance posts and market commentary highlight that the proposal has strong backing from the community, with the Uniswap Foundation and Uniswap Labs agreeing that making protocol revenue and buy-and-burn key to UNI’s value is important. At the same time, Uniswap v4’s “hooks” and aggregator features are designed to bring in more outside liquidity and MEV flows through the protocol, which could increase the fees that support burns and rewards for liquidity providers in the long run.

Market performance and levels

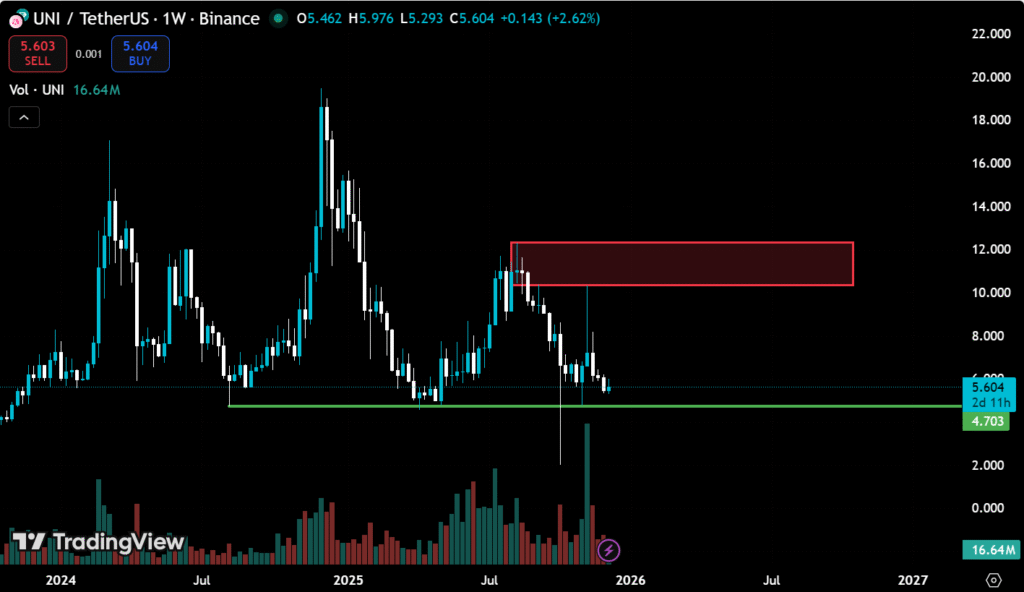

Recent data shows UNI trading just under $6, with a market cap of $3.64 billion, after a prior Q4 spike where the token traded around $7–9 on UNIfication headlines and governance optimism. Over the last few months, UNI has significantly outperformed during periods of DeFi rotation yet remains well below its all-time high, near $45, leaving it in a mid-cycle recovery zone rather than late-cycle euphoria.

One month ago, on November 5, 2025, the price was $5.21, marking a 12.03% increase. In comparison to the previous year, on December 5, 2024, it stood at $15.43, which reflects a 62.15% decline over the year. Derivatives and spot charts highlight important price levels: there was recent resistance close to the high single digits (near the previous $9–10 highs), while the order-book data provided by major exchanges indicates that many bid and ask orders are concentrated in the price range of mid-$5 and low-$6 at the time of writing. With the crucial short-term support and resistance points Volatility remains elevated relative to large‑cap L1s, which reflects UNI’s dual exposure to both DeFi sector flows and protocol‑specific governance catalysts.

Competitive landscape

Sector studies rank Uniswap as the top DEX by TVL and daily volume, with PancakeSwap and Curve following at lower aggregate TVL levels and more chain‑specific dominance. Uniswap’s main edge remains deep liquidity in blue‑chip assets, a broad long‑tail listing universe, and strong brand integration into wallets, aggregators, and institutional trading workflows.

Curve continues to specialize in stablecoin and LST liquidity, PancakeSwap dominates on the BNB Chain, and Raydium focuses on Solana; however, Uniswap’s multi-chain deployment across Ethereum and L2 ecosystems keeps it central to ERC‑20 and EVM liquidity. The network effect makes it harder for competitors to displace Uniswap as the default venue for price discovery, even as alternative DEXs experiment with different AMM curves and incentive schemes.

Bull vs Bear outlook

Bull case fundamentals

- Successful activation of UNIfication’s fee switch, burn mechanisms, and PFDA can create a recurring buy‑and‑burn flywheel, directly tying UNI’s scarcity to protocol usage and MEV capture.

- Continued growth in multi‑chain usage, especially on Arbitrum, Base, Optimism, and Unichain, can expand fee revenue while lowering user costs, reinforcing Uniswap’s dominance in on‑chain trading.

- Here’s a clean version with no em dashes:

- Ongoing growth in DeFi and Layer-2 activity as the market improves could allow UNI to reach and possibly go beyond its recent price range of high single digits to low double digits, with the potential to rise into the low teens if market conditions are good.

Bear case risks

- Regulatory issues affecting DeFi platforms, turning on fee switches, or MEV auctions could restrict the protocol’s ability to earn fees or limit access in important areas.

- Technical or economic misdesign in PFDA, fee routing, or Unichain integration could reduce LP returns and shrink liquidity, which can weaken the sustainability of the burn model.

- A sector‑wide rotation away from DeFi or a sharp decline in TVL and trading volumes may compress fees, slow burns, and leave UNI more exposed to its inflation schedule, keeping price in a lower band.