Key Takeaways

- Strategy buys 155 BTC; total holdings at 628,946 BTC.

- The strategy started the Bitcoin buying tactic 5 years ago.

- MSTR has a $112 billion market capitalisation and an enterprise value of $123 billion

Michael Saylor’s Strategy (MSTR) has undertaken another Bitcoin purchase of 155 BTC for approximately $18 million. The move, in tandem with the firm’s continuous accumulation tactics, was announced on the social media platform X by Saylor on August 11th, 2025.

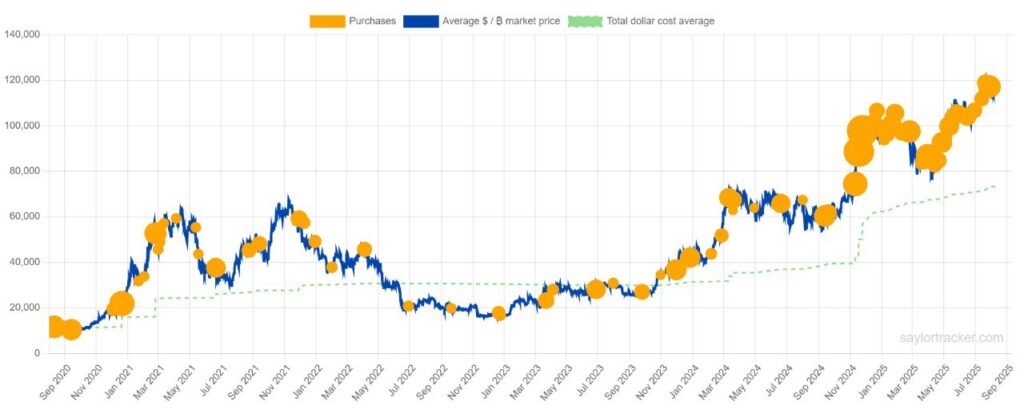

The recent purchase, averaging around $116,401 per Bitcoin, has grown the firm’s stash even larger while maintaining its status as the biggest publicly listed company to hold Bitcoin. The NASDAQ-listed firm has achieved a 25% Bitcoin yield year-to-date in 2025. As of August 10, 2025, Strategy holds 628,946 BTC, acquired at an average price of about $73,288 per Bitcoin, totalling roughly $46.09 billion in investments.

The accumulation demonstrates Strategy’s belief in the long-term worth of Bitcoin and its dedication to optimising a higher yield. The sustained growth indicates Saylor’s positive outlook on Bitcoin’s prospects and uses. Interestingly, as of block 909,559, Strategy owns 3.16% of the 19,904,653.94 BTC in circulation.

The company’s continued accumulation comes amid Bitcoin climbing 0.89% to $119,566.32 in the last 24 hours.

Strategy Celebrates Five-Year Anniversary of First Bitcoin Purchase: Here is What We Know

Five years ago, on Aug. 11, 2020, Strategy (MSTR) established a Bitcoin standard by paying $250 million for its initial purchase of 21,454 BTC. The acquisition underscored a dramatic change in the way corporate treasury was handled. Strategy not only started a market trend of keeping Bitcoin as an asset reserve for corporates, but it also established itself as the biggest firm to do so.

However, Strategy’s pivot towards Bitcoin accumulation came after the former AI and software development company had seen its stock price plateau and stagnate after the early 2000s tech boom, falling over 95% from its peak by August 2020.

The company has used a variety of tactics to finance its Bitcoin holdings, raising $46 billion through credit and equity, including $8.2 billion in outstanding convertible debt and four perpetual preferred stock offerings (STRK, STRF, STRD, and STRC) that are aimed at different yield curve segments.

The strategy’s Continuous Bitcoin Purchase Signals Strong Institutional Confidence in Bitcoin

Strategy’s ongoing Bitcoin buys have prompted other companies to jump on the bandwagon as well. When one major player steadily adds to their Bitcoin stash, it sends a clear message that confidence in the crypto is growing. Other firms, including Metaplanet, MARA Holdings, Riot Platforms, etc, have likely been encouraged by Saylor’s optimistic views, creating a chain reaction.

As more firms buy Bitcoin, demand for the biggest cryptocurrency rises, which helps push the price up and keeps the momentum going. This wave of interest boosts Bitcoin’s value and attracts new investors who want to be part of the action.

Currently trading at $404 per share, Strategy (MSTR) has a $112 billion market capitalisation and an enterprise value of $123 billion. Investor valuation of the company’s underlying assets is reflected in its net asset value (NAV) multiple, which is 1.491. Notably, Bitcoin holdings represent 67.1% of Strategy’s market cap, underscoring its significant exposure to BTC. This strong correlation positions MSTR as a key player for investors seeking indirect Bitcoin exposure through the stock market, and the company continues to leverage its assets in both the technology and cryptocurrency space.