Key Takeaways

- Bitcoin miner TeraWulf inks agreements to supply electrical power for AI data infrastructure worth $3.7 billion.

- Alphabet unit Google will support the contracts by offering a financial guarantee of $1.8 billion for the project-related debt financing.

- If the deal between Google, TeraWulf and Fluidstack works out, it can push other technology giants to support crypto miners.

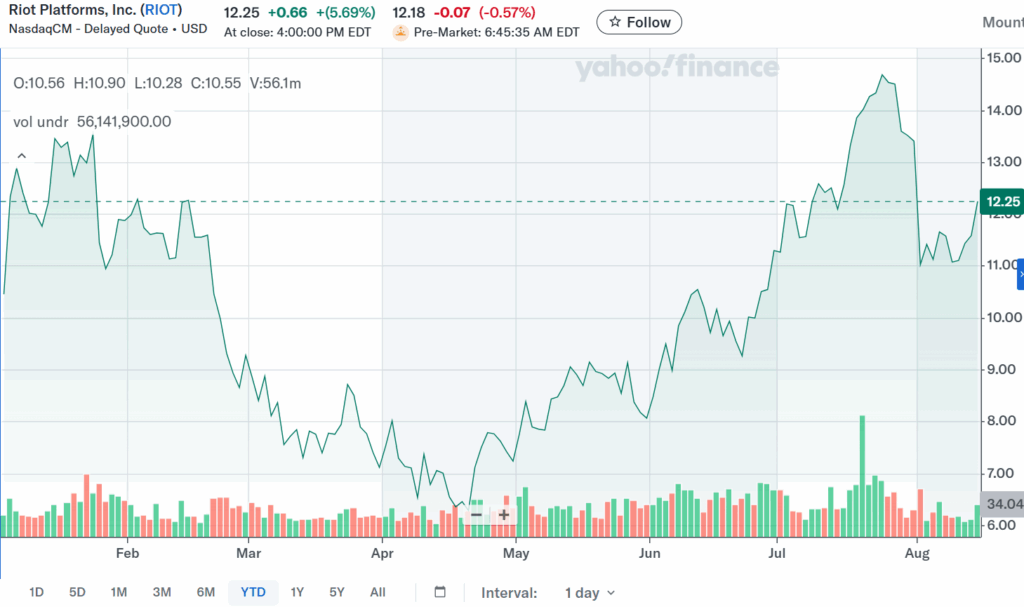

Mining firm TeraWulf’s shares rise over 59% on Thursday, with the firm securing two AI hosting deals. The NASDAQ-listed Bitcoin miner scored agreements to supply electrical power for AI data infrastructure worth $3.7 billion. The rise in the share price comes in tandem with the surge of the broader crypto mining stocks like Iris Energy and Riot Blockchain.

The deals, signed with AI-cloud platform Fluidstack, will see TeraWulf deliver more than 200 megawatts of critical IT electric load at its Lake Mariner data centre campus in Western New York.

Interestingly, Alphabet unit Google will support the contracts by offering a financial guarantee of $1.8 billion for the project-related debt financing. Further, the tech behemoth will get roughly 8% of TeraWulf’s stock in return. The contract arrangement is a unique intersection of large tech investment, artificial intelligence, and cryptocurrencies.

Initial market reaction to the announcement saw TeraWulf shares rise 36% higher ahead of the morning bell at $7.57. The stock later closed the trading day at a high of 59.52% at $8.71. The current market capitalisation of TeraWulf is $3.414 billion.

Google’s involvement in TeraWulf Deal Signals More Than Just Funding

Google is much more than just a financial backer for the TeraWulf deal. The tech giant’s share purchase will provide TeraWulf with access to some of the most cutting-edge AI infrastructure. Additionally, the $1.8 billion investment in the deal will help the firm significantly advance its technological capabilities.

Furthermore, Google’s presence at the table for important decisions will give TeraWulf better strategic choices. This is in line with a growing trend in the technology sector, where large corporations are actively involved in guiding their partners’ paths rather than merely investing capital. The cooperation builds deeper, more integrated tech industry relationships by combining active guidance with financial support.

The deal also highlights Google’s indirect participation in the crypto industry, cementing the fact that more corporates want exposure to Bitcoin-related businesses.

TeraWulf Agreement Likely To Get Future Extensions

The contracts also have two possibilities for five-year extensions, potentially increasing the total value of the deal to $8.7 billion in the future.

Paul Prager, Chief Executive Officer of TeraWulf. “We are proud to unite world-class capital and compute partners to deliver the next generation of AI infrastructure, powered by low-cost, predominantly zero-carbon energy.

TeraWulf Deal Could Pave Way For More Tech-Crypto Deals: Here is How

The agreement between TeraWulf and Google demonstrates how the fields of AI and cryptocurrency are becoming more interconnected. Crypto mining facilities that were previously only utilised for Bitcoin are now being transformed into AI data centres, which will revitalise these locations.

The change gives mining firms a means of generating extra income streams to help them mitigate the risks associated with fluctuating cryptocurrency values. It also provides quicker access to sophisticated computer resources, which may take years to develop from the ground up for the AI business.

Additionally, if the deal between Google, TeraWulf, and Fluidstack works out, it can push other technology giants to support crypto miners. The process of minting cryptocurrencies involves a greater deal of electricity consumption and infrastructure, making many miners flock to AI-related businesses to stay profitable.

By modifying current mining infrastructure, both businesses usually gain in the arrangement. AI rapidly obtains the processing power it requires, while cryptocurrency companies acquire stability and new prospects, demonstrating how innovation can unite seemingly disparate areas.