Artificial Intelligence (AI) and blockchain technology are not the future, but they are happening right now! And when these two amalgamate, a new kind of innovation will evolve.

Distributed computing transforms into a decentralized intelligence network when it combines transparency and token-based incentives. A decentralized network defies central control. AI-based crypto protocol facilitates AI model training on open-source, self-reliant agents and blockchain-based applications.

According to Gartner’s report, 2026 is anticipated to be the year that global AI spending could rise to $2 trillion with the support of the incorporation of artificial intelligence in various products, which include smartphones, personal computers, and infrastructure. The boost in AI investment could additionally strengthen the decentralized blockchain systems. By featuring verifiable data, transparent incentives, and secure settlement, blockchains essentially establish a trust layer for AI systems.

U.S. Leads Crypto Adoption

Crypto adoption in the U.S. continues to grow, with 13% of the population, around 33.7 million people, owning cryptocurrency. The U.S. leads global Bitcoin trading volumes at roughly $1.5 billion. Bitcoin remains the most popular asset, held by 36% of U.S. crypto owners, followed by Ethereum at 25%, above the global average. Ownership is heavily skewed toward men, who make up 74% of U.S. crypto holders.

What are Artificial Intelligence (AI) coins?

AI coins represent a cryptocurrency category that fuels decentralized systems that combine blockchain technology and artificial intelligence. They provide incentives in the form of tokens to data, computing power, or AI model providers and thus make open and collaborative AI advancement possible.

The top five AI-focused cryptocurrencies are

Bittensor (TAO)

Bittensor was founded back in 2021 and is a peer-to-peer AI network. The coin leverages blockchain technology to decentralize artificial intelligence, turning machine learning into an open marketplace. The protocol advocates the essence of AI decentralization by countering the growing effectiveness of tech giants like OpenAI. The project rewards developers based on their usefulness. Bittensor hosts over 129 active subnets as of October 2025.

Founding Team:

Founded back in 2021 by Jacob Steeves and Ala Shaabana, a team with considerable experience in machine learning and decentralized systems.

Key Metrics

| Market Cap | $2.8B |

| Circulating Supply | 10.41M TAO |

| All-Time High | $540 |

| ROI | 38.85% |

2026 Outlook:

Subnets and broader enterprise integration position TAO as a core infrastructure token for decentralized AI. We expect TAO will lead the market with its distinctive features and applications.

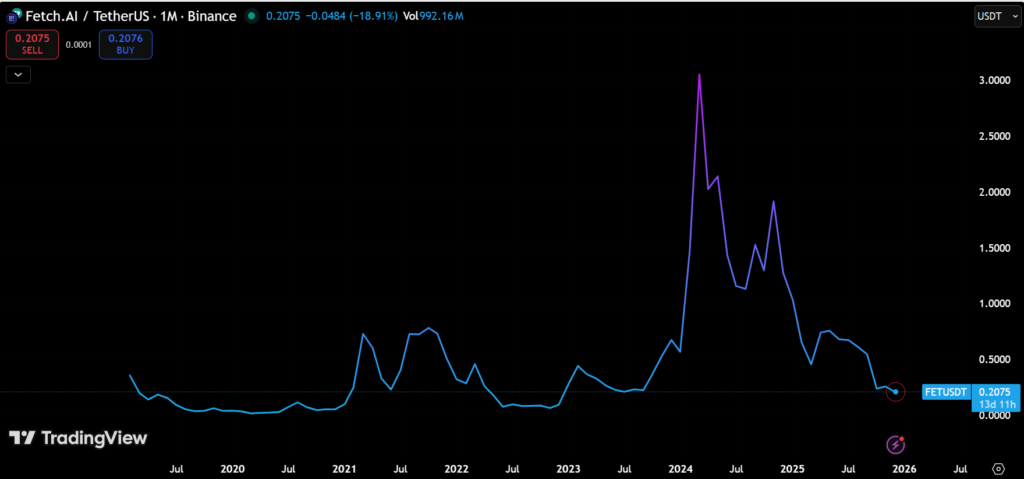

Fetch.ai (FET)

FET, the native cryptocurrency of the Fetch.ai platform, is the key to its internal ecosystem. The platform’s services are accessed by users through FET payment, while FET staking gives them a vote in governance and an influence on the platform’s future, along with earning a variable annual interest rate of 10%. The necessity of FET for the creation of a digital twin or an Autonomous Economic Agent (AEA) aids in the elimination of unwanted and harmful operations, thus securing and making the platform more effective.

Founding Team:

Fetch.ai was founded in 2017 by a UK-based team consisting of Humayun Sheikh, Toby Simpson, and Thomas Hain, with Sheikh serving as the company’s CEO.

Key Metrics

| Market Cap | $492.05M |

| Circulating Supply | 2.31B FET |

| All-Time High | $3.48 |

| Peak Growth (from launch) | 877.3%. |

2026 Outlook:

The growth of autonomous agents and institutional partnerships will reinforce FET as a leading token for decentralized AI applications. The upcoming year

Render Network (RENDER)

Render Network turns unused Graphics Processing Units (GPUs) into a decentralized supercomputer, which allows one to train AI models, render 3D images, and process videos at significantly lower costs. The network uses the RENDER token to promote the trade of computing resources, thus making these services more affordable and attracting creators in the fields of entertainment, AR/VR, and the metaverse. As the demand for AI workloads and the technology in AR/VR continues to grow, Render is expected to be a major player in the production process by 2026.

Founding Team:

Jules Urbach, who possesses expertise in graphics rendering, distributed computing, and blockchain-based marketplaces, founded the company.

Key Metrics

| Market Cap | $830.22M |

| Circulating Supply | 518.58M RENDER |

| All-Time High | $13.64 |

| Peak Growth (from launch) | 117.9%. |

2026 Outlook:

The decentralized GPU computing will be a tremendous help to train large-scale AI and creative rendering, which will in turn make the adoption of RENDER’s ecosystem stronger.

The Graph (GRT)

The Graph is often referred to as the “Google of blockchain” because it indexes on-chain data to make it accessible by dApps and AI models efficiently. One of the benefits of its subgraph protocol is that it enables AI to work with the data instantly, which in turn helps make forecasts in the area of DeFi, among others. The number of queries reached a record high of 6.49 billion in 2025, thus enabling The Graph to process the influx of queries from AI and the scaling of layer-2 solutions.

Founding Team:

The Graph was founded by Yaniv Tal, Brandon Ramirez, and Jannis Pohlmann, a team of engineers with experience in blockchain infrastructure and data indexing.

Key Metrics

| Market Cap | $491.25M |

| Circulating Supply | 10.61B GRT |

| All-Time High | $2.89 |

| Peak Growth (from launch) | 713.9%. |

2026 Outlook:

The higher requirement for data that is decentralized and AI-ready could drive up the adoption rate of subgraphs, the number of queries, and the DeFi and analytics areas where GRT is used, to a certain extent.

Numeraire (NMR)

Numeraire (NMR) is the primary currency of Numerai, a hedge fund that sources predictive models from data scientists all over the world. It is the contributors who create the machine learning models to forecast the trends in financial and crypto markets, and NMR is the reward for the best-performing ones. The platform has an impressive staking system that not only provides rewards for correct predictions but also attracts more players, thus helping in the creation of a decentralized, AI-powered ecosystem for financial forecasting.

Founding Team:

Richard Craib, a data scientist and AI enthusiast, started the company with a team working on the integration of crowdsourced AI models into financial strategies that can be applied in practice.

Key Metrics

| Market Cap | $80.2M |

| Circulating Supply | 7.63M NMR |

| All-Time High | $96.20 |

| Peak Growth (from launch) | 75.3% |

2026 Outlook:

Numeraire continues to expand its AI ecosystem by the participation of more and more data scientists, which potentially results in improved model quality and greater predictive power. The token-based rewards system supports the user’s engagement and thus makes NMR a key AI-related cryptocurrency in the areas of finance and predictive analytics.

Challenges Ahead!

The AI cryptocurrency ecosystem faces challenges that include high-energy-consuming AI processes, scalability, and performance limitations. Additionally, there is ongoing uncertainty regarding regulations, as well as issues related to data quality and accessibility.

However, with the recent regulatory updates and gradual acceptance of blockchain technology and AI, their amalgamation is likely to play a key role in shaping the future of digital finance and the global economy.