Key Takeaways

- AI Tokens: The convergence of artificial intelligence (AI) and blockchain is driving a new wave of innovative projects that aim to decentralize and democratize AI infrastructure and applications.

- Tokens from projects like Bittensor, NEAR Protocol, Internet Computer, Render, and Artificial Superintelligence Alliance represent distinct, foundational roles within the AI crypto space.

- While these projects offer significant growth potential due to increasing AI adoption and technological breakthroughs, investors should be mindful of risks such as early-stage technology challenges, regulatory uncertainties, competition, and adoption timelines.

- The AI crypto sector is still nascent and complex, requiring investors to have a long-term outlook, manage volatility carefully, and stay adaptive as these technologies and markets mature.

The fusion of AI and blockchain has sparked one of the most promising trends in cryptocurrency investing. With AI revolutionizing global industries, a handful of crypto projects are strategically positioning themselves to lead this new wave of innovation. For investors seeking exposure to this explosive growth sector, five AI tokens stand out as the most promising opportunities: Bittensor (TAO), NEAR Protocol (NEAR), Internet Computer (ICP), Render (RNDR), and Artificial Superintelligence Alliance (FET).

These projects are more than just speculative bets on AI hype. They’re actively building the decentralized computing infrastructure that could power the next generation of artificial intelligence applications. Let’s dive into their tokenomics to see what they offer to investors.

Bittensor (TAO): A Trailblazer in Decentralized AI Networks

This is a novel, peer-to-peer network where AI models both compete and collaborate to solve complex tasks. The Bittensor protocol functions like a decentralized brain, composed of interconnected subnets, each representing a community of machine learning models (MLMs) focused on a specific domain of expertise. These subnets contribute specialized intelligence to the broader Bittensor network, enhancing its collective learning capabilities.

At the heart of this ecosystem is the TAO token, which powers the network’s incentive and governance systems. By aligning economic incentives with computational intelligence, Bittensor and its TAO token aim to democratize access to artificial intelligence, enabling an open and permissionless marketplace for machine learning that’s not controlled by centralized entities.

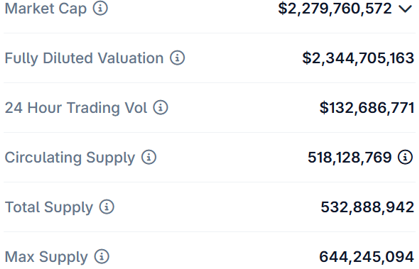

Bittensor Statistics

Investment Strengths

- Nasdaq-listed Oblong Inc. is raising $7.5 million to buy TAO tokens. This is a sign of institutional confidence in a decentralized AI project.

- Bittensor hosts a growing number of AI subnets. Each one is focused on specific tasks like language models or data analysis.

- Despite volatility, TAO’s price trend remains upward.

- The Crypto Fear and Greed Index puts TAO at 64 (“greed scale”), indicating strong buying momentum, with investors optimistic about it.

Investment Risks

- TAO’s price can swing sharply. Investors need to be prepared for large ups and downs.

- Bittensor’s architecture is advanced. It may be hard for non-technical users to fully understand or adopt.

- Projects like Fetch.ai and SingularityNET are building similar platforms. TAO must stay ahead to keep its lead.

- The legal status of decentralized AI is still unclear. Future rules could impact the growth or use of the network.

Consideration: TAO offers exposure to cutting-edge AI and blockchain. It appeals to those seeking early access to a potentially transformative technology. However, the risks are real. Only experienced, risk-tolerant investors should consider it at this stage. Institutional moves like Oblong’s provide credibility, but the project remains in an early and volatile phase.

NEAR Protocol (NEAR): The Accessible and Scalable AI Blockchain

NEAR Protocol is a high-performance, scalable blockchain designed to support decentralized applications with fast transaction speeds and low fees. NEAR, the platform’s native token, powers the network by enabling transaction fees, securing the system through staking, and driving decentralized governance. All this is essential to the ecosystem’s growth and stability. As the blockchain expands, especially into areas like AI, DeFi, and NFTs, the demand and utility for the NEAR token continue to grow, making it a key asset for users and investors within the platform.

NEAR Protocol Statistics

Investment Strengths

- NEAR supports AI applications, smart contracts, AI agents, and open finance services at scale.

- The platform’s JavaScript-based development environment attracts traditional web developers.

- NEAR’s sharding technology enables high-throughput applications necessary for AI processing.

- Analysts expect potential growth from current levels by the end of 2025.

Investment Risks

- Faces intense competition from Ethereum Layer 2 solutions and other smart contract platforms.

- With a market cap of around $3.6 billion, NEAR’s potential upside may be more constrained compared to smaller-cap opportunities.

- Sharding implementation faces ongoing technical challenges and potential security considerations.

- Success depends heavily on continued developer and enterprise adoption.

Considerations: NEAR offers a balanced risk-reward profile for investors seeking AI blockchain exposure with more established market presence. The project’s focus on usability and developer experience makes it attractive for those betting on mainstream AI application adoption, though growth potential may be more measured than smaller competitors.

Internet Computer (ICP): The Web3 AI Infrastructure Play

The ICP token underpins the Internet Computer — one of the most ambitious blockchain initiatives to date. It has a vision to build a decentralized internet capable of running full-scale applications, websites, and AI systems entirely on-chain, without dependence on traditional IT infrastructure.

With its novel architecture and reverse gas model, the Internet Computer presents a scalable, secure, and cost-efficient alternative to centralized cloud services. The ICP token acts as the core utility and governance asset of the network, powering computation and allowing users to participate in protocol decisions via the Network Nervous System (NNS).

Internet Computer Statistics

Investment Strengths

- ICP powers computation and storage on the Internet Computer, a highly scalable blockchain capable of hosting real-world apps and AI systems entirely on-chain.

- ICP holders can participate in protocol governance via the Network Nervous System (NNS), giving them direct influence over the network’s development and evolution

- With its reverse gas model and web-speed performance, Internet Computer stands out from other Layer-1s. ICP benefits directly from increased adoption of this architecture.

- The project is backed by the DFINITY Foundation and supported by a highly experienced team, adding credibility and strategic resilience to the ICP token.

Investment Risks

- The platform’s advanced architecture and novel approach may present a steep learning curve for developers and integrators.

- Some critics have raised concerns about the true level of decentralization within the Internet Computer’s node infrastructure.

- While the technology is robust, mainstream adoption of dapps and enterprise use cases is still in its early phases.

- Realizing the full vision depends on executing a complex roadmap that pushes the boundaries of blockchain capability.

Considerations: ICP appeals to forward-looking investors who envision a fully decentralized internet where AI and applications run directly on the blockchain. The project offers breakthrough technological advantages but may require long-term commitment and patience as the ecosystem matures and adoption expands.

Render (RNDR): Powering the Future of AI Graphics

Render (RNDR) has established a distinct position in the AI crypto landscape by offering decentralized graphics processing unit (GPU) rendering services, which are an increasingly critical resource for AI model training, inference, and high-performance visual computing.

By tapping into underutilized GPU power from a global network of contributors, Render enables scalable, cost-efficient compute infrastructure for creators, researchers, and AI developers.

The RNDR token facilitates transactions across the network, aligning incentives between node operators and users while supporting a more open, decentralized alternative to traditional cloud-based solutions.

Render Statistics

Investment Strengths

- Render delivers decentralized GPU computing power essential for AI model training, 3D rendering, and high-end visual effects.

- The accelerating growth of AI is driving massive demand for scalable, distributed GPU resources, positioning RNDR as a key player in AI infrastructure.

- RNDR has demonstrated strong price momentum recently, significantly outperforming the broader crypto market with notable short-term and weekly gains.

- An active and growing developer base contributes to continuous improvements, fostering innovation and long-term project sustainability.

Investment Risks

- RNDR’s success is closely tied to sustained growth in AI, gaming, and digital content creation sectors.

- Large centralized cloud providers like AWS and Google Cloud pose a competitive challenge with their scale and resources.

- The current revenue-sharing and pricing model may face scalability or sustainability issues as the network grows.

- GPU rendering demand may fluctuate with trends in the entertainment industry, AI development cycles, and macroeconomic factors.

Considerations: Render presents a targeted investment opportunity within the broader AI and Web3 ecosystem, offering exposure to a crucial infrastructure layer—GPU compute. With a well-defined utility and increasing demand, RNDR appeals to investors looking for a high-conviction bet on decentralized AI rendering. However, its narrower market scope compared to general-purpose AI platforms warrants thoughtful risk assessment.

Artificial Superintelligence Alliance (FET): Building the AI Agent Ecosystem

The Artificial Superintelligence Alliance (ASI) is a pioneering initiative that brings together three major decentralized AI projects – Fetch.ai, SingularityNET, and Ocean Protocol – to form a unified ecosystem focused on developing artificial general intelligence (AGI) and, ultimately, artificial superintelligence (ASI).

The alliance aims to build a decentralized infrastructure where autonomous AI agents can interact, collaborate, and trade data and services across an open, permissionless network. The FET token, originally native to the Fetch.ai network, currently serves as the transitional token for the ASI alliance.

It powers key functions such as AI agent operations, governance, staking, and access to AI-driven marketplaces. Over time, FET will be rebranded and upgraded into the ASI token, reflecting the merged utility and value of the three ecosystems. This alliance not only consolidates technological strengths but also signals a bold step toward democratizing access to advanced AI capabilities on a global scale.

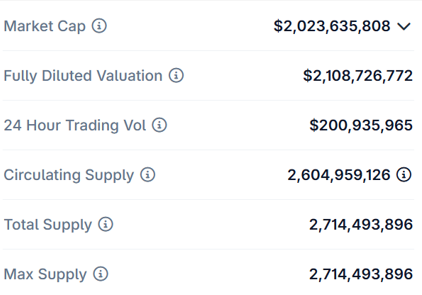

Artificial Superintelligence Alliance Statistics

Investment Strengths

- FET powers a platform centered on autonomous AI agents capable of operating independently within complex digital economies.

- The technology is being applied to practical scenarios such as supply chain optimization, autonomous vehicle coordination, and decentralized data marketplaces.

- FET has shown consistent strength in 2025, standing out alongside peers like TAO as a leading AI-focused cryptocurrency.

- Growing interest and collaboration from both AI developers and crypto enthusiasts are fueling ecosystem development and innovation.

Investment Risks

- Autonomous AI agents remain an emerging technology, with scalability and long-term viability still to be proven.

- As AI agents gain sophistication and autonomy, they may attract increased regulatory scrutiny and compliance challenges.

- FET faces competition from established centralized AI providers as well as other decentralized AI platforms.

- The full potential of autonomous AI agents and their impact on the digital economy may take several years to fully materialize.

Considerations: The FET token offers investors a unique opportunity to participate in the frontier of AI innovation, specifically around autonomous agents shaping the future digital economy. While the technology promises transformative use cases and growing market relevance, investors should approach it with a long-term perspective and tolerance for the inherent risks of emerging tech.

The Road Ahead For These AI Tokens

The AI cryptocurrency sector represents one of the most dynamic and potentially rewarding areas of digital asset investment. These five AI tokens – TAO, NEAR, ICP, RNDR, and FET – each offer unique approaches to solving different aspects of the AI infrastructure challenge.

Success in this space will require patience, strong risk management, and the ability to adapt as the technology landscape evolves. While the potential rewards are substantial, investors must carefully weigh the significant risks and maintain appropriate position sizing within their overall portfolio strategy.

This notwithstanding, the intersection of AI and blockchain technology is still in its early stages, making this an exciting time for investors willing to navigate the complexity and volatility in pursuit of potentially transformative returns.

Read More: Top 5 AI Shares to Consider for Growth-Oriented Investors