Table of Contents

The cryptocurrency market is developing and gaining acceptance across the institutional and retail market spaces. The market capitalization of the broader crypto market climbed to $3.86 trillion in September 2025.

Bitcoin marked its recent all-time high (ATH) of $124,457 on August 14, 2025, supported by strong institutional adoption and market enthusiasm following the creation of the Strategic Bitcoin Reserve. ETH marked its ATH of $4,957.63 on August 24, 2025. Overall, the year 2025 has proved to be a good year for all Crypto enthusiasts so far.

It is interesting to note that, Bitcoin’s dominance drops under 59%, which implies that the capital flow might shift toward altcoins. Which could mean Altseason is nearby.

Here, we explained the top 5 Altcoins that could create value for investors. The underlined coins are listed on innovation, acceptance, and market momentum; these coins could offer growth opportunities in the near future.

1. Avalanche (AVAX)

Avalanche is a layer-1 blockchain that operates quickly and at low fees, putting it in competition with Ethereum and Solana. It has a market capitalization of $17 billion. Avalanche’s Snow consensus mechanism can handle up to 4,500 TPS, making it suitable for DeFi and NFT applications.

The Token’s burning will reduce the total supply of AVAX coins from 720 million, which will impact the circulation of tokens and could impact the price positively.

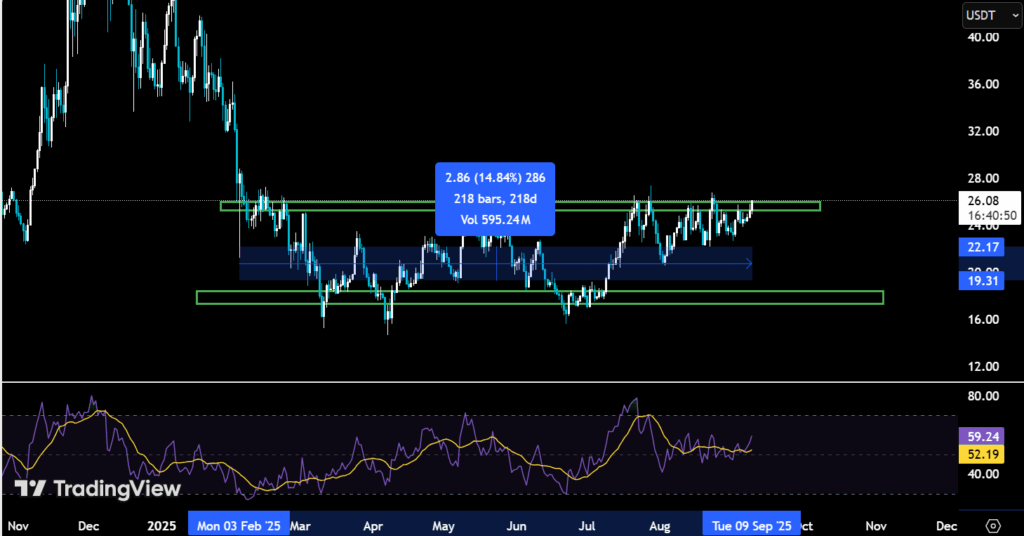

Trading at ~$26 with a 3.88% 24-hour gain, AVAX shows a consolidating range of 218 days and is getting ready for a breakout if macrofactors support it.

Leading the way with 4B+ transactions and 275% YoY transaction volume growth contributed by the Octane upgrade. BlackRock’s BUIDL Fund and ETF speculation drive institutional validation and long-term potential.

2. Polkadot (DOT)

Polkadot is a decentralized blockchain operating on nominated proof-of-stake with the advanced smart contract capabilities. According to CoinMarketCap, the network has a current market cap hovering around $6.67 billion.

The ecosystem utilizes the BABE protocol (Blind Assignment for Blockchain Extension) for block production and the GRANDPA protocol (GHOST-based Recursive Ancestor Deriving Prefix Agreement) achieves deterministic finality.

It becomes well suited for decentralized finance (DeFi), gaming, and enterprise applications. It is designed to be an inflationary model with an annual issuance of ~10%, promoting staking for economic viability.

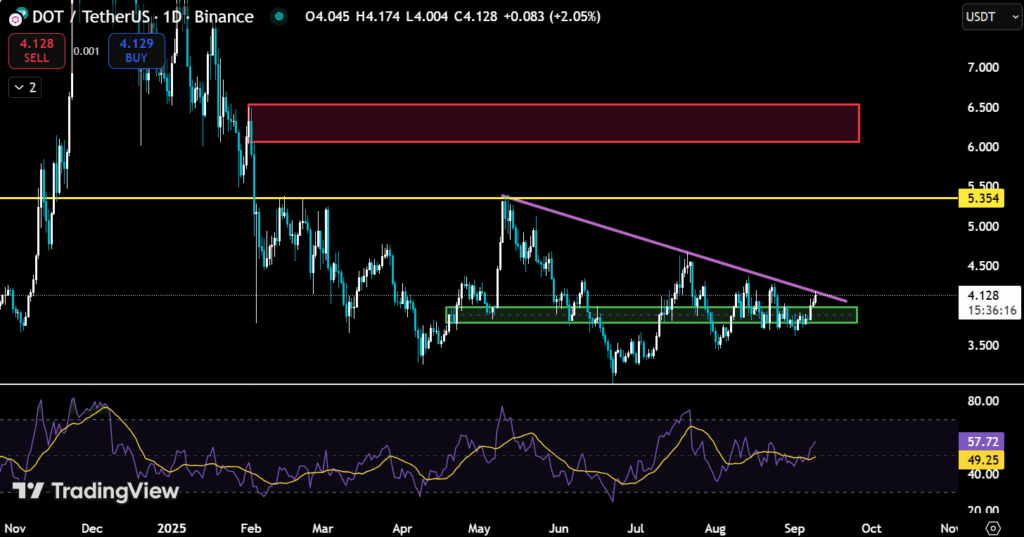

DOT is currently priced at ~$4.12 with a 24-hour change of a 3.28% rise. It has formed an ascending triangle, holding above the daily level support in the relative range around $3.98.

Polkadot is leading, with its 137 million+ transactions in Q1 2025 and an ecosystem growth of 150% in unique accounts driven by the upgrade to Polkadot 2.0. DOT staking increased 7.9% quarter-over-quarter to 843.9 million DOT staked, demonstrating the long-term faith in the Polkadot ecosystem.

3. SUI

The native token for the SUI blockchain network holds fundamentally strong, with a total value locked (TVL) of more than $2.5 billion. The token holds the current market cap of $12.59 billion and focuses on high-speed transactions functioning at low cost for DeFi and NFTs.

The network marked its daily active addresses, hitting over 1.2 million in July 2025. The technical and economic strengths of the network are changing the way institutions think about blockchain adoption.

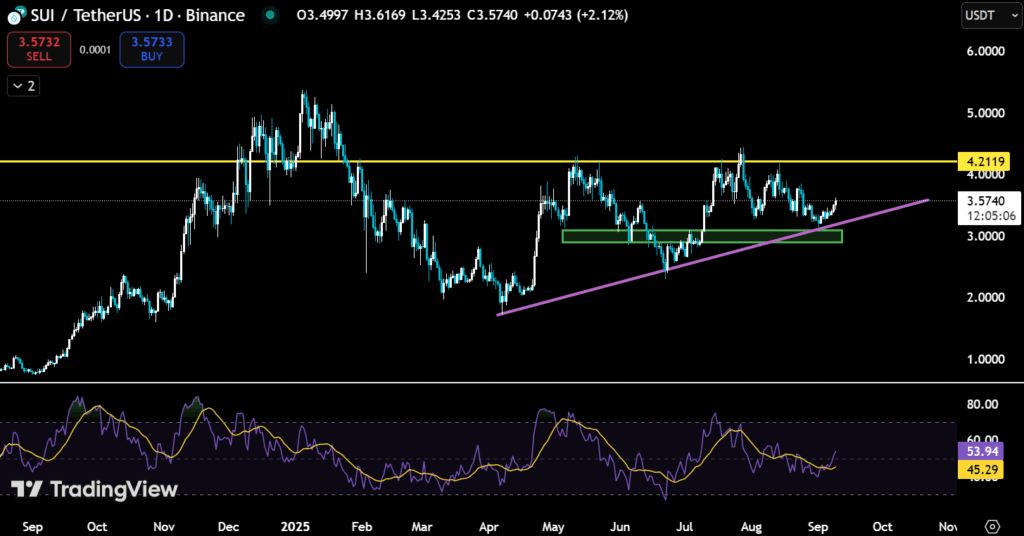

Technically, SUI’s price at $3.57 (up 3.44% in 24 hours) is maintaining its daily RSI (relative strength index) at 53.9. The price holds above the daily trendline (marked in purple), corresponding with its support zone of $3.1. With the macroeconomic factors support, the price for the asset could surge, making $4.21 its next target.

4. Pyth Network (PYTH)

Pyth Network (PYTH) is a decentralized oracle that brings real-time market data to several blockchains and makes it on the top 5 list due to its key role in DeFi, solid institutional adoption, and positive technical metrics. The market cap for the asset currently stands at $1.05B. Its collaboration with the U.S. Department of Commerce supported its rise of over 70% in 24 hours back in August 2025.

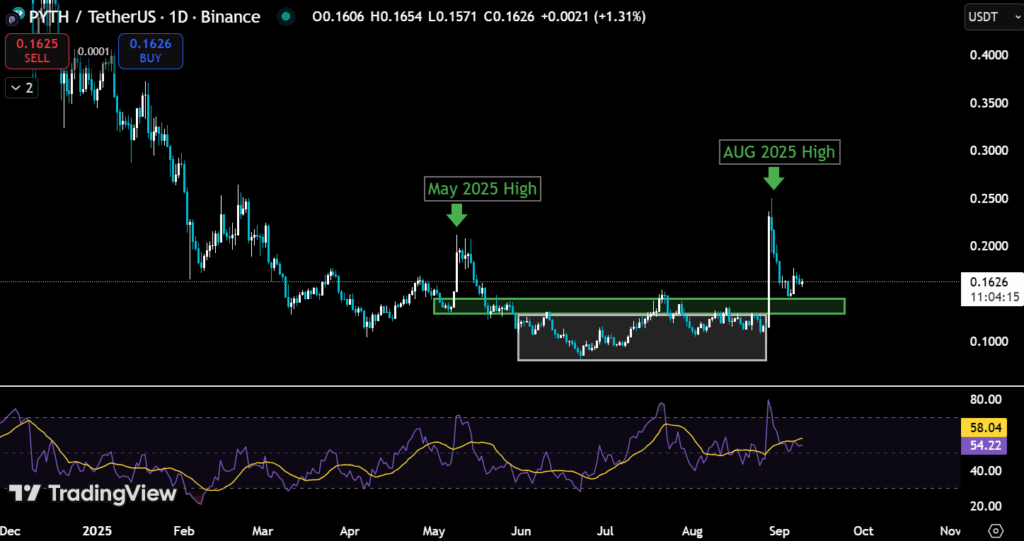

Technically, PYTH’s RSI is at 54.2 and trading at $0.1626, which is a golden pocket level (a strong level of retracement fib level), which could make the bullish price structure continue. The asset continues to trade with a volume of ~$140 million. The grey zone indicates the deviation below the support, and price trading above this provides an additional bullish factor for PYTH.

5. Arbitrum (ARB)

Arbitrum maintains the total value lock (TVL) at $3.25B, which is a jump of 12.94% from 1 Jan 2025. Market cap for the asset stands at $2.67B and holds a 37.1% L2 market share. The network currently holds 2.16B in transactions and the active wallets metric stands at 1.45M. The DRIP (DeFi Renaissance Incentive Program) by Arbitrum is allocating up to 80 million ARB tokens to promote decentralized finance. Furthermore, PayPal implementing the PYUSD integration for consumers to use the “Pay with Crypto” service also highlights the establishing adoption.

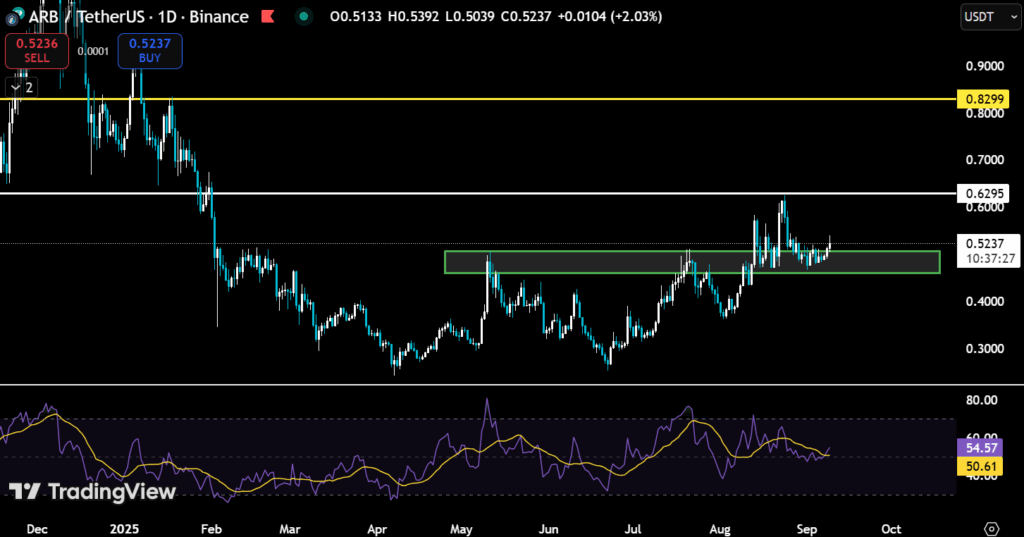

ARB’s price is currently trading at $0.523, rising over 4% in the past 24 hours, with a $2.7B market cap and $540M volume. The momentum indicators for the daily time frame are showing a neutral RSI (54.57). The price has already flipped to a bullish structure and needs to break above $0.629 resistance for additional confirmation.