Key Takeaways:

- The top DeFi crypto lending platforms alone account for over 75% of the market share.

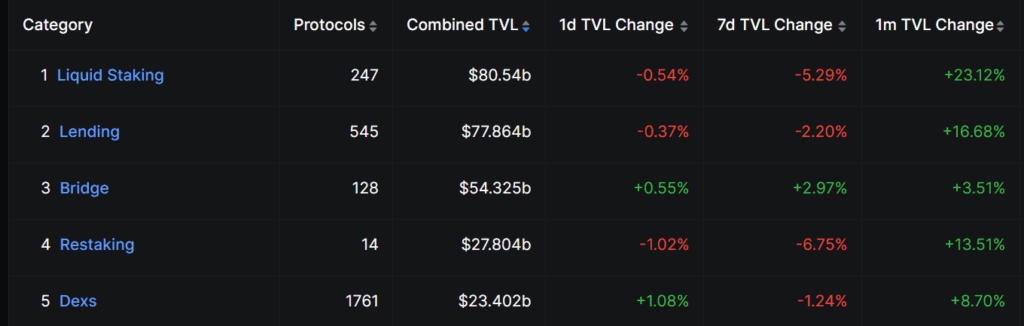

- Crypto lending is one of DeFi’s main categories, accounting for over half of the industry’s market share and ranking as the second largest overall.

- The majority of the loan market is controlled by only a few lending platforms, so if one of them collapses or is hacked, it could set off a chain reaction of losses across the whole DeFi sector.

Crypto lending has established itself as the backbone of the decentralized finance (DeFi) industry, with about $78 billion in assets and the second-largest DeFi category after liquid staking. Despite short-term volatility, lending platforms have reached new milestones, with outstanding loans exceeding $26.47 billion, a 42% quarterly increase that indicates increased confidence in the industry.

The lending sector leads DeFi, accounting for more than 50% of the industry’s total value locked (TVL). TVL is the total amount of money (in cryptocurrency) that users have deposited into a DeFi network, indicating how large and trustworthy it is.

How Do Crypto Lending Platforms Work?

Similar to a conventional lending mechanism, such as borrowing or earning interest on your deposits from a bank, crypto lending works in a similar way. Crypto lending platforms allow users to earn interest on their crypto holdings and allow them to borrow crypto assets upon depositing collateral without having to sell their holdings.

Factors to Consider When Choosing the Best DeFi Crypto Lending Platforms

Total Value Locked (TVL): The amount of money or cryptocurrency holdings that have been deposited into the platform.

Fees and Interest: The cost of borrowing and the yield on lending; lower fees and reasonable rates are preferable.

Loan-To-Value (LTV): The maximum amount you can borrow against your collateral; a greater LTV provides more funds but increases risk.

Tokens supported: The range of tokens or cryptocurrencies supported by the platform. More options give greater flexibility.

Smart contract audit: Verifies the code’s security; audited platforms are less vulnerable to hacking.

Launch Date: How long has the platform been operating? Older platforms showcase a better track record of surviving adverse market conditions.

Top 5 DeFi Crypto Lending Platforms

- Aave

Aave is one of the oldest and largest players in the DeFi lending market, having a 50% market share with a TVL of $38.95 billion. Founded in 2017, initially known as ETHLend and it launched its native token AAVE in the same year. It currently has a market capitalization (cap) of $4.82 billion and is trading around the levels of $316 at the time of reporting.

The lending platform is used on the Ethereum, Polygon, Avalanche, BNB Chain, Fantom, and Harmony networks, as well as Layer 2 chains including Base, Arbitrum, Optimism, Gnosis, Base, Scroll, Metis, and ZKsync Era.

Since Aave offers borrowing and lending across different tokens, the LTV is different for all of them. Aave earns from the difference in interest rates between borrowers and lenders, plus liquidation penalties upon bad debt repayments.

Aave’s smart contracts have been assessed by Oxorio and Certora. Moreover, it also offers an ongoing bug reward program to encourage the discovery of any concerns.

2. Morpho

Morpho is the second-largest DeFi lending platform with a TVL of $7.55 billion and a market share of 9.70%. The lending platform currently has active loans worth over $4 billion. Active loans imply the money given out by the platform as loans.

Morpho was founded in December 2022 and launched its token MORPHO on November 21, 2024. The token has a market cap of $634.8 million.

Morpho allows borrowers to obtain loans without paying fees and lenders to automatically earn returns on borrower interest payments through Morpho Vaults without undertaking any processing fees.

It currently supports 70 different tokens according to CoinGecko and LTVs typically start from 86%, remaining higher for other tokens. Morpho has completed over 25 security audits by firms such as Trail of Bits, Spearbit, and OpenZeppelin.

3. JustLend

JustLend is the third-largest DeFi lending platform with a TVL of $4.96 billion and a market share of 6.37%. The lending platform has been giving out active loans worth $173.84 million.

JustLend was TRON’s first official lending platform, launched on December 7, 2020, and has since become a key component of the TRON ecosystem’s DeFi architecture. JustLend’s native token is called JUST and has a market cap of $344 million.

It supports eight different cryptocurrencies as collateral, according to DappRadar. When you deposit these currencies, you will obtain “jTokens” in return, which are essentially receipts for your deposit and may be traded for your original coins plus any interest gained.

JustLend’s last smart contract audit was conducted by Certik in 2022; since then, no official report has been released by them regarding smart contract auditing.

4. SparkLend

SparkLend is the fourth-largest DeFi lending platform with a TVL of $4.93 billion and has a market share of 6.33%. Currently, SparkLend has given out $2.17 billion in active loans. SparkLend was launched by Sky (formerly MakerDAO) on May 9, 2023, as their first native lending platform.

Its main features are Savings, which allows users to make money on their stablecoin holdings, SparkLend allows them to borrow and lend, and the Spark Liquidity Layer, which distributes liquidity throughout DeFi to generate additional income.

The tokens supported include ETH, WBTC and stablecoins such as USDC and DAI. The liquidation threshold varies by asset; ETH has a maximum LTV of 82%, whereas wstETH has a maximum LTV of 79%.

ChainSecurity conducted comprehensive security audits for SparkLend in 2024, including additional reviews for supplementary code implementations.

5. Compound Finance

Compound Finance is the 5th largest DeFi lending platform with a TVL of $2.72 billion and has a market share of 3.49%. The lending platform has given out over $1 billion in active loans. Compound Finance was launched in 2017, and its native token COMP was listed in 2018. COMP currently has a market cap of $410 million.

Compound Finance currently supports 9 tokens, including ETH, DAI, SAI, USDC, USDT, ZRX, REP, BAT, and WBTC. The LTV changes for different assets and is decided by the COMP community but typically ranges around 90%.

The smart contract auditing for the DeFi platform was last conducted in 2020 by OpenZeppelin. However, they currently have bounty reward programs running.

What is a DeFi lending platform?

A DeFi lending platform is a blockchain-based application that allows users to lend and borrow cryptocurrency directly via smart contracts, bypassing banks and intermediaries.

What is TVL?

TVL (Total Value Locked) is the total amount of cryptocurrency deposited/locked in a DeFi platform, indicating the platform’s trust, liquidity, and activity levels.

What is Liquid Staking?

Liquid staking allows you to get rewards for locked or staked crypto while also trading or using a token that represents your staked assets.

What is a bounty program?

A bounty program is a compensation scheme in which cryptocurrency projects pay users (typically in tokens) for accomplishing tasks such as finding bugs, testing features and code improvement.