UK-based IG group is set to acquire Australian crypto exchange Independent Reserve. The deal comes at an enterprise value of A$178.0 million or $117.5 million. IG group aims to increase its market share with the acquisition, hoping to cash on the rapidly expanding Asia-Pacific region.

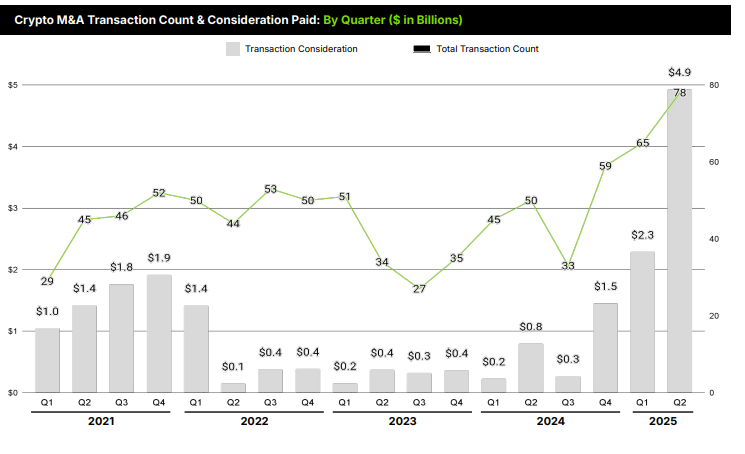

The deal comes against the backdrop of a rising M&A trend in the crypto space, which has picked pace in the past five years.

Further, the move builds the UK based trading platform’s international presence, while creating growth opportunities for crypto rollouts in the U.S. and the U.K. Further, the platform aims for additional regulated crypto trading options by joining one of the markets with the fastest rates of rise in digital asset infrastructure.

The deal exemplifies IG’s overall strategy to integrate its expertise in conventional trading with technological developments to provide investors with a more diverse platform and ensure its ongoing relevance in the financial sector.

Matt Macklin, Managing Director of Asia Pacific & Middle East at IG, commented: “This acquisition marks an important step in IG’s crypto strategy in a key region. Independent Reserve is one of Australia’s largest and fastest-growing digital asset exchanges with established regulatory foundations, proven technology and strong leadership. I am delighted that the Independent Reserve team will join IG as they embark on their next phase of growth.”

IG Group Acquires Independent Reserve: Deal Details

The Independent Reserve buy out comes amid a rise in hype for crypto trading platforms. Independent Reserve provides retail and institutional clients with trading in 34 digital assets in several currencies.

Through the deal, IG gains instant access to these areas and has the ability to grow its offering throughout the Middle East and Asia Pacific regions. The leadership team and staff will stay with Independent Reserve and have a combined 30% stake upon completion, contributing their strong crypto-native knowledge to spearhead IG’s future initiatives.

On completion of the deal, the Group will keep the Independent Reserve name and incorporate its product into IG’s trading platforms, starting in Singapore and Australia.

IG To Pay 70% Payment Upfront for Acquisition

IG group’s pay out for Independent Reserve will not have a single upfront payment but will rather comprise of a system based on the Australian crypto exchange’s revenue over the past year.

Under the agreement, IG will take an initial 70% stake, paying A$109.6 million (£53.4m). It will also receive about A$8.4 million (£4.1m) in surplus cash from the exchange. If Independent Reserve meets certain performance targets in FY26, IG could pay an additional A$15 million (£7.3m), bringing the total price for its 70% stake to A$124.6 million (£60.8m).

The platform will also have the option to buy the remaining 30% stake at a later date, with the price linked to Independent Reserve’s performance in FY27 and FY28.

However, the acquisition still needs regulatory approvals from Singapore’s MAS and Australia’s FIRB, with closing expected in early 2026.

IG expects the deal to boost earnings as soon as FY27 and deliver strong long-term returns by FY29-31. The move underscores IG’s confidence in Asia-Pacific’s fast-growing crypto markets.

IG Group Acquires Independent Reserve Amid Rise in Crypto M&A Sector

The crypto M&A scene is seeing extensive hype at the moment. Big players are snapping up exchanges, custody firms, infrastructure providers and DeFi developers to expand their reach and lock in regulatory advantages.

A lot of this activity is happening in key regions like Asia-Pacific, Europe, and the U.S., where demand for trusted platforms is surging. On the flip side, market turbulence has left some companies undervalued, creating opportunities for larger firms to step in and consolidate.

Traditional finance isn’t staying on the side-lines either, banks and fintech are striking deals to get a foothold in digital assets. The trends suggest a shift in the space, highlighting that crypto is moving fast from experimentation into mainstream finance.