Key Takeaways

- Whales have added 30 million XRP amid the price dip, hinting at an ideal buying opportunity.

- Over the past week, 4 million XRP left Binance, suggesting investors are seizing the market dip by following a buy-the-dip strategy.

- 51.48% of traders are currently betting on short positions, highlighting a bearish short-term trend.

XRP whales appear to be capitalizing on the recent price dip as accumulation continues to rise. A crypto expert recently shared on-chain data revealing that whales holding between 100K and 10 million tokens have added a massive 30 million XRP to their holdings in the past 24 hours.

XRP Whale Activity Suggests Ongoing Accumulation

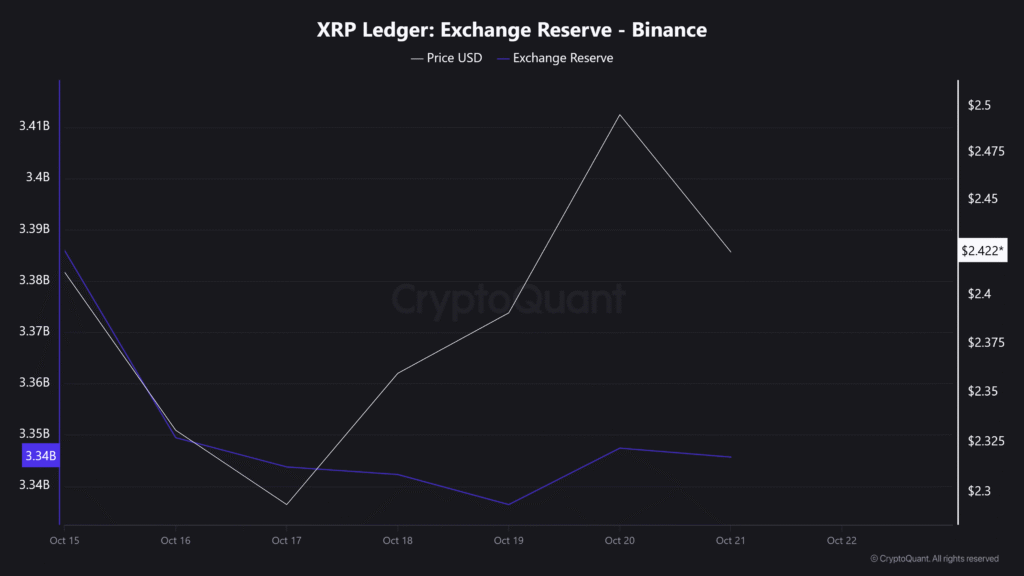

Meanwhile, on-chain analytics platform CryptoQuant reveals that the accumulation is still ongoing. The on-chain data shows that XRP’s exchange reserve on Binance continues to decline, plunging by 4 million tokens over the past week.

This drop in exchange reserves indicates potential accumulation or the movement of assets from exchanges to private wallets, reflecting investors’ and whales’ strong belief in the asset’s long-term potential. Additionally, it’s a bullish sign for XRP holders and suggests an ideal buying opportunity for investors looking to follow the footsteps of whales and long-term holders.

As per the latest data, XRP is trading at $2.37 and has posted a price dip of over 2% today, as per TradingView data. Meanwhile, traders and investors’ participation during the same period has shown a lack of interest, as evident in the trading volume, which dropped by 5.10% to $5.02 billion.

XRP Technical Outlook: Upcoming Levels

With today’s price decline, XRP has weakened its price action and strengthened its bearish outlook, opening the door for a further fall.

According to TimesCrypto’s technical analysis, XRP appears bearish as it trades below the 200-day Exponential Moving Average (EMA) and has formed a bearish harami candlestick pattern, followed by another red candle near the resistance level — potentially confirming a bearish continuation.

In addition, XRP’s Average Directional Index (ADX) has further strengthened its bearish continuation, with its value now reaching 43.47, indicating strong directional momentum that currently remains bearish.

Based on the current price action, if the downward momentum continues but XRP manages to hold above the $2.235 level, it could see a price rebound; otherwise, it may fall to the $1.95 level in the near future due to the absence of further support.

51.5% XRP Traders Go Short

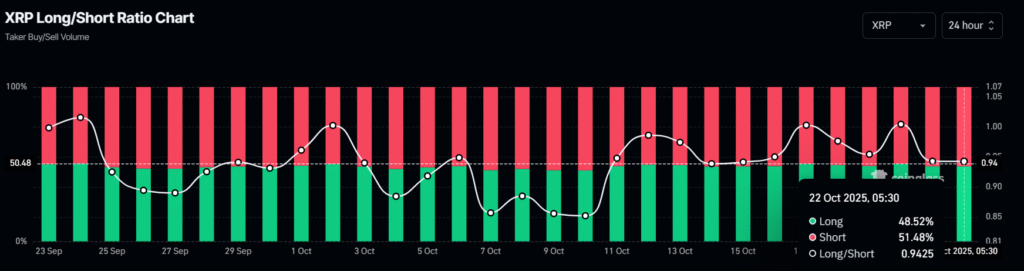

Derivative tool Coinglass reveals that traders are following the current market trend by heavily betting on short positions. At press time, the XRP long/short ratio stands at 0.9425, indicating that for every single short position, there are 0.9425 long positions, reflecting traders’ bearish outlook.

This metric further reveals that 51.48% of traders across the crypto landscape are betting on short positions, while 48.52% are on long positions.

Combining all these metrics, XRP appears to have strong long-term potential, making this an ideal buying opportunity. However, the short-term trend remains bearish, and the price could either consolidate or move sideways.