Key Takeaways

- Bitcoin (BTC) plummeted again, recording a 0.45% dip, raising questions about whether this downturn will continue.

- The crypto market downturn is potentially caused by Powell’s Hawkish tone, continuous ETF outflows in BTC and ETH, and ongoing crypto liquidations.

The overall crypto market is down again as Bitcoin (BTC) faces continued selling pressure. Over the past week, BTC has plunged from $116,000 to below the $100,000 mark for the first time since mid-June 2025, recorded on Tuesday. Although the price briefly recovered to $104,000, it remains under pressure, slipping another 0.45% today.

Not just Bitcoin, but the altcoins, including ETH, XRP, BNB, and SOL, have also suffered steep losses during the same period. This decline in the crypto market has dragged the overall market capitalization down to $3.41 trillion, from above $4 trillion earlier.

Why is the Crypto Market Down?

The key catalysts driving this prolonged downward momentum appear to be the Federal Reserve’s hawkish tone, fading investor interest, billions in crypto liquidations, and the continued rise in Bitcoin dominance.

FED Cautious Tone

Let’s look at what exactly happened. In a recent FOMC meeting, Federal Reserve Chair Jerome Powell highlighted that there is no guarantee of an additional rate cut in December 2025, following a 25-basis-point easing. This comment by Powell hit crypto ETFs hard.

ETFs Outflows Continue to Rise

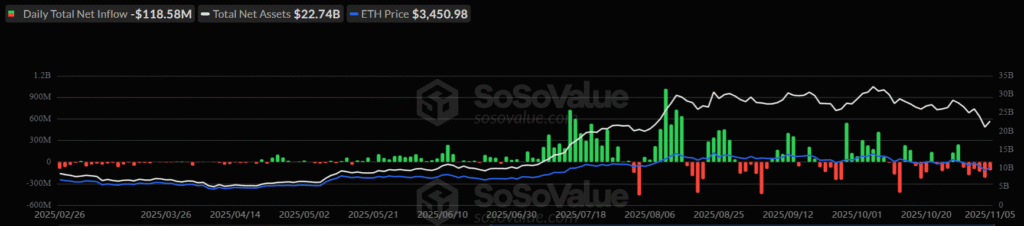

According to the on-chain analytics platform SoSoValue, November 5, 2025, marked the sixth consecutive day of net outflows from top crypto ETFs, including Bitcoin and Ethereum, the highest since March 2025.

Over this period, more than $2.95 billion in net outflows have been recorded, indicating not only that American investors are withdrawing their capital from these crypto funds but also raising red flags for crypto investors.

The impact of these outflows has been clearly evident in BTC and ETH prices, which fell more than 4.75% and 11% over this period, respectively. They also pushed the Fear and Greed Index down to 27 (extreme fear), its lowest level since March 2025, indicating low confidence and rising risk across crypto assets.

Ongoing Crypto Liquidation

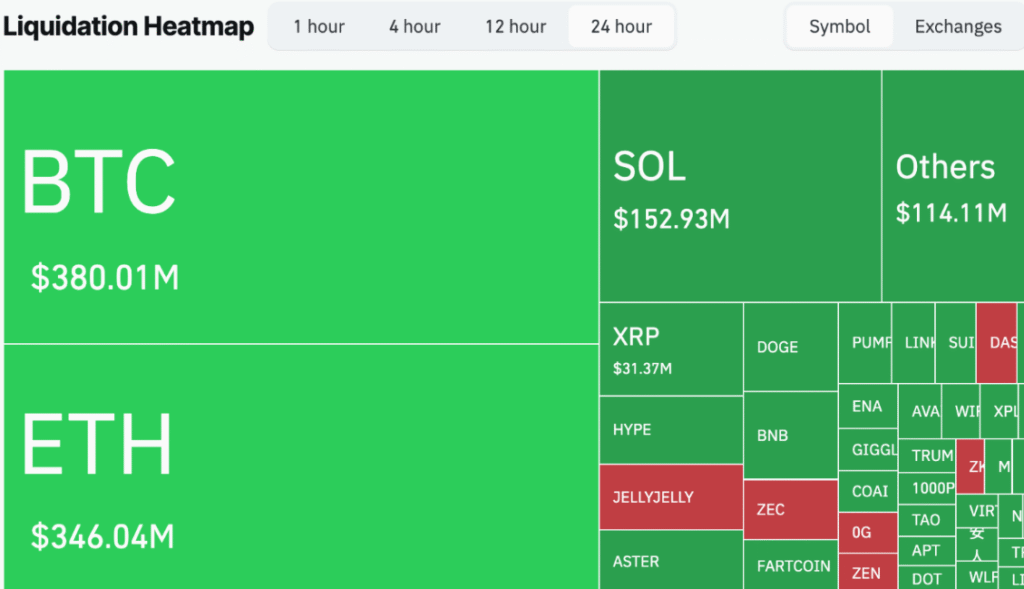

Besides this data, another catalyst for the ongoing crypto market downturn is the liquidation of over-leveraged crypto positions over the past week, amounting to billions of dollars.

According to the derivatives tracking platform Coinglass, in October 2025, more than $25 billion worth of crypto liquidations were recorded, with the largest totaling $19.16 billion following the US tariff hike on China on October 10, 2025. Since then, the overall market has been struggling to gain momentum.

Rising Bitcoin Dominance

Another metric contributing to the crypto market downturn is Bitcoin dominance, which has been continuously rising and recently crossed a key resistance level of 60.50%.

Considering its upward momentum, if BTC.D closes a daily candle above 60.70%, it could significantly impact the overall market.