Table of Contents

Key Takeaways:

- Solana (SOL) has risen 20% in the last month, exceeding $220 for the first time in eight months, boosted by the debut of the SOL-based staking ETF (SSK).

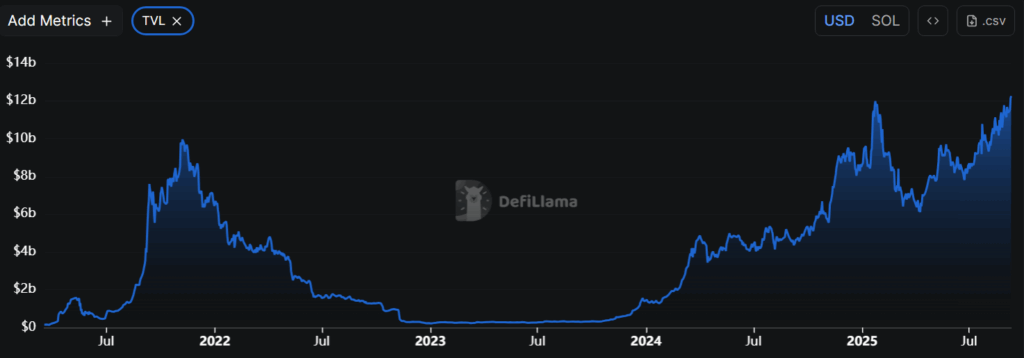

- SOL’s Total Value Locked (TVL) reached an all-time high of $12.25 billion, which was largely driven by liquid staking and trading.

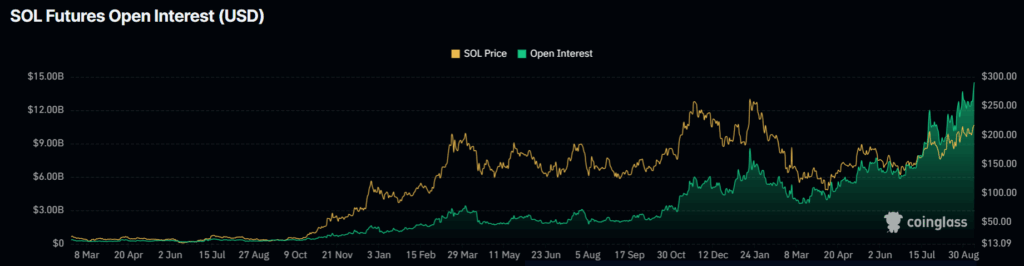

- SOL CME futures open interest hit $1.49 billion and total open interest reached $14.5 billion, signaling strong bullish bets but also a higher risk of volatility.

The broader crypto market currently remains volatile as the top three crypto tokens by market capitalization (cap), such as Bitcoin (BTC), Ethereum (ETH) and XRP, have declined by 0.41%, 0.74% and 2% respectively over the last day.

However, it is important to note that Solana (SOL) has shown positive momentum over the past month, increasing by 20%, outpacing BTC, ETH and XRP. SOL has crossed the mark of $220 for the first time in eight months, followed by the launch of the first-ever SOL-based staking ETF in July, launched by Rex Shares called SSK.

Total Value Locked (TVL), which measures the total amount of money deposited into a DeFi platform, indicates trust and activity. For instance, think of it like users depositing into banks or financial institutions.

SOL’s TVL reached an all-time high, crossing $12 billion. Currently, according to DefiLlama, the TVL for SOL stands at $12.25 billion. The reason for the increased TVL is the increase in users’ deposits across DeFi and trading protocols within the SOL ecosystem.

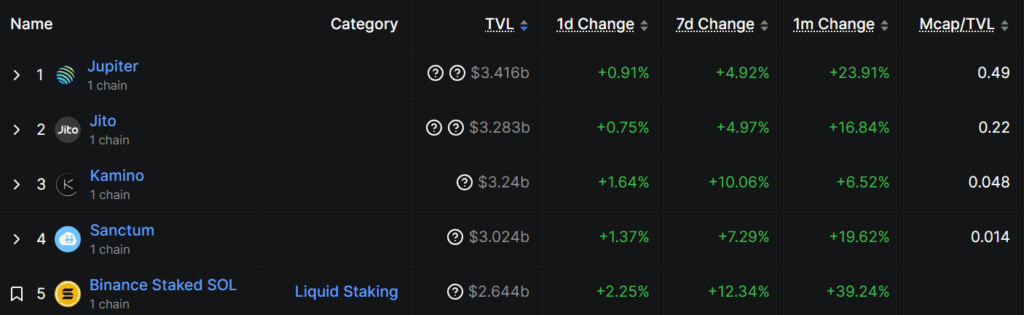

Liquid staking and trading were the primary drivers of TVL. Jupiter, which is a decentralized exchange, had the highest amount of money in the exchange within the SOL ecosystem, followed by liquid staking protocols such as Jito.

Liquid staking includes locking up your crypto to earn rewards, but you also get a “receipt token” that you can still use or trade while your original crypto stays locked.

The one-month change in TVL depicts a positive picture, with Jupiter and Jito reporting 23% and 16% increase, respectively. Moreover, Binance staked SOL reported an increase of 39% in TVL in one month. The current economics behind SOL is driven by liquid staking and trading activity based on the data.

What Is Driving the Revenue for Solana?

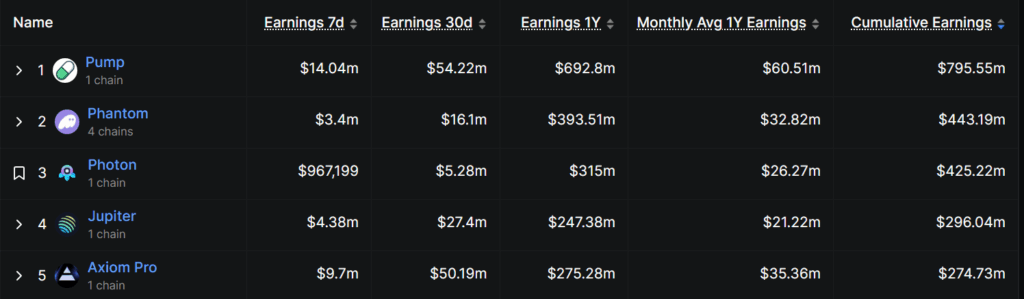

According to Milk Road Daily, SOL has generated $1.25 billion in revenue, nearly 2.5x more than ETH. But what are the primary drivers for creating a billion-dollar revenue?

According to the data, the majority of Solana’s top fee earners are trading-focused apps, including Pump (meme-coin launchpad), Phantom (wallet with swaps), and DEX platforms such as Photon, Jupiter, and Axiom Pro. With annual profits in the hundreds of millions, it’s evident that speculation, token launches, and decentralized trading account for the majority of Solana’s ecosystem earnings, while non-trading apps such as gaming and social networks have yet to catch up.

Solana Sees a Spike in CME Futures and Open Interest

Moreover, another reason for SOL’s dramatic rise over one month is that it has outpaced other major crypto tokens such as BTC, ETH and XRP due to the surge in open interest (OI) of SOL CME futures, which hit a new ATH of $1.49 billion.

Open interest is the total amount of active futures or options contracts that have not yet been closed or settled, indicating how much money is entering the market.

Furthermore, total open interest has reached an all-time high (ATH) of $14.5 billion, indicating increased speculative activity in the market. With SOL showing significant upward momentum, the increase in OI indicates that optimistic traders are increasingly setting up long bets in the futures market. However, record open interest also indicates increased risk of unexpected volatility.

What’s Next for Solana?

Solana’s price reaction is attracting attention among investors and traders, which is fueled by trading, liquid staking and soaring futures activity. SOL remained under a bullish momentum over the last month as it outpaced other major crypto assets such as BTC, ETH and XRP. Nonetheless, market participants should remain cautious as high open interest could lead to increased volatility.