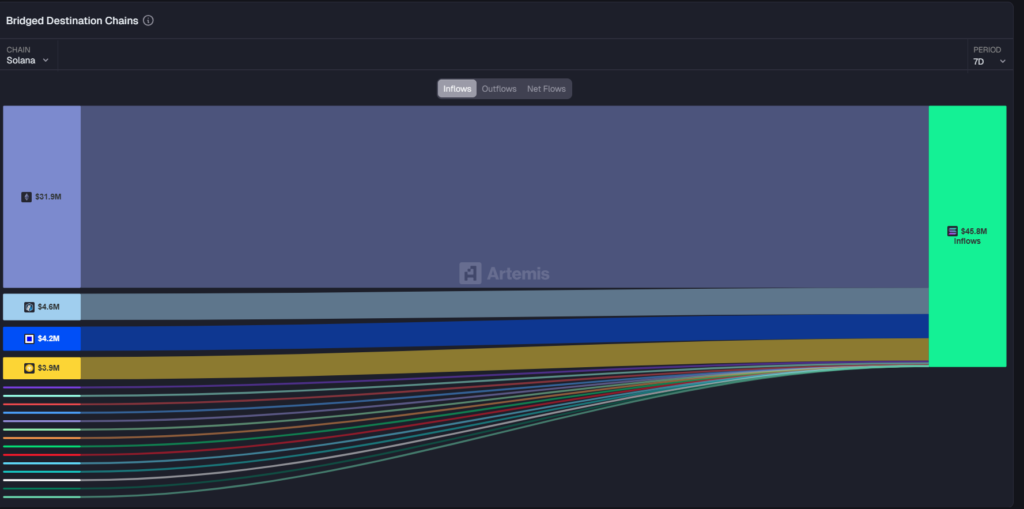

Capital Inflows Highlight Renewed Ecosystem Momentum

The on-chain analytics platform, Artemis, indicates that capital has been steadily moving back to Solana since the network achieved increased status as a Layer 1 network in early 2026. The Artemis analytics report states that $45.8 million in net inflows occurred in the past 7 days, with Ethereum accounting for the highest percentage at $31.9 million, which makes up about 70% of total inflows. The Layer 2 ecosystems showcase their active participation through three platforms, which include Arbitrum ($4.6 million), Base ($4.2 million), and BNB Chain ($3.9 million). The smaller inputs from Polygon PoS, Hyperliquid, and Avalanche C-Chain point out that multiple cross-chain projects show interest in Solana’s high-throughput infrastructure.

SolanaFloor disclosed nearly $80 million in total bridged volume for the same period, over $50 million of which originated from Ethereum alone. The divergence in figures primarily reflects methodological differences: Artemis focuses on net flows across important protocols, while SolanaFloor and other bridge analytics, like Wormhole, Mayan, Portal, and deBridge, look at gross transaction volumes and a wider range of bridges. Despite these differences, the directional signal remains consistent: Solana continues to attract sustained capital inflows across multiple chains.

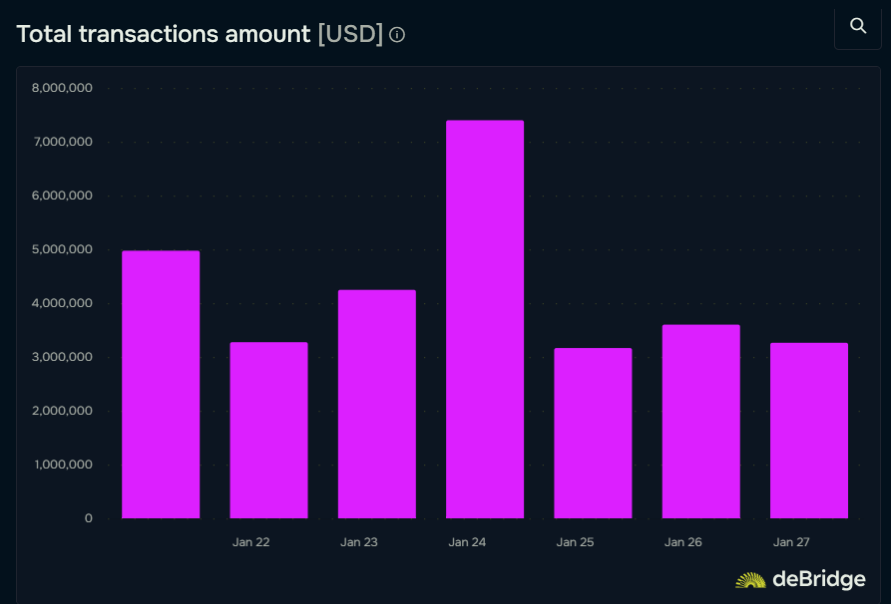

Daily Bridge Activity Suggests Concentrated Usage Patterns

A deeper look at deBridge’s daily transaction data for the solana from January 22 to today shows the movement of capital. The transaction volumes ranged from $3.2 million to $7.45 million, with the peak taking place mid-week on January 24.

At the start of the week, there were nearly 3150 trades per day. The number declined to under 800 at the time of writing. The cumulative trades increased gradually during the week until they reached 18000 at the reporting period end and now total 17500.

Key patterns include:

- The mid-week volume trend: Last Saturday’s market activity was followed by the market participants executing to take advantage of DeFi yield strategies, market rotation patterns, and different high-frequency trading opportunities.

- Gradual taper toward the weekend: Lower activity on January 25–27 lines up with typical crypto market patterns but does not weaken weekly momentum.

- Cumulative adoption growth: The steady increase in cumulative trades implies consistent engagement with Solana’s ecosystem and deBridge as a preferred cross-chain solution.

Ethereum serves as the primary source of capital but Layer 2 networks and Base provide significant support, which confirms that Solana functions as a cost-effective execution platform instead of an autonomous ecosystem.

Structural Advantages Reinforce Solana’s Position

The Solana chain has seen strong growth and has structural advantages, which include high throughput, low transaction costs, and reliable performance during the phases of market stress. According to data sources like Chainspect, the chain has more than 101 billion transactions, which keeps attracting retail traders, active DeFi participants, and high-frequency strategies.

Small transactions and rapid trading activities benefit most from low execution costs, which become ineffective when applied to the Ethereum mainnet and certain Layer 2 solutions. Solana has established itself as the preferred Layer 1 platform due to its swift transaction processing and stable fee structure that meets the needs of applications that demand immediate transaction confirmation.

The diverse ecosystem of Solana motivates users to opt for cross-chain networks because they can transfer funds from Ethereum, Arbitrum, Base, and BNB Chain to access Solana’s special performance and cost-saving features.

Comparative Analysis: Net vs. Gross Flows

According to the data from Artemis The net inflow estimate amounts to $45.8 million. Sources like SolanaFloor reported that in the last 7 days, nearly $80 million was bridged from other chains to Solana, including $50 million+ from Ethereum alone. The network’s net inflows show real capital growth because they subtract outbound transfers from inbound flows. This gives a conservative estimate of how much liquidity is growing. The method used for this research underestimates the total activity that occurs within the ecosystem. Cross-chain total capital movement shows all asset transfers between blockchains, including those assets that return to their original blockchain. This method provides deeper insights into both trading activity and cross-chain trading patterns.

Both metrics ultimately support the ecosystem growth thesis, but they do so in different ways. Net inflows indicate that meaningful capital is leaning toward Solana, even under a moderate framework. The followed trend suggests a shift in liquidity. Gross volumes, meanwhile, capture the degree of cross-chain expansion, revealing how actively users and capital are flowing in and out of the chains.

The inflow patterns observed in January 2026 carry several broader implications:

- Cross-chain rotation is accelerating: Ethereum and Layer 2 liquidity keep continuing to flow into different Layer 1s, with Solana showing up as a primary beneficiary.

- Bridges play a critical role in adoption: protocols like deBridge, Wormhole, and Portal serve as vital infrastructure for cross-chain capital movement, enabling liquidity to access Solana efficiently.

These trends indicate that Solana is not just staying important but is also becoming a top choice for cross-chain strategies, especially for users looking for quick and reliable transactions.