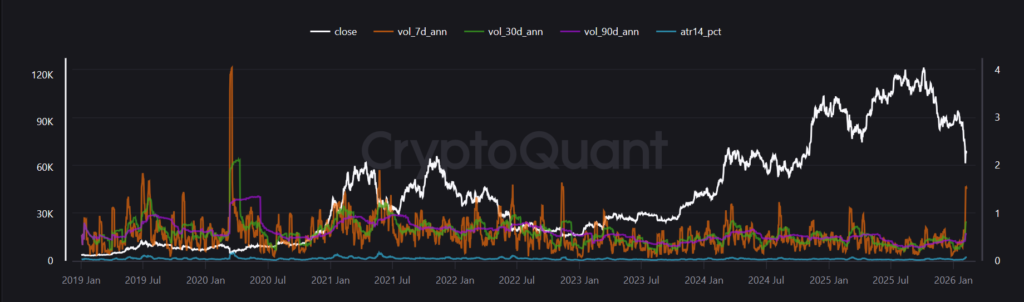

CryptoQuant’s data on Bitcoin’s volatility on Binance in February 2026 shows that the market may be at a turning point. With Bitcoin being traded near $67,000 and no major institutional activity taking place in recent times, short-term annualized volatility has climbed to 151 percent, marking it as the highest level since the 2022 deleveraging episode.

Data from early 2019 demonstrates the times when markets experienced similar volatility spikes, which resulted in subsequent positive market movements instead of only negative market movements. The current market regime demonstrates tight price ranges with intermittent short-duration events, which create energy that will lead to a market breakout in one direction, according to the on-chain flow data, exchange activity, and economic conditions. The 2019 parallel shows that new money entering the market will create significant upside potential despite existing downside market risks. The market investors should utilize risk management strategies while monitoring essential support points and inbound capital to identify the early indicators of a market reversal.

Current Market Conditions and Measures of Volatility

The Bitcoin price shows strong price movements because it continues to rise in February 2026. The asset is trading around $67,000 on major exchanges like Binance after a recent 4 to 5 percent pullback. The previous month experienced greater price fluctuations when Bitcoin reached almost $98,000 during mid-January before it fell under $60,000 shortly after.

Liquidations were also a significant driver for the drop, where over $800 million in liquidations took place with fewer stablecoin inflows. Trading volumes are 40% higher when compared to the monthly average.

The Binance BTC Volatility and Range Engine from CryptoQuant shows this tension. The seven-day annualized volatility is 1.51 (151 percent), which is the highest it has been in years, similar to 2022. According to the data as per CryptoQuant, the 30-day volatility is 0.81, and the 90-day volatility is 0.56. The above graph shows that there are small, burst-like changes during the times of consolidation. The 14-day ATR percentage of 0.075 shows that daily ranges are getting smaller, which indicates the phase of market deleveraging and risk is going up. These are conditions that often happen before trend expansions.

Similarities in History: 2022 and 2019

The comparison from 2022 is still useful. That year, the most volatile times were when FTX went down, the Fed raised interest rates, and BTC dropped 70% from its $69,000 highs. Realized capitalization stopped, just like net inflows have since November 2025. Carmelo Alemán and other analysts see breakdowns below $80,000 as bearish confirmations.

Newly looked at data from January to April 2019 shows a bullish side. After the bear market in 2018, BTC traded in a low-volatility range of $3,500 to $4,000, with an average seven-day annualized volatility of 0.45 and ATR percentages below 0.03. Prices stayed pretty steady, with an average of $3,882.

Bitcoin experienced a rise of 17% on April 2, 2019, when the price went from $4,145 to $4,857. The trend of seven-day volatility reached a value of 1.10, which was the highest level since late 2018. In the time period of just 2 days, it reached the highest point of 1.11. Bitcoin climbed to $5308 by April 10. Seven-day annualized volatility experienced a positive relationship with price (0.38) and ATR with 0.59. On Jan 10, the largest cryptocurrency experienced a drop of 9.6% and saw a rise of 17% in April.

The volatility increase during 2019 created a bull market, which resulted in BTC reaching $14,000 by June, a 250% price increase. The low-volatility base, which formed in 2019, created upward potential because investors expected post-halving results and institutional investors to start participating. The 2022 market contraction showed different patterns from the current situation. The current setup mirrors previous conditions because the ATR value has decreased while short-term volatility has increased, which creates conditions for a future build-up of market activity that will happen after six stablecoins reach the $1 billion threshold and U.S. Bitcoin reserve discussions continue.

There are macro differences, such as tech sell-offs and other problems in 2026, but the volatility gradient of high short-term and low long-term measures is similar to previous transitional phases, which suggests that directionally decisive moves could happen next.

Changes in Structure and the Market’s Transition

Binance data shows that there is a liquidity mismatch: spot bids build up during dips while futures selling takes over, with $3.2 billion leaving since November. On February 6, short-term holder inflows hit 100,000 BTC, which was more than the capitulation levels from April 2025 and a sign that they might be running out of steam. Equity correlations are going up, which makes global volatility risks worse, but possible rate cuts could help.

The 2019 trend, in which the average seven-day volatility rose from 0.22 to 0.98 after spikes, shows how volatility bursts can lead to new regimes. In 2026, a low 90-day volatility of 0.56 suggests stability, but a low ATR suggests that things are about to get bigger. Matt Hougan of Bitwise says that the market might prefer slow accumulation, with portfolio allocations of 1 to 5 percent recommended.

| Metric | Current (Feb 2026) | 2019 Peak (Apr) | 2022 Peak | Implication |

|---|---|---|---|---|

| 7-Day Annualized Volatility | 1.51 (151%) | 1.11 (111%) | ~1.60 (160%) | Spikes mean that the regime is changing; 2019 led to a rally |

| 30-Day Annualized Volatility | 0.81 (81%) | 0.58 (58%) | 0.95 (95%) | Consolidation for the next 90 days, with a 90-day annualized volatility of 0.56 (56%) to 0.54 (54%) to 0.70 (70%) |

| 90-Day Annualized Volatility | 0.56 (56%) | 0.54 (54%) | 0.70 (70%) | Long-term base intact |

| ATR % (14-Day) | 0.075 | 0.042 | 0.12 | Compression comes before expansion |