On-chain data continues to offer some of the earliest signals of structural changes in crypto markets, often revealing shifts in behavior among large participants before those changes fully appear in price action. The following two signs are getting a lot of attention right now: a big increase in Bitcoin inflows from whales to Binance and a clear decrease in the amount of Tether (USDT) available on the Ethereum network, which Tether issued. All of these changes point to tighter liquidity conditions and a possible rise in selling pressure across the Bitcoin market.

A lot more whales are coming to Binance

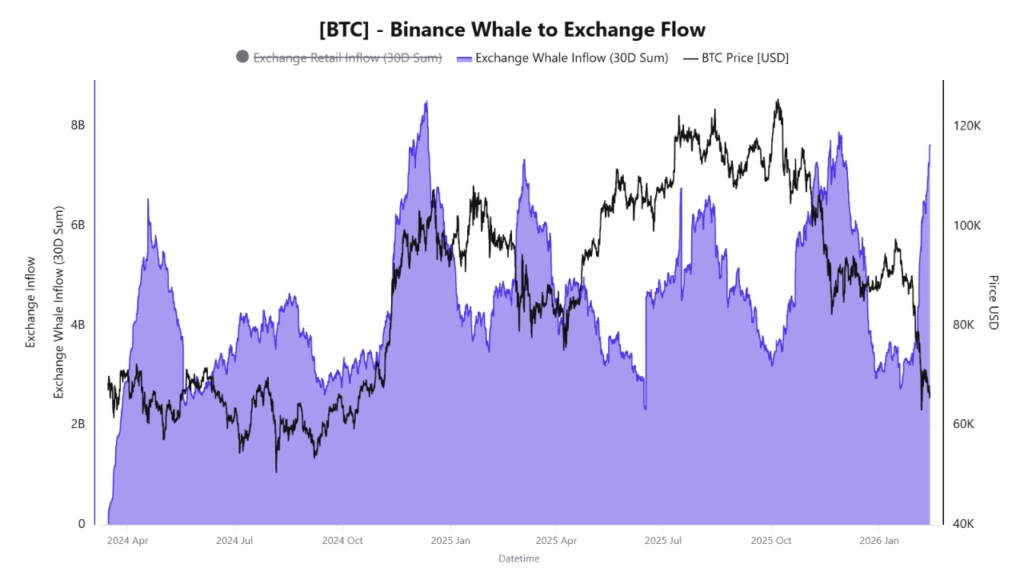

Recent on-chain data that tracks Bitcoin inflows into Binance over the past 30 days shows a big increase in activity from large holders, also known as whales. Inflows have gone over $7.5 billion, which is one of the highest levels seen in the past year. This kind of movement doesn’t happen very often, and it usually happens when the market is making big changes.

In the past, similar spikes have often happened at turning points. The last time something like this happened was in late November, when whale deposits shot up before a big drop. In the weeks that followed, the price of Bitcoin dropped from close to $92,000 to below $70,000. These inflows don’t always mean that people will sell right away, but they do often mean that people are getting ready for possible market distribution, hedging, or portfolio rebalancing.

The market participants usually move their assets to a centralized trading platform for the selling, hedging the positions, or making changes in the allocations whenever there is a requirement for the liquidity. The assets become available for the trading purposes once they get deposited to the exchange, unlike the assets that are stored in custodial or other cold wallets.

Considering the bigger picture of inflows, the current setup stands out more. Retail participation seems to be going up along with whale transfers, which adds even more weight to the supply side. When both big and small players move assets to exchanges at the same time, it often makes more sell pressure available. The market usually prices in the chance of distribution, which can slow down upward momentum, even if not all coins are sold.

Stablecoin liquidity is starting to get tighter.

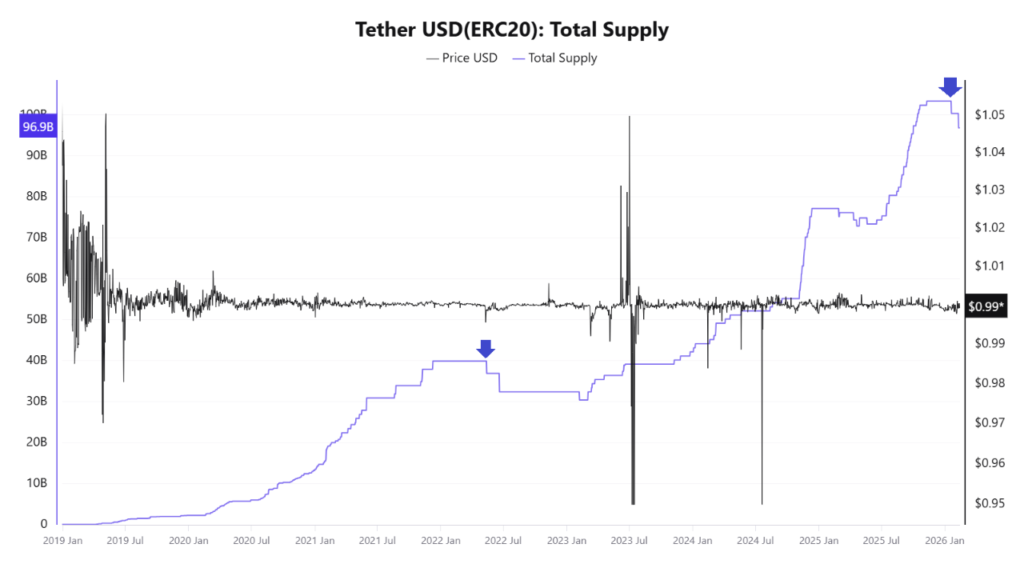

At the same time, changes in the stablecoin markets are affecting the state of liquidity. In the last few weeks, the total amount of USDT on Ethereum has gone down a lot. Since January 18, supply has gone down from more than $103 billion to about $96 billion by mid-February. This is a drop of almost $7 billion in less than a month. This drop is big, especially since Ethereum is one of the main networks that supports trading, lending, and liquidity flows in the crypto ecosystem.

Stablecoins are the main source of liquidity for digital assets. People use them a lot for spot trading, collateral for derivatives, decentralized finance, and settling trades across exchanges. When there are more stablecoins available, it usually means that new money is coming into the market or that people can borrow more money. On the other hand, a decrease in supply often means that people are taking money out, paying off debt, or becoming less willing to take risks.

In mid-May 2022, the same thing happened: the USDT supply on Ethereum dropped by about $3 billion. Bitcoin price experienced a price correction from over $30000 to under $20000 during that time. The market’s ability to absorb the selling pressure has weakened with the decline in available stablecoin liquidity that further intensified the downside trend and elevated volatility.

The current reduction has been partly driven by a large one-time burn of approximately $3.5 billion in USDT. The market effect still remains the same even though the changes in treasury management and operations can impact the supply. When there are fewer stablecoins in the ecosystem, people generally have less buying power right away, especially when risk sentiment is already low.

The structure of the market and the dynamics of liquidity

When looked at together, rising exchange inflows and falling stablecoin supply tell a clear story of a market structure that is getting tighter. When whale deposits go up, the amount of Bitcoin that could be sold goes up. When stablecoin reserves go down, the amount of liquidity that can take in that supply goes down.

Historically, periods marked by elevated exchange inflows together with declining stablecoin supply have tended to trigger consolidation or corrective phases instead of sustained bullish trends. For upward momentum to persist, markets typically call for fresh liquidity and capital inflows to take in selling pressure. Without sufficient liquidity, the market rallies often find it difficult to maintain strength and can quickly lose momentum when selling activity intensifies.

What This Means for the Future of Bitcoin

It’s important to remember that on-chain signals are not always reliable. Whale deposits don’t always mean that people will sell right away. Institutional players may be using hedging strategies, making over-the-counter (OTC) trades, or restructuring their businesses. In the same way, shifts in the structure of stablecoin supply may be more important than capital flight. But when both parameters move in the same direction, they usually represent that the market participants are less willing to take risks and that the market is lacking liquidity. The short-term future of Bitcoin will likely depend on whether liquidity conditions stay the same or get worse. A new issuance of stablecoins, a slowdown in exchange inflows, or clear signs of accumulation by big investors could all help bring back bullish momentum.

In this environment, it’s even more important for market participants to keep an eye on on-chain metrics as well as price trends. Changes in the structure of the market often show up in exchange flows, stablecoin supply, and derivatives positioning before they show up in market sentiment. These signals don’t tell you exactly what prices will do, but they give you a lot of useful information about how supply and demand are balanced.

A Market That Is Being Careful

Right now, the data points to a market that is becoming more cautious. Liquidity is getting tighter, whales are moving their assets closer to trading venues, and the overall environment is moving toward risk management. This doesn’t mean that a downturn is coming soon, but it does mean that conditions for sustained growth are limited unless capital inflows come back.

The way whales act and the amount of stablecoin available will continue to be a big part of how Bitcoin moves. When liquidity grows, markets tend to move; when it shrinks, they tend to stay still. With both exchange inflows going up and the supply of stablecoins going down, the current structure suggests that there could be a time when volatility stays high and directional conviction stays low.