Chainlink (LINK) is not just another crypto project vying for the market’s attention. It strategically occupies the role of the so-called backbone of the whole blockchain economy, being the bridge that connects smart contracts to the real world. Most decentralized apps require oracles that supply reliable data on prices, interest rates, weather, cross-chain messages, and reserves. Chainlink helps connect blockchains to real-world data, events, and systems.

Presently, LINK is worth approximately $9.7 billion in market capitalization, being traded at about $13.74, thus putting the network among the top 20 cryptocurrency assets worldwide. This kind of valuation is not due to hype cycles or meme-driven speculation but rather reflects the fact that Chainlink is increasingly considered a part of the infrastructure: necessary and extensively used.

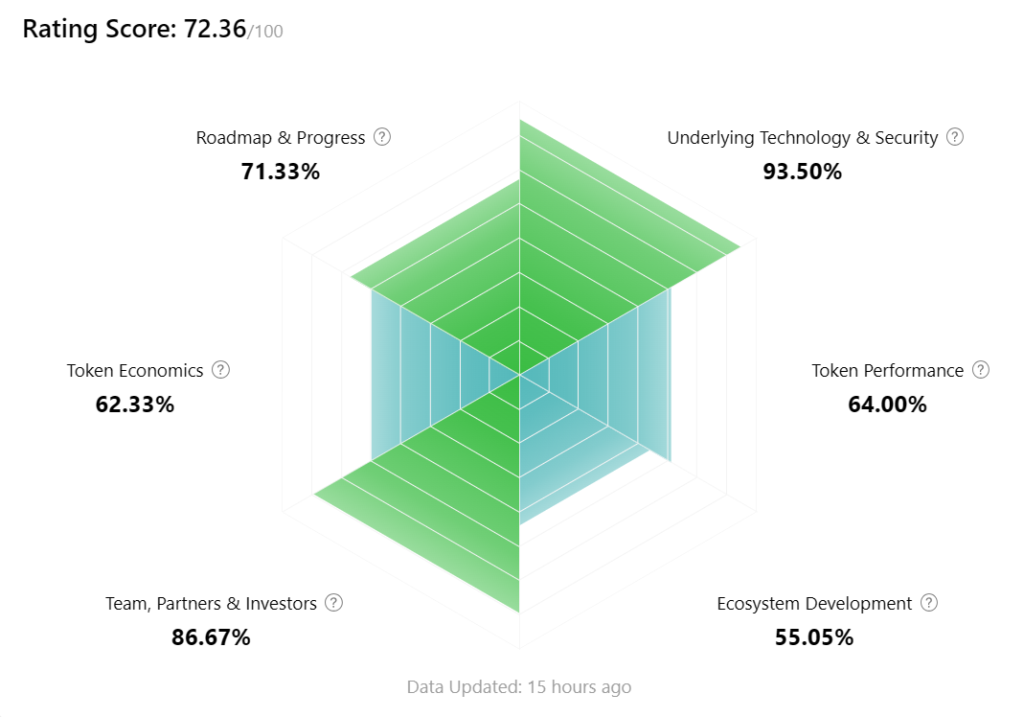

The protocol is presently rated as an “A Stable” standard with a composite score of 72.36/100, indicating outstanding technical underpinnings and institutional trustworthiness, while at the same time revealing areas where the token economy and ecosystem growth can still improve.

Origins: Solving Blockchain’s Biggest Blind Spot

Chainlink emerged from a very basic but fundamental understanding of the blind spots in smart contracts. These are powerful instruments that provide immutability, but they lack the ability to access external information. It becomes difficult for the blockchain to securely obtain off-chain data without a trusted central authority, which renders it unsuitable for trust-minimizing mechanisms.

Sergey Nazarov and Steve Ellis were among the first to spot the problem. Nazarov had a unique combination of technical knowledge and entrepreneurial knowledge, having dealt with both the P2P development and traditional investment worlds, including a connection to firms like FirstMark Capital and a stint at Google. Ellis was the one who provided the strong engineering support to transform this idea into reality.

In 2017, they released the Chainlink whitepaper, suggesting a decentralized oracle network that works as follows:

- Data would be obtained from a range of independent providers.

- Results would be combined through statistical techniques.

- The system would not be vulnerable to any one oracle.

Chainlink’s official launch was on the Ethereum mainnet on May 30, 2019, when it just started with an ETH/USD price feed backed by only three nodes. What followed was not explosive hype but, rather, gradual, compounding adoption.

Organic Growth Through Real Demand

In late 2019, Synthetix was one of the first major protocols that integrated Chainlink price feeds, abandoning the use of centralized oracles even though this choice incurred higher costs. Thus, it was an early indication that the market was ready to pay for the quality of trust.

The DeFi market underwent a rapid expansion in 2020 and 2021, during which protocols like Aave, Compound, dYdX, Liquidity, and many others used the Chainlink feed for lending, collateral management, and liquidations. It was then that Chainlink rolled out Off-Chain Reporting (OCR), a revolutionary development that brought down the gas fees by 90% while ensuring the same level of security.

The year 2022 saw the network going further to achieve cryptoeconomic security with Staking v0.1, which was a move beyond reputation-based incentives. The process gained more strength with the launch of Staking v0.2 in 2023, which brought in unbonding periods, explicit slashing rules, and more flexible reward structures linked to future fee revenue.

Key Metrics

Chainlink today looks less like a speculative altcoin and more like a mature infrastructure asset.

- Price: $13.74 (+1.18%/24 hours)

- Market Cap: $7.7B (Rank #12)

- 24h Volume: $955M (+42.93%)

- Circulating Supply: 708.09M LINK

- Max Supply: 1B LINK

- Fully Diluted Valuation: $13.81B

LINK trades around 73% below its all-time high; it indicates that infrastructure often develops quietly while markets remain cyclical. With the token utility expansion, the gap between market cap and FDV also highlights both dilution risk and long-term flexibility.

Rating Breakdown: Where Chainlink Excels (and Lags)

Chainlink’s overall score demonstrates a strong foundation at the center and a few weak areas around the ecosystem development:

- Technology & Security (93.5%): Top-notch engineering and audit processes in the industry

- Team, Partners & Investors (86.7%) – Support from well-known researchers like Ari Juels and Dahlia Malkhi, as well as collaboration with Google Cloud, AWS, and Deutsche Telekom

- Roadmap & Execution (71.3%): Good track record but still short of full potential

- Token Performance (64%): Working, but not fully mature

- Token Economics (62.3%): A positive beginning; value accrual is still maturing

- Ecosystem Development (55.0%): Unquestionable growth potential

Under the Hood: How Chainlink Works

Chainlink has expanded its capabilities significantly. It is now managing around 1,000 decentralized oracle networks (DONs) complemented by twelve blockchain and layer 2 networks and securing smart contracts worth up to $40 billion.

Core Oracle Design

- Involvement of multiple independent node operators

- Data sources that are premium and diversified

- Aggregation methods that are robust

- Submission of nodes is fully transparent

Off-Chain Reporting (OCR)

The OCR method is a smart way to collect reports from nodes outside the blockchain and send just one transaction to the blockchain, which lowers costs while still keeping the important benefit of cryptographic integrity.

Expanding Service Stack

VRF: Reliable, verifiable source of randomness for NFTs, gaming, and lotteries

Functions: Safe off-chain computation with provable results

CCIP: Cross-chain interaction and token transfers through ~70 mainnets and ~200 assets.

Deep Roots in DeFi

Chainlink is the backbone of some of the biggest DeFi protocols:

- Aave (around 35.41 billion US dollars total value locked): Prices of assets, ratios of collateral, and liquidations.

- Synthetix: Prices of synthetic stocks, commodities, and foreign exchange.

- Derivatives Platforms: Data through data streams with low latency

- Stablecoins: Proof of reserves for collateral transparency.

Enterprise and Institutional Momentum

The collaborations between Chainlink and AWS, Google Cloud, Deutsche Telekom, and significant players in the financial sector make it a junction between the traditional systems and blockchain technology.

By implementing the rapid process of real-world asset tokenization, the capability of Chainlink to offer pricing, compliance checks, proof of reserves, and cross-chain settlement could drive significant market demand.

Token Economics and Distribution

LINK’s total supply is limited to 1 billion tokens, which is set to be distributed in the below manner:

- 35% – Public sale

- 35% – Node operators and ecosystem incentives

- 30% – Development and operations

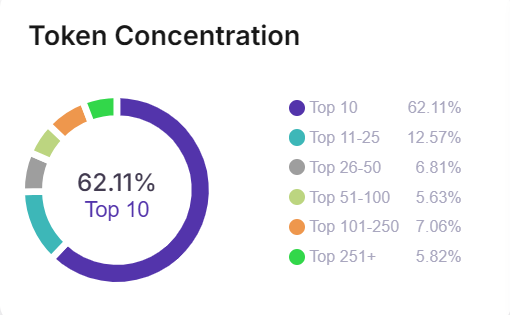

Concentration Snapshot

- 62.11% – Top 10 holders

- 12.57% – Holders 11–25

- remaining supply: dispersed

Centralization is still a risk, but with staking alongside emissions, tokens are slowly being transferred to the active network users.

Staking v0.2: Securing the Network

In August 2023, Staking v0.2 was launched with a capacity increase of 80% and the featured modular upgrades.

Community Stakers

- Min: 1 LINK | Max: 15,000 LINK

- Base APR: ~4.5%

Node Operators

- Min: 1,000 LINK | Max: 75,000 LINK

- Base APR: ~4.5% + delegation rewards

- Slashing: 700 LINK penalties

- Total Cap: 45M LINK

- Unstaking: 28-day cooldown + 7-day window

Delegated options such as stake.link provide higher returns but also entail counterparty risk.

What Comes Next

Chainlink Runtime Environment (CRE)

The SmartCon 2025 announcement introduced CRE, which aims to integrate multichain workflows through:

- Orchestration of native Chainlink services

- Completing the compliance procedure automatically with the help of ACE

- Confidential Computing (beginning of 2026)

DECO and Privacy

The combination of zero-knowledge proofs and TLS makes it possible to confirm sensitive data without letting it go, thus enabling identity verification, proof of funds, and sanctions screening.

Real-World Assets

The collaborations with Swift and DTCC hint at Chainlink still being a major player in the settlement layers for the institutions of the future.

Investment Lens

Strengths

- Industry-standard oracle infrastructure

- World-class research team

- Deep enterprise ties

- Fixed supply with growing demand

Opportunities

- Institutional tokenization

- Cross-chain growth

- Privacy-preserving compliance

Risks

- Token concentration

- Ecosystem growth lag

- Execution risk around CCIP and CRE

Chainlink Beyond the Narrative

Chainlink’s functionality as an oracle is no longer in question. The operating efficiency of years without interruption and the strong connection with the blockchain industry have revealed the answer to this query. The protocol’s value will increase when blockchains are widely accepted as settlement tools by institutions, businesses, and governments.

Chainlink’s exceptional quality is its combination of technical expertise and the manner in which it has integrated itself into the infrastructure of decentralized finance. Usually, users do not get to interact with Chainlink directly, but they require it every time they borrow, lend, trade derivatives, synthesize assets, or check the backing of collateral. This kind of invisible dependability is usually a sign of an infrastructural facility that has transformed from experiment into demand.

A critical aspect of an investment in LINK has been the perception that it is a way to get exposure to a layer of cryptocurrencies that will not suffer at the hands of a single dying application but rather prosper along with the whole ecosystem. When more assets get tokenized, more chains get deployed, and more regulatory-compliant products are made available on-chain, the need for secure data delivery, cross-chain messaging, and verifiable computation will naturally grow along with them.

For developers, Chainlink provides an advanced, well-documented, and tested toolkit that lessens the complications involved in building applications that communicate with the real world. For long-term investors, it provides a fixed-supply asset that is linked with the increasing network usage, with staking mechanisms that enable the holders to participate in network security directly while earning yield.