Bitcoin started 2026 at about 87,700 and has since dropped about 22% to about $68,670 at the time of writing. If things keep going the way they are, this first quarter could be the hardest start to a year for Bitcoin since 2018, when CoinGlass data shows the largest cryptocurrency lost nearly 22% YTD. The decline has been steady but slow, with the asset losing money for five weeks in a row, including a 10.2% drop in January and more losses in February. This pattern shows that the market is weak in the short term, not that it is breaking down.

Ethereum experienced a market decline during the start of 2026, which extended beyond the market drop of Bitcoin. The price for Ethers began at $2,975 in 2026 before it reached its current value of $1,990, which represents a 33% decline. The market performance of Bitcoin, which went through a decline of 21% during the same timeframe, shows that traders view the largest cryptocurrency as a more reliable benchmark than most altcoins.

In earlier cycles, Ether’s first-quarter drawdowns were often similar to or smaller than Bitcoin’s, but 2026 so far ranks among its weaker early-year starts.

Price Action and Levels of Support

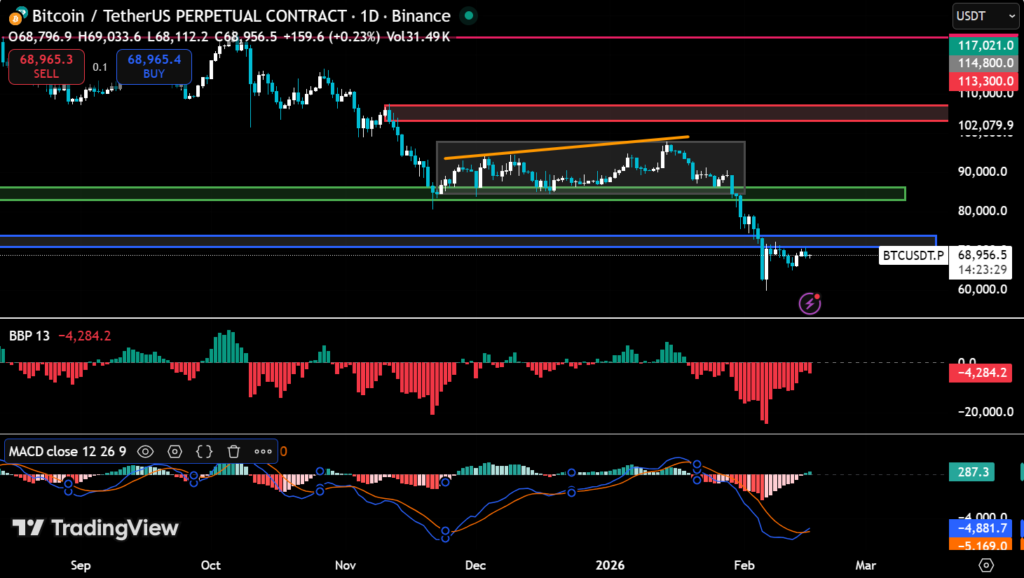

From a technical point of view, Bitcoin’s price movements show that there is still stress in the mid-60k range. The $80,000 level is crucial for turning around the current negative trend in February, but the market has had trouble getting back up to that level. Daily drops of 2 to 3 percent show that sellers are still active and that profit-taking is still putting pressure on the market. Ether’s path is similar to this one, but its relative performance is affected by factors specific to its sector, such as decentralized finance activity and network upgrades.

The way Bitcoin and Ether prices are set up at the moment, it gives the market participants a clue about the near-term support. Bitcoin has repeatedly stabilized for short periods of time close to the range of $68,000, while Ether has shown small price retracements near $2,100. The bulls are showing caution because losses have continued for multiple weeks. It will be crucial for the market prices, which will involve either significant institutional investment or reduced macroeconomic uncertainty, to sustain their upward trend.

Data-Based Historical Background

Cryptocurrency prices are often volatile in the first quarter, but the magnitude varies a lot by year. For example, Bitcoin fell by about 51% between 1 January and 31 March 2018, a much sharper drawdown than recent quarters. In comparison, Q1 2025 saw a decline of about 12%, and Q1 2020 experienced a drop of roughly 11%. Ether shows a mixed picture as well: it dropped about 48% in Q1 2018, was slightly positive in Q1 2020, and fell about 46% in Q1 2025. These examples from the past suggest that early‑year pullbacks, even when they are large, do not automatically mean a structural bear market is starting.

Conditions in the Broader Market

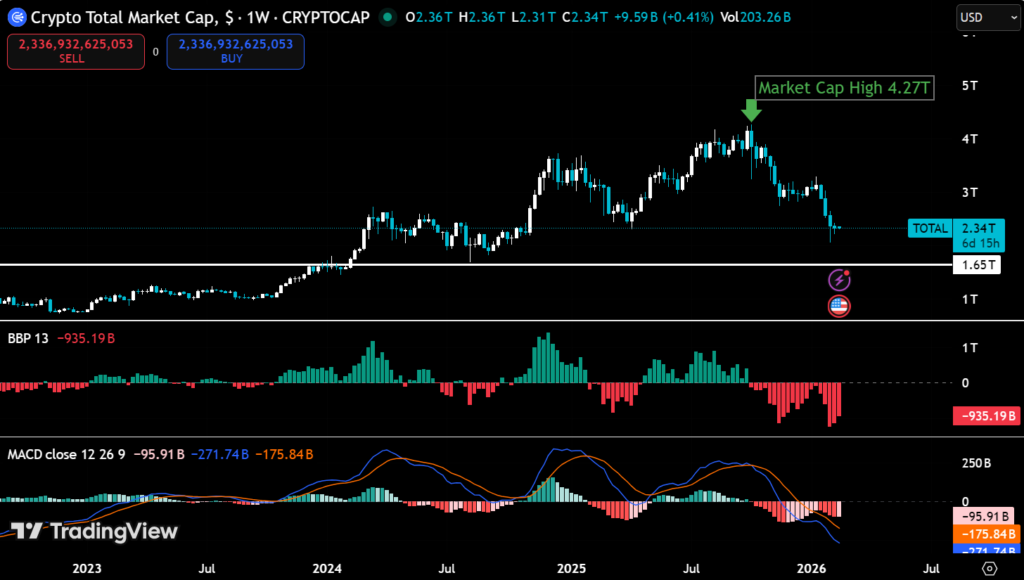

The whole crypto market, not just Bitcoin and Ether, has also been in a risk-off environment. The total market capitalization stood at $2.34 trillion in the same time frame. This drop is in line with the fluctuations in other mid-scale and low-market-cap altcoins. The supply of stablecoins has gotten a little tighter, with USDT and USDC reserves going down a little on major exchanges. Spot volumes on Binance, Coinbase, and Kraken show that most of the money coming in is going into Bitcoin and Ether. Altcoins tend to follow the same path as Bitcoin and Ether, but they are more volatile.

Institutional activity has picked up in places, but it remains selective rather than broad-based. Larger Bitcoin holders and some institutional vehicles appear to be adding on net, yet these flows have not clearly overwhelmed the selling pressure from smaller, more tactical participants. Market liquidity is still thinner than in past bull phases, particularly in derivatives, and options markets continue to price relatively high annualized volatility for Bitcoin, reflecting ongoing uncertainty rather than clear conviction in either direction.

Conditions on a larger scale also matter. Changes in interest rate expectations, global liquidity measures, and geopolitical events can have a big impact on market participants. Events like the Producer Price Index release on Feb 27 could trigger short-term volatility. These parameters tend to support the current cautious viewpoint in the crypto markets, with short-term gains limited even when the long-term thesis supports halving cycles and structural adoption trends.

Important Levels and Signs

Several short-term indicators are being looked at by the market experts to see if a recovery is possible. Bitcoin needs to get back above the $80,000 mark on a weekly basis to stop losing money in February. The closing patterns of the next two to three weeks will show us whether the five-week losing streak continues or stops. The market participants should also keep an eye on Ether’s support level around $1,880 and resistance level around $2,600 to see if the asset can break away from Bitcoin’s trend in a good way.

Institutional flows will also be crucial. If macroeconomic uncertainty goes down, any big accumulation from well-funded participants could help stabilize prices. On-chain data that shows wallet activity, exchange inflows, and liquidity measures gives us the numbers we need to judge these trends.

Bottom Line

The current quarter of 2026 has gone through a high volatility and influence of macroeconomic factors. BTC is down about 22% year to date and ETH about 34%, which signals investors are avoiding risk, but these moves are not unprecedented for early‑year crypto drawdowns. So far, the price action suggests key support levels are being tested rather than clearly broken, and any recovery will likely depend on a mix of renewed institutional interest, a more supportive macro backdrop, and improving risk appetite across the broader altcoin market.