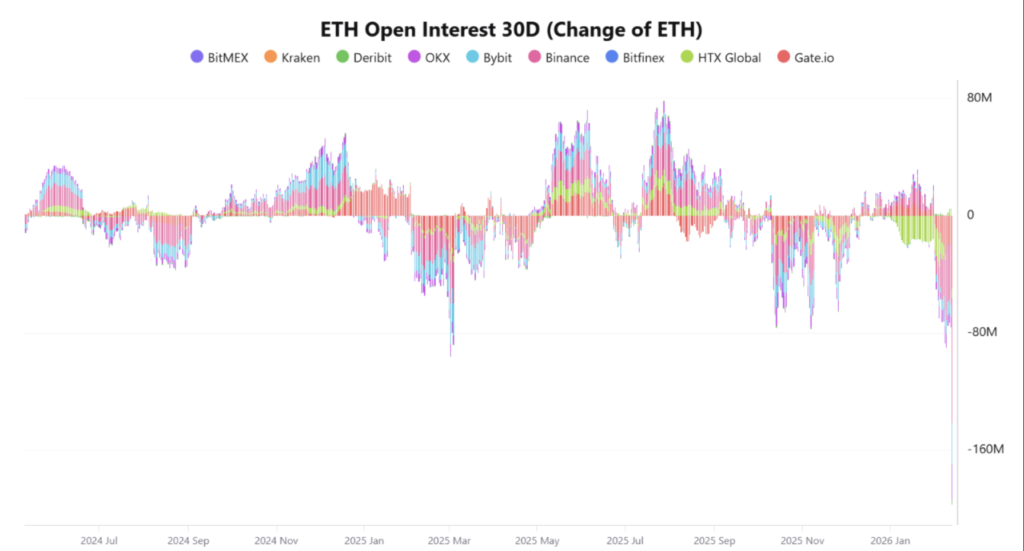

The Ethereum derivatives market currently shows significant deleveraging activities. The centralized exchanges experience this trend through a substantial decrease in their open interest measurement. The open interest value for Ethereum derivatives has declined by more than 80 million ETH during the past 30 days. The trend usually shows that the individuals have now started deleveraging. The current price pattern matches with the behavior of Ethereum during late 2025, a time of low market activity and limited speculative trading.

Big Drops on Major Exchanges

The biggest drop in open interest is on the biggest perpetual futures platforms for Ethereum. In the last month, Binance has had the most outflows, losing about 40 million ETH. Gate.io has lost the second most, with more than 20 million ETH gone. OKX and Bybit have also lost a lot, with OKX losing about 6.8 million ETH and Bybit losing about 8.5 million ETH.

These four exchanges are responsible for about 75 million ETH of the total drop. The total drop is now more than 80 million ETH, thanks to smaller contributions from sites like BitMEX, Deribit, Kraken, Bitfinex, and HTX Global. Over the last two years, historical charts of open interest show peaks and valleys that happen over and over again. But this downturn is different because it is so deep and wide. The big drops in late 2025 and early 2026 show how strong this wave of deleveraging is. This deleveraging is occurring not just on a single platform, but across all platforms.

Reasons for Deleveraging

At this time, traders are not actively scaling in toward the leveraged positions due to several reasons. The market participants are now more inclined toward positions where they can prioritize risk management strategies.

A large proportion of traders exited voluntarily to preserve their capital during the time of recent price drops below the psychological levels. Following this, the trend of retailers’ trading has been shifting from high leverage to conservative approaches like margin rebalancing. This cautious behavior is being reinforced by shifts in institutional flows and ongoing macroeconomic uncertainties that have weighed on overall market confidence. In addition to this, the occasional reversals in money moving in and out of spot Ethereum ETFs and similar products have made the market participants less enthusiastic about derivatives and limited aggressive bets on price direction.

Due to overheated leverage positions in the past, it made the market more likely to make quick and destabilizing moves. The current purging of positions is meant to lower risk by getting rid of too much exposure. If the price of Ethereum suddenly goes up or down, this makes it less likely that a chain reaction of liquidations will happen.

What This Means for the Market Structure

A big drop in open interest is a sign that a speculative cycle is ending and a period of cleaning up is starting. In this case, weaker hands, or traders who can’t or don’t want to hold leveraged positions, leave the market. This makes it more stable. In the past, these kinds of phases came before periods of base-building or consolidation, when prices stayed stable as selling pressure went down.

The current deleveraging might make the Ethereum market more stable in the long run. When there is less leverage in the market, sudden changes in high-leverage long or short positions are less likely to have an effect. People are more likely to start buying again now that institutions are buying more, networks are getting better, or people are just feeling better in general.

The size of the drop, though, shows that there is still some uncertainty about where Ethereum will go in the near future. Data providers like CoinGlass have found that total futures open interest has dropped a lot in terms of dollars. The drop shows that people in the market are being careful and trying to keep prices steady in the current range.

A Strategic View

This part of deleveraging might make the market structure stronger in the future. Changes in open interest are something that traders and investors should pay close attention to. It could signify that the market confidence for the asset is coming back if things start to settle down or slowly improve. Key support levels that are close to recent lows will still be crucial. If prices stay above these levels, it could help the bullish trend start up again.

In the case that the open interest experiences a rise with the price moving up or being stable, it would mean that the accumulation phase has been started and Ethereum has started to move out of the deleveraging cycle. Caution remains the most important thing and more steps to manage risk may be needed.

The current trading trend shows that people are being extra cautious right now and focusing on keeping their capital safe. It also minimizes systemic risk and excess leverage that usually triggers sudden retracement. Getting rid of unstable positions will probably make the market more stable. Over time, such actions will make the base for the price structure stronger. The Ethereum derivatives market is continuously deleveraging, as shown by the more than 80 million ETH drop in open interest on major exchanges in the past 30 days. The current process demonstrates that the traders are adjusting their positions and are proceeding with the risk management strategies to preserve their financial resources. The system achieves two benefits through its function of eliminating excessive leverage and systemic risk. The market will achieve greater stability through the elimination of all high-risk positions. The price base will develop increasing strength throughout the upcoming period.