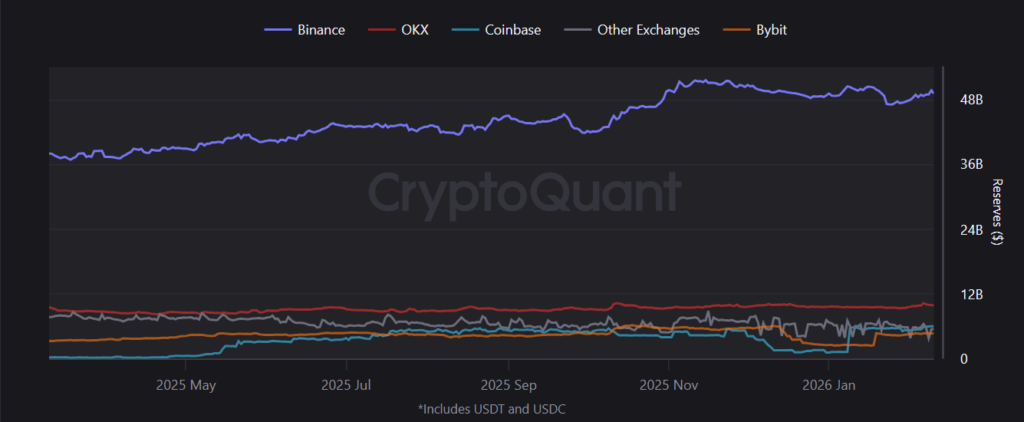

The stablecoin liquidity on the centralized exchanges (CEX) continues to be a key indicator of the market’s composition in the current market phase. The cryptoquant data reflects that the capital is moving within the ecosystem, not exiting. Reserves were at their highest point prior to the drop in crypto prices during late 2025, rising to $11.4 billion in the time period of 30 days leading up to November 5. This proof suggests that the market participants were getting ready for more volatility by holding stable, easily accessible assets. As the market corrected, reserves experienced a drop of $8.4 billion by December 23. The decline shows that participants were utilizing liquidity during the first bear cycle. Over the prior month, outflows have slowed to just $2 billion. This trend shows that the market is stabilizing and that investors would rather keep their money ready to be used again than leave it completely.

Binance: Leader in Stablecoin Reserves

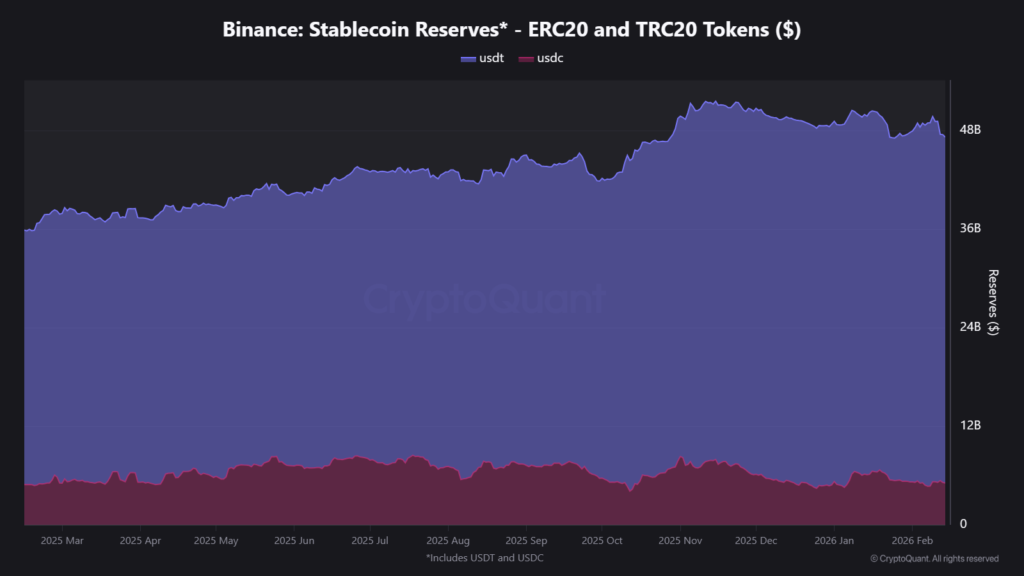

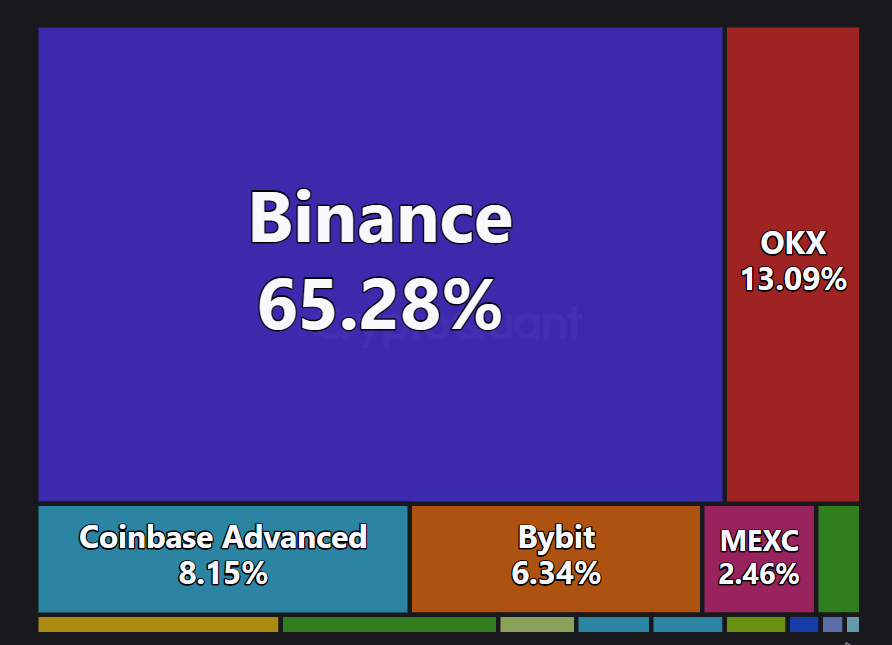

Binance still has the most stablecoin reserves. The exchange has about $47.5 billion in USDT and USDC, which is 31% more than the $35.9 billion it had a year ago. This is about 65% of all USDT and USDC held on centralized exchanges, which shows that Binance is both a major trading hub and a major place to put money to work. This kind of concentration lets people in the market stay exposed even when things are unclear.

Other exchanges only have a small amount of stablecoins. The remaining market share belongs to Bitget and other platforms; while OKX controls 9.5 billion dollars at 13 percent market share, Coinbase controls 5.9 billion dollars at 8 percent market share, and Bybit controls 4 billion dollars at 6 percent market share. The market distribution demonstrates that when major exchanges handle most of their trading volume, it has significant impacts on order book depth, trading spreads, and market movement velocity.

Capital rotation, not full withdrawal, drives market activity

Most of Binance’s stablecoin reserves consist of USDT, which amounts to $42.3 billion from a total of $47.5 billion. USDC, on the other hand, has $5.2 billion. USDT balances have seen year-over-year growth, climbing by 36%, while USDC balances still remain unchanged. Traders demonstrate their preference for USDT since they want to trade in markets that offer high liquidity, which they consider crucial for serving the purpose of both derivatives markets and high-frequency trading (HFT). The platform maintains stablecoin reserves as a financial safeguard, which enables it to retain funds for future use instead of permitting complete withdrawal during periods of low asset prices.

The market participants are engaging in cautious behavior by safeguarding their liquid assets during times of market stress, which results in lower outflow rates. The current market behavior shows similarity to past bear cycles because participants reduce their outflow rates to maintain operational capital while minimizing their overall exposure to risk.

Concentrated Liquidity Impact

The market moves are greatly impacted by the stablecoin reserve changes on the major exchanges. In the case where not substantial tokens are on exchange, the inflow or the withdrawals can trigger volatility in the near-term price movement. Such volatility makes both quick rallies and sudden pullbacks more noticeable. Binance’s large stablecoin balances show the market can absorb shocks, but the same concentration also leaves it sensitive to sudden swings when liquidity is tight.

Macro Factors Help Keep Capital

Stabilized exchange reserves happen at the same time as a macro environment that supports keeping capital safe. Expectations of a more relaxed U.S. Federal Reserve policy have made people more willing to take risks, which means traders can keep a lot of money on exchanges and be sure that their financing costs will stay low. Also, more institutions are getting involved, especially through spot Bitcoin ETFs, which take up market supply and make it less necessary to sell stablecoins right away.

The Reserve Distribution

With 65% of stablecoin reserves concentrated on Binance, it’s clear how uneven liquidity can shape market behavior. Exchanges with smaller reserves tend to experience wider spreads and sharper price swings during large trades, while those with more capital can absorb shocks more smoothly. This setup shows that just a few major exchanges can have an outsized influence on overall crypto market liquidity, especially when trading volumes are low or market conditions are tense.

Statistical Background and Consequences

The $47.5 billion on Binance is a large part of the stablecoins that can be traded on exchanges. Historical data shows that periods of stable or rising reserves usually come before market stabilization, while sharp declines happen at the same time as sell-offs caused by a lack of liquidity. The current slowdown in outflows suggests a constructive, defensive phase rather than ongoing de-risking.

Looking Ahead: Market Stability and Possible Triggers

As reserves stay concentrated and outflows stay low, people in the market are likely to keep deployable capital on exchanges. This gives individuals the freedom to react to macro-driven events or trading opportunities. There may still be short-term volatility, but the data shows that the market is not going through a broad liquidation. Price changes in the future will depend on how much money flows into institutions, how clear the macroeconomic picture is, and whether exchange balances change slowly or suddenly because of strategic or high-frequency trades.

The stablecoin trend is followed by the two cases where if stablecoin balances are stable or rising, the market will be following a consolidation phase instead of a collapse and participants are keeping capital ready. On the contrary, market stress or a sell-off phase will be triggered if reserves drop sharply.