Key Takeaways:

- The Altcoin Season Index reached 80, officially indicating the beginning of altseason.

- Altcoin Season Index is rising rapidly, driven by ETF approvals and corporate treasuries.

- Macroeconomic issues, particularly the Federal Reserve’s interest rate policy, remain key in determining whether the rally will continue.

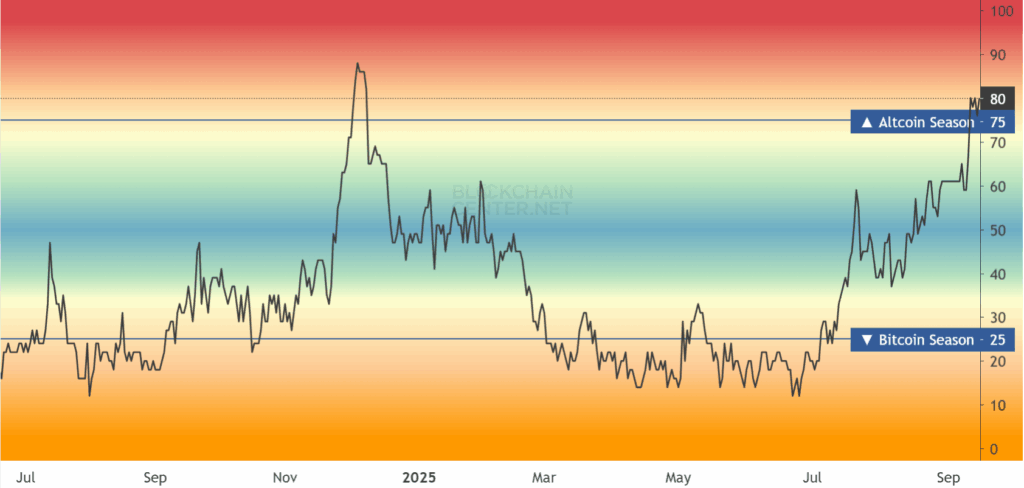

The cryptocurrency market is currently experiencing the Alt Season as the Altcoin Season Index is at 80 at the time of reporting, fueling speculation that a new “altseason” is on the way, according to Crypto Rover. Altseason implies that major altcoins, which include cryptocurrencies other than Bitcoin (BTC), outperform BTC itself in terms of price.

According to Blockchain Center, when the indicator crosses 75, it signals the start of an altseason. On September 12th, Crypto Rover tweeted, confirming that we are currently in phase 2 of the altcoin season. Traders and investors are now eagerly waiting to see if the rally will continue.

Crypto Rover later also tweeted, depicting an extremely bullish nature about the altcoin season, saying –

Other major voices on X within the crypto industry also tweeted about the altcoin season. Key Opinion Leader (KOL) and Crypto trader known as “Mister Crypto” on X tweeted –

Famous host and key opinion leader on X, Carl Moon, tweeted to his 1.5 million followers on X,

BUY ALTCOINS NOW. SELL IN DECEMBER. THANK ME LATER.

What is the Altcoin Season Index?

The Altcoin Season Index measures how many of the top 50 cryptocurrencies outperformed BTC in the last 90 days and a value above 75 indicates that the altseason has been confirmed.

What Does It Mean for Altcoins?

When the index rises, it indicates that altcoins collectively, such as Ethereum (ETH), Solana (SOL), and Cardano (ADA), are growing faster than BTC.

When the Altcoin Season Index is high (over 75), it indicates that altcoins are outperforming BTC, which frequently results in rapid price gains across numerous altcoins, which is known as altseason.

When the index is low (less than 25), it indicates that BTC is outperforming altcoins, implying that most altcoins are weaker and may lose value in comparison to BTC. According to Blockchain Center and CoinGlass, the altcoin season index is at 80 at time of reporting, depicting a highly bullish picture for altcoins based on the index.

What Determines the Altcoin Season?

Certain factors determine the impending altcoin season, such as-

- Bitcoin dominance

- The Altcoin Season Index climbs beyond 75

- TOTAL3 Index

- Federal Reserve Interest Rate Policy

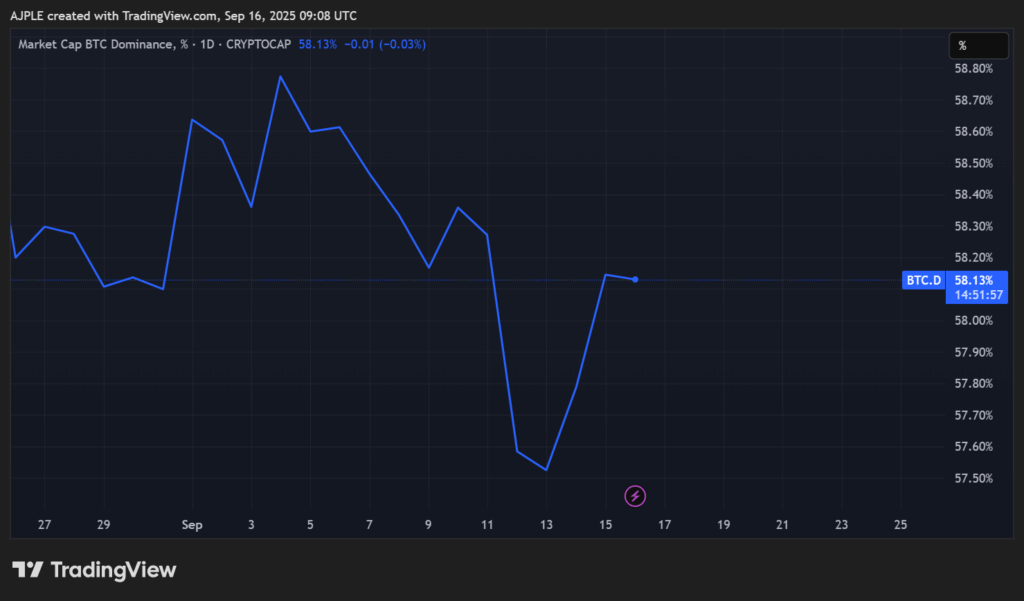

Bitcoin Dominance: BTC dominance refers to the percentage of the total cryptocurrency market that is comprised of BTC’s market cap. It displays the percentage of BTC’s market cap in relation to the total value of all cryptocurrencies, which is currently at 58.13%. Essentially, determining how much market share is controlled by BTC.

When BTC dominance is high, this indicates that the market sentiment is bullish towards BTC. However, a falling BTC dominance would indicate that market sentiment is shifting towards altcoins, as they believe it could provide better returns in comparison to BTC.

The BTC dominance chart was trending upwards since the beginning of the year, followed by US President Trump’s inauguration, pro-crypto policies such as BTC reserves being established by governments and corporate treasuries. These developments led to BTC reaching an all-time high (ATH) as well. However, since May, BTC dominance has witnessed a slight pullback, while the altcoin Index has shown an upward trend.

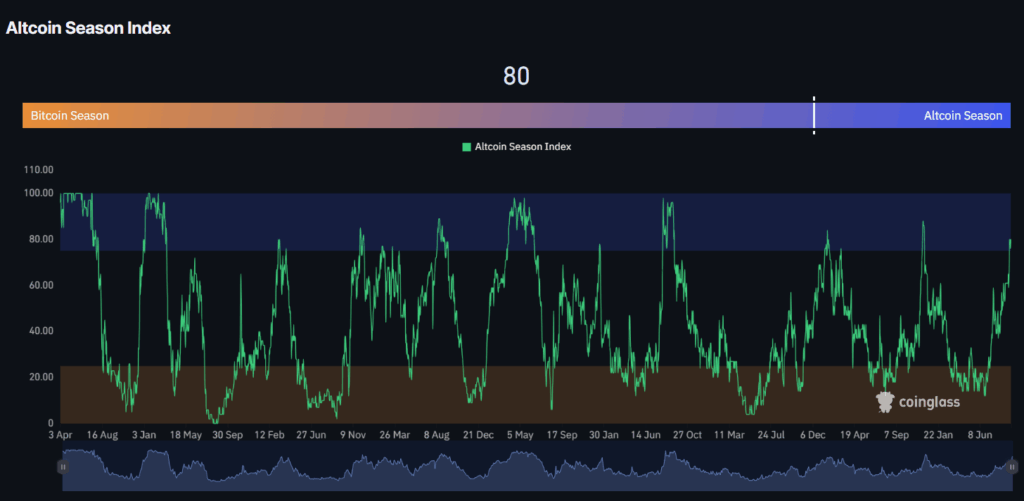

The Altcoin Season Index: For the altcoin season to commence, the index needs to be above 75. According to CoinGlass, since the beginning of the year, the altcoin season index faced a downturn due to BTC reaching an ATH. Nonetheless, by the beginning of July, the altcoin index started picking up, led by the rise of corporate treasuries and institutional interest.

Furthermore, the recent surge in ETH’s price, combined with progress on altcoin ETFs, like Rex Shares’ approval of Solana’s staking ETF (SSK), has given the market a positive momentum. According to CoinGlass, the altcoin season index has begun since it crossed 75 and is at 80 at the time of reporting, which is close to the levels of 2022 ATHs.

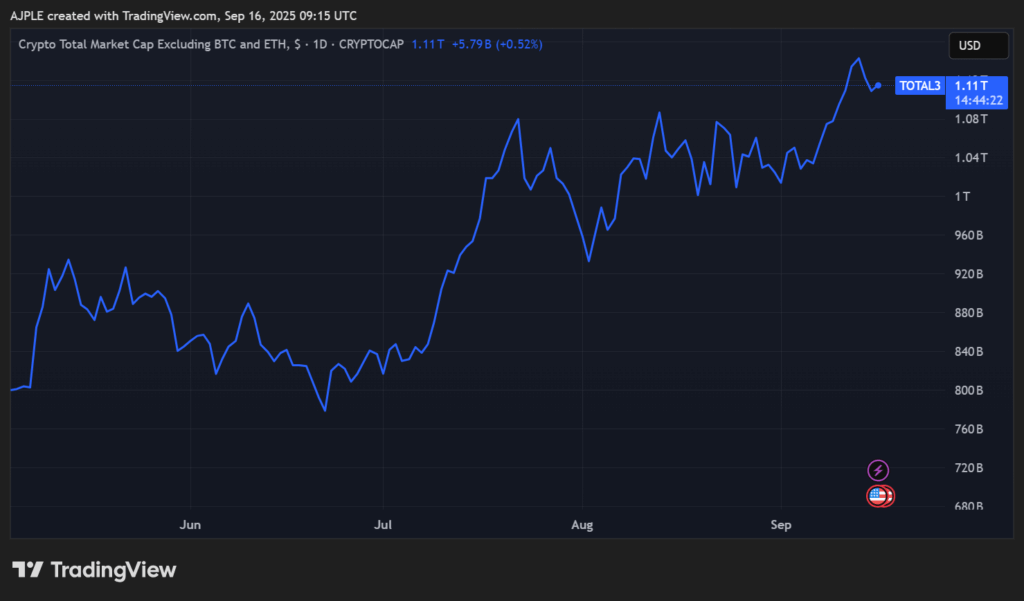

TOTAL3: TOTAL3 tracks the combined market cap of all crypto tokens except BTC and ETH. In the world of crypto, the majority of investors or traders focus on BTC or ETH. This does not give a full picture of altcoins’ performance or the market sentiment towards other altcoins.

If the TOTAL3 rises, this would indicate that capital is flowing into altcoins, showcasing bullish momentum. On the other hand, a fall in the TOTAL3 index would signal the opposite, as traders or investors would aim to shift away from altcoins.

Traders use it as an early indicator, as breaking over resistance can signal the start of an altcoin rally, while dropping below support may indicate market weakness. The chart below shows TOTAL3 has risen since the beginning of September, around the same time the altcoin season index started picking up.

Federal Reserve Interest Rate Policy: The monetary policy has a great role to play in determining liquidity in the markets. For instance, when interest rates go down, borrowing becomes cheaper, and greater liquidity flows into risky assets such as altcoins. On the other hand, when interest rates go up, borrowing becomes expensive and investors will shift to safer assets such as the U.S. dollar or treasuries.

The interest rate, which is decided by the Federal Reserve, determines the liquidity flowing into the cryptocurrency markets. The relationship between interest rates and risky assets such as crypto is inversely proportional.

The upcoming inflation rate data scheduled for September 11th will determine the interest rate expectations, which is scheduled to be announced on September 17th by the Federal Reserve.

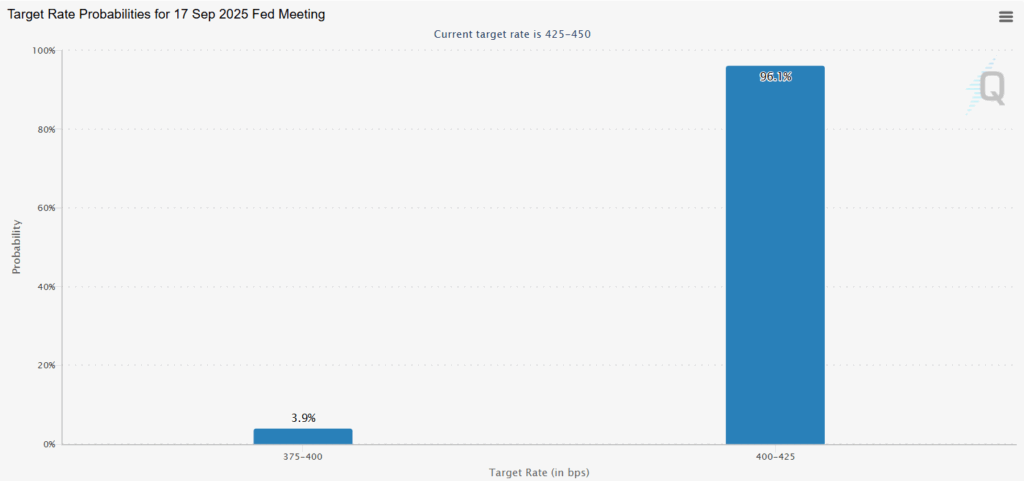

Additionally, the interest rate expectations according to the CME Fed Watch tool show a 96.1% probability of the interest rate cuts, with interest rates going from 4.25-4.50% to 4.00-4.425%.

What’s Next for Altcoins?

Altcoin Season Index has reached 80, surpassing 75, which indicates that the altseason has started. ETF approvals, growing adoption of altcoins in corporate treasuries and TOTAL3 market cap all hint at increased capital rotation into altcoins.

However, macroeconomic issues such as the Federal Reserve’s imminent interest rate decision will play an important role in maintaining this momentum. The index is currently at 80, indicating high optimistic sentiment, but traders should be wary of volatility as speculation heats up.