Hyperliquid is a decentralized trading protocol that operates as a spot and perpetual market utilizing its custom Layer-1 blockchain to handle a high volume of transactions. The slogan of ‘low latency execution, transparent on-chain settlement, and advanced trading features’ is mostly associated with centralized exchanges. The ecosystem utilizes its native token, HYPE, for serving the purpose of utility and governance.

Protocol Architecture and Product Scope

The Hyperliquid exchange is a decentralized platform that uses a Layer-1 infrastructure designed specifically for trading in derivatives. The network is powered by HyperBFT, a unique consensus mechanism that borrows from Hotstuff, which allows for block confirmation times of less than one second and the ability to process 100,000 orders per second on the network. Such a setup paves the way for the protocol to facilitate the trading of large volumes of shares while keeping the execution on-chain and the crypto assets in the traders’ wallets.

The decentralized platform has the capability for both spot trading and perpetual contracts, ultimately allowing traders to take long or short positions without expiry restrictions. In February 2025, Hyperliquid announced the advancement of its technical stack with the launch of HyperEVM on its mainnet, a move that made smart contracts compatible without compromising the low-latency trading environment of the protocol.

Ecosystem Development and Market Positioning

The development of Hyperliquid was started in late 2021, with the protocol’s mainnet launched back in the first quarter of 2023. The successful implementation has marked the beginning of the platform continuously broadening its feature set and market coverage.

Hyperliquid was the dominant force in the DeFi perpetuals market by August 2025, controlling over 80% of it. This trend shows that the platform is being widely used in decentralized derivatives trading. The introduction of the HIP-3 in October 2025 allowed the setting up of completely permissionless perpetual market listings and the deployment of new derivatives markets by external developers without any centralized approval.

There has been a rise in institutional interest as well. In September 2025, Lion Group Holding Ltd. (NASDAQ: LGHL) announced a strategic treasury reshuffle favoring Hyperliquid, which was a clear sign that the protocol is being gradually acknowledged by the traditional finance industry.

Token Supply and Distribution Structure

The HYPE token has a capped supply of 1.0 billion tokens, and the current total supply of tokens is 962.3 million. According to the most recent figures from Messari, the number of circulating tokens is 238.4 million, which is roughly equal to 24.77% of the fully diluted valuation.

Allocation Breakdown

- Future Emissions & Community Rewards: 38.89%

- Genesis Distribution: 31.00%

- Core Contributors: 23.80%

- Hyper Foundation: 6.00%

- Community Grants: 0.30%

- HIP-2: 0.01%

The token distribution structure points towards a significant portion of supply remaining that is further allocated to future emissions, positioning token unlocks as a crucial ongoing variable in valuation analysis.

Recent Supply Expansion and Dilution

A recent vesting release of a founding allocation allowed 12,457,813 HYPE tokens to be obtained by the core contributors. These tokens turned tradable and the circulating supply jumped by 5.5%, from 225,927,502 to 238,385,315 tokens.

The total estimated dilution of $331 million was allocated among the existing token holders. Although there is no direct cause-and-effect relationship between such supply expansions and price declines, they do significantly change the dynamics of circulating supply and market capitalization.

Token unlocks are, however, predictable in the future. Another issuance of about $268 million worth of HYPE tokens is on February 6th. This unlock is after an earlier unlock on November 29th that released about $345 million of new circulating supply. In total, these three events will contribute roughly $945 million in dilution within a three-month period.

Market Performance

HYPE’s price performance illustrates the dynamic between the increase of supply and the market conditions in general.

- Past Month: −6%

- Past Six Months: −36%

- One Year: +15.98%

Although the short-term performance has been volatile, the long-term returns continue to be positive when compared with the USD and BTC benchmarks. The trend suggests that the recent weakness is primarily in the intermediate timeframes.

Market Metrics and Trading Activity

Valuation and Supply

- Market Capitalization: $6.49B

- Fully Diluted Valuation: $26.20B

- Circulating Supply: 238.4M

- Mcap / FDV Ratio: 24.77%

- Sector Rank: #8

The difference between market capitalization and fully diluted valuation points out the significance of future emissions in long-term price discovery.

Trading Activity (24H)

- Spot Volume: $6.75B (+27.56%)

- Futures Volume: $541M

- Open Interest: $411M

- Funding Rate: 0.01%

- Annualized Funding Rate: 15.03%

The metrics activity stays active, with funding rates demonstrating slightly balanced leverage positioning instead of drastic directional bias.

Relative Performance Analysis

| Period | vs USD | vs BTC | vs Sub-Sectors |

| 7D | +8.03% | +2.05% | +3.93% |

| 30D | −6.70% | −8.70% | −308.99% |

| 90D | −37.66% | −18.10% | −56.89% |

| 1Y | +15.98% | +21.32% | +1,417.05% |

The above table reflects that the performance over longer time frames was better than that of the sub-sector benchmarks, although the recent period showed a negative difference in performance due to the supply dynamics.

Revenue and Capital Management

In total, Hyperliquid has brought in $720.46 million, with an annual revenue of $438.28 million, which makes the protocol one of the top decentralized exchanges in terms of revenue. The capital management strategy has comprised buying back a significant amount of the company’s shares:

- Total Buybacks: $694.89M

- Buybacks (HYPE): 20.49M tokens

- Circulating Supply Bought: 12.64%

- Annualized Buybacks: $868.61M

A part of the circulating supply expansion is covered by these buybacks, even though they are working together with scheduled token unlocks.

Liquidity Distribution

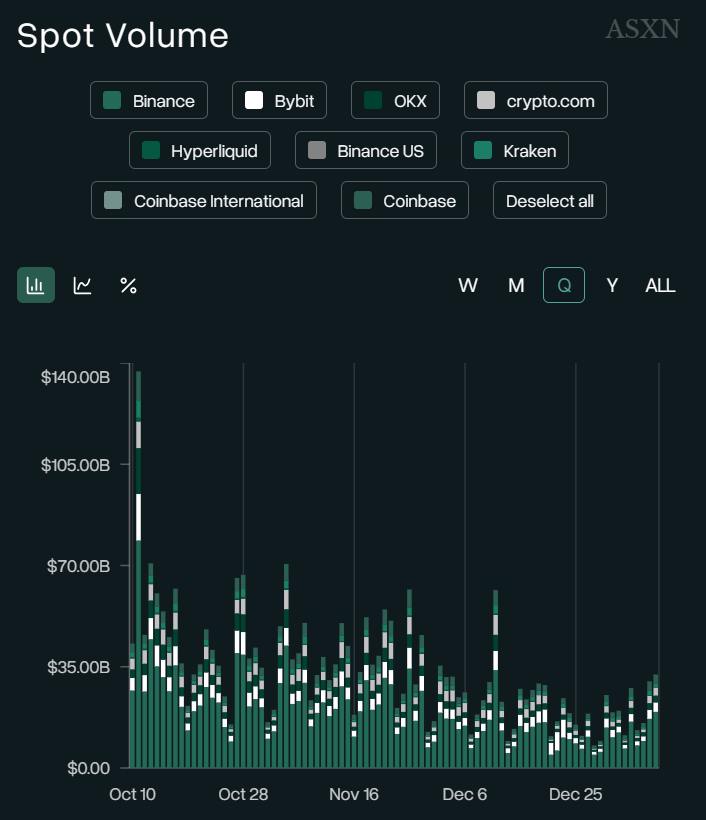

The liquidity of the spot market is mainly pinned down on the centralized exchanges, with Binance, Bybit, Coinbase, Crypto.com, OKX, and Kraken being the exchanges with the highest volumes. The trading volume of Hyperliquid’s native platform is one of the smallest of all spot trading volumes, with the market access of external venues being broader.

The above chart shows the downtrend for the DEX volume metric. For the quarterly time, the metric has seen a drastic plunge, falling from $187.87 million to just $8.71 million as of January 7, 2026. The following substantial decline calls for a comprehensive analysis of trading activities on the platform in the recent time period. It also brings up doubts about user participation, liquidity backdrop, and the future viability of the short-term volume trends.

Hyperliquid’s total DEX volume recorded a staggering $34.73 billion, and the platform’s average daily volume was $107.20 million despite the drop in activity during the quarter. The number of transactions processed by the platform is 34.82 million, with the average trade size is $997.39. The trend indicates that even though there has been a decline in activity lately, still the protocol has been a vigorous and consistent contributor to trading flows in the market during past periods.

Conclusion

Hyperliquid is a sophisticated decentralized derivatives platform, technologically, and also possesses a significant market share, a substantial amount of income, and a development of the ecosystem that is still ongoing. However, the increase in the supply of tokens is a primary market performer. If future emissions proceed as planned, the valuation could still be very much dependent on striking a balance between protocol growth, revenue generation, and efficient supply management.