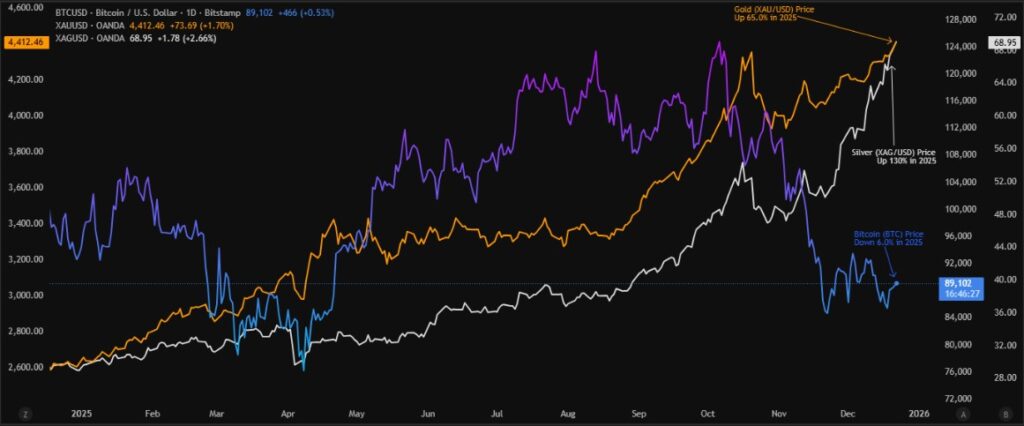

Silver shines brightest with a 130% yearly gain as 2025 is nearing an end. A softer U.S. dollar, strong institutional buying, and supply constraints are among the key catalysts that grab major attention.

By comparison, gold is up more than 60% as it renews its record top near $4,400, while Bitcoin is down nearly 6% this year—despite a recent bounce toward $89K.

Bitcoin hasn’t benefited much from easier Fed policy or positive industry headlines, not to forget the softer U.S. dollar. Still, rising institutional interest and hopes of a 2026 recovery keep the debate alive. Once called “Digital Gold,” Bitcoin now faces a new question as silver shines brighter: Is BTC becoming “Digital Silver”? Let’s determine it!

The following chart aptly describes the BTC, XAU/USD, and XAG/USD moves while citing a clear disconnect among the once friends.

Bitcoin, Gold, and Silver Price Performance

Having examined the price performance, it’s time to observe the market capitalizations of BTC, XAU/USD, and XAG/USD.

Market capitalization, or market cap, is the total value of an asset, derived by multiplying the floating supply of the financial instrument by the market price. Market cap explains the underlying asset’s size, stability, and market value in comparison to others.

Top 10 Global Assets in 2025

Gold remains the world’s largest financial asset, silver ranks fourth, and Bitcoin sits at number eight on the global market-cap ladder.

Gold firmly protects its historic crown. Its high value and limited supply keep it the ultimate haven—and a key market trendsetter that traders closely watch.

However, 2025 flipped the story. Silver overtakes gold in terms of returns.

Silver follows with strength. A tight demand–supply gap and a much lower price than gold push it into the fourth spot, making it both scarce and accessible.

Bitcoin stands eighth in the market cap rank, backed by BTC’s high price per coin.

What Fuels Gains in Silver?

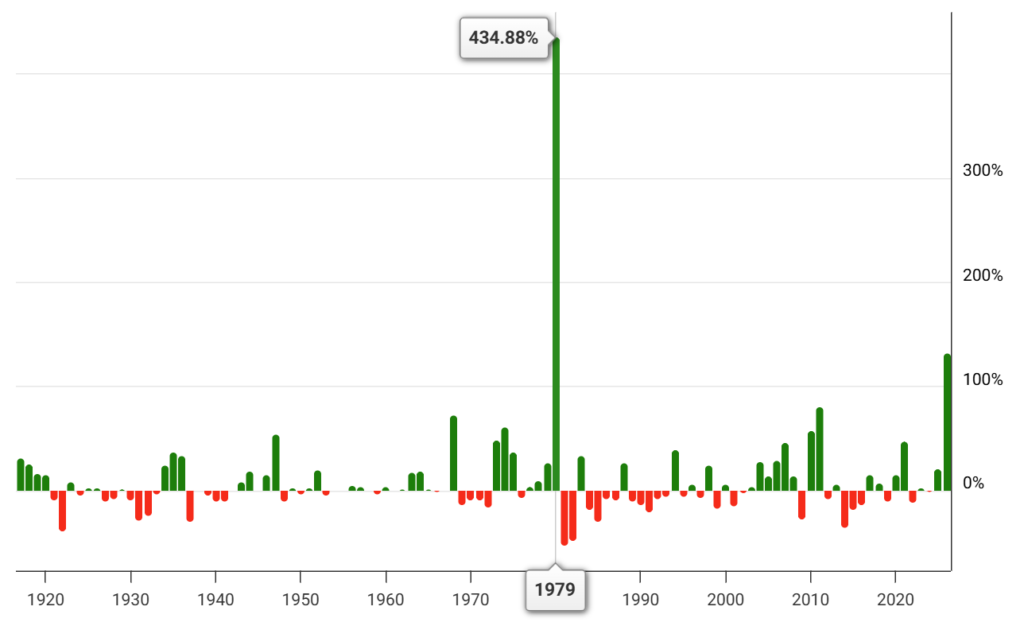

Silver could be considered the “Stellar Silver,” as it achieved the biggest yearly jump since 1979, with around 130% YoY gains in 2025.

While checking the key catalysts, the U.S. dollar’s weakness, due to the Fed moves, joins the metal’s industrial demand and the upbeat Exchange-Traded Products (ETPs) demand to bolster the white metal to its record high of $67.46 in December.

“We knew investors were especially keen on silver by mid-year, when over 95 million ounces of silver were targeted to ETPs, surpassing the 2024 total,” said Michael DiRienzo, President and CEO of the Silver Institute.

Notably, the U.S. and India have been the top physical silver investment markets, while Germany and Australia came in third and fourth, according to the Silver Institute’s latest report.

Notably, China’s exchange-traded silver inventories slumped to the lowest level since 2015, per the Shanghai Futures Exchange data.

India is currently the world’s biggest consumer of silver, according to a report by the London Bullion Market Association (LBMA). The latest LBMA update mentioned that approximately 4,000 tonnes of silver are consumed annually in India, the vast majority of which is used in the production of ornamental items—jewelry, utensils, and gift articles.

Furthermore, the persistent deficit in the silver market is growing, particularly during periods of strong prices. As per the latest buzz, silver mines produced around 820 million ounces in 2025, versus the total global demand of 1.2 billion ounces. This number generates a 400 million ounce deficit for the year, the fifth consecutive yearly deficit, and justifies the jump in the silver price.

If we look at the returns, the silver price posted the highest returns since 1979, when the XAG/USD rallied nearly 435%.

The Silver Price Moves

Looking at the silver price action of 2025, the white metal edged higher during the initial year before hitting the annual low in April. However, the prices have since rallied before experiencing a mild pullback in October, followed by a new record high in December.

Why Silver Overshadows Other Markets?

The silver price overshadows global markets as XAG/USD’s store of value rallies based on macroeconomic factors and joins growing demand from modern technology and clean energy. Meanwhile, a persistent five-year deficit in the silver mine production and silver demand, discussed earlier, also underpins a strong rally in the silver price.

Despite this, the demand for solar panels, electric vehicles (EVs), artificial intelligence (AI) chips, and data center equipment continues to surge during this time. Meanwhile, Oxford Economics calculated that silver demand in the auto sector will grow annually by 3.4% between 2025 and 2031, backed by a 65% projected increase in US data center build-outs.

Where Gold Is Heading

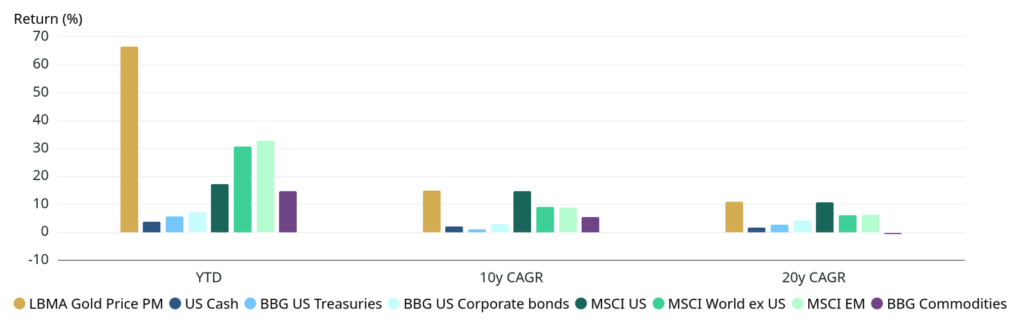

Unlike Bitcoin, the spot gold price (XAU/USD) rose for 11 months in 2025, apart from July’s modest loss of 0.40%, to post a 65% yearly gain, with the latest quote being $4,340. That said, the precious metal hit a record high in October and looks well-set to end the year on a positive note.

Among the key catalysts, the U.S. Federal Reserve’s (Fed) rate cuts and growing global uncertainty, due to a slew of trade and political factors, allowed XAU/USD to remain firmer in 2025. Additionally, a steady flow of investment demand also underpinned the precious metal’s rally.

The Federal Open Market Committee (FOMC) cut the benchmark rates four times in 2025, to 3.75% at the latest, which in turn pressured the U.S. dollar to face the biggest yearly loss since 2017 and allowed the gold price to remain firmer.

Talking about the Gold ETF demand, the institutional interest in the bullion was spectacular in 2025. US-listed ETFs added 137 tons in the third quarter (Q3), a 160% year-over-year (YoY) surge, bringing total holdings to 1,922 tons ($236 billion in assets under management (AUM)), per the World Gold Council (WGC).

“Global gold ETFs have seen US$77 billion in inflows so far this year, which has added more than 700 tons to their total holdings, bringing the overall amount to 3,912.06 tons, according to the WGC.”

The report also mentioned a 64% YoY fall in the bar and coin demand for Q3, the weakest demand since the pre-COVID 2017-19 trough.

Talking about the returns, the gold price offered the highest returns in the past 20 years.

The Gold Price Action

Looking at the gold price action of 2025, the bullion began the year on a normal footing but hit a record high in October before pulling back a bit, just to resume the uptrend afterwards. That said, the XAU/USD rose for 11 months in 2025, except for July’s monthly loss, and it is currently aiming for the ATH.

The aforementioned monthly chart of the gold price portrays an upward trajectory since September 2023. Notably, the trading volume is known as the total quantity exchanged between buyers and sellers, suggesting market participants’ interest.

That said, the trading volume has been softer since 2021, even as the prices remain firmer, suggesting a few players dominate the moves. It also validates the growing popularity of the ETFs while fueling the prices.

Gold/Silver Ratio

Having discussed the basics of Bitcoin, gold, and silver, it’s time we discuss another key aspect for the global financial market watchers, namely, the gold/silver ratio. The ratio suggests how many ounces of silver are needed to buy one ounce of gold, depending on the prices of both metals. A higher ratio signals the undervaluation of silver and vice versa.

The latest slump in the gold/silver ratio highlights a comparatively stronger silver price. Its currency drops toward the yearly low, around 60.00, and can further attract the XAG/USD buyers.

Bitcoin Moves and Related Catalysts

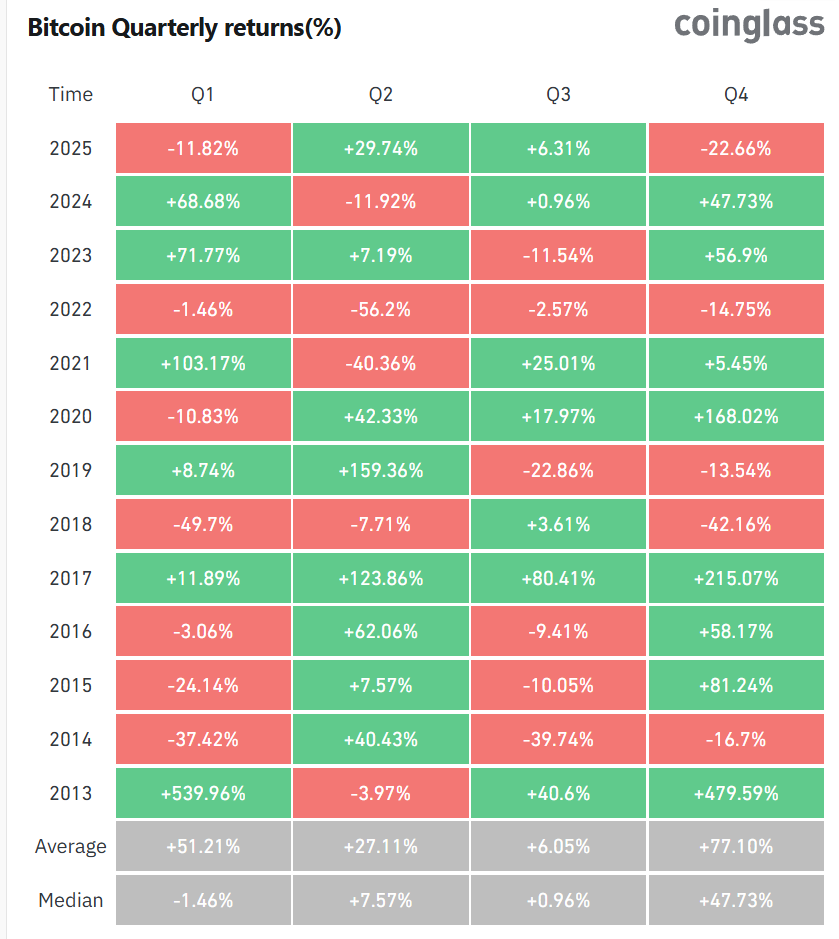

As discussed earlier, the Bitcoin price dropped nearly 6.0% in 2025 despite refreshing its all-time high (ATH) in October, down 2.6% in December to around $88,000 by press time.

That said, BTC looks set to post six monthly losses in 2025, facing a three-month losing streak of late, as growing concerns about the Fed’s interest rate moves joined firmer Treasury bond yields.

In doing so, the Bitcoin price fails to cheer U.S. President Donald Trump’s positive contribution to the crypto industry and institutional demand for BTC. On the same line, the downbeat performance of the U.S. dollar also failed to inspire BTC buyers.

Still, the cryptocurrency leader occupies the eighth spot in the global asset tally (as per the market capitalization).

That said, the U.S. Dollar Index (DXY) faces the biggest yearly loss since 2017, down over 9.0% in 2025, as the Fed’s rate cut, the U.S. government shutdown, and Trump’s trade/political plays weighed on the greenback. Still, the dollar’s weakness failed to inspire BTC buyers.

On the other hand, the growing acceptance of Real-World Asset (RWA) tokenization, U.S. President Donald Trump’s push for crypto-friendly policies, and sturdy Exchange-Traded Fund (ETF) inflows, despite the latest pullback, could be considered major positive catalysts for BTC.

Notably, the Trump administration managed to ease the crypto oversight and came up with a law describing when to define crypto token states as securities within an optimistic “Crypto Project.”

Elsewhere, the latest data from SosoValue suggests $22.16 billion of inflows into the U.S. BTC spot ETFs during 2025.

Meanwhile, CryptoQuant mentioned that new whales (wallets holding more than 10K BTC) account for almost 50% of Bitcoin’s realized cap, versus slightly more than 20% before 2025.

Amid these developments, Bitcoin’s average return for 2025 is projected to be only 0.40%, according to the latest data from Coinglass, as shown below:

The Bitcoin Price Action

A quick look at Bitcoin’s price action in 2025 shows that the cryptocurrency started the year on stable ground, reached a yearly low in April, refreshed its all-time high (ATH) in October, and then hit a multi-month low in November before consolidating.

Institutional Projections and 2026 Outlook

The following table aptly describes the key institutional forecasts for Bitcoin, gold, and silver for 2026. The following details suggest strong optimism for the Bitcoin price and the silver price.

Smart money has opinions—and Bitcoin is at the center of the debate.

JP Morgan is bullish on BTC. Further, MicroStrategy’s Michael Saylor sees Bitcoin hitting $1 million by 2029.

Trump’s “Project Crypto” rules on Bitcoin’s securitization and rising institutional demand.

Gold, meanwhile, is losing some shine. Most banks expect XAU/USD to reach $5,000 in 2026 from around $4,400, but those forecasts are cautiously optimistic. Markets are already pricing in a pause in gold’s rally, driven by the Fed’s reluctance to cut rates further, a potential U.S. dollar rebound, and growing investor focus on silver’s explosive 2025 run.

Silver bulls may also take a breather. JP Morgan and the World Bank both expect XAG/USD to pull back in 2026, citing a stronger dollar, easing geopolitical risks, and possibly slower institutional demand—partly because capital may shift toward Bitcoin.

Average forecasts from major banks suggest a nearly 50% jump in the bitcoin price, a 10% increase in the gold price, and less than a 5.0% rise in the silver price from the current levels.

This year, silver took the top slot. It will be intriguing to see whether the precious metal will maintain the same momentum in 2026. Global market uncertainty and higher inflation will keep investors engaged in the precious metals.

Silver offers the dual benefits of being a precious metal and an industrial commodity. Tighter supply conditions and higher physical demand may lead to increased prices for silver. On the other hand, gold serves as an inflation hedge. Warren Buffett, known as “The Oracle of Omaha,” asserts that silver adheres to the principles of investment.

The white metal is utilized in medicine, defense, and electrical equipment. Silver is more volatile than gold. Bitcoin is the most unpredictable of the three and is still awaiting inclusion in the mainstream investment category.

Therefore, it is more appropriate to refer to Bitcoin as “Digital Silver,” since it serves as an alternative to gold rather than being gold itself.