Jupiter (JUP) is one of the leading aggregators on the Solana blockchain that offers both decentralized exchange aggregation and perpetual trading products. The platform shows high user demand with metrics like TVL (total value locked) of $2.4 billion, which brings in consistent revenue via trading fees. The current price trend indicates that short-term movements in JUP will result in significant market volatility. The recent $35 million strategic investment from ParaFi Capital demonstrates institutional confidence, which will help support future growth.

Protocol Fundamentals

Jupiter protocol capitalizes on the trade optimization across Solana liquidity pools while also preserving the offering of perpetual futures trading. The project’s TVL of $2.428 billion makes it a leader among the other Solana-based protocols, benefiting from high throughput and low transaction costs.

The protocol generates substantial revenue from transaction fees. According to the data from DefiLlama, annualized figures stand with total fees of $672.41 million, with net revenue of $156.43 million. Token holders have captured $144.15 million of this respective value, which reflects a focus on stakers. The working of the protocol is not dependent on the incentive-based programs, which gives an upper hand to Jupiter in terms of long-term profitability.

In the time period of the past 30 days, the project has processed DEX aggregator volume of over $31.7 billion and $9.86 billion in perpetual trading, which shows the strong developments in protocol fundamentals. The metric of Direct DEX volume was comparitively compact standing the value at $1.71 million.

With a market capitalization standing at $632.86 million and a fully diluted valuation of $1.34 billion. The project still has room for growth; however, thin liquidity of $3.7 million may lead to short-term price swings. Borrowed assets currently sit at $711.72 million, which points towards leverage activity within the ecosystem.

From a valuation perspective, the protocol displays an attractive price-to-sales ratio of approximately 4.05, which exceeds the ratios of its competitors Uniswap and 1inch, making it a clear winner. The strong reason is that Solana offers faster transaction speeds at lower costs.

Revenue and Profitability

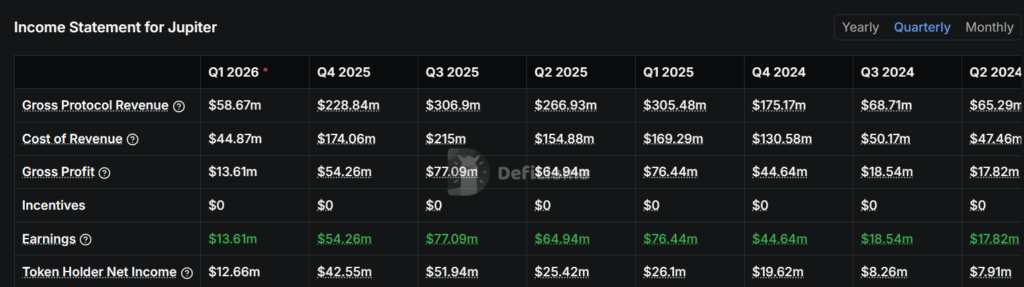

Jupiter’s income statement illustrates a lean and efficient structure. Gross revenue totals $228.84 million, with $174.06 million spent on operational costs, primarily from the perpetual exchange, which accounts for 75% of fees. Gross profit of $54.26 million represents a 24 percent margin, fully translating to earnings.

The distribution of value is directed toward token holders, with aggregator fees carrying a noticeable chunk. The generated fee are most likely put toward buybacks or token burning, which can assists to enhance shareholder value. Although the project shows no net losses, the high cost ratio highlights potential for improvement. Relative metrics, such as the reduced reliance on perpetual trading or the increasing margins from aggregator services, demonstrate the project has room for growth. Perpetuals, which offer growth potential but also expose the platform to derivatives market volatility, substantially help to drive the overall revenue.

Price Trends

At the time of writing, $JUP is changing hands near $0.194 with a circulating supply of 3.24 billion tokens. The short-term price trend has been favorable, with a 24-hour gain of nearly 6%. However, the broader trends for the asset remain bearish: the 30-day change is -7.4%, the 90-day decline is -46%, and one-year losses exceed 79%. This decrease corresponds to wider crypto market shifts since 2024 and challenges around the Solana ecosystem. Recent developments may indicate initial signs of stabilization, as renewed interest in DeFi continues to develop.

Trading Activity and Liquidity

The past 24 hours reported spot trading volume of $31.67 million while futures volume reached $153.01 million. The low level of liquidations indicated that traders used leverage with great caution. The open interest stood at $46.64 million which demonstrated active participation from derivatives traders.

The difference between spot trading and perpetual trading volumes shows that Jupiter attracts the market participants who operate in the financial markets with high leverage. The performance process depends on Jupiter’s aggregator system; the main reason involved here is the thin market conditions that restrict the ability for the large trades’ execution.

Strategic Investment and Growth Prospects

The recent $35 million investment from ParaFi Capital has performed its role as a bullish indicator for the jupiter ecosystem. The funding, which comprised of $JupUSD at the current market value, demands a long-term token lockup. The practice is expected to assist in the growth of institutional confidence in the project’s short-term value. ParaFi intends to assist Jupiter in developing its perpetual trading systems and aggregation platforms and its new financial product offerings.

The long-term growth is supported by this capital injection, which reinforces Jupiter’s treasury and development that aligns with market incentives. In a competitive Solana DeFi landscape, it gives Jupiter an upper hand when compared to its competitors such as Raydium and Orca.

Risks Associated

Jupiter faces multiple challenges, including Solana network scalability and legal investigations of derivatives trading. In addition to this, the trend opens up the possibility of a market downturn. The project may experience profitability challenges considering both operational costs and low liquidity, which could add financial pressure in the case of low sales volumes or low market interest. The absence of incentives allows organizations to conduct focused campaigns, which could possibly help them grow their metrics, such as TVL, and also attract new users to the ecosystem.