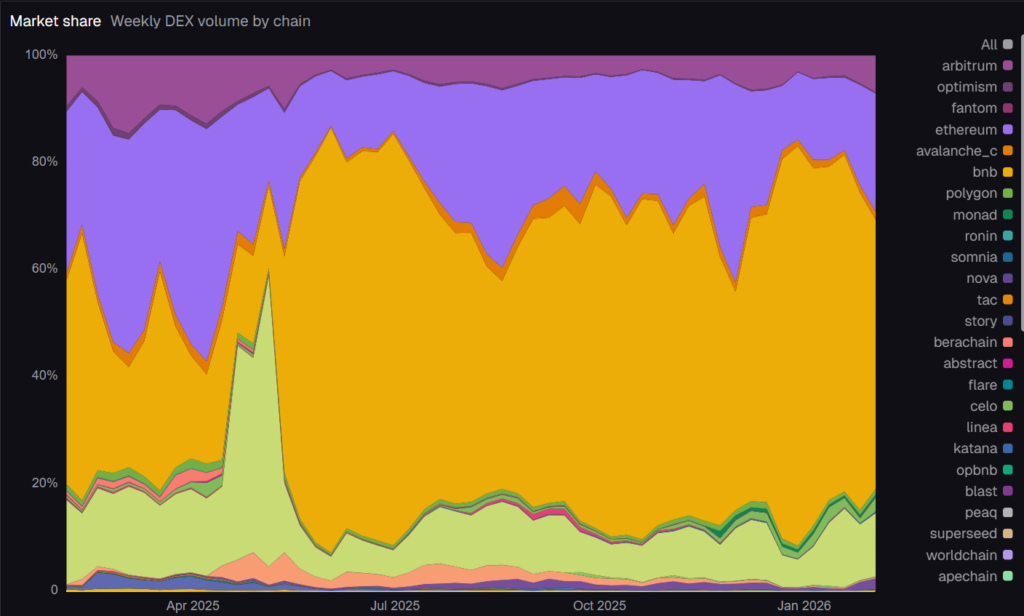

Decentralized exchanges (DEX) are still the most important part of blockchain trading. The centralized exchanges like Binance lead the space but with some restrictions. The decentralized exchanges have gained attention because they let people trade without the involvement of any middlemen. Data from Dune highlights that from early 2026, the market is settling on a few chains, with BNB Chain at the top. The metrics, like the number of active addresses, have experienced a decline. As a result, it reflects that the cost-efficient networks are attracting more users when comparing from February 2025 to February 2026. Ethereum and other chains are slowly losing their share.

Changes in the number of Chains

The weekly DEX volume tells you how many people are using the network and what kinds of liquidity they like best. In February 2025, BNB Chain had the most volume at 38%, followed by Ethereum at 30.1%, Base at 15.8%, and Arbitrum at 9.4%. Smaller chains like Avalanche, Polygon, and Optimism made up less than five percent of the total.

By February 2026, BNB Chain had marked a 50.3% growth, which highlighted its growing adoption among users. Ethereum dropped to 22%, Base witnessed a fall to 11.8%, and Arbitrum reached 6.8%. HyperEVM secured a 2% market share, whereas all other networks operated beneath 1% capacity. The concentrated nature of the market share suggest that PancakeSwap functions as a network effect platform since its broad trading pools draw in potential liquidity providers and traders.

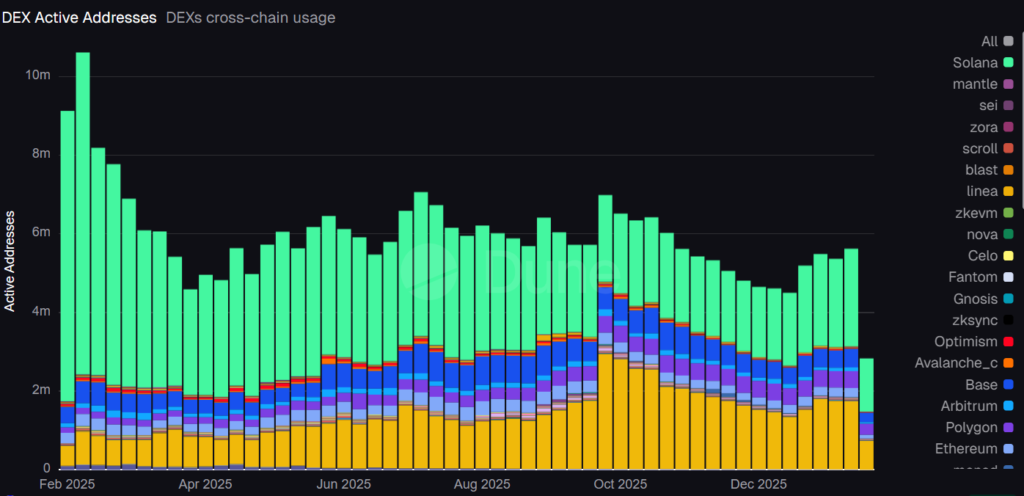

User engagement and Active Addresses

The above chart represents the number of active addresses and the level of activity that exists on the network. In February 2025, Solana had 7.38 million addresses, BNB Chain had 0.50 million, and Ethereum had 0.27 million. The active addresses across all major chains reached close to 3 million by February 2026. Solana experienced a decrease to 1.35 million, BNB Chain increased to 0.74 million, Polygon increased to 0.28 million, Base maintained its count at 0.24 million, and Ethereum slipped to 0.10 million. Arbitrum experienced a decline to 0.04 million, while HyperEVM recorded 0.01 million addresses.

The drop in active addresses suggests that the crypto market is experiencing maturity. This is because efficiency and liquidity concentration mean that the market participants don’t need to do as many transactions every day. Users can also be influenced by other metrics, like pressure from regulators or a market that is cooling off.

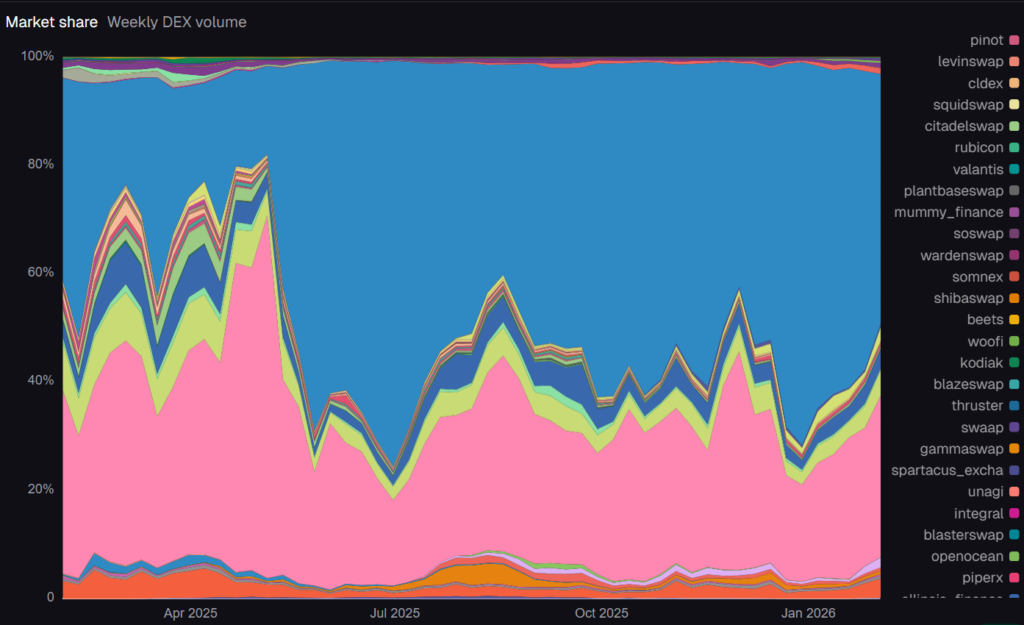

Volume Leaders

In the last 24 hours, DEXs generated $11.47 billion in volume. In the last week, they made $102 billion. The main catalyst that supported BNB Chain’s weekly volume was PancakeSwap. The DEX contributed towards chain growth for more than 50%. Ethereum continues to maintain its position as an integral element of Ethereum Virtual Machine (EVM) DEX volume, considering that it still accounts for 20% of total trading activity.

Additionally, Aerodrome, Curve, and Fluid were runners-up on the list and marked weekly volume with $4.39B, $3.51B, and $3.49B respectively. The DEXs displayed high volume during their peak periods, which implied their critical role in changing network performance metrics.

PancakeSwap: The Best DEX?

The leading DEX, PancakeSwap, trends with $52.04 billion in weekly volume and with the daily readings at $5.73 billion, which makes up more than half of BNB Chain’s total DEX volume. Uniswap follows with $27.73 billion weekly and $4.38 billion daily volume.

The decentralized exchanges Aerodrome, Curve, and Fluid handle huge amounts of weekly trading volumes that usually range between $3.49 billion and $4.39 billion. As these platforms operate with high trading volumes, it leads to substantial effects on vital network metrics that include total trading activity. These platforms are counted as leaders in DEX space as they provide strong liquidity and operate efficiently.

Performance of Aggregators: KyberSwap leads the way

The main purpose of DEX aggregators is to help the users in finding the optimal price for the trade. It makes sure that the trades are processed quickly. This carries out pulling data from multiple sources for trade optimization. This assists in keeping the fragmented markets running smoothly. The top three aggregators when aggregated in terms of volume (7 days) are KyberSwap ($2.63 billion), CoW Protocol ($2.04 billion), and 0x API ($1.84 billion). On the other hand, 1inch, Bebop, and Velora all made less than $1.5 billion. Aggregators don’t have as many trades as native DEXs, but they highlight the important trade routing and execution strategies in Decentralized Finance (DeFi).

Things to Keep in Mind

- The volume on BNB Chain is stabilizing because PancakeSwap has a lot of liquidity and trading.

- Most chains are seeing less activity from users. This could mean that the market is maturing and there are fewer trades based on speculation.

- Ethereum is still important, but there are faster and cheaper options that are putting pressure on it.

- Aggregators keep making execution better and faster across pools of fragmented liquidity.