Table of Contents

Key Takeaways:

- In Q2 2025, the crypto-backed loans metric grew significantly, making a growth of over 27.44%.

- By the end of the recent quarter, Q2 2025, DeFi lending made up 59.83% of the lending market. It marks a growth from the previous quarter’s record of 54.56% but remains lower than the Q4 2024 peak of 61.99%.

- The dominating lending platform, Aave, marked a value of over $41.1 billion in TVL, adding to growing market concentration across the other competitors in the lending space.

- Stablecoin lending rates kept steady, hovering between 4.8% and 5% APY across all DeFi lending platforms. On the other hand, institutional and OTC (over-the-counter) lending markets showed limited movements.

- The on-chain value of total RWA (real-world assets) by the end of Q2 2025 trends around $27.92 billion.

The crypto market has evolved dynamically over time. The Web 3.0 market space has gone a long way from just a new idea, people’s consideration, to the development and acceptance that has exploded in recent years. Bitcoin tested its all-time high (ATH) at $124,517 in August 2025, marking a milestone for the future of the digital currency.

Crypto lending is another interesting phenomenon in the ever-evolving crypto space, similar to traditional finance. In traditional finance, a bank lends money in physical currency and earns interest.

Crypto lending means that crypto HODLers or investors lend their holdings to borrowers in exchange for interest payments. It can be understood as getting a crypto-backed loan if you require funds from your holdings. In the year 2025, the activity experienced a remarkable growth

Let’s explore how the crypto lending market performed in 2025. We break down the study on the basis of market size, protocol-specific performance, interest rate structure, and other important metrics.

1. Crypto Lending : Market Size and Growth Dynamics

Total Market Capitalization

The crypto lending ecosystem has seen an extraordinary trend growth across centralized (CeFi) and decentralized (DeFi) platforms. There was a total of $53.09 billion in the crypto-collateralized lending market ending Q2 2025. This is the highest total crypto-collateralized lending amount since Q1 2022, which peaked at $63.43 billion. This marks an $11.43 billion addition, a 27.44% rise from the previous quarter.

The DeFi lending platforms marked a total value of $26.47 billion in total outstanding loans, marking a new all-time high and 42.11% growth quarter-over-quarter. CeFi platforms continued to represent $17.78 billion in open borrows, which grew by 14.66% over the same time period.

Market Share Distribution

The DeFi lending applications controlled 49.86% of the total crypto-collateralized lending market as of Q2 2025, an increase of 515 basis points from the previous quarter. CeFi venues accounted for 33.48% of the market share, while collateralized debt position (CDP) stablecoins made up 16.65% of the market.

Current Total Value Locked (TVL) Statistics

- DeFi TVL across all protocols: $156.039b

- Lending protocols account for 50.07% of total DeFi TVL.

- Combined lending sector TVL: $79.157b

2. Protocol-Specific Performance

Aave Protocol Dominance

Aave protocol continues to dominate the sector when compared to competitors in Q2 2025; the current deposits for Aave protocol hold at $67.84B when compared to Morpho’s deposit of $11.08B, its closest competitor. Aave succeeded as the market leader in DeFi lending, controlling approximately 50% of the entire DeFi lending market’s TVL and generating a 30-day profit of $12.43 million.

The protocol achieved multiple records in August 2025:

- $41.1 billion in TVL: A new all-time high (24 August 2025)

- $28.9 billion in active loans for the leading protocol, AAVE.

- AAVE surpassed $3 trillion in cumulative deposits since August 15, 2025.

Leading Protocol Market Shares

| Rank | Name | TVL |

| 1 | Aave | $39.811b |

| 2 | Morpho | $7.278b |

| 3 | SparkLend | $5.427b |

| 4 | JustLend | $5.188b |

| 5 | Kamino Lend | $2.866b |

With a total value locked (TVL) of $39.8B across 18 chains, Aave is leading the lending space, notably higher than Morpho ($7.3B on 22 chains), SparkLend ($5.4B), JustLend ($5.2B), and Kamino Lend ($2.9B). The top 5 protocols account for roughly 76.3% of the total value in the lending category.

3. Interest Rate Structural Comparison

Stablecoin Fee types and Lending Rates

| Protocol | Fee Types | Rates | Fee Allocation |

| Aave | Interest spread, Swap fee | Approx. 10–20% (0.09%) | Mostly allocated To DAO staking and some burned |

| Sky Protocol (MakerDAO) | Stability fee | Ranges between 1 and 5% | Utilized to burn MKR tokens |

| Compound | Interest | ~10% | Reserves allocation |

| Spark | Interest spread, Flash loan fee | ~10–20%, 0.09% | Spark DAO |

| Morpho | P2P spread | Small, variable | NA (protocol doesn’t impose fees) |

| Kamino (Solana) | Interest spread, Swap fee | Variable ~0.3% | Fees for following protocol |

Data source: Defirate

The stablecoin lending space saw relative stability in Q2 2025. The weighted average stablecoin borrow rate increased just slightly in Q2, from 4.7% on March 31 to 4.96% on July 31. This increase indicates relatively stable borrowing demand and relatively little variation in parameters across the major protocols.

Key observations on rates:

Onchain USDC rates were 180 basis points below those of the OTC markets on July 28, 2025.

The average DeFi stablecoin interest rate remains unchanged at 4.8%.

Following the time period from mid-March 2025, stablecoin rates across Aave have been unchanged.

Bitcoin and Ethereum Lending Costs

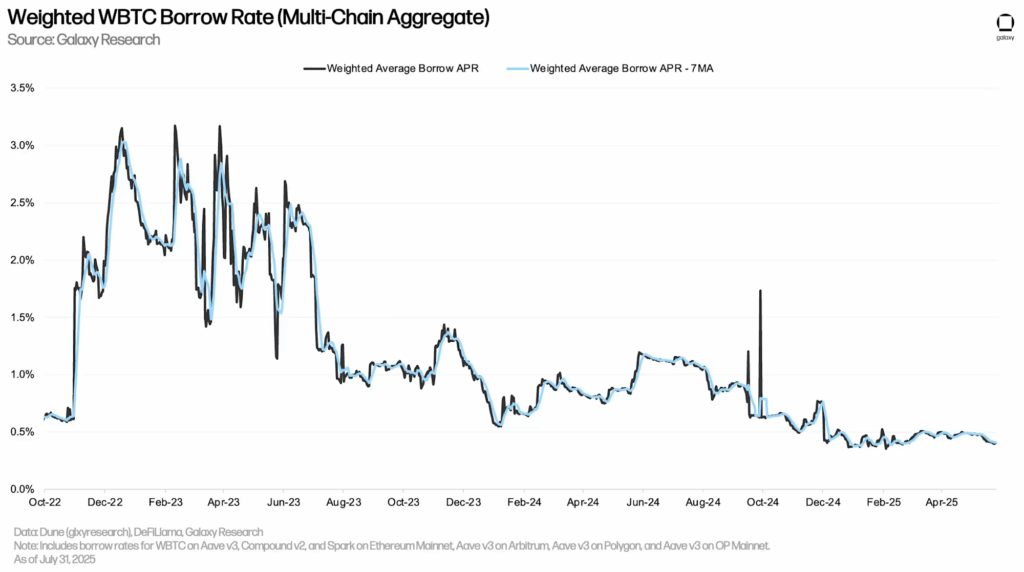

Throughout Q2 2025, Bitcoin borrowing costs remained stable, with wrapped bitcoin (WBTC) retaining low on-chain borrowing rates supported by its primary use as collateral instead of just a borrowing asset. OTC market bitcoin rates held steady around 2.25% by the end of July 2025.

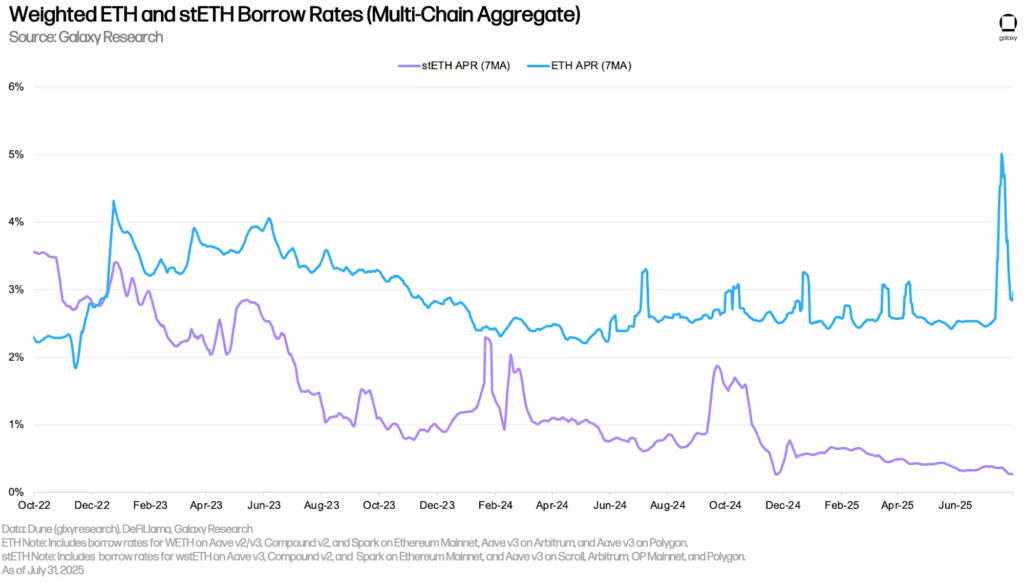

ETH borrow rates on Aave V3 shot up mid-July as approximately 300,000 ETH was withdrawn following the time period. Thus disrupted the typical looping strategy, where users would provide stETH as collateral, borrow ETH, stake it, and repeat that process to generate additional exposure to Ethereum staking yield. When borrowing rates became greater than staking APY, the strategy became unprofitable. This led to a surge of withdrawals from staking that drove the Ethereum staking exit queue to a peak of nearly 13 days.

4. Institutional Adoption and Regulatory Impact

Institutional Market Participation

Institutional adoption also indicated a positive sign following the acceptance of cryptocurrency lending as a new way to generate yield, manage risk, and diversify portfolios. The rising shift in the following metric is supported by growing loan volumes, increasing tokenized assets, and relevant financial institutions entering into the market.

Key Statistics and Trends

- Investment Allocations: A study of 352 institutional investors indicated that 83% are looking to increase their crypto allocation in 2025, with 59% planning on committing more than 5% of assets under management (AUM) to the growing sector of cryptocurrencies, including lending. Institutional crypto investments reached $21.6 billion in Q1 2025 alone, showcasing a significant increase from previous years.

- Loan Volumes and Growth: By mid-2025, ongoing loans climbed to a record $26 billion while showing sustained growth in both centralized (CeFi) and decentralized (DeFi) lending sectors. Total lending volume surpassed $62 billion, the historic high of 2021, due to new entrants like decentralized autonomous treasury companies (DATCOs) and Bitcoin ETFs.

Regulatory Framework Effects

The lending activity had a major impact after the introduction of regulatory frameworks like Markets in Crypto-Assets (MiCA). All the crypto lending platforms in the EU (European Union) now collectively have over $230B in assets. This marks it as a 27% YOY growth since 2024.

The major impacts of MiCA:

- Regulated platforms originate 82% of all EU crypto loans, versus 55% pre-MiCA.

- Rates on stablecoin lending are regularizing around 6.5% for Q1 2025, compared to 8.9% prior to MiCA.

- 92% of the EU lending market is composed of collateralized offerings, as unsecured crypto loans fell 68%.

5. Real-World Asset (RWA) Integration

Tokenized Asset Growth

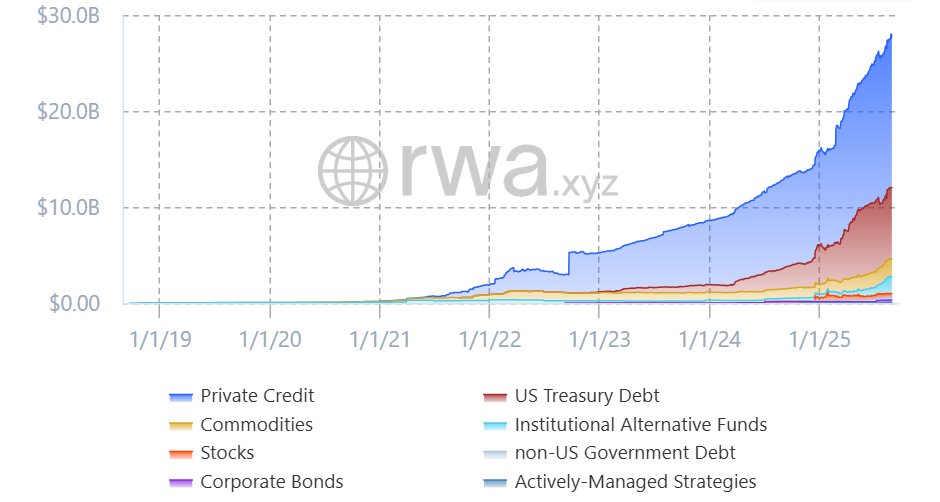

Real-world asset expansion to DeFi lending is an additional opportunity narrative. With over $15.8 billion worth of tokenized private credit on-chain, value has already experienced growth of 61.2% from January to August 2025. According to RWA.xyz data, the total scaled value of on-chain RWA operational in August 2025 was 27.9 billion.

Real World Asset Lending Characteristics:

Tokenized private credit growth: Total RWA (real-world asset) on-chain is $27.92B, $15.8B of which is from tokenized private credit, the fastest-growing category after stablecoins.

Institutional On-Chain Lending: Protocols like Spark are capitalizing large amounts (e.g., $50M to Maple Finance) to build stable yielding on-chain lending products.

Tokenized Treasuries: Institutions are holding ~$7.5B of tokenized U.S. Treasury bills on-chain, regularly using them as regulated, yield-bearing assets as collateral or to trade within DeFi.

Futures Market

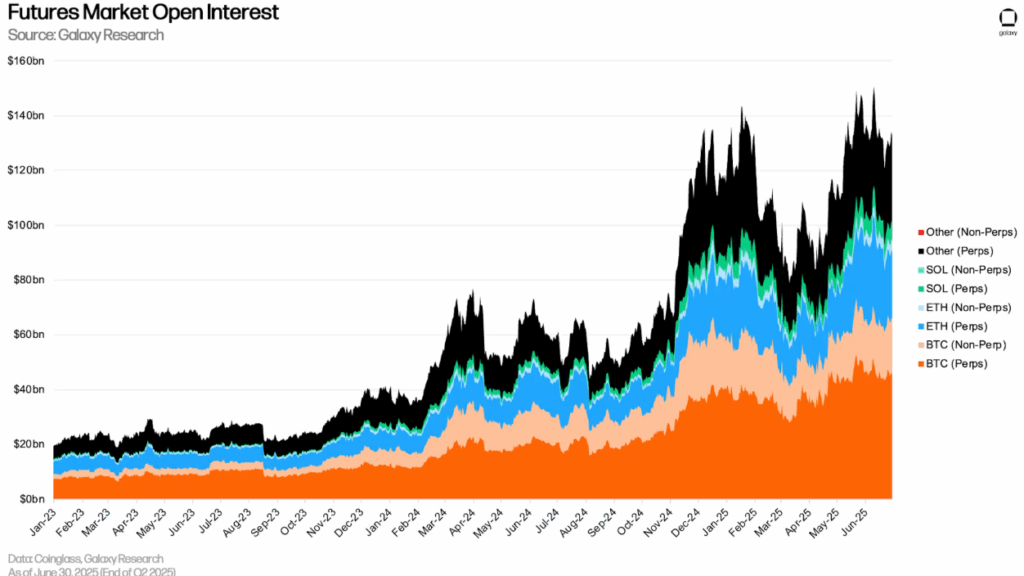

As of mid-Q2 2025, total futures open interest (OI) was $132.6 billion, a gain of $36.1 billion (+37.5%) quarter-over-quarter. Increases in OI were notable for Bitcoin futures (+34.9%, $16.9B), Ethereum (+58.7%, $10.5B), and Solana (+42.8%, $2B), with other assets rising by an average of ~38.5%.

CME’s overall share of OI was 15.5%, an increase from Q1 of 14.0%, but below earlier levels in the year. Its share in Bitcoin OI came to 26.3% (+380 bps QoQ) and 10.8% (+218 bps) share of Ethereum OI. CME’s overall market share had peaked earlier in the year at 19.1% in February.

Perpetual futures (perps) were the leaders at OI of $108.9 billion, up 36.7% QoQ, but still 14% below the June 10 ATH of $126.7B. Perpetual futures market share was Bitcoin 41.8%, Ethereum 23.1%, Solana 5.9%, and others 29.2%. However, Perps OI made up for 82.0% of the total OI.

Conclusion

Q2 2025 achieved a notable milestone in crypto-collateralized lending, with total market activity marking over $53.09 billion and DeFi platforms highlighting their dominance. Aave remains the leader with stable interest rates, and strong institutional support points to the current and future development for the lending sector. The integration of tokenized RWA (real-world assets), together with supportive regulatory frameworks, has further generated market depth and stability, setting crypto lending for continued growth in the upcoming quarters.

What is crypto lending?

Crypto lending involves a process where borrowers can borrow cash (or stablecoins) by collateralizing their crypto holdings. It offers the opportunity for the lenders to receive the compensation in the form of crypto-based rewards. The crypto lending process can be done in centralized and decentralized form based on the user requirements.

What are DeFi Lending Protocols?

The DeFi lending protocols function as blockchain-based services or platforms that allow the network users to lend and borrow cryptocurrencies instantly without the involvement of any traditional banking intermediaries.