Over the period of a year, Ethereum and Solana have shown completely opposite ways with regard to the main on-chain performance metrics. Among others, Total Value Locked, On-Chain Trading Volume, Network Fee Generation, Active Address Counts, and Stablecoin Capitalization are the metrics that are used to evaluate the overall health of the network, capital efficiency, and user behavior. These metrics help in identifying the amount of money that is pooled in each network, the extent to which the protocols are used, the number of transactions taking place, the degree of validator reward, and the flow of money between different protocols, thus revealing not only the strength of each network but also the changes in user participation corresponding with the economy and market trends.

Stablecoin Market Capitalization

Ethereum’s large increase in market capitalization from $117.38 billion to $162.17 billion reflects its continuous dominance as the settlement and liquidity layer for DeFi protocols, decentralized exchanges, and cross-boundary lending and borrowing. Stablecoins serve as low-volatility instruments that enable large-scale capital movement without involving the participants through the price fluctuations of the underlying tokens; thus, their use can be considered a sign of ongoing economic activity on-chain.

Solana’s stablecoin market grew from $10.70 billion to $14.32 billion. The market maintains its limited size due to the involvement of users from specific industries adopting the network, while its operational performance depends on economic cycles and shifts in investment patterns. The stablecoin supply of Solana increased because users maintained their use of the network to benefit from its low transaction costs, which allowed them to conduct certain settlement and liquidity operations, despite a general decline in market activity and speculative trading.

Overall, the growth of stablecoins on both networks shows that there is still a strong interest in low-risk digital assets, which helps individuals understand how the capital rotates, how well protocols are being used, and how stable the financial systems of each network are.

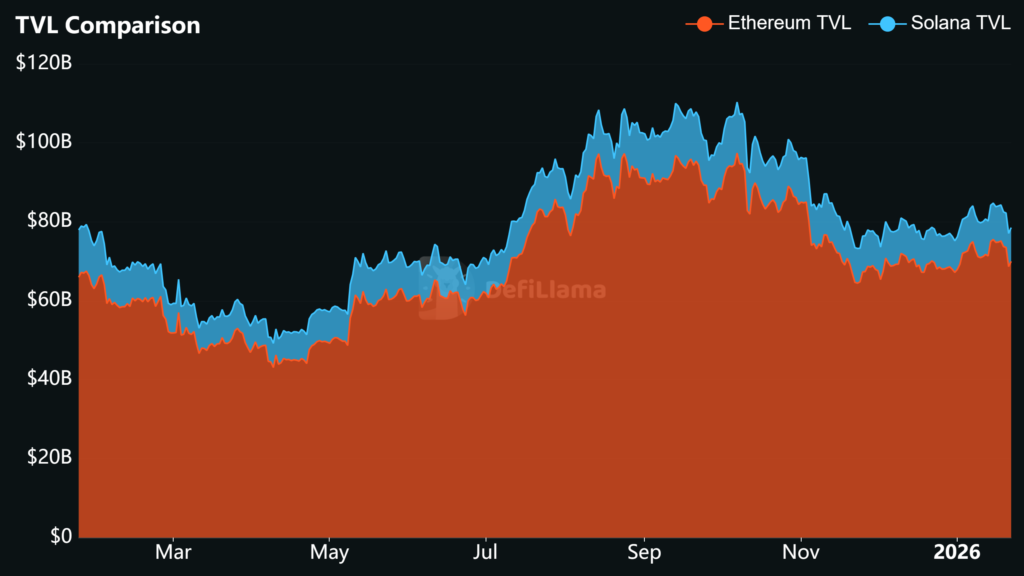

Total Value Locked (TVL) Growth and Contraction

greater thanEthereum continues to lead in total value locked. January 2025 uncovered Ethereum with a $65.97 billion TVL, which was significantly greater that of Solana’s $11.99 billion. Following that, in the first month of 2026, Ethereum’s TVL climbed up to $69.99 billion, meaning it emphasizes the strong inflow of capital to the network. The trend also shows strong confidence from DeFi players.

At the same time, Solana witnessed low TVL as it slipped to $8.55 billion, which served as an indication of reduced liquidity for the protocol. The trend suggests that Ethereum effectively attracts in the market participants while conserving the capital, whereas Solana leans on market sentiment and global economic factors.

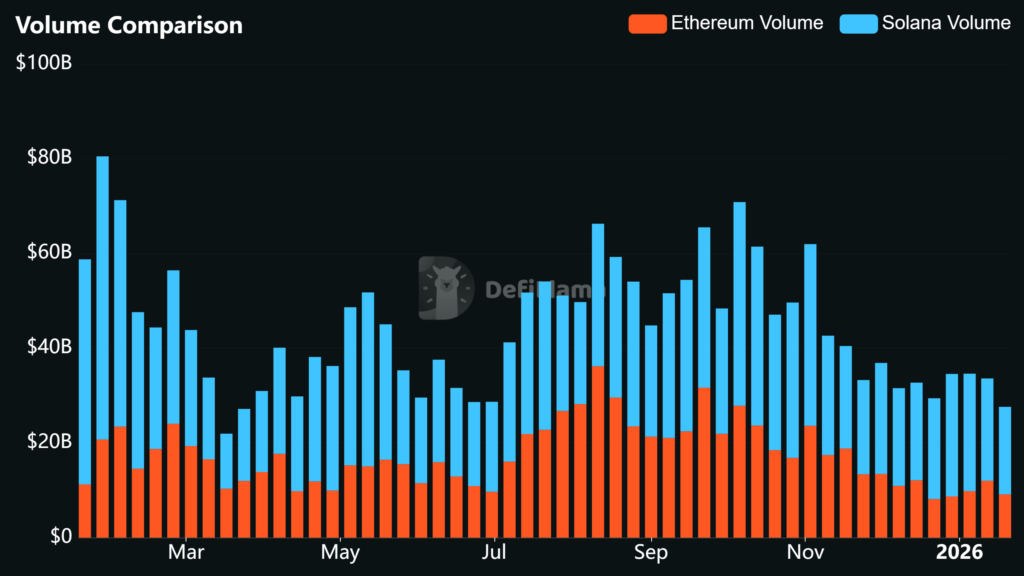

Trading Volume Normalization

The traded volumes of every week represent the activity and participation of the network users. Solana had a trading volume of $47.50 billion, which is significantly greater than Ethereum’s $11.25 billion, from January 13 to 19, 2025. One reason for the excellent volume of Solana is its low transaction fees and high capacity, which are certainly making it the most preferred blockchain for high-frequency trading, speculative strategies, and quick capital rotations by the traders.

From January 12 to 18, 2026, the total weekly trading volume of Solana fell to $18.47 billion, and Ethereum’s volume dropped significantly less to $9.19 billion. The decline in Solana is interpreted as a return to normal trading levels after the peak, probably affected by the fall in activities related to speculation and the capital rotation to Ethereum or other networks. The decline in Ethereum reflects a more stable and regular usage pattern, which, on the other hand, supports the demand for DeFi, decentralized exchanges, and multi-chain connections to be the reason for its crypto ecosystem’s maturity.

Activity Comparison: The State of Network Fees

In late January 2025, Solana’s total fees reached $76.4 million, whereas Ethereum’s fees were only $23.99 million. Another year later, by January 22, 2026, the fees for Solana dropped very steeply to only $5.53 million, which amounts to a more than 90% decrease, while Ethereum’s fees, on the other hand, decreased at a much slower rate to their new level of $3.97 million. The same trend is evident in the weekly snapshots as well. The week of January 13 to 19, 2025, saw Solana bagging $42.84 million worth of fees, while Ethereum’s aid was $14.5 million only, and by mid-January 2026, these figures had dropped accordingly to $2.72 million for Solana and $2.04 million for Ethereum.

The steep drop in Solana fees suggests that there is a downward trend in transaction throughput with the concomitant decrease in economic activities, which could lead to the shrinking of the incentives for the network validators and participants as well. Ethereum, on the other hand, keeps a more or less constant level of fee, which is indicative of the stable demand for block space and also of the engagement in DeFi protocols and token transfers that is even seen in the periods of market stress.

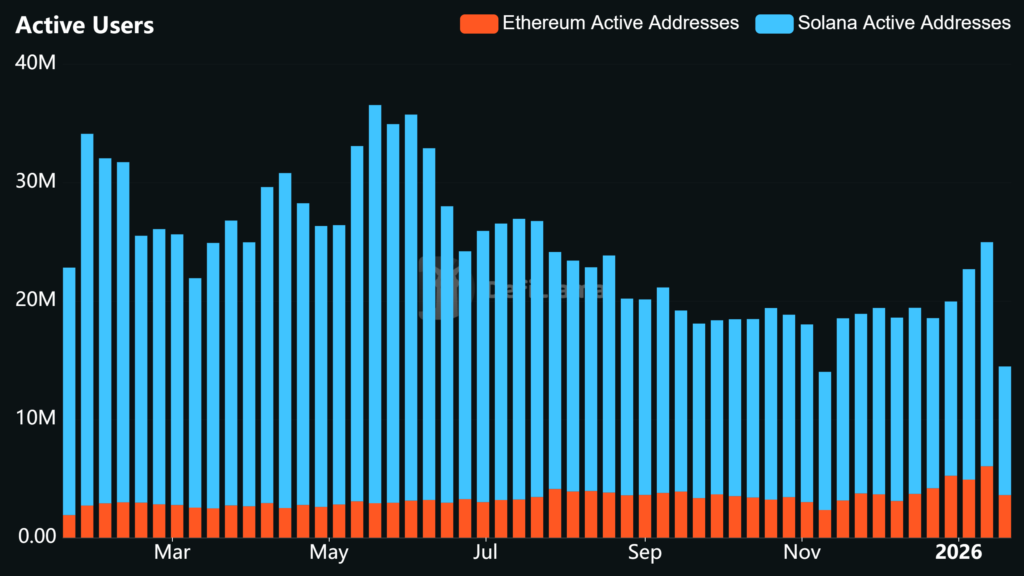

Active Addresses and User Engagement

Active addresses are a valuable indicator of the actual network usage. To illustrate, in the month of January 2025, Solana had 20.9 million active addresses, whereas, for Ethereum, the metric value was only 1.9 million. The number of active addresses in Solana reached an all-time high of 33.63 million from May 12 to May 18, 2025, which can be interpreted as periods of significant engagement. In January 2026, the total number of active addresses for Ethereum had surpassed 6.03 million, reflecting a steady growth trend, while Solana’s daily active addresses went through a sudden drastic drop. The significant decrease in Solana’s daily active addresses coincides with the drops in volume and transaction fees; thus, it can be determined that either a large number of users lessened their activities or simply left the network. On the other hand, Ethereum’s constant rise is the signal of a more trustworthy environment for the participation and the coming transactions of DeFi activities.

Analysis and Implications

The Ethereum network demonstrates ongoing stability while maintaining consistent growth and achieving widespread adoption throughout its ecosystem, especially in decentralized finance and stablecoin implementation. The Solana network shows high transaction capacity and low-cost transactions yet its operational metrics experience more fluctuations than its competing platforms do. The ecosystem of Solana demonstrates increased vulnerability to market fluctuations and changes in investor sentiment.

For developers, investors, and analysts, these trends indicate that Ethereum remains the core network for sustained on-chain activity and capital retention. Solana might need specific incentives, liquidity programs, and ways to engage users to get back to the transaction and participation levels seen in 2025.

Conclusion

The Ethereum network maintains its stable performance while developers work to improve its decentralized finance protocols and stablecoin operations, which users continue to utilize. The Solana network enables users to conduct fast transactions at low costs, yet its activity and market trends show greater volatility compared to other networks.

The current version of the smart contract platform requires ongoing analysis of on-chain metrics, which include total value locked, trading volume, network fees, active addresses, and stablecoin capitalization to track the development over time. The indicators provide information about three different aspects, which include capital movement between networks, user pattern changes between different protocols and the network performance impact on each ecosystem’s sustainability.