Key Takeaways:

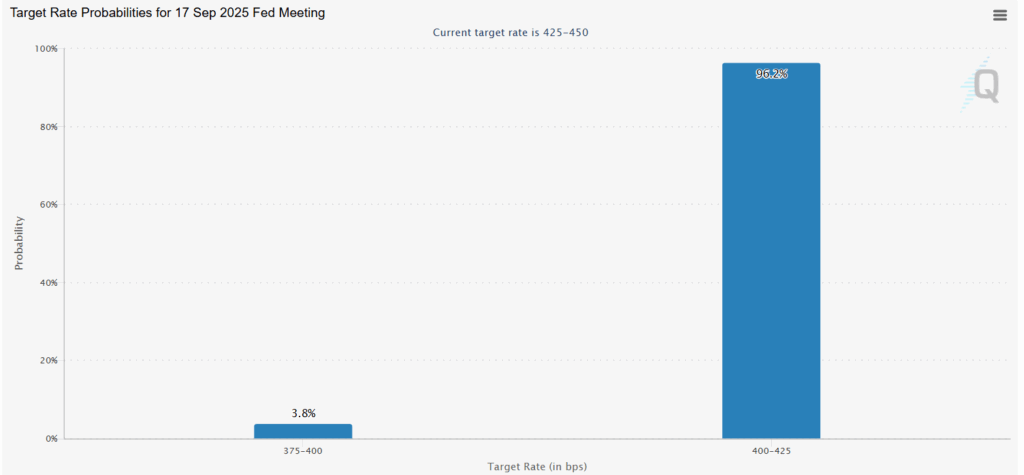

- According to the CME FedWatch Tool, the Federal Reserve is expected to lower interest rates on September 17th from 4.25-4.50% to 4.00-4.25%, with a probability of 92.5%.

- Weak job data is fueling expectations: weekly jobless claims reached 263,000 (a four-year high), only 22,000 jobs were added in August, and unemployment climbed to 4.3%.

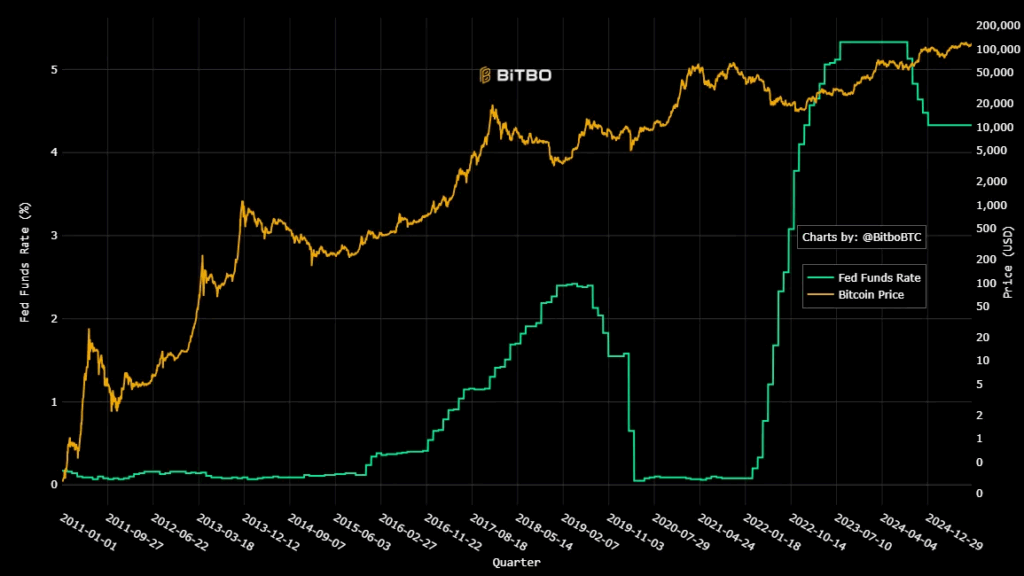

- For cryptocurrency, rate cuts may increase liquidity and positive momentum, whilst rate holds may keep prices sideways. However, rapid cuts could indicate economic weakness.

Markets are anticipating the Federal Reserve’s interest rate decision, which is scheduled to be announced on September 17th. The Federal Open Market Committee (FOMC) is expected to cut rates from 4.25-4.50% to 4.00-4.25% in the next meeting, according to the CME Fed Watch Tool. The probability of the interest rate cuts expectations has increased from 89% to 96.2% at the time of reporting.

Why the Market Expects Rate Cuts?

The expectations of interest rate cuts rose after several macroeconomic indicators. For instance, the recent job numbers in the US indicate that the labor market is weakening. The unemployment claims rose to 263,000, the highest in four years. Additionally, in August, only 22,000 jobs were added against the forecasts of 75,000, with the unemployment rate rising to 4.3% from 4.2%.

Furthermore, the economy was revealed to have created 911,000 fewer jobs from April 2024 through March 2025 than previously recorded, the highest downward revision since 2000, according to the Bureau of Labor Statistics. This demonstrates that hiring is stalling, and the employment market is under greater strain than previously assumed.

Producer price inflation (PPI), which measures wholesale costs, declined 0.1% in August, lower than predicted. This indicates that businesses are either delaying price increases or that demand is slowing.

Nonetheless, on the other hand, inflation data is suggesting mixed signals as the inflation (CPI) came in at 2.9% for the month of August, still above the Fed’s 2% target. For the Federal Reserve, this presents a balancing act: inflation is not completely under control, but rising unemployment is a major worry. If the Federal Reserve decided to cut interest rates, it would lead to a greater liquidity flowing into riskier assets such as cryptocurrencies.

Moreover, on September 12th, the Bureau of Labor Statistics revealed that 36% of the August Consumer Price Index (CPI) data was based on estimates, the highest since 2019. The Analyst from Bitunix warns that this undermines confidence in CPI, pushing the Fed to lean more on PCE and job data. The news briefly weakened the dollar, lowered Treasury yields, and boosted risk sentiment in markets like crypto.

What Do Federal Fund Futures Suggest About Interest Rates?

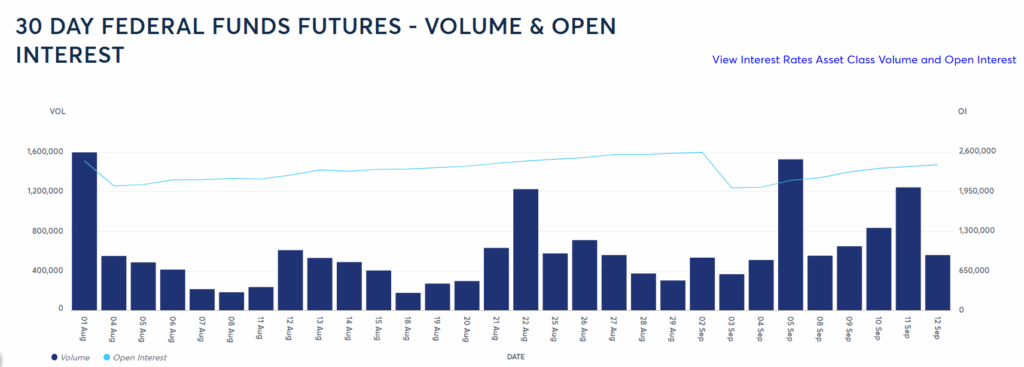

The 30-Day volume and open interest of Fed Funds Futures show that open interests have risen to over 2 million contracts, indicating that investors are holding greater positions with conviction. The trading activity increased on key days such as August 1st, August 22nd, September 5th and September 11th, wherein numerous macroeconomic parameters were announced. Taken together, the futures market indicates rising confidence in at least a 25-basis-point rate decrease this month, with some traders anticipating additional cuts later this year.

How Does it Impact the Crypto Market?

The crypto market is highly volatile in response to the Federal Reserve’s interest rates. According to the market expectations, either we would notice a rate cut or a rate hold in both of these conditions; this is how the broader crypto market would react.

When the Federal Reserve decided to lower interest rates, the borrowing costs became cheaper, which also led to yields of government bonds decreasing, leading to greater liquidity. This leads to greater liquidity for the crypto market, as investors and traders prefer to invest in risky assets.

However, when the Federal Reserve decides to take no stance or maintain interest rates in this scenario, crypto markets move sideways or cool due to low demand and restricted new capital inflows. Nonetheless, rapid rate cuts could also suggest a weakening economy, which could be a problem for numerous asset classes in the long run.

What’s Going to Happen on September 17th?

The market’s expectations for a rate cut remain at 96.2% according to the CME Fed Watch Tool. If the Federal Reserve decided to cut interest rates, this would push the prices of volatile asset classes such as cryptocurrencies higher but also signal a potential weak economic outlook.