- Stablecoins work like an intersection between digital and traditional finance. They are popular money-market instruments that have systemic run and contagion vulnerabilities, like sudden mass redemptions.

- The regulation remains fragmented and inconsistent, with inefficiencies across regions that facilitate arbitrage and reduce accountability.

- The risks associated with operation and security persist, such as smart contract imperfections, custody weaknesses, and vulnerability to fraudulent activity.

- The stablecoin market maintains its steady growth, boosted by cross-border payments and global institution adoption.

Summary

Stablecoins have quietly established a prominent position in the finance industry through 2025, with a market capitalization of over $312 billion and over 1.5 billion in transactions. The growth derives from constant advancement in blockchain infrastructure and enhanced transparent regulations. It also supports the applications that vary from remittances to treasury management. Despite this, shortcomings like de-pegging and cybersecurity risks still exist and need strong solutions.

Key Points

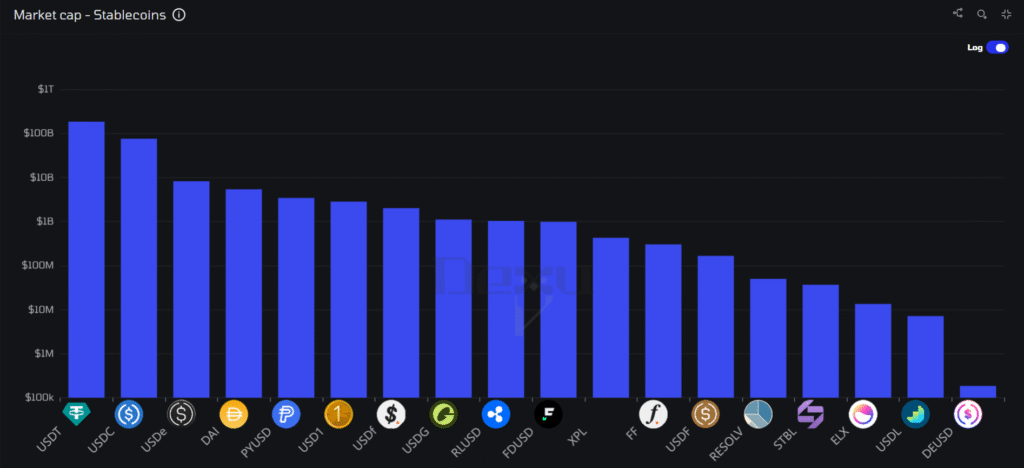

- The leading stablecoin, Tether (USDT), holds a market capitalization of over $183 billion, which consequently makes it the largest by value. With ~$76 billion for the contextual metric, the stablecoin from Circle, USDC, secures the second spot.

- In total, stablecoins process $20–30B in payments on a daily interval and typically don’t involve high operational costs.

- The important metric of on-chain activity has recorded 69% year-over-year growth in the Asia-Pacific region.

Regulatory Landscape

Laws like the U.S. GENIUS Act (enacted July 2025) make reserves clear that ultimately boost institutional and retailer confidence. The EU’s MiCA, on the other hand, promotes compliance but limits yields. Canada’s proposed framework is an addition to global efforts, but it still leaves elements too fragmented.

Table of Contents

1. Introduction

1.1 Overview of Stablecoins

Stablecoins are built for price stability when compared to other blockchain-based digital assets like Bitcoin, Ethereum, etc. These are generally tied or pegged to fiat currencies, for example, the USD (United States dollar). It can also include the stablecoins backed by reserves, such as Treasuries. Since the beginning of the year, stablecoins have slowly evolved from specialized trading tools to important pillars of digital finance. There are fiat-collateralized (like USDT and USDC) stablecoins, crypto-collateralized (like DAI) stablecoins, and algorithmic stablecoins. The yield-bearing variants, like the ones backed by short-term government securities, have gained popularity with 4–5% annual returns. The shift regulates volatility in broader cryptocurrencies, allows round-the-clock settlements, and also assists in minimizing costs in global market transactions.

1.2 Report Scope and Methodology

Timescrypto’s year-end report focuses on stablecoin developments, such as market dynamics, adoption, regulations, applications, and risks. Data is sourced from on-chain analytics platforms, industry reports, and regulatory documents, which include metrics from CoinMarketCap, Chainalysis, and TRM Labs. The methodology includes examination of transaction volumes and market sizes through numbers, looking at trends in a more descriptive way, and checking social media insights from X to understand current feelings about the market. Projections draw from expert analyses, balancing optimistic and conservative scenarios.

2. Market Overview

2.1 Size and Composition

Stablecoins continue to hold a major portion of the crypto market, which accounts for the overall sector being worth more than $311B in value. USD-denominated stablecoins maintain their dominance at over $304B, driven mainly by fiat-backed assets, which total approximately $298B. Synthetic dollars make up more than $11B, while crypto-backed stablecoins account for nearly $9B.

U.S. Treasury-backed stablecoins offer an additional $2 billion to the total. In addition to dollar assets, EUR-based stablecoins control about $645M, and algorithmic stablecoins maintain roughly $573M. Commodity-backed options are valued close to $81M, whereas niche stablecoin categories like CNY ($22M) and TRY ($18M) constitute the smallest portions of the market.

2.2 Historical Growth

The stablecoin market capitalization has experienced strong growth from $204 billion (early 2025) to $312 billion by November; that represents a rise of 52.9%. The metric reflects 69% growth in 2024 compared to $130 billion in 2023. Transaction volumes further recorded a rise from $10 trillion in 2024 to over $15 trillion in 2025, as well as monthly averages hitting over $1.25 trillion.

2.3 Key Performance Metrics

2.3.1 Stablecoin Transaction Count

From the start of the year, the metric has shown strong growth from 134.61M to 224.69M by October 2025. The figure represents a 66.9% rise, which highlights strong growth over the same time period. However, the mid-November data reveals a sharp cooldown, sliding to 99.04M. The value signifies a 55.9% decline from the October peak and a 26.4% decrease from the start of the year that marks a notable reset after months of steady expansion.

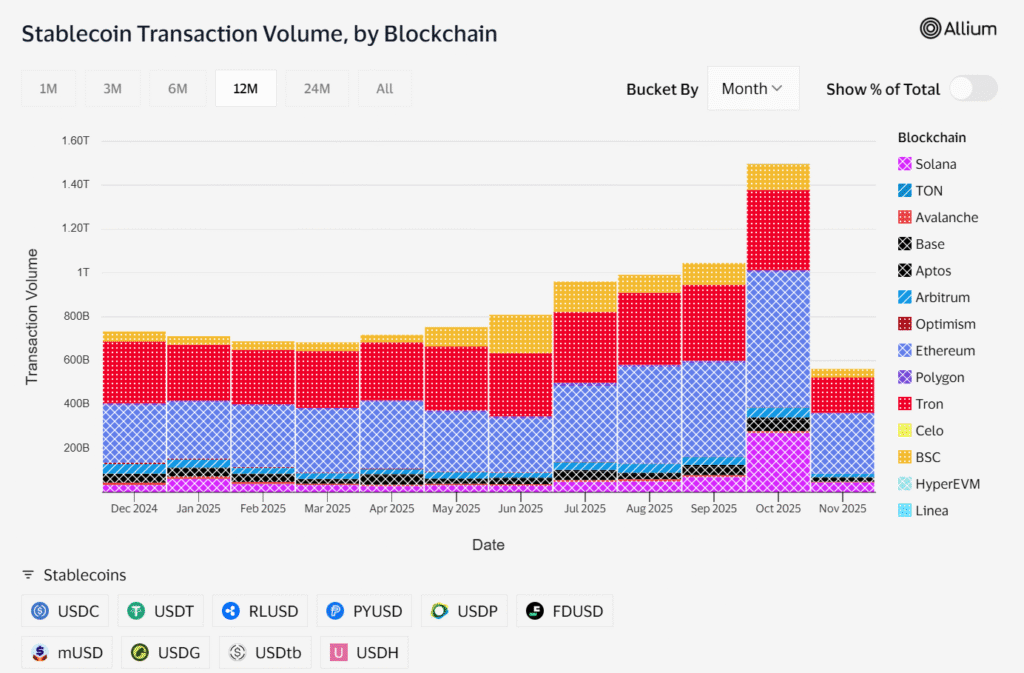

2.3.2 Stablecoin Transaction Volume

Stablecoin transaction volume among blockchains has expanded substantially throughout the year. The growth initially began at 712.11B, then climbed through the first three quarters and crossed 1.5T in October. The trend represents a noteworthy 110.6% growth from its baseline level. The metric slowed down in mid-November, with volumes going down to 563.13B. It marks a 62.1% decline from the October record high and is also 20.9% lower than at the start of the year. Ethereum continues to position itself among blockchains, with 272.74B in transaction volume. The relative trend suggests a clear cooldown after months of heavy activity.

2.3.3 Stablecoin Cumulative Metrics

In the past twelve months, the total transfer volume of stablecoins across popular blockchains reached more than $9 trillion. Activity continued to shift from higher-cost to lower-cost networks.

- Tron (USDT) continues to lead with $3.4 trillion in USD value, with 534.8 million transactions, further proof of its dominance in payments for retail individuals and emerging markets.

- Ethereum had a total volume of $4.0 trillion in USDT and USDC ($2.5 trillion USDC + $1.5 trillion USDT). However, the total volume of transactions was still less than $87 million, which indicates that high fees still continue to put pressure on institutional and high-value use.

- Layer-2 and other Layer-1 networks had strong growth, collectively surpassing $2 trillion total: BSC (USDT $857 billion), Solana (combined total $725 billion), USD (Base combined $383 billion), and Arbitrum (combined total of $372 billion).

- The capital has continued to move away from networks with high fees and toward chains with low fees and high throughput. The trend makes the high demand for scalable infrastructure even stronger in retail and everyday stablecoin transfers or payments.

3. Growth Drivers and Adoption Trends

3.1 Institutional Participation

The transparent regulation and higher demand for faster settlement drive substantial growth in institutional participation in stablecoins, especially due to the emergence of major financial players. The dominant banks and payment giants like JPMorgan, Fidelity, Mastercard, Visa, Citigroup, and Morgan Stanley establish stablecoin infrastructure or set up digital-asset offerings. Major financial businesses like Circle and Robinhood have continued implementation of new blockchain systems for payments and real-world asset transactions, which demonstrates the upward trend of business adoption and utilization.

Investment products and corporate treasuries additionally continue to drive growth. As per a16zcrypto, on-chain exchange-traded products hold more than $175B, which brings a wave of institutional capital that previously sat on the sidelines. DAT-style public businesses hold about 4% of all BTC and ETH accounts for nearly 10% of institutional ownership when combined with ETPs, while real transaction activity continues to rise: JPMorgan has carried out over $1.5T in stablecoin transfers, and Stripe’s $1.1B acquisition of Bridge highlights how aggressively traditional firms are moving into stablecoin infrastructure.

3.2 Regional Adoption

Latin America shows up as the most significant region for real-world stablecoin usage. More than 71% of users there utilize them for cross-border transactions, compared to 58% in Europe, 53% in Asia, and 39% in North America. Businesses are actively implementing stablecoin payment strategies, engaged in pilot programs, or planning them. 92% of these businesses confirm that their wallet and API infrastructure fully supports stablecoin transactions, demonstrating their readiness for on-chain payment systems.

By combining stablecoins with local payment rails, Latin America offers a faster, cheaper, and more reliable cross-border experience, something traditional banking systems simply do not offer.

4. Regulatory Developments

4.1 Global Frameworks

The EU’s MiCA framework mentions that non-euro stablecoins can’t be worth more than €200 million and need AML. The Stablecoin Ordinance in Hong Kong, on the other hand, states the need for a license. The Financial Stability Board (FSB) finds gaps in 30% of jurisdictions.

The U.S. GENIUS Act requires 100% reserves and audits, which lets issuers like Circle obtain banking licenses and drove the market value of its IPO to $15 billion. In Europe, MiCA raises yield caps, but in Japan, new rules make yen-stablecoins worth up to $5 billion. As Canada makes its own rules for 2025–26, it sets aside $10 million for oversight.

4.2 Impacts on Market Dynamics

The market dynamics have experienced these developments that enhanced trust and assisted in handling de-pegging cases but increased compliance costs for issuers. Non-compliant companies are vulnerable to bans, as seen with Tether’s EU delisting under MiCA. Additionally, the regulatory environment has contributed to 40% market growth while dealing with illicit use.

| Major Regulations 2025 | Jurisdiction | Key Provisions | Impact |

|---|---|---|---|

| U.S. GENIUS Act | US | 100% reserves, audits | More confidence in issuers and IPOs |

| MiCA Framework | EU | Yield caps, AML | Compliance-focused sustainable growth |

| Stablecoin Ordinance | Hong Kong | Licensing standards | Set up Asia as a stablecoin hub |

5. Key Use-Case Highlights for Stablecoins in 2025

5.1. Cross-Border Payments and Remittances

The acceptance of stablecoins to enable cross-border payments continues to expand with the faster settlement and reduced costs in comparison to traditional methods such as SWIFT and private banking. By early 2025, the stablecoin niche had captured nearly 3% of the $200 trillion global cross-border payments market. Stablecoins facilitate remittances, as well as payments for small businesses and foreign migrant workers. Stablecoins’ transaction volumes stay in the daily range of $20 to $30 billion.

Traditional solutions are held up in the payment settlement for the time period of nearly 1–3 business days, although stablecoins cut that down to seconds and work round the clock. In addition to that, it allows bridging cross-border payment transactions for low- to middle-income economies and regions with low experience with financial services.

5.2. Crypto Trading and Capital Market Settlement

Stablecoins are a key part of the crypto and digital asset markets. They are the base pair for more than 80% of trading on major centralized exchanges. They also back settlement in capital markets, which includes bonds, Treasury bills, and tokenized securities. Around $250 billion in stablecoins were in circulation by the middle of 2025. Tether issues $155 billion and Circle issues $60 billion in stablecoins. As these assets operate on-chain, they ensure instant settlement and complete transparency with the support of significant liquidity.

5.3. Cash Management

Institutions utilize stablecoins for real-time liquidity and cash management, allowing funds to earn intraday yield and improve operational efficiency. The examples include the Franklin OnChain US Government Money Fund with $0.8B, the Ondo Short-Term US Treasuries Fund ($0.7B), and the BlackRock USD Institutional Digital Liquidity Fund ($2.9B). Stablecoins provide a more swift and automated alternative to traditional treasury operations by granting instant access to funds and automated payments.

6. Risks and Challenges

Stablecoins have reached a market capitalization soaring over $300 billion since the start of the year. The relative trend shows a strong growth and adoption but due to their close ties to traditional finance, they are also more vulnerable to hacks. The ESRB, the FSB, and the Federal Reserve are some of the most noteworthy institutions that see three main risks: threats to systemic stability, regulations that aren’t unified, and ongoing security vulnerabilities.

6.1 Systemic and Financial Stability Risks

Stablecoins function like shadow banks, as they don’t require deposits like traditional banks. Furthermore, they hold immense reserves in treasuries and bank securities with the convenience of instant withdrawals.

- The statements from the European Systemic Risk Board (ESRB) concentrate on the financial stability risks linked with stablecoins that are collectively issued by EU and non-EU entities. As the market develops and establishes connections with traditional finance, joint issuance might put pressure on EU reserves during the period of market stress and could make redemption runs worse. The official statements from ESRB emphasize the fact that all these arrangements should not be authorized under MiCAR, or in the case of any allowance, there should be stricter control, international cooperation, and legal protections to minimize systemic risks.

- The Federal Reserve underscores several risks that are associated with stablecoins, such as run dynamics, reliance on non-cash or illiquid reserves, compliance gaps, possible consumer exposure, systemic vulnerabilities from issuers that function like banks, and uneven protections.

6.2 Regulatory and Compliance Challenges

There are still many different rules around the world, although the US GENIUS Act (July 2025) and EU MiCA are now in effect. The gaps could lead people to make regulatory arbitrage.

- The Federal Reserve and the FSB state that stablecoin regulations are uneven and not strict enough. In the U.S., federal and state rules differ, and global standards also vary. As a result, these disparities possibly leave gaps that unwanted entities could take advantage of for their own gain through regulatory arbitrage. It therefore becomes essential to implement strong and consistent regulations to reduce such risks, ultimately protecting the user funds.

- In the U.S., distinct regulatory bodies handle different parts of stablecoin regulation, which often results in inconsistent oversight. Additionally, since stablecoins function on permissionless blockchain networks and trade on secondary markets, unlawful entities can access them after issuance. It could create difficulty in the implementation of making AML/CFT. Strong oversight and consistent rules are necessary to mitigate these risks.

6.3 Operational Risks and Security Gaps

The cryptocurrencies’ digital nature makes them vulnerable to scams and hacks; more than $2.47 billion worth of digital currencies has been stolen in the first half of 2025. Stablecoins were the most popular way for the payment of ransomware and fraud due to their rapid settlement advantage.

- Stablecoins usually carry a high risk of security breaches due to vulnerabilities in smart contracts, oracle manipulation, and cross-chain bridges. Technical failures may cause permanent fund loss, even after safety measures and audits are in place.

- The stablecoin’s operational risks include poor storage systems, difficulties in tracking keys, and complicated legal systems. On the other hand, limited insurance and unclear rules could make it more likely that reserves might be misused and problems could arise during market stress.

Conclusion

In 2025, stablecoins highlighted strong growth even as regulations eased up and technology improved. Even though stablecoins still carry risks, it is clear that they could facilitate finance more accessible to everyone, as long as problems are dealt with ahead of time. The way the sector grows toward trillion-dollar levels could affect how global payments work in the future.

Glossary

- Stablecoin: A digital asset that is intended to maintain a stable value, usually fiat-backed such as USD

- De-Pegging: It refers to the situation where the intended value is compromised for the asset.

- DeFi: Decentralized blockchain protocols that facilitate users to trade, lend, and borrow digital assets.

- RWA: Real-World Assets (RWA) refer to the tokenized form of physical or financial assets on the blockchain.

Key Citations

- Stablecoins – Market Cap | Series – MacroMicro

- Stablecoin Adoption 2025: Inside the Internet’s New Settlement Layer

- Fireblocks- State of Stablecoins 2025

- Stablecoins, the Beating Heart of Crypto Markets – Kaiko – Research

- Top Stablecoins by Market Cap to Invest in 2025 – CoinDCX

- Which stablecoins are the largest and most popular in 2025?

- Top Stablecoins Coins by Market Cap – Kraken

- Top Stablecoins by Market Cap – CoinCodex

- What to Know About Stablecoins – J.P. Morgan Global Research

- Stablecoins payments infrastructure for modern finance – McKinsey

- Stablecoin Transaction Volume Up 83% Year-on-Year: TRM Labs

- Blockchain in cross-border payments: a complete 2025 guide – BVNK

- Crypto rule comparison: the US GENIUS Act versus EU’s MiCA

- The Strategic Implications of the GENIUS Act and MiCAR Framework

- 2025 Crypto Adoption and Stablecoin Usage Report – TRM Labs

- The Chainalysis 2025 Global Adoption Index

- State of Crypto 2025: The year crypto went mainstream

- Global Insights: Stablecoin Payments & Infrastructure Trends

- The rise of stablecoins and implications for Treasury markets

- [PDF] Stablecoins in focus: navigating the new digital financial landscape

- Stablecoin Use Cases: Payments, DeFi, Treasury & More – USDC

- Stablecoins, Modernizing financial infrastructure | Morgan Stanley

- [PDF] Crypto Assets Monitor – IMF Connect

- [PDF] Digital Money – Treasury.gov

- Stablecoins, a new payments revolution? – BNP Paribas CIB

- [PDF] Stablecoins in focus: navigating the new digital financial landscape

- Stablecoin Growth Could Lower Rates And Alter Fed Policy Over Time

- Cost savings and speed drive stablecoin adoption | EY – US

- [PDF] The stablecoin moment | State Street

- Stablecoins, Liquidity and the Future of Tokenized Assets – DTCC

- Stablecoin Risks: Some Warning Bells – Bank Policy Institute

- What to Know About Stablecoins | J.P. Morgan Global Research

- Stablecoin Security Risks in 2025: Full Risk Assessment Guide

- Security Risks of Stablecoins – Chainalysis