Key Takeaways

- BNY Mellon and Goldman Sachs launch institutional tokenized MMFs initiative using GS DAP

- Tokenized MMFs shares to be offered via BNY’s LiquidityDirect and Digital Assets platforms.

- Tokenized MMFs offer faster settlement, Improved collateral utility, and real-time ownership visibility.

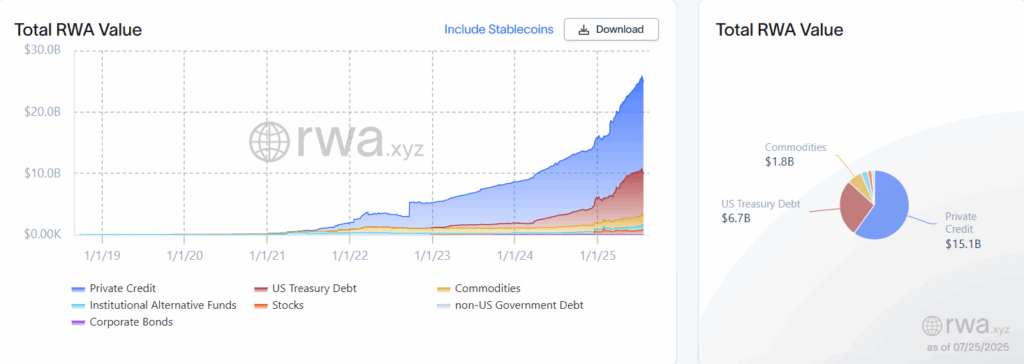

- Tokenized real-world asset market tops $28B, led by private credit and stablecoins.

The Bank of New York Mellon Corporation, known as BNY Mellon, and Goldman Sachs announced a joint initiative to tokenize money market funds (MMFs) shares using blockchain infrastructure, aiming to integrate digital ledger technology into traditional financial markets.

According to BNY’s announcement on Wednesday, The partnership will allow BNY Mellon to leverage Goldman Sachs’ GS DAP blockchain platform to maintain a record of customers’ ownership in select money market funds (MMFs) through mirrored tokenization.

Meanwhile, the tokenized shares will be available through BNY’s LiquidityDirectSM and Digital Assets platforms, enabling investors to subscribe and redeem them in a digital format.

Asset managers involved in the initial rollout include BlackRock, BNY Investments Dreyfus, Federated Hermes, Fidelity Investments, and Goldman Sachs Asset Management.

While the mirror tokens do not replace official records, which will continue to be maintained by BNY Mellon, they are intended to reflect fund ownership in real time and pave the way for new use cases, such as faster settlements and more flexible use of assets as collateral, according to the BNY.

Highlighting the importance of merging blockchain technology with institutional finance, Laide Majiyagbe, Global Head of Liquidity, Financing and Collateral at BNY Mellon, said:

As the financial system transitions toward a more digital, real-time architecture, BNY is committed to enabling scalable and secure solutions that shape the future of finance.

Supporting that stance, Mathew McDermott, Global Head of Digital Assets at Goldman Sachs, added:

Using tokens representing the value of shares of Money Market Funds on GS DAP would enable us to unlock their utility as a form of collateral and open up more seamless transferability in the future.

What New Capabilities Do Tokenized MMFs Bring to Market?

With the new tokenized MMFs shares, institutional investors are expected to benefit from faster access to liquidity and greater operational efficiency, particularly in collateral use and intra-day transactions.

Additionally, The real-time tracking of mirror tokens could simplify fund workflows, reduce settlement delays, and increase transparency.

The move may also expand the role of MMFs as programmable collateral, pointing to a broader shift in how capital moves across financial markets.

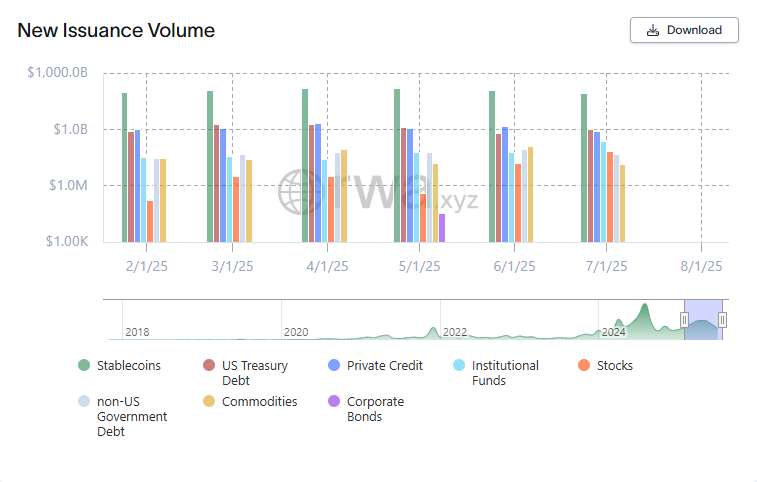

Tokenization Wave to Reshape Traditional and Real-World Assets

Earlier in July, tokenization efforts expanded beyond fund products to include equities, bonds, deposits and real estate.

Bitget, a major cryptocurrency exchange, introduced tokenized stocks on its Onchain platform through a partnership with xStocks, offering tradable blockchain-based versions of equities such as Tesla, Nvidia and Apple.

The tokenized stocks mirror their traditional counterparts and offer extended access with faster settlement times.

Also in July, in the United Arab Emirates, the Dubai Land Department signed an agreement with Crypto.com to explore the use of blockchain and digital assets in property transactions.

The partnership includes testing real estate tokenisation, blockchain-based settlement, and digital investor verification, aligning with the city’s Real Estate Strategy 2033 and Economic Agenda D33.

Final thoughts

Taken together, these developments highlight the growing institutional interest in tokenized assets and the blockchain infrastructure that supports them.

As market infrastructure matures and regulatory frameworks evolve, the integration of digital assets into traditional financial systems is set to reshape how value is stored, transferred, and managed across the global economy.

Read More: Trump’s $WLFI Token Goes Live: Political Crypto Experiment Faces Market Test