Key Takeaways

- Stablecoins have grown sharply this year, far outpacing the rest of the crypto market and triggering heightened scrutiny from global regulators.

- An ECB report says the largest stablecoins have become systemically important, with rapid expansion outpacing international regulatory coordination.

- Most activity remains centered on facilitating movement between crypto assets, but issuers’ large holdings of US Treasury bills create potential spillover risks for traditional financial markets.

- Regulators warn that uneven global rules and high market concentration could amplify stress in a crisis, though current risks to the euro area remain limited.

Table of Contents

Stablecoins have expanded at an exceptional pace this year, growing far faster than the broader crypto market and drawing new attention from regulators concerned about the speed of their rise.

Although the market remains small in the euro area, authorities warn that the combination of rapid expansion and heavy exposure to traditional financial assets is increasing the risk of cross-market spillovers.

According to a study by the European Central Bank (ECB) prepared by financial stability experts Senne Aerts, Claudia Lambert and Elisa Reinhold, the largest stablecoins have taken on systemic relevance long before their use in the real economy has become widespread.

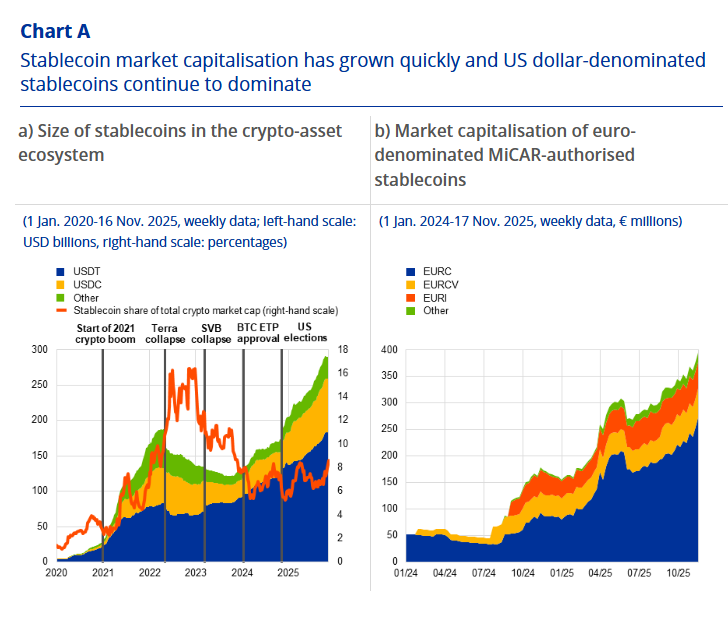

The study says the sector’s expansion has outpaced regulatory coordination across major jurisdictions, creating vulnerabilities that could intensify market stress. It estimates the total value of stablecoins at more than 280 billion dollars, with Tether and USD Coin accounting for nearly nine tenths of global supply, while Euro-denominated tokens remain a marginal segment, with about 395 million euros in circulation.

Regulatory Push Brings Broader Stablecoin Adoption

According to the ECB study, the expansion comes as policymakers move to tighten oversight.

The European Union has completed implementation of its Markets in Crypto-Assets framework last year, introducing detailed rules for reserves and redemption rights.

Meanwhile, the United States followed with the GENIUS Act, and Hong Kong has introduced its own licensing system.

The study says clearer rules may have reinforced demand by offering greater legal certainty to issuers and trading platforms.

Stablecoins Serve Primarily as a Trading Medium

Despite expanding oversight, the ECB study notes that stablecoins’ main function remains serving as a medium of exchange between crypto assets.

Stablecoins are used primarily to shift between crypto assets without converting back into traditional currencies, and they appear in roughly four fifths of activity on centralized exchanges.

Other suggested functions, including remittances, retail payments and use as a store of value in high-inflation economies, remain limited, with data showing only a small share of transactions coming from retail-sized flows.

Loss of Peg Seen as Main Systemic Threat

The ECB warns that the main source of systemic risk is the potential loss of a stablecoin’s peg.

The study warns that a wave of redemptions would force issuers to liquidate their reserve holdings, exposing markets far beyond crypto. The biggest issuers now hold large portfolios of short-dated US government debt, putting them among the largest buyers of Treasury bills. Their holdings are comparable to major money-market funds, prompting concern that rapid sales in a stress event could disrupt the Treasury market.

Sector Growth and Concentration Deepen Vulnerabilities

Analysts note that risks could rise further if the sector continues to expand toward the two-trillion-dollar level some forecasts suggest, as heavy concentration deepens the vulnerability, with two issuers controlling most of the stablecoins in circulation.

ECB Sees Limited Near-Term Impact but Calls for Global Alignment

For now, the ECB sees only limited direct risks to euro-area financial stability, noting that stablecoins are still rarely used for everyday payments and that the dominance of dollar-based tokens leaves their reserve portfolios only lightly connected to European markets.

Even so, policymakers argue that the sector’s rapid expansion and its growing ties to global financial markets make stronger international coordination essential, pointing to the G20’s crypto-asset roadmap and recent guidance from the Financial Stability Board and the Basel Committee as key steps toward narrowing cross-border regulatory gaps.

Read More: Canada Targets Emerging Tech in 2025 Budget, Regulates Stablecoins & Invests Nearly C$1 Bn in AI