Key Takeaways

- A senior ECB official warned that a large outflow from major stablecoins could force issuers to liquidate reserves quickly, putting pressure on bond markets and draining liquidity.

- Olaf Sleijpen said such instability could weaken the effectiveness of monetary policy and may push the ECB to rethink its interest rate stance if market stress spreads into the wider economy.

- The Bank of England has moved ahead with its own safeguards, proposing strict reserve rules for sterling stablecoins and requiring issuers to hold a substantial share of backing assets at the central bank.

- London’s framework also includes limits on stablecoin holdings, stricter rules on how users can convert tokens back into cash, and requirements for overseas issuers to keep backing assets in the UK.

Table of Contents

A senior European Central Bank (ECB) official has warned that a large and abrupt outflow from major stablecoins could trigger rapid liquidation of reserve assets, unsettle funding markets and even push the ECB to reconsider its interest rate stance, highlighting rising concern that digital tokens once seen as niche payment tools have grown large enough to send disruptive shocks through the wider financial system.

Dutch central bank governor Olaf Sleijpen said in an interview with Financial Times that the rapid rise of dollar-based-stablecoins is pushing these digital assets to a sensitive point where any sign of instability could affect the broader economy. He noted that a sudden loss of confidence in a major token could force issuers to liquidate their reserve assets quickly, a reaction that would put pressure on government bond markets and drain liquidity from key parts of the financial system.

Analysts warn that a forced liquidation of the assets backing stablecoins, often held in short term government securities or other high-grade-debt, could amplify stress in funding markets. In such a scenario, Sleijpen suggests that the ECB could be forced to review its interest rate settings or deploy other policy instruments if financial instability threatened to weaken the impact of its decisions.

Sleijpen stressed the need for coordinated oversight, noting that stablecoins move swiftly across borders and rely heavily on dollar denominated reserves. He said the speed at which liquidity enters and leaves these tokens heightens their vulnerability, particularly because their stability depends completely on the value and liquidity of the assets that support them.

He added that policymakers across Europe are already assessing whether additional tools may be required if market instability undermines the effectiveness of the ECB’s current framework, with options ranging from liquidity support and changes to collateral rules to potential adjustments in interest rates.

As ECB Sounds Alarm, England Moves Ahead With Its Own Stablecoin Safeguards

While the European Central Bank examines the risks posed by large stablecoin outflows, the Bank of England has already begun shaping a detailed regulatory framework aimed at preventing similar shocks in the United Kingdom.

Earlier this week, the central bank outlined how it plans to supervise sterling-linked stablecoins once they become widely used for retail payments, corporate transactions or settlement in core financial markets.

In its framework, the Bank of England proposes a structure that would require stablecoin issuers to hold a significant share of their backing assets as deposits at the central bank, with the remaining share invested in short-term government securities. This split is intended to keep liquidity high during periods of stress while still allowing issuers to operate sustainable business models.

Additionally, officials in London acknowledge that periods of heavy withdrawals may temporarily push firms outside the prescribed asset mix. In such cases, issuers would be required to notify the Bank and restore the ratio within a reasonable timeframe.

The central bank is also weighing a lending facility that would allow stablecoin issuers to obtain short-term liquidity against their government bond holdings, creating a controlled mechanism to absorb redemption surges without destabilizing markets.

Furthermore, to support newer firms entering the market, the plan proposes a gradual approach for coins designated as systemic at launch. These issuers could begin with a higher share of their backing assets held in government securities, with the mix shifting toward the standard ratio as usage increases.

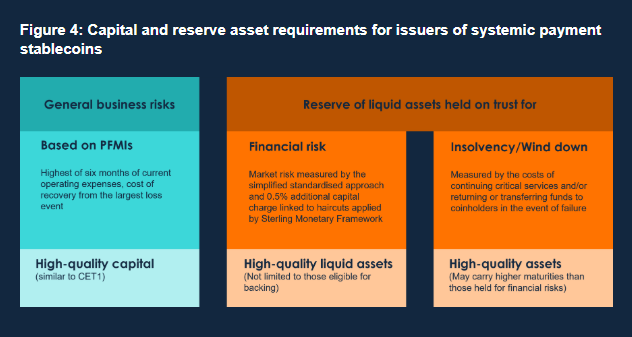

The Bank of England also sets out capital and reserve standards meant to protect users if a stablecoin issuer fails.

Firms would need to hold capital in line with international standards for financial market infrastructure, ensuring they have enough resources to withstand severe but plausible business losses or wind down operations without disrupting payments. Additional reserves would shield users from fluctuations in the value of backing assets and cover the cost of operating essential services during an insolvency process.

The framework also aims to prevent a sudden drain of deposits from the banking system. The Bank of England warned that widespread stablecoin use could pull money out of traditional banks. To address this risk, the central bank is proposing temporary holding limits of up to 20,000 pounds for individuals and 10,000,000 pounds for businesses, with exemptions for firms that require larger operational balances.

Furthermore, the Bank of England expects issuers of systemic stablecoins to maintain direct access to major sterling payment systems, reducing reliance on intermediary banks and strengthening settlement between stablecoins, e-money and bank deposits.

The bank has also confirmed that issuers may use public blockchains, though they must meet strict standards on governance, cybersecurity and operational resilience, regardless of the technology they choose.

Finally, London’s plan address the role of overseas issuers. Any non-UK firm offering a sterling stablecoin considered systemic would need to set up a UK subsidiary and keep its backing assets in Britain. For non-sterling coins issued abroad, the Bank of England would rely on the home regulator only if equivalent standards and close cooperation are in place, otherwise additional safeguards would be required.

Read More: Canada Targets Emerging Tech in 2025 Budget, Regulates Stablecoins & Invests Nearly C$1 Bn in AI