Key Takeaways

- Tether has made a strategic investment in Ledn, a Canada-based firm offering bitcoin-backed loans, as part of its broader push into real-world financial infrastructure.

- Ledn has issued more than $1 billion in loans in 2025, including $392 million in the third quarter alone, a figure that comes close to matching its total lending volume for the entire year of 2024.

- The deal supports Tether’s aim to expand access to credit without requiring users to sell their digital assets, reinforcing self-custody and decentralized finance principles.

- Ledn’s platform may serve as a distribution channel for Tether-issued assets, opening new pathways for stablecoin use in global credit and lending markets.

Table of Contents

Tether, the world’s largest digital asset firm by market share and the issuer of the USDT stablecoin, has taken a strategic stake in Ledn, a company recognized for its consumer-focused bitcoin-backed lending products.

The investment is part of Tether’s broader strategy to expand access to credit markets by supporting infrastructure that allows borrowers to obtain financing while retaining ownership of their digital assets.

Over $1 Billion in Loans Issued in 2025

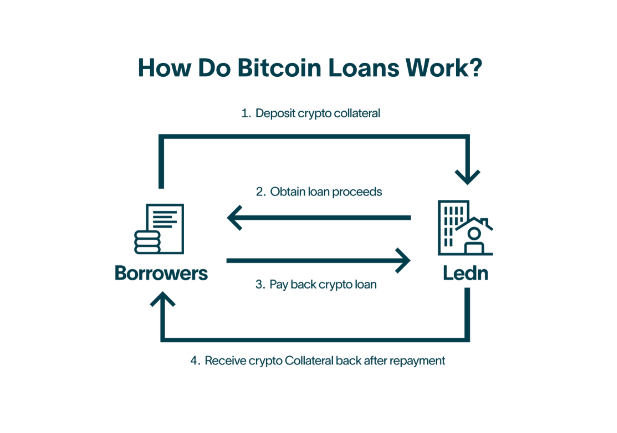

Ledn, a Canada-based lender, offers credit products backed by bitcoin collateral, enabling borrowers to unlock liquidity while retaining their assets.

The lender has originated more than $1 billion in loans in 2025, with $392 million issued in the third quarter. That amount is nearly equal to its total lending volume for the whole of 2024. Since its launch, the company has facilitated over $2.8 billion in bitcoin-backed loans and now generates annual recurring revenue of more than $100 million.

Tether Eyes Real-World Lending Utility Through Blockchain

While financial terms of the deal were not disclosed, Tether described the investment as part of its continued interest in blockchain-based solutions that have real-world utility. The company has increasingly targeted infrastructure ventures that support decentralized finance models.

“Our investment reflects Tether’s belief that financial innovation should empower people”, said Paolo Ardoino, CEO of Tether. “Together with Ledn, we are expanding access to credit without requiring individuals to sell their digital assets. This approach strengthens self-custody and financial resilience, while creating real-world use cases that reinforce the long-term role of digital assets as essential pillars of a more inclusive global financial system.”

Ledn Positioned to Broaden Tether’s Stablecoin Reach

Ledn’s infrastructure could also be leveraged to extend the distribution of Tether-issued assets into new markets, as the company’s lending model is structured to scale, making it a complementary platform for expanding stablecoin use cases beyond trading and remittances.

“This investment brings together two market leaders to shape the future of the bitcoin-backed lending market,” said Adam Reeds, co-founder and CEO of Ledn. “As Ledn’s loan book is on track to nearly triple from our 2024 levels, it validates our decision to go all-in on bitcoin. We expect demand for bitcoin financial services to continue soaring, and this collaboration with Tether ensures that Ledn remains well-positioned to lead as the market continues to evolve and grow.”

What Could Bitcoin-Backed Loans Mean for Borrowers?

For borrowers, the Tether–Ledn partnership could make crypto-backed lending more accessible, efficient, and secure. One key benefit is the ability to access cash without selling their digital assets, which allows individuals and businesses to retain long-term exposure to the assets while meeting short-term liquidity needs. This is especially useful during periods of rising prices, when selling could lead to capital gains taxes or disrupt long-term investment plans.

As Ledn’s loan products grow with support from Tether, borrowers could benefit from improved terms. These may include higher loan-to-value ratios, more competitive interest rates, or faster approval times. Such enhancements could stem from increased liquidity provided by Tether and a wider circulation of stablecoins like USDT across the lending market.

In addition, this type of lending could become more attractive to users in emerging markets, where access to traditional bank credit is often limited or unreliable. Stablecoin-denominated loans, secured by crypto holdings, may provide an alternative to volatile local currencies and help individuals bypass slow or exclusionary banking systems.

The collaboration may also encourage more consistent risk practices across the lending sector. If successful, it could raise standards for borrower protections, improve transparency in how collateral is managed, and promote responsible loan servicing.

These measures are particularly relevant given past failures in the crypto lending space. Over time, such improvements could attract more cautious investors and help position cryptocurrency as a practical form of collateral rather than merely a speculative asset.

Read More: ECB Warns Stablecoin Outflows Could Trigger Market Stress and Policy Shift; What to Expect?