Key Takeaways

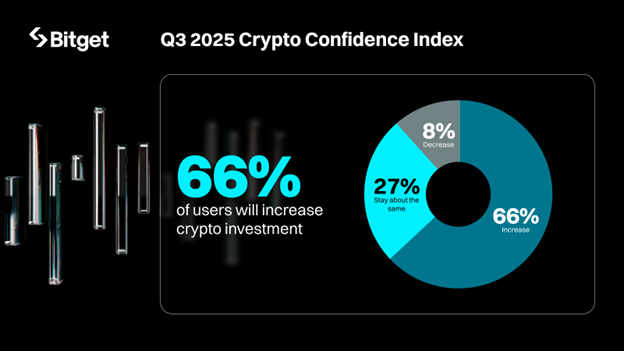

- 66% Plan to Buy More: Global investor confidence in crypto remains strong despite economic uncertainty

- Bitcoin Outlook Still Bullish: Nearly half expect BTC to hit $150K–$200K, while veteran traders see potential beyond $250K

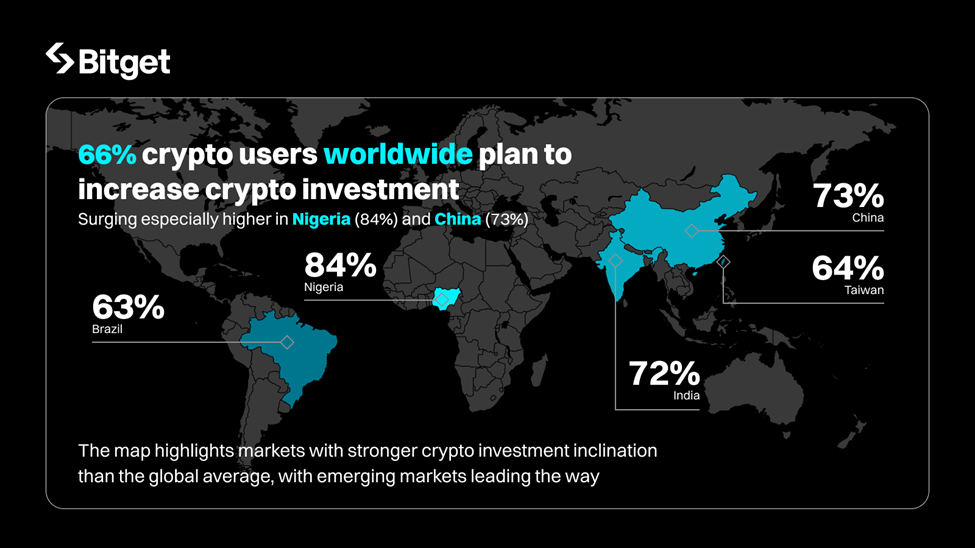

- Emerging Markets Lead Growth: Nigeria (84%), China (73%), and India (72%) show the strongest investment appetite

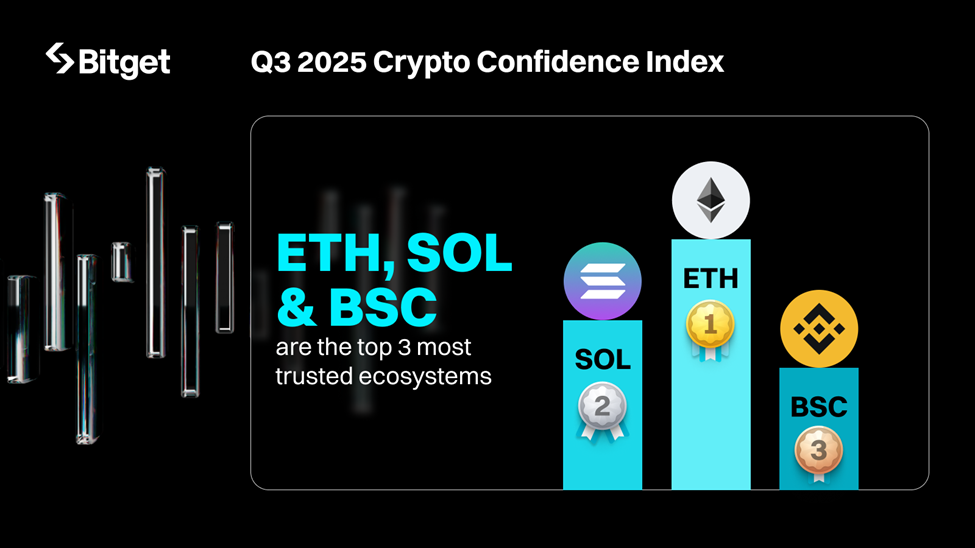

- Shift Toward Long-Term Strategies: Forty-three percent favor savings and wealth management as Ethereum and Solana gain traction.

- Ethereum and Solana Gain Momentum: Ethereum remains the most trusted ecosystem, while Solana attracts investors with its speed and performance.

Table of Contents

Cryptocurrency investors are showing renewed confidence in digital assets, with 66% planning to increase their investments over the next six months, according to Bitget’s Q3 2025 Crypto Market Confidence and BTC Investment Trend Report. The survey, conducted between August 25 and September 5 across 3,047 participants globally, reveals growing optimism in the face of macroeconomic instability.

A Divided Outlook, a Shared Optimism

The survey, conducted between August 25 and September 5 across 3,047 participants globally, reveals growing optimism in the face of ongoing economic uncertainty, particularly among more experienced investors. Nearly 52% of traders with over five years of market experience said they plan to increase their crypto holdings, compared to 45% of newcomers who have been involved for less than three months.

Furthermore, Bitcoin remains at the center of most portfolios, with 49% of respondents expecting its price to rise to between $150,000 and $200,000 in the next market rally, while Around 7% of long-term investors believe Bitcoin could go even higher, surpassing $250,000.

Newer participants, however, tend to be more cautious, with 41% expecting the price to stay below $150,000.

This gap in expectations reflects a maturing market, where experienced investors show stronger conviction while newcomers take a more measured approach.

Emerging Markets Lead the Next Wave of Crypto Growth

Investor optimism is strongest in emerging markets, with Nigeria leading globally, as 84% of respondents from the country said they plan to increase their crypto holdings. China (73%) and India (72%) also showed a strong appetite for expansion. In contrast, developed economies, such as Germany, France, and Japan displayed more cautious sentiment.

However, South Korea stood out as an exception among developed markets, with 20% of respondents indicating plans to reduce their investments, the highest level of negative sentiment recorded in the survey.

Shift Toward Long-Term Strategies Signals Maturation

The survey revealed a clear shift in investor behavior. Half of all participants said they plan to increase their trading activity, while 43% preferred long-term savings or wealth management strategies, a sign that the market is maturing and moving away from short-term speculation.

Beyond Bitcoin, investor attention is shifting toward Ethereum and Solana. Ethereum was favored by 67% of respondents for its reliable ecosystem and strong foundation, while Solana attracted 55% support, largely due to its speed, performance, and active developer community.

Rising Interest in Layer 2s and Niche Assets

While BTC and ETH continue to dominate portfolios, there is a growing interest in niche assets, including platform tokens, meme coins, and Layer 2 blockchain projects. These are particularly popular in innovation-led markets in Asia and among younger investor cohorts.

Additionally, Ethereum remains the most trusted ecosystem globally, with Solana close behind. Layer 2 chains are increasingly adopted across various regions, hinting at a multi-chain future.

Investor Profiles Reveal Diverging Risk Tolerances

The survey found a clear division among crypto investors. Those with more experience were more likely to take larger positions and express confidence in higher price targets, while newer participants tended to favor more conservative strategies and limit their risk exposure.

Regionally, Latin America demonstrated strong retail-driven enthusiasm, Asia leaned toward innovation-fueled optimism, and Europe remained conservative, shaped largely by regulatory oversight.

Conclusion: Confidence Seen as Key Driver of Future Adoption

Despite economic headwinds, the survey indicates that global crypto confidence remains resilient. With 66% of users ready to deepen their investment and nearly half anticipating significant Bitcoin gains, the momentum in digital asset adoption continues to build.

Read More: Crypto Market Crash Triggers Record $19B Liquidations Amid Tariff Panic & Insider Trading Suspicion