Key Takeaways:

- WLFI froze several user wallets and prepared to shift funds to new accounts, raising questions about how much authority the project holds over user assets.

- The team said the affected wallets were compromised through phishing and exposed seed phrases, stressing that the breach originated outside its own code base and was not caused by WLFI’s smart contracts or platform infrastructure.

- Developers tested updated contract logic and required fresh identity checks before reallocating funds, explaining that the process would take time as safeguarding assets was prioritized over speed.

- Critics argue that WLFI’s power to freeze wallets and move funds shows a level of central control that contrasts with its claims of community-driven governance.

Table of Contents

World Liberty Financial, a crypto project backed by members of the Trump family, is facing heat again after confirming that it froze a group of user accounts and prepared to move funds into new wallets. The move has intensified debate over how much control the project holds over customer assets despite promoting itself as a community-governed platform.

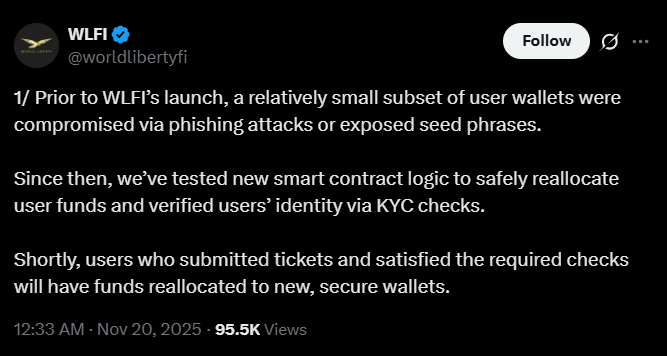

In a series of posts, the project said that a limited number of wallets were breached through phishing schemes or through seed phrases that users had accidentally exposed. The company stated that the incident did not stem from its own software or smart contract framework, placing the responsibility on security failures in third-party environments.

Wallet Freezes Imposed as Team Validates Ownership Claims

WLFI said its team froze the affected wallets in September to stop any further movement of funds while it checked who owned each account. Users who reported suspicious activity were then asked to complete a new round of identity verification so the company could confirm ownership before releasing replacement wallets.

Smart Contract Tools Updated to Manage Reallocations

The company said it developed and tested new smart contract processes to handle large-scale fund reallocations safely, aiming to move assets into secure wallets without adding further risk for users. It described the work as an essential step to ensure the transition could be carried out in a controlled way.

WLFI Says Safeguards Must Come Before Speed

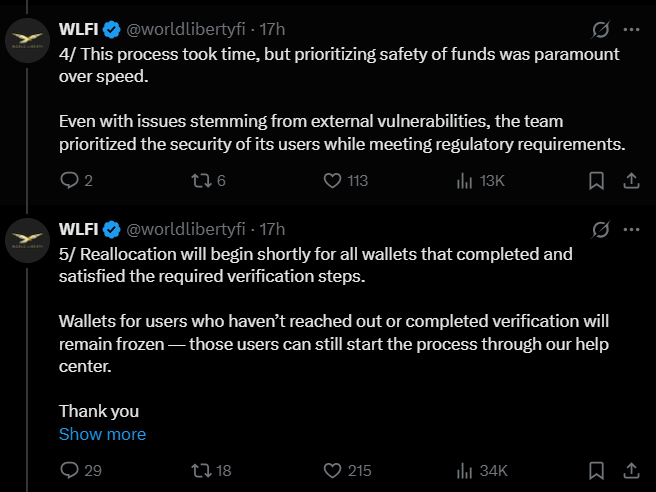

WLFI said the verification process and technical reviews took time but argued that safeguarding funds outweighed any desire to accelerate the response. The team noted that even though the breach originated outside its own systems, the project implemented additional checks and procedures to protect users and meet regulatory expectations.

Verified Users Next in Line as Project Prepares to Release Funds

The project said transfers will begin for users who have submitted tickets and passed identity checks, with unverified accounts staying frozen until their owners finish the verification process.

The incident has drawn renewed scrutiny to the project, with critics arguing that WLFI’s ability to freeze wallets and reassign funds points to centralized control that does not match its claims of community-led governance, effectively placing key decisions in the hands of the project’s operators.

Lawmakers Question Who Holds Power Inside WLFI’s Governance System

The timing of WLFI’s announcement comes as the project is already under political pressure in Washington, where two Democratic senators have urged federal authorities to examine whether the firm allowed its governance tokens to be purchased by traders with links to sanctioned or hostile networks.

Earlier this week, Senators Elizabeth Warren and Jack Reed asked the Justice Department and the Treasury to review whether WLFI enabled buyers connected to North Korea, Russia and other restricted groups to acquire its token. The senators warned that such access could offer foreign actors an opening to influence decisions inside the project.

Their request drew on research from Accountable US, a nonprofit watchdog that analyzed blockchain activity tied to WLFI. The group said token sales appeared to reach traders whose wallets had earlier connections to a North Korean hacking unit, a Russian payments channel, an Iranian exchange and the mixer service Tornado Cash.

The senators said the findings suggested that individuals with illicit ties may have gained a pathway into the projects governance system, since holding WLFI tokens gives buyers the ability to propose and vote on changes to the protocol.

Together, the political concerns in Washington and the projects decision to freeze and reassign user funds have raised wider questions about how WLFI is governed, how much control its operators retain and how well its systems can prevent outside influence. Analysts say the two incidents suggest the project is still trying to strike the right balance between community participation, security safeguards and the authority exercised by those overseeing the platform.

Read More: U.S. Crypto Bill Moves Forward With Senate Vote Planned for Early Next Year; Will It Pass?