Key Takeaways

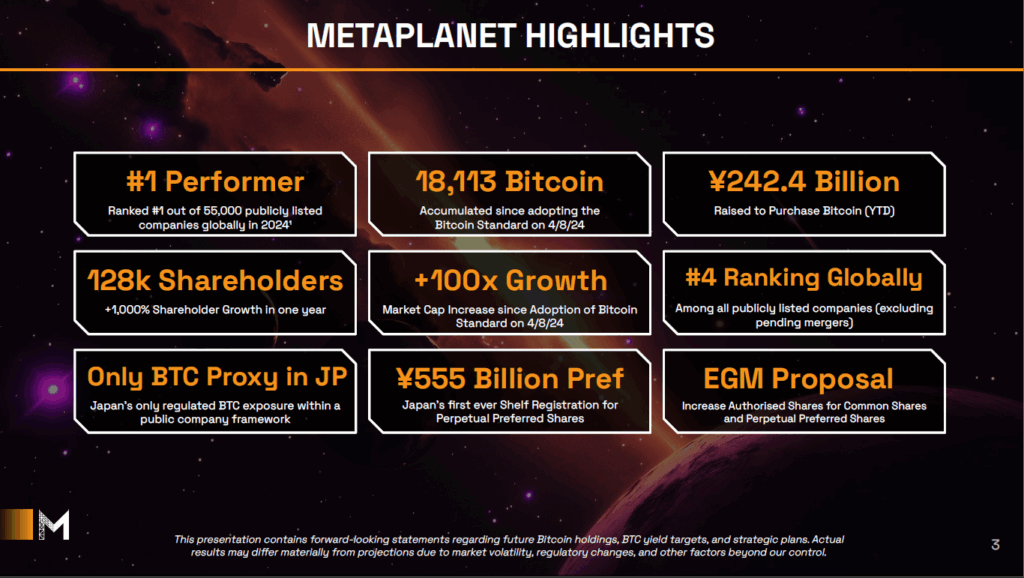

- Metaplanet announces new funding strategy, proposing a Bitcoin-backed preferred share plan to tap Japan’s low-yield market.

- The company’s Bitcoin holdings keep climbing, doubling roughly every 60 days since adopting its BTC standard in April 2024.

- Investor demand remains strong, with ¥242.4 billion raised so far this year in what is reportedly Japan’s largest equity offering of 2025.

- Second-quarter results show momentum, driven by Bitcoin income generation and boosted by ¥31.3 billion in unrealized gains.

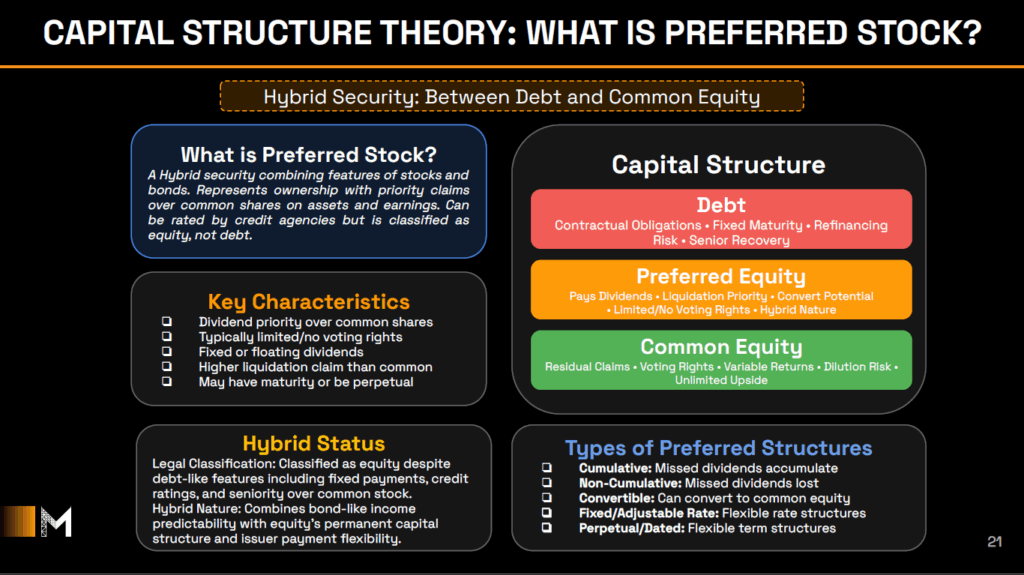

Metaplanet Inc, Japan’s largest publicly listed holder of Bitcoin, plans to introduce “Metaplanet Prefs”, a perpetual preferred share plan backed by Bitcoin.

The company said in its quarterly report it will launch a Bitcoin-backed perpetual preferred share plan, with issuance of up to ¥555 billion over two years, pending shareholder approval at a September 1 extraordinary general meeting.

Proceeds from the planned issuance would be used to purchase additional Bitcoin for the company’s treasury, while preferred shareholders would receive fixed yen-denominated dividends.

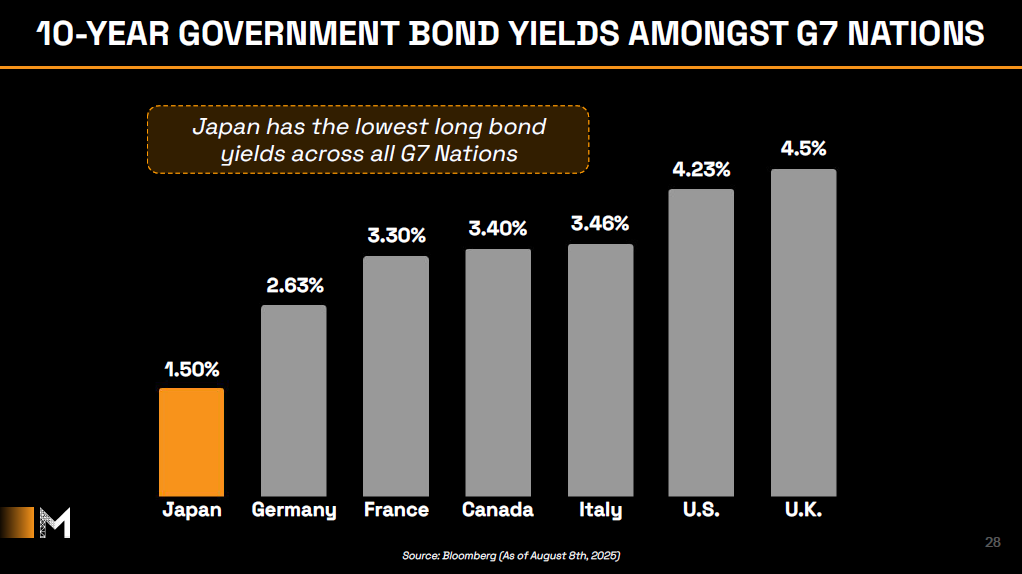

According to Metaplanet, the structure is aimed to tap into Japan’s low-yield fixed-income market, with the offering of preferred shares capped at 25% of Bitcoin net asset value (NAV) to limit dividend obligations and provide over-collateralization.

The plan includes two classes of preferred shares. Class A would pay fixed dividends, rank ahead of Class B in dividend payments and liquidation, and carry no conversion rights to common stock. Class B would also pay fixed dividends but would be subordinate to Class A and offer investors potential capital gains if Metaplanet’s common share price increases.

Bitcoin Accumulation

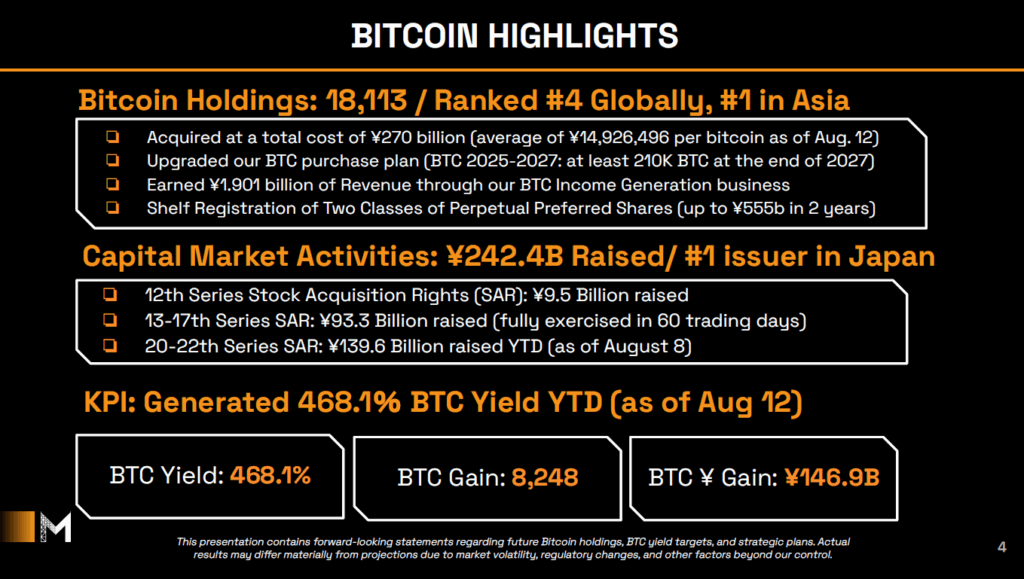

According to the company’s Q2 revenue report, Metaplanet held 18,113 Bitcoin as of August 12, acquired for ¥270.36 billion at an average cost of ¥14.93 million per Bitcoin.

The company also reported a 468% increase in Bitcoin per share so far in 2025, supported by capital raised through equity offerings and redeployed into Bitcoin purchases. Additionally, holdings have doubled roughly every 60 days since it adopted its Bitcoin standard in April 2024.

Capital market activities

The company has raised ¥242.4 billion so far in 2025, reportedly the largest equity raising in Japan this year. That includes ¥139.6 billion secured in two months through warrant exercises, ¥9.5 billion from its 12th series stock acquisition rights, and ¥93.3 billion from its 13th to 17th series, which were fully exercised within 60 trading days.

Financial Performance

The report said second-quarter revenue was ¥1.24 billion, with 91% coming from its Bitcoin income generation business. Moreover, operating profit was ¥817 million, while unrealized gains on Bitcoin holdings since the end of the quarter totaled ¥53.6 billion.

Targets

Metaplanet aims to hold 210,000 Bitcoin, about 1% of the total global supply, by the end of 2027.

Forward-looking Statements and Risk

The company said projections for Bitcoin holdings, yield targets and strategic plans are subject to market volatility, regulatory changes and other factors beyond its control. Preferred share issuance remains subject to shareholder approval and market conditions, it added.

Why This Matters

Japan has some of the lowest sovereign bond yields among G7 economies, with 10-year Japanese government bonds yielding around 1.5% compared with more than 4% in the United States and United Kingdom.

Additionally, household cash and deposits total about ¥7.6 trillion, representing more than half of all household financial assets.

Metaplanet is aiming to tap this pool by offering a fixed-income instrument backed by Bitcoin, giving domestic investors exposure to the cryptocurrency without direct custody or regulatory hurdles. If successful, the move could open a new channel for capital to flow into Bitcoin through Japan’s public markets.

Read More: Strategy Rolls Out $100 STRC Stock in 5 Million shares Offering