Key Takeaways

- AfCFTA has launched ADAPT, a continent-wide digital trade program backed by IOTA, WEF and the Tony Blair Institute, aiming to modernize Africa’s fragmented trade systems.

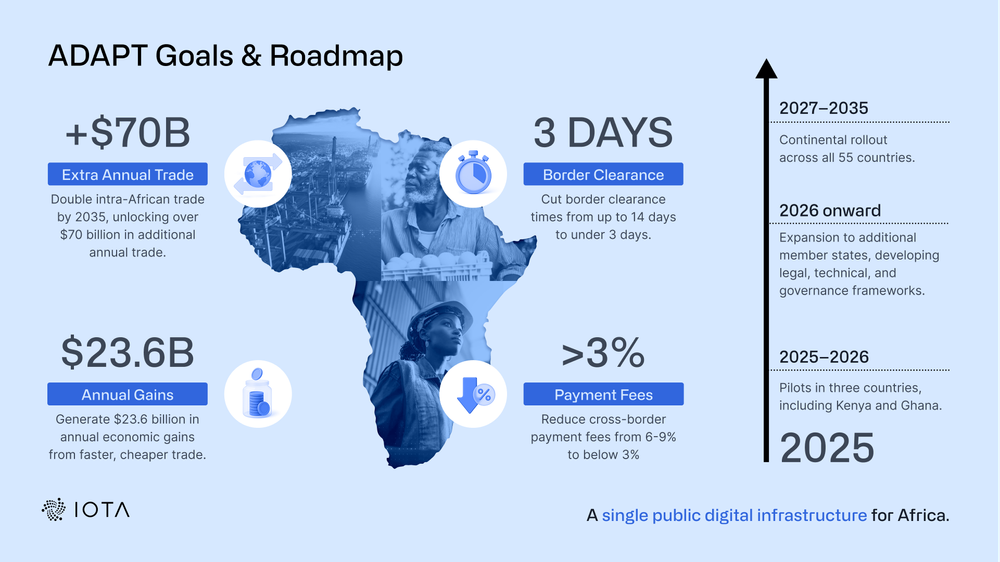

- The initiative targets major economic gains, including doubling intra-African trade by 2035 and adding more than $70 billion in yearly trade value.

- ADAPT introduces a three-layer digital framework covering identity, data exchange and payments, supported by IOTA’s blockchain.

- Pilot projects begin in Kenya and Ghana in early 2026 before expanding toward a full continental rollout planned through 2035.

Table of Contents

Africa is preparing to overhaul how goods, data and payments cross its borders, through a new digital trade program led by the African Continental Free Trade Area and backed by the IOTA Foundation, the World Economic Forum and the Tony Blair Institute.

The initiative, called ADAPT, is positioned as one of the continent’s most ambitious attempts to bring its fragmented trade systems into the digital era. According to the AfCFTA, the program could double intra-African trade by 2035, unlock more than $70 billion in additional annual trade and generate about $23.6 billion in yearly economic gains.

Fragmented Systems Keep African Trade Far Below Potential

The AfCFTA is building a unified digital infrastructure that connects business identities, trade documents and cross-border payments, addressing the lack of trusted digital systems that continues to hinder intra-African trade.

AfCFTA officials argue that a shared digital framework could relieve the pressure on African supply chains, which have long faced border queues, slow paper-based clearances and above-average payment charges.

Three-Layer System to Handle Identity, Data and Payments

ADAPT is structured around digital identities, a shared data-exchange mechanism and a financial layer that brings together mobile money networks, banks, stablecoins and other digital currencies.

The financial layer will also support tokenization of physical commodities and other goods, aiming to broaden access to trade financing channels and lower the cost of capital.

The goal is to give all participants access to the same reliable information, reduce fraud, speed up compliance checks and allow documents to move as quickly as the shipment itself.

Furthermore, this approach could bring border clearance times down by days and sharply reduce cross-border transaction fees, according to the partners.

IOTA Network Powers the Backbone of ADAPT’s Digital Framework

The initiative will use open-source tools, including IOTA’s public blockchain, to secure trade records and ensure their integrity across borders.

IOTA says the technology will allow documents, shipments and payment information to be verified instantly, creating a single source of truth for customs authorities and financial institutions.

AfCFTA Secretary General Wamkele Mene described ADAPT as the backbone of Africa’s digital single market, while Tony Blair said his institute will continue providing technical support in more than a dozen countries to ensure steady adoption.

Pilots Start in Kenya and Ghana in Q1

Pilot projects in Kenya, Ghana and a third country yet to be named, will run through 2025 and 2026, with wider expansion to follow as legal and technical standards are completed, ahead of a continent-wide rollout planned for 2027–2035.

Read More: ECB Warns Stablecoin Outflows Could Trigger Market Stress and Policy Shift; What to Expect?