Key Takeaways

- Metaplanet Co Ltd has taken a $100 million loan through a credit agreement signed in October, backed by its Bitcoin reserves.

- The company holds 30,823 BTC worth about $3.5 billion, giving it significant collateral flexibility and a cushion against price swings.

- Funds from the loan will support further Bitcoin purchases, the firm’s Bitcoin income business, and potential share buybacks.

- Metaplanet expects only a minor impact on its 2025 earnings but says it will update investors if financial effects become significant.

Table of Contents

Metaplanet Co Ltd, a Tokyo-listed investment firm known for its aggressive Bitcoin accumulation strategy, has drawn down a $100 million loan through a credit agreement signed last month, using its Bitcoin holdings as collateral to strengthen liquidity and expand its crypto-related operations.

The loan, completed on Oct. 31, carries a variable interest rate linked to U.S. dollar benchmark rates plus a spread and automatically renews each day, allowing Metaplanet to repay it at any time at its discretion

Metaplanet pledged part of its Bitcoin holdings, totaling 30,823 BTC valued at about $3.5 billion as of Oct. 31, as collateral, saying its large reserves provide a strong buffer against market volatility and that it maintains a conservative approach to leverage to avoid forced collateral additions in the event of sharp price declines.

The company said it will use the loan proceeds to buy more Bitcoin, support its Bitcoin income business, and, depending on market conditions, potentially repurchase its own shares.

Additionally, funds allocated to its income division will be deployed in options strategies to generate premium income.

Metaplanet said the impact of the loan on its 2025 financial results is expected to be minor, adding it would disclose further information if the effect becomes material.

Market Reaction and Technical Overview

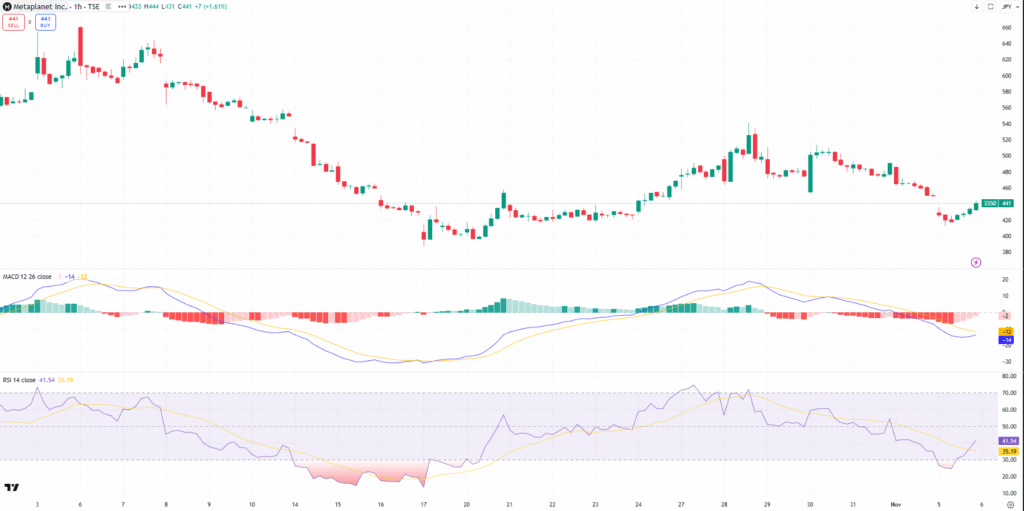

Metaplanet’s shares have bounced modestly after recent selling pressure, with prices last at ¥441 (about $2.90), up 1.6%.

The rebound comes after the stock found short-term support around ¥400 (about $2.63), which aligns with a previous consolidation zone.

Technical indicators show early signs of recovery as the MACD histogram is flattening after an extended decline, and the RSI has risen back above 40, suggesting that bearish momentum is easing.

Even so, the broader structure still reflects a downtrend from late September highs near ¥540 (around $3.55), meaning investor sentiment remains cautious until the price breaks decisively above the ¥470 to ¥480 (around $3.10 to $3.17) area.

In the larger view, the chart suggests a consolidation phase following earlier gains.

Furthermore, Metaplanet’s share price continues to mirror Bitcoin’s movements, with the market seemingly absorbing the loan announcement rather than reacting aggressively to it. Many traders appear to be waiting for a more decisive move in Bitcoin or new signals from the company before positioning for a sustained reversal.

Metaplanet’s Bitcoin Strategy Draws Comparisons to MicroStrategy’s Risky Playbook

Metaplanet’s growing reliance on Bitcoin has become a key focus for investors, who increasingly describe it as the “Japanese MicroStrategy,” referencing the U.S.-based firm now known as Strategy Inc., which pioneered the Bitcoin-treasury model in public markets.

While Metaplanet retains small operations in hotel asset management and Web3 consulting, these contribute only a fraction of its revenue as the company’s strategy now revolves almost entirely around Bitcoin accumulation and income generation through derivatives trading.

This heavy reliance on Bitcoin, while welcomed by crypto enthusiasts, may not reassure traditional investors who worry about concentration risk and price volatility.

In October 2025, S&P Global Ratings assigned a “B-” rating with a stable outlook to Michael Saylor’s Strategy Inc., citing risks related to liquidity, heavy Bitcoin exposure, and limited business diversification.

In Metaplanet’s case, the company’s enterprise value has fallen below the value of its Bitcoin reserves, implying that investors are pricing in execution risks or potential volatility in its crypto-focused business model.

Although Metaplanet reports minimal debt and has doubled revenue guidance following its recent Bitcoin acquisitions, the shrinking gap between its market capitalization and Bitcoin holdings underscores a growing question among investors: how resilient is the model if Bitcoin prices fall or financing conditions tighten?

Read More: El Salvador Expands Bitcoin Use, Begins Securing Public Records on Bitcoin Blockchain